简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Waiting for Bullish Extension on a Biden’s Victory

Abstract:Biden declared victory in the election and addressed the nation on Sunday. Market risk appetite was therefore lifted, boosting gold at the expense of the US dollar.

WikiFX News (9 Nov.) - Biden declared victory in the election and addressed the nation on Sunday. Market risk appetite was therefore lifted, boosting gold at the expense of the US dollar. Gold prices in the Asian market started Monday with a modest increase, up to $1958.59 per ounce.

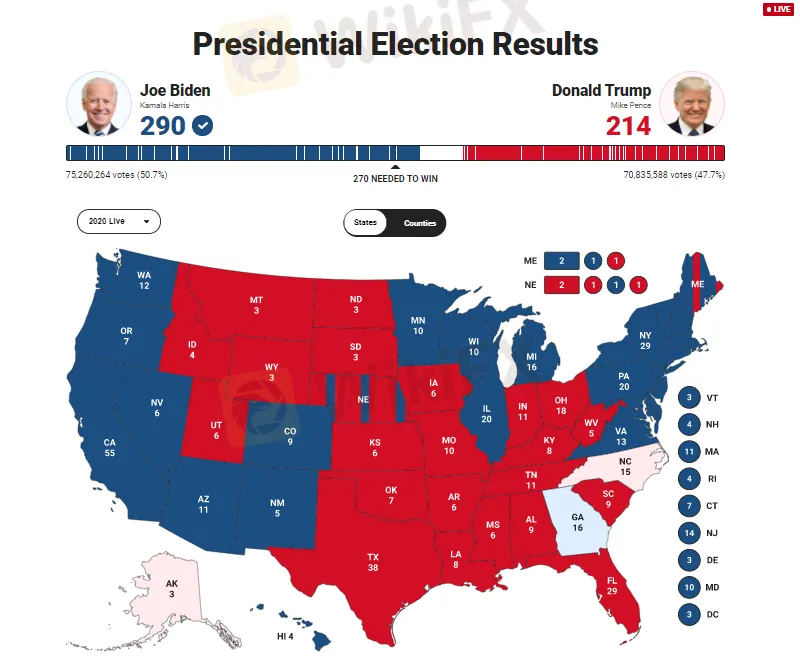

According to the latest data from Fox News, Biden has beaten Trump with 290 electoral votes. Market risk appetite was fueled by the projection that Biden would take a softer approach to international trade. Worries about a further split Congress weighed on the DXY, which nudged slightly lower on Monday to a two-month low of 92.17.

Bidens launch of a larger stimulus package is also expected. While inflation may depress the greenback, gold will embrace a significant increase in the purchase as a hedge.

Gold gained choppy advances last week, reaching as high as $1,960.39 per ounce, with bullish extension expected in the near term amid the declining dollar and the boosted risk sentiment.

All the above is provided by WikiFX, a platform world-renowned for forex information. For details, please download the WikiFX App: bit.ly/wikifxIN

Chart: Ballots of Biden vs. Trump

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Gold Market Technically Analysis

The trend of gold on the daily chart is in line with technical requirements.

Gold Price (XAU/USD) Struggling to Break Meaningfully Higher

Gold Price (XAU/USD) Struggling to Break Meaningfully Higher

Gold Q3 Fundamental Forecast: Outlook Deteriorates for Gold Prices

Gold Q3 Fundamental Forecast: Outlook Deteriorates for Gold Prices

Gold Price Forecast: XAU/USD has a good chance to regain the $1900 level – TDS

Gold Price Forecast: XAU/USD has a good chance to regain the $1900 level – TDS

WikiFX Broker

Latest News

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

BSP Shuts Down Uno Forex Over Serious AML Violations

Rupee gains against Euro

ACY Securities Expands Global Footprint with South Africa Acquisition

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

Currency Calculator