简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Next recession: Peter Schiff says next one will outdo housing bubble - Business Insider

Abstract:Peter Schiff explains why the US economy is headed for higher rates, stagflation, and a deep recession.

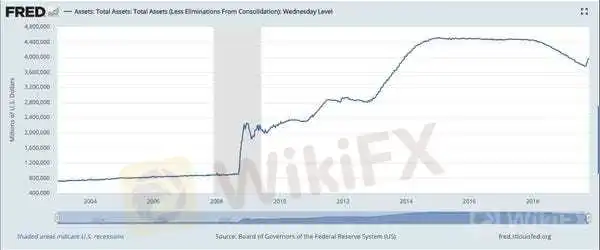

Peter Schiff, the outspoken CEO and president of Euro Pacific Capital, has a stark warning for investors who think the Federal Reserve will be able to bail out the US economy.Schiff says the Fed has lost all credibility, and that exploding debt levels and massive deficits will be too much for the dollar to handle. He's predicting: stagflation, rising rates, and a deep recession even worse than the last.Click here for more BI Prime stories.There's no denying that the housing bubble of the 2000s was the most severe economic event to roil the world since the Great Depression.Excessive leverage, risky lending practices, and overexuberance almost brought the entire financial system to its knees. But the world was able to side-step economic disaster through emergency government and central bank action. And although the US economy has been humming along ever since, some are convinced that the policies put in place during the recovery are going to be responsible for an even bigger collapse. One such man is Peter Schiff, president and CEO of Euro Pacific Capital, who says the US economy is nearing judgment day.“The bubble that the Fed inflated this time is far bigger than the housing bubble,” he said at The MoneyShow Las Vegas, a recent financial-markets conference. “The economic collapse that is going to follow the bursting of this bubble is going to far more dramatic.”If this sounds familiar, it's because Schiff has danced this dance before.He saw the same low-rate hubris leading up to both the tech and housing bubbles — and he says the similarities to today's situation are too uncanny to ignore. In his opinion, rates were kept too low for too long, which led to excessive risk taking and eventual collapse. Still, the Federal Reserve was waiting in the wings, waiting to mop up the ensuing economic mess that resulted, in his opinion, of their own doing.Why this time is differentBut this time it's different — and Schiff is quick to demonstrate his thinking.“Everybody started to believe the Fed,” he said. “But the belief that the policy worked was completely predicated on the fact that is was temporary and that it was reversible — that the Fed was going to be able normalize interest rates and shrink its balance sheet back down to pre-crisis levels. ”That's an important distinction. To Schiff, the Fed's policies are neither temporary nor reversible — and over time, he thinks they've proved him right.For context, the Fed's balance sheet is currently hovering around $4 trillion, nowhere near where it was pre-crisis. In fact, it's roughly $3 trillion higher.The graph below depicts the total assets held by the Federal Reserve since late 2002.

Board of Governors of the Federal Reserve System (US)

What's more, the Fed's path to interest rate normalization was cut short by an unruly stock market.“They had raised interest rates to the point where the markets could no longer handle it,” he said. “How high did we get? Two and a quarter? Two and a half?”He continued: “Is that normal? No! It's not even close to normal.”Schiff thinks markets have been duped. These policies are seemingly here to stay — something he believes makes the Fed much less credible. And if no one trusts the Fed, no one is going to bank on them pulling the US economy out of the doldrums.“Nobody is going to believe that it's temporary,” he said. “Nobody is going to believe that the Fed has this under control — that they can reverse this policy.”But that's not all.He also thinks that sky-high deficits and exploding debt levels are going to make it nearly impossible for the dollar to retain it's purchasing power — and once that domino falls, he expects all hell to break loose.“The dollar is going to crash,” he concluded. “And when the dollar crashes, it's going to take the bond market with it, and we're going to have stagflation, we're going to have a deep recession with rising interest rates, and this whole thing is going to come imploding down.”

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Recession Concerns Ease: Can the U.S. Sustain Its Momentum?

The U.S. Conference Board Consumer Confidence Index rose to 100.3 in July 2024, up from a revised 97.8 in June. For Q2 2024, the U.S. GDP grew at an annualized rate of 2.8% in a preliminary reading, a notable increase from the 1.4% growth in Q1 2024. The Eurozone's annual Consumer Price Index (CPI) rose to 2.6% in July 2024, up from 2.5% in June. This slight increase was driven mainly by a jump in energy prices, which rose by 1.3% compared to 0.2% in the previous month. The US Core PCE which...

What's happening with the US Dollar? Why do countries ditch USD?

As several nations focus on enhancing their currencies, the dominance of the US dollar in the global monetary system is declining. Nouriel Roubini, also known as “Doctor Doom” for accurately forecasting the 2008 global financial crisis, recently warned that the dollar’s position as the primary reserve currency in the world is at risk. This warning is proving accurate, as the world’s major emerging economies have agreed to ditch USD for trade!

What is Recession and How it would Impact Our Daily Lives?

An updated report by Ned Davis reveals some sobering historical context, showing that a global recession is 98% likely. The harsh reality is that every single person will suffer from the effects of a recession, and you can already feel the inflationary pressure as interest rates and consumer prices rise globally. Here's what a recession means for your wallet and what you can do to prepare!

What's happening with the US Dollar? Is it losing its dominance?

As several nations focus on enhancing their currencies, the dominance of the US dollar in the global monetary system is declining. Nouriel Roubini, also known as “Doctor Doom” for accurately forecasting the 2008 global financial crisis, recently warned that the dollar’s position as the primary reserve currency in the world is at risk. This warning is proving accurate, as the world's major emerging economies have agreed to ditch US dollar for trade!

WikiFX Broker

Latest News

ASIC Sues HSBC Australia Over $23M Scam Failures

Trader Turns $27 Into $52M With PEPE Coin, Breaking Records

Singaporean Arrested in Thailand for 22.4 Million Baht Crypto Scam

Elderly Trader Loses RM2.1M in WhatsApp Forex Scam

Spotware Unveils cTrader Store, Global Marketplace for Algo Creators

Gigamax Scam: Tracking Key Suspects in RM7 Million Crypto Fraud

WikiFX Review: Is IQ Option trustworthy?

CFI Partners with MI Cape Town, Cricket Team

Doo Financial Expands Reach with Indonesian Regulatory Licenses

5 Questions to Ask Yourself Before Taking a Trade

Currency Calculator