简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

NFP and Forex: What Is the NFP Report and How to Trade?

Abstract:The publication of the data about the Non-Farm Payrolls (NFP) generates volatility in the trading market. Forex traders use the economic calendar to prepare for this publication.

NFPand Forex Trading: Principal Points of Discussion

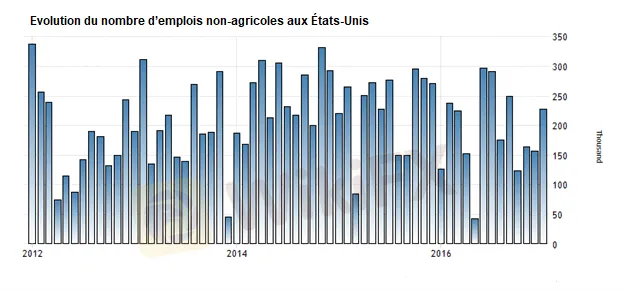

The publication of the data about the Non-Farm Payrolls (NFP) generates volatility in the trading market.

The NFP measures the monthly net evolution of employment.

Forex traders use the economic calendar to prepare for this publication.

What Is the NFP?

The NFP is a major indicator of the US economy. It represents the number of created employment out of the agricultural sector, the government, and non-profit organizations. It also doesnt identify domestic workers.

Generally, the publication of the NFP report generates increased volatility in the Forex market. This data is usually released on the first Friday of each month at 8:30 a.m., New York time. This article will explain to you the role of the NFP in the economy and how to use the publication of this data in a Forex trading strategy.

How Does the NFP Report Affect Forex?

The data from the NFP report is important because its released on a monthly basis, making it a good indicator of the health of the US economy. The data is published by the Bureau of Labor Statistics. To know about the next publication date, you can consult an economic calendar.

Employment is a very important indicator for the Fed. When the unemployment rate is high, the members of the monetary policy committee tend to adopt an expansionary policy (stimulating, with low-interest rates). An expansionary monetary policy seeks to increase economic performance and the level of employment.

Also, if the unemployment rate is higher than usual, it is assumed that the economy is spinning below its potential and the committee members will try to stimulate it. A stimulating monetary policy involves lowering interest rates and reducing the demand for dollars (cash flows from low-yielding currency).

The chart below shows how volatile the Forex market can be after the release of the NFP report. Regarding the NFP published on March 8, 2019, the consensus was for 180,000 (new jobs), but the data was disappointing, with only 20,000 new jobs. As a result, the Dollar Index (DXY) depreciated and the volatility increased.

Forex traders should pay attention to the data releases, such as the NFP. Their trades could lose out due to the sudden increase in the volatility. When the volatility increases, so do the spreads. High spreads can lead to margin calls.

Which Are the Currency Pairs Most Impacted by the NFP?

NFP is an indicator of the labor market in the United States. Therefore, the US dollar pairs (EUR/USD, USD/JPY, GBP/USD, AUD/USD, USD/CHF, etc.) are the most exposed to the release of these data.

Other currency pairs also see their volatility increase when the NFP is released, and traders should be aware of this as their positions can be cut. The chart below shows the development of the CAD/JPY price during an NFP release. As can be seen, the increased volatility can pull a trader out of their position even if he didnt trade a currency pair linked to the US dollar.

Release Dates of the NFP

Typically, the Bureau of Labor Statistics releases the NFP report on the first Friday of each month at 8:30 a.m. (New York time). The publication dates are available on the Bureau of Labor Statistics website.

Given the volatility generated by the NFP release, we recommend that you use a pullback strategy rather than a breakout strategy. As part of a pullback strategy, traders should wait for the currency pair to retrace before placing a trade.

Based on the same example above (NFP at 20,000, the consensus at 180,000), we expect the US dollar to depreciate. The example below is for the EUR/USD pair. As the NFP data has been disappointing, we expect the EUR/USD pair to rise.

Trading the NFP Publications: Best Tips and Further Reading

Here are some tips to keep in mind during the NFP publications for wise Forex trade:

The NFP is released on the first Friday of every month;

The NFP publications are accompanied by an increase in the volatility and an expansion of spreads;

The phenomena are not limited to dollar-linked pairs;

It can be dangerous to trade the NFP publications due to the rise of volatility and the possible expansion of spreads. To remedy this, as well as to avoid exiting the market, we recommend that you use the appropriate leverage, even if you dont use the leverage at all.

Other Important Publications to Monitor:

Typically, the NFP influences the market, but all of the data like CPI (inflation), the Fed funds rates, and the GDP growth is also important.

(Source: https://www.dailyfx.com/francais/actualite_forex_trading/ressources_forex/2019/11/07/le-NFP-et-le-forex-trading.html)

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

BSP Shuts Down Uno Forex Over Serious AML Violations

Rupee gains against Euro

ACY Securities Expands Global Footprint with South Africa Acquisition

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

US Regulators Tighten Oversight on Bank Anti-Money Laundering Efforts

Doo Group Expands Its Operations with CySEC License

Exness: Revolutionizing Trading with Cutting-Edge Platforms

Currency Calculator