简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

PayPal and Synchrony are teaming up to launch a Venmo credit card in 2020 - Business Insider

Abstract:PayPal and Synchrony are teaming up to launch a Venmo credit card – enabling customers to split purchases and pay bills directly in the Venmo app.

This story was delivered to Business Insider Intelligence Payments & Commerce subscribers earlier this morning. To get this story plus others to your inbox each day, hours before they're published on Business Insider, click here.The product, expected to debut next year, will be issued in partnership with Synchrony Financial and will “round out” what PayPal saw as a gap in its business, according to CNBC.

Business Insider Intelligence

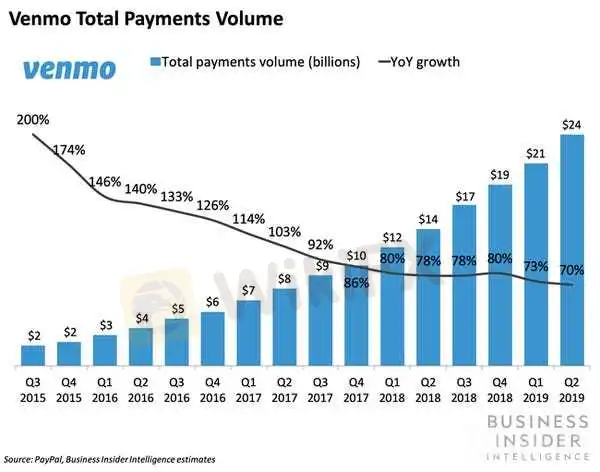

The news follows an April report in The Wall Street Journal that the peer-to-peer (P2P) payments giant was in talks with banks and nearing a deal with Synchrony Financial. Details about the card remain scarce, but it will enable customers to split purchases, opt into sharing their payments in the social feed, and pay their bills directly in the Venmo app.The card could reach a massive audience, but it would need an exceptionally strong value proposition to do so. Venmo is one of the leaders in the growing digital P2P space: It counts 40 million users, boasted $24 billion in volume in Q2 2019, and has reportedly been used by 20% of customers between ages 20 and 24.This demographic, which represents the age when most consumers apply for their first credit card, is attractive to issuers looking to grow their audiences amid rising credit appetite and intense industry competition. But issuers including Amex have been aggressively targeting millennials too. Though Venmo is advantaged by its reach, the card would have to offer a valuable and differentiated rewards program, low or no fees (like Apple Card has done), and a strong startup bonus to bring users into the fold.But if the Venmo credit card is a success, it'd be a huge win for both PayPal and Synchrony.The product could boost engagement on Venmo in a way that meaningfully benefits monetization. As Venmo's popularity has grown, it's become a drain on PayPal's take rate. Though the firm has successfully launched a series of monetization-related initiatives, including fee-based instant transfer, Pay With Venmo, and the Venmo card to strong success, with 40% of the firm's base engaging in monetizable transactions, Venmo still isn't profitable. PayPal would have a “profit-sharing” agreement with Synchrony for the card, which could earn revenue that might bring Venmo closer to monetization.And it plays to Synchrony's strengths in a way that could give the firm's business a much-needed boost. After a few tough quarters, Synchrony's purchase volume began accelerating again earlier this year, but the loss of top-five partner Walmart could impact its results through this year. Doubling down on its partnership with PayPal — the firm owns PayPal Credit's receivables and issues cards for the provider — could help improve its business, particularly because the account represented 75% of the firm's interest and fees on loans last year. And working with Venmo specifically could help Synchrony further grow its digital efforts, which we previously noted would be key to its future success.Want to read more stories like this one? Here's how to get access: Sign up for Payments & Commerce Pro, Business Insider Intelligence's expert product suite keeping you up-to-date on the people, technologies, trends, and companies shaping the future of consumerism, delivered to your inbox 6x a week. /> /> Get StartedJoin thousands of top companies worldwide who trust Business Insider Intelligence for their competitive research needs. /> /> Inquire About Our Enterprise MembershipsExplore related topics in more depth. /> /> Visit Our Report StoreCurrent subscribers can log in to read the briefing here.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

PayPal profit beats estimates, U.S. Venmo users can pay on Amazon from next year

PayPal Holdings Inc beat Wall Street estimates for quarterly profit and said U.S. users of its peer-to-peer payment service Venmo would be able to pay on Amazon.com starting next year.

PayPal Increases Crypto Purchase Limits to $100K

The company said the move was aimed at giving customers “more choice and flexibility" to purchase crypto.

US personal savings rate increases due to lowered spending amid social distancing - Business Insider

The US personal savings rate increased from 8% in February to 13.1% in March due to lowered spending from social distancing.

US Banking Digital Trust Study from Business Insider - Business Insider

The US banks with the highest levels of digital trust in 2020 are PNC, Chase, and Citibank, according to our inaugural Banking Digital Trust study.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

Top 10 Trading Indicators Every Forex Trader Should Know

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

YAMARKETS' Jingle Bells Christmas Offer!

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

Currency Calculator