Score

GSM

United Kingdom|5-10 years|

United Kingdom|5-10 years| https://www.gsmfx.net

Website

Rating Index

Contact

Licenses

Licenses

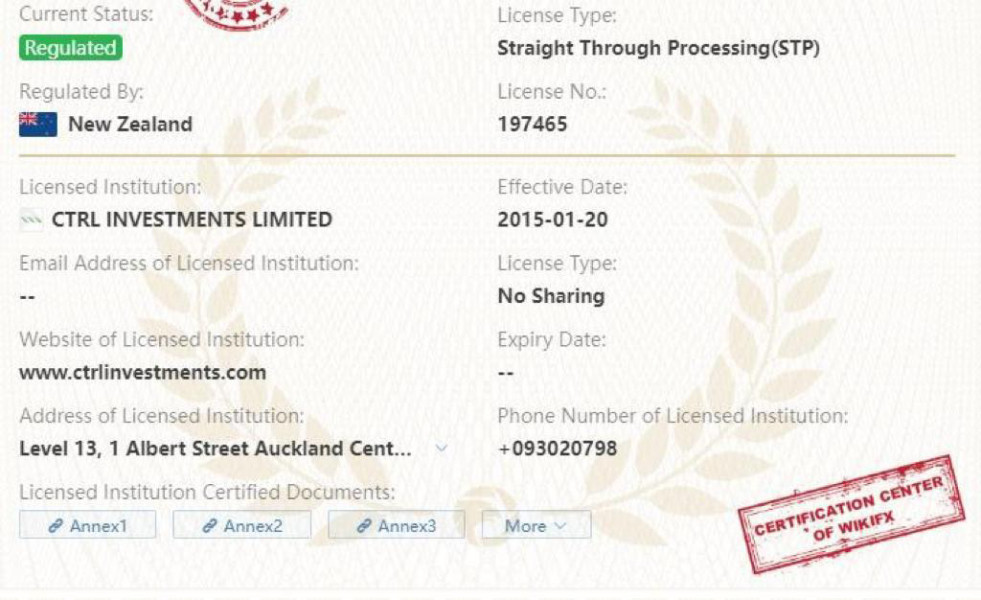

Licensed Institution:H Four Glory Pty Ltd

License No.:001281851

Single Core

1G

40G

1M*ADSL

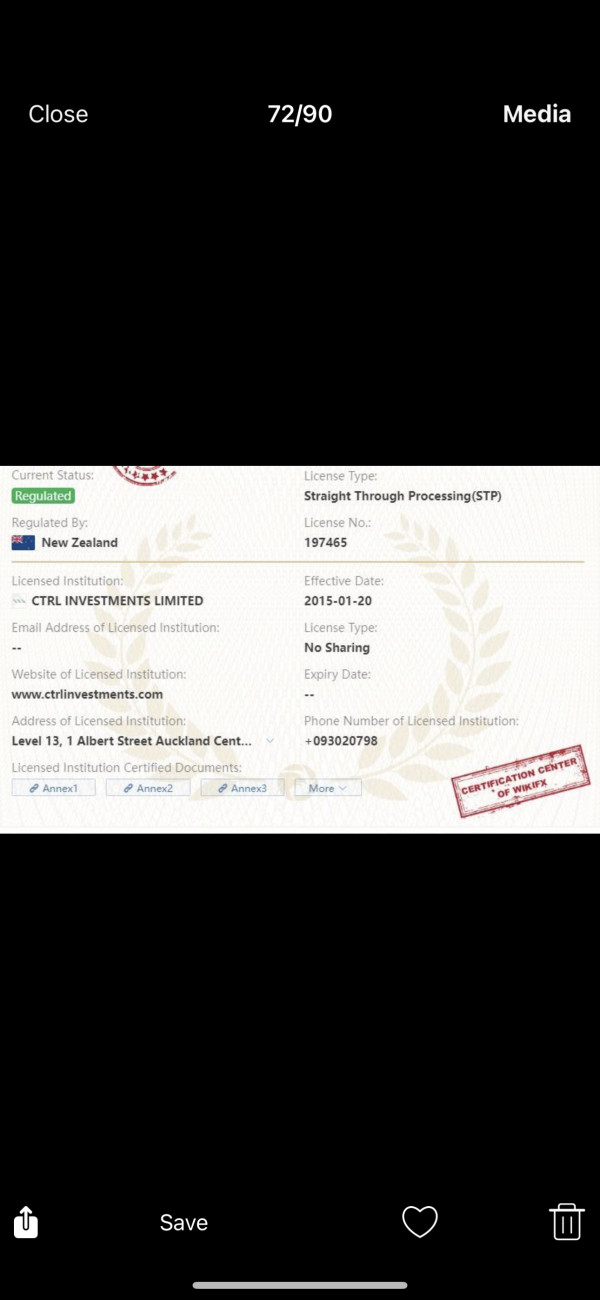

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

United Kingdom

United KingdomUsers who viewed GSM also viewed..

GTCFX

- 10-15 years |

- Regulated in United Kingdom |

- Straight Through Processing(STP) |

- MT4 Full License

AUS GLOBAL

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

gsmfx.net

Server Location

Hong Kong

Website Domain Name

gsmfx.net

Server IP

47.91.164.210

Company Summary

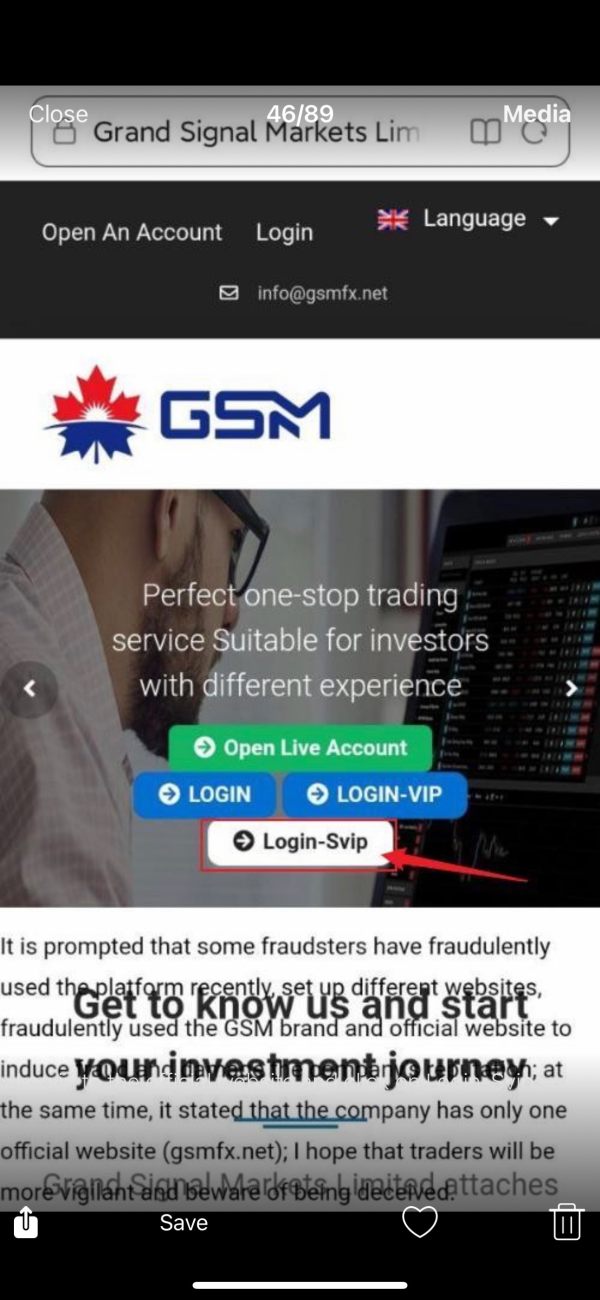

Note: GSMs official site - https://www.gsmfx.net/ is currently not functional. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

Risk Warning

There is a level of danger that comes with trading on the financial markets. As sophisticated instruments, foreign exchange, futures, CFDs, and other financial contracts are typically traded using margin, which significantly increases the inherent risks involved. Therefore, you should consider carefully whether or not this sort of investment activity is right for you.

The information presented in this article is intended solely for reference purposes.

General Information

| GSM Review Summary in 10 Points | |

| Founded | 2019 |

| Registered Country/Region | United Kingdom |

| Regulation | unregulated |

| Market Instruments | Forex, Metals, Energies, and Digital Currencies |

| Demo Account | N/A |

| Leverage | 1:200 |

| EUR/USD Spread | 1.6 pips |

| Trading Platforms | MT5 |

| Minimum deposit | $100 |

| Customer Support | Phone, email |

What is GSM?

Registered in the United Kingdom, Global Signal Markets (short for “GSM”) is an online forex broker offering its clients trading services on Foreign Exchange, Metals, energies, and Digital Currencies. GSM offers three types of trading accounts to choose from, with the maximum leverage available up to 1:200. GSM is not authorized or regulated by any regulatory authorities, please be aware of the risk involved.

Pros & Cons

| Pros | Cons |

| • Offers a variety of trading instruments including forex, metals, energies, and digital currencies | • NFA license reported to be unauthorized |

| • Offers competitive trading conditions | • Limited information available about the company |

| • Offers the popular MT5 trading platform | • Website currently unavailable |

| • Offers multiple account types | • Lack of transparency and oversight |

Note that these pros and cons are based on the available information and may not be representative of the actual experience of trading with GSM. It is recommended to conduct additional research and due diligence before deciding to work with any forex broker to ensure that your trading needs and funds are protected.

GSM Alternative Brokers

IG: IG offers a range of trading platforms and competitive trading conditions, making it a popular choice among traders.

XM: With a variety of account types and trading platforms, XM is a good choice for traders looking for flexibility and accessibility.

Forex.com: Forex.com offers a user-friendly trading platform and a range of educational resources, making it a solid choice for novice traders.

There are many alternative brokers to GSM depending on the specific needs and preferences of the trader. Some popular options include:

It is important for traders to carefully evaluate their options and choose a broker that meets their individual needs, preferences, and risk tolerance.

Is GSM Safe or Scam?

There are several red flags and concerns that have been raised about GSM. Firstly, GSM's NFA license is reported to be unauthorized, which could indicate that they are operating outside of regulatory guidelines. Additionally, there is limited information available about the company, including their history, ownership, and management team. The unavailability of their website could also raise concerns about the reliability and stability of the company. Furthermore, the lack of transparency and oversight could potentially expose traders to higher levels of risk.

Therefore, it is crucial for traders to do their own research and due diligence before deciding to work with any financial institution, including forex brokers like GSM, to ensure that their funds are protected and their trading needs are met. It is recommended to consider alternative brokers that offer more transparency, regulatory oversight, and a proven track record of reliability and customer satisfaction.

Market Instruments

GSM advertises to offer a diverse range of trading instruments including Forex, Metals, Energies, and Digital Currencies.

Forex trading involves the buying and selling of different currencies, which allows traders to profit from the fluctuations in exchange rates.

The metals market includes precious metals such as gold and silver, which are popular investments due to their ability to retain value and act as a hedge against inflation.

Energies refer to commodities such as crude oil and natural gas, which are traded based on supply and demand factors and geopolitical events.

Digital currencies, such as Bitcoin and Ethereum, have gained popularity in recent years due to their decentralized nature and potential for high returns.

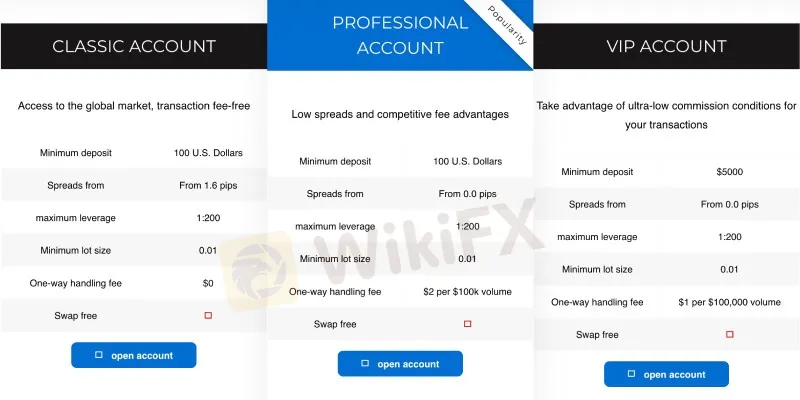

Accounts

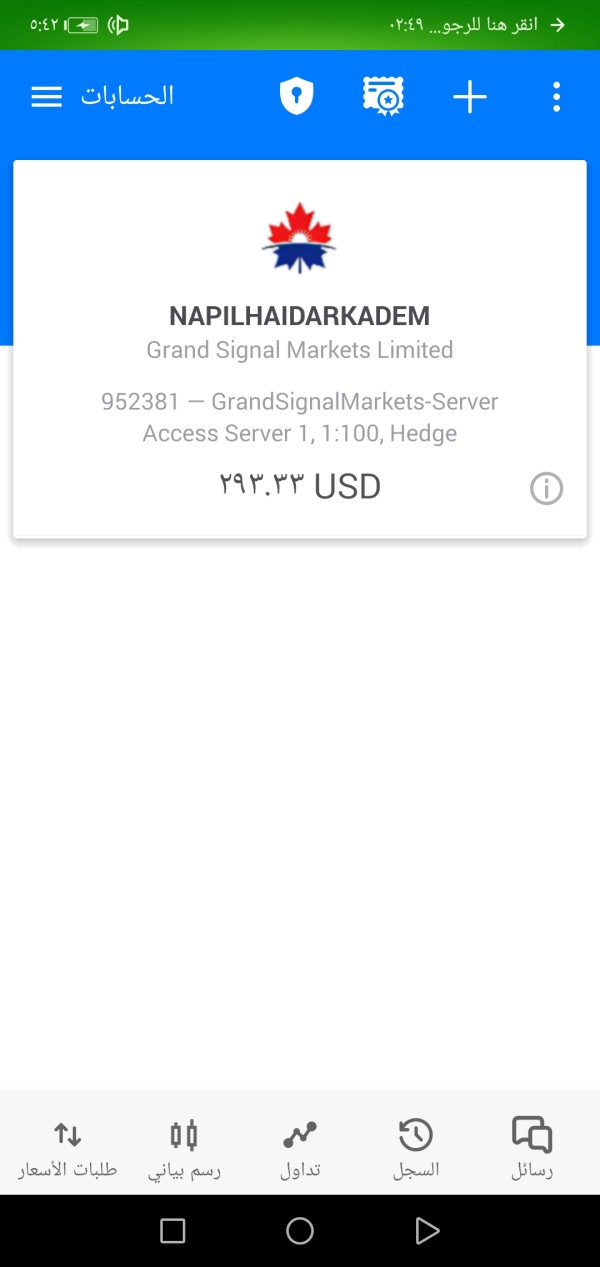

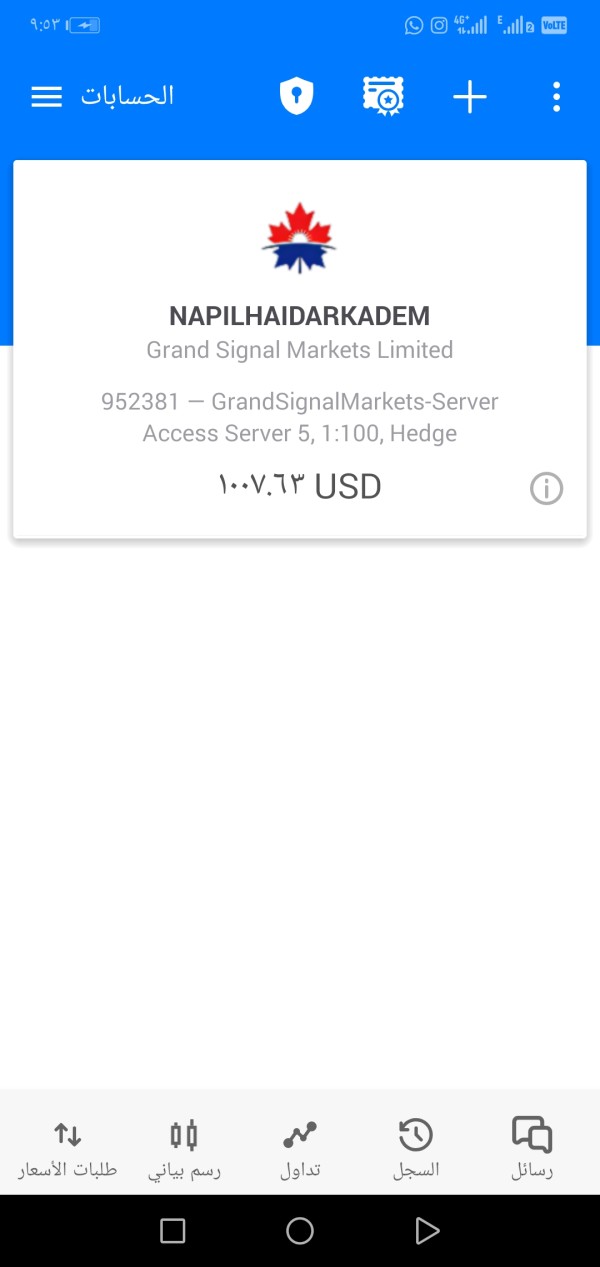

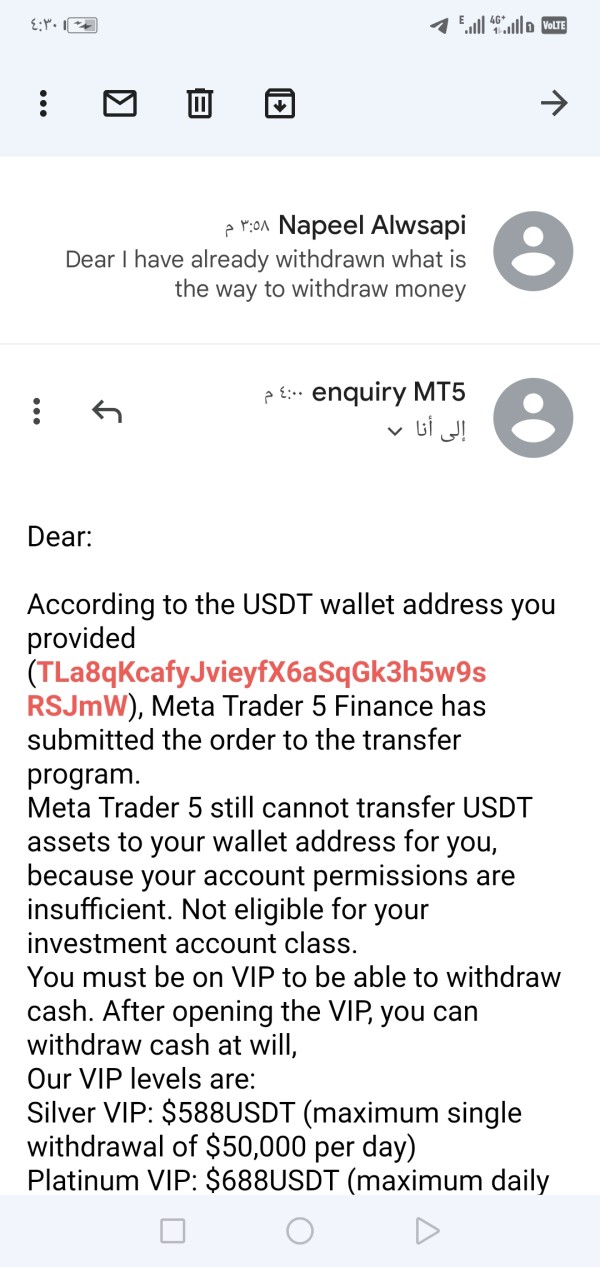

GSM offers three trading accounts to suit different traders trading needs, namely Classic, Pro, and VIP accounts. The Classic account is suitable for all types of traders, with an initial deposit of acceptable $100. The Pro account is more suitable for professional accounts, and to open this account, only $100 is enough. The VIP account is ideal for institutional clients, and traders who want to try this account need to fund at least $5,000. The Swap-free Islamic account option is applicable with all these three trading accounts.

Leverage

Problematically, GSM permits traders to use the leverage of up to 1:200, which is higher than the levels regarded as appropriate by many regulators. Although leverage is considered an amazing tool for clients to increase their potential profits. However, it can also cause serious fund losses, especially to inexperienced traders. Thus, it is important for clients to choose the proper amount that they feel most at ease.

Spreads & Commissions

Spreads and commissions are determined by what trading accounts you are holding. The Classic account is offered a commission-free trading environment, accompanied by average spreads from 1.6 pips. Spreads start at 0.0 pips and commissions are $2 per side for every $100,000 traded on the Pro and VIP accounts, respectively.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commissions |

| GSM | 1.6 pips | None |

| IG | 0.6 pips | None |

| XM | 0.6 pips | None |

| Forex.com | 0.8 pips | None |

Note that the spreads and commissions can vary depending on market conditions and account types, and the above figures are meant to be indicative only. Additionally, it's worth noting that while some brokers may not charge commissions, they may have other fees such as swap fees or inactivity fees that traders should be aware of.

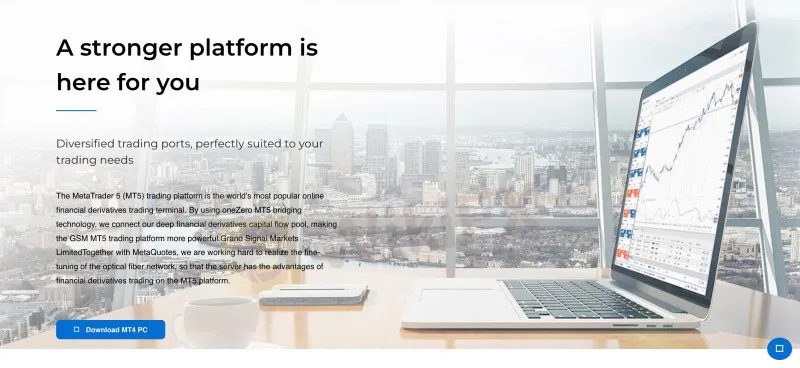

Trading Platforms

GSM provides its clients with access to a popular MT5 trading platform that can be available for PC and Mobile devices. Traders can quickly analyze market activity, place trades, and integrate automated systems thanks to this powerful platform's convenient workspace (Expert Advisors). Everything you need to begin trading on the financial markets, including all of the above features, is available in a single, convenient interface.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| GSM | MetaTrader 5 (MT5) |

| IG | IG Trading Platform, MetaTrader 4 (MT4), MetaTrader 5 (MT5), L2 Dealer |

| XM | MetaTrader 4 (MT4), MetaTrader 5 (MT5), WebTrader |

| Forex.com | Advanced Trading Platform, MetaTrader 4 (MT4), FOREX.com Web Trading, mobile apps |

Note that the availability of trading platforms may vary depending on the region and account type. Additionally, some brokers may offer additional platforms or tools, such as social trading or algorithmic trading, that may be of interest to certain traders. It is recommended to carefully evaluate the available trading platforms and features to determine which broker best meets your individual trading needs and preferences.

Deposits & Withdrawals

Unfortunately, without access to GSMs website, it is difficult to provide a comprehensive review of their deposit and withdrawal options. The only available information from the Internet is their minimum deposit requirement ($100).

GSM minimum deposit vs other brokers

| GSM | Most other | |

| Minimum Deposit | $100 | $100 |

Customer Service

Traders can reach out to GSM about any questions or concerns they may have about their accounts or their trading through the following methods: Telephone: +44 2084 323 088 and Email: info@gsmfx.net. Registered Company Address: 41 DEVONSHIRE STREET, GROUND FLOOR OFFICE.

Reliable and responsive customer service is an essential aspect of any reputable forex broker. Traders may wish to consider the availability, responsiveness, and quality of customer service when evaluating different brokers. Additionally, it is recommended to research customer reviews and feedback to gain a better understanding of the level of support provided by a particular broker.

Conclusion

Overall, it is concerning that GSM is reported to have an unauthorized NFA license, as this may indicate that they are operating outside of regulatory guidelines. Additionally, the unavailability of their website could also raise questions about the reliability and stability of the company. However, the fact that GSM offers multiple account types and competitive trading conditions, along with the use of the MT5 platform, may be attractive to traders looking for variety and flexibility in their trading. It is important for individuals to do their own research and due diligence before deciding to work with any financial institution, including forex brokers like GSM, to ensure that their funds are protected and their trading needs are met.

Frequently Asked Questions (FAQs)

| Q 1: | Is GSM regulated? |

| A 1: | No. Their National Futures Association (NFA) license is unauthorized. |

| Q 2: | Does GSM offer the industry-standard MT4 & MT5? |

| A 2: | Yes. GSM supports MT5. |

| Q 3: | What is the minimum deposit for GSM? |

| A 3: | The minimum initial deposit to open an account is $100. |

| Q 4: | Is GSM a good broker for beginners? |

| A 4: | No. GSM is not a good choice for beginners. Not only because of its unregulated condition, but also because of its inaccessible website. |

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

News

Exposure WikiFX Review: What you should know about GSM?

The exposure on WikiFX about the broker is a red flag. It may be alerting you that the broker is dangerous!

2022-09-28 16:28

News WikiFX Review: Why does GSM catch many traders’ attention recently?

Recently GSM has become a trending topic in forex markets. What is the relationship between GSM and WinterSnow Limited? WikiFX made a comprehension review on it to help you better understand this broker. we will analyze the reliability of this broker from specific information, regulation, exposure and etc. Let’s get into it.

2022-08-30 10:46

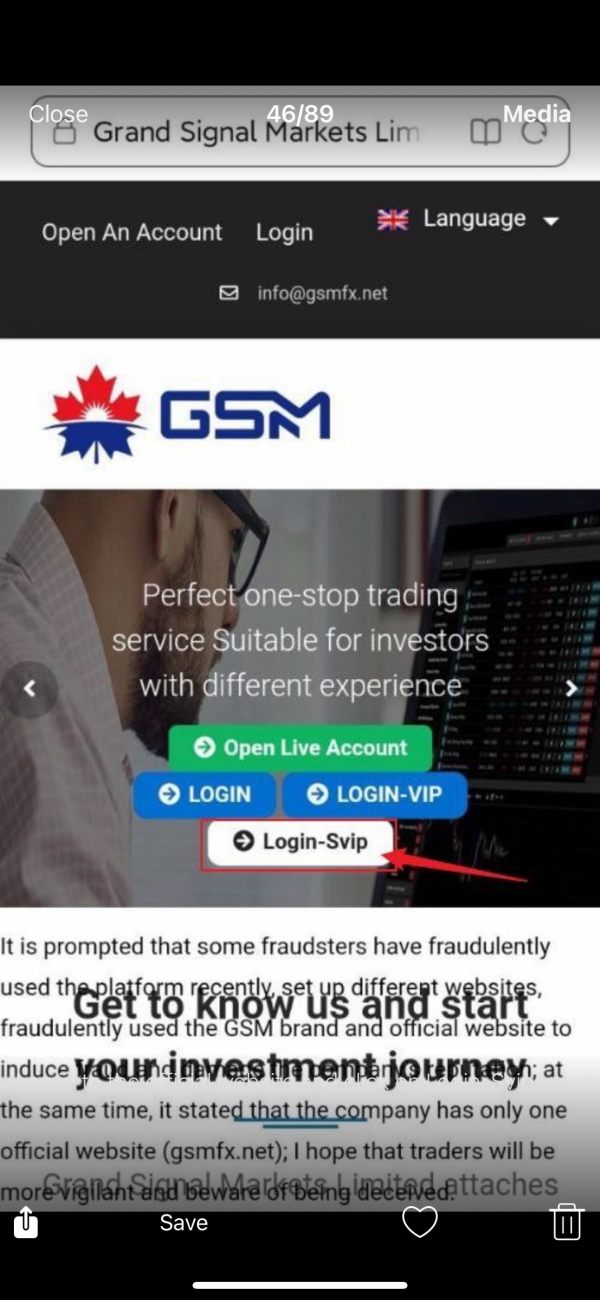

Exposure Wintersnow Ltd Changed Its Name to GSM Ltd After Being Exposed?!

It was just last week when WikiFX reported that Wintersnow Ltd could have bought fake followers to boost its Twitter account. Unbeknownst to many, now the Wintersnow Ltd's Twitter account is gone within a week since our article. Keep reading to see what could have happened.

2022-08-19 19:00

Review 38

Content you want to comment

Please enter...

Review 38

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

OM 6551

United Kingdom

from internet far east people scamming europian it seems like the company register in uk but reality after police review is scam and fraud chiness man behind it . don’t trust this scammer i have lost lot with them . totally fraud .

Exposure

02-19

OM 6551

United Kingdom

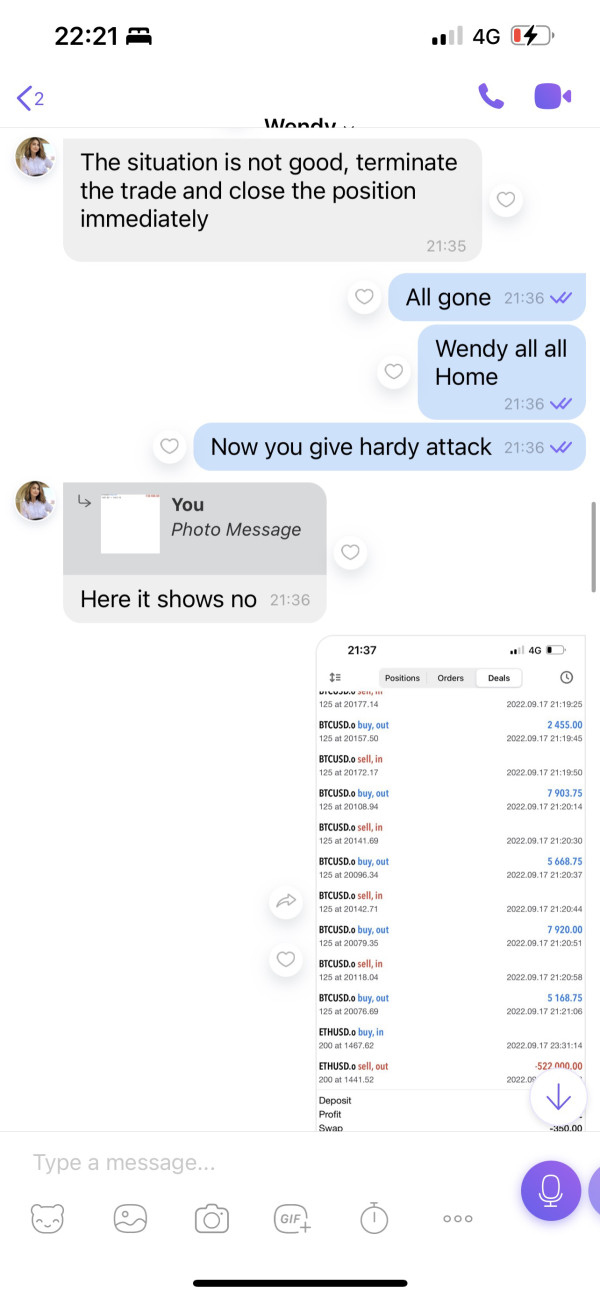

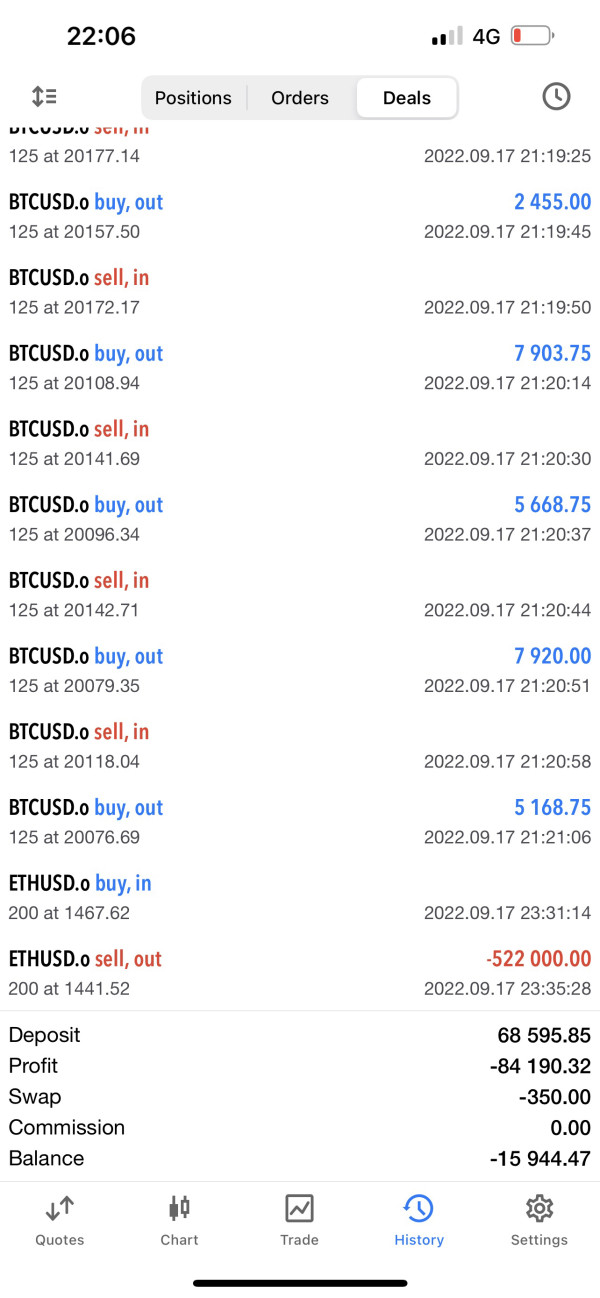

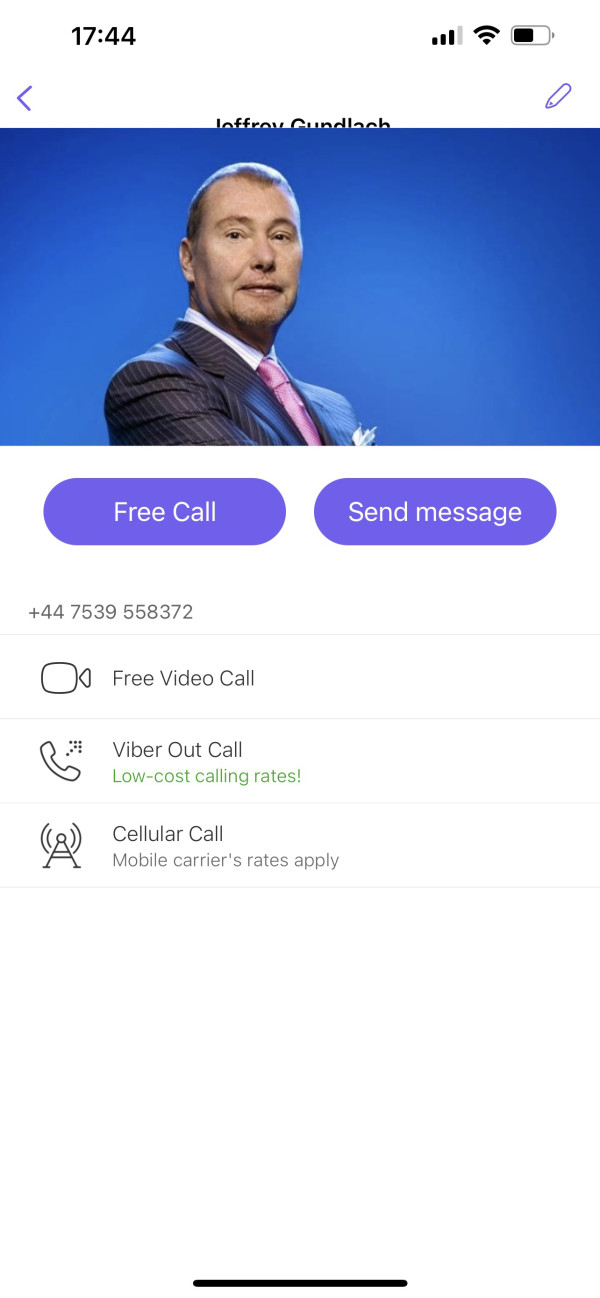

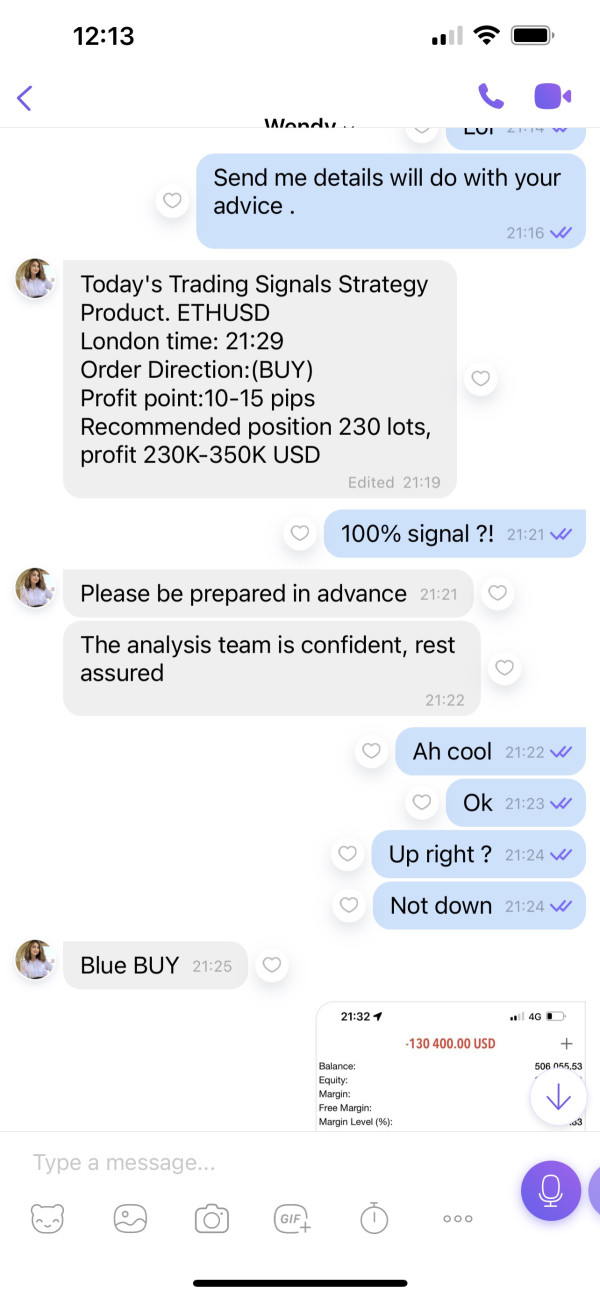

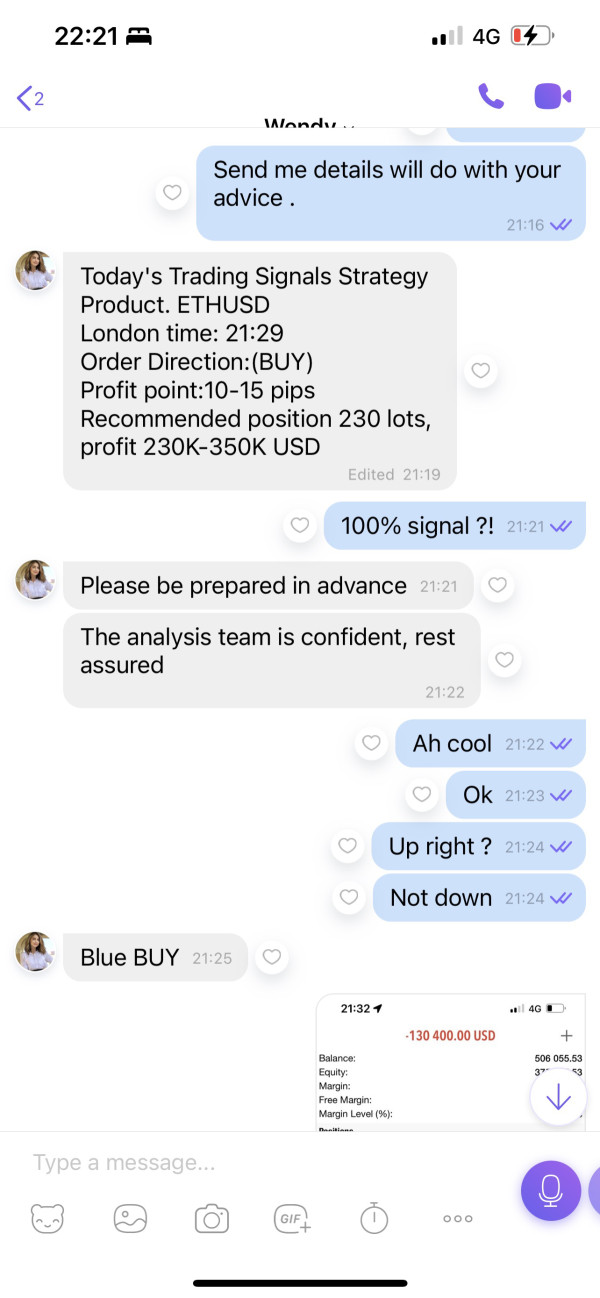

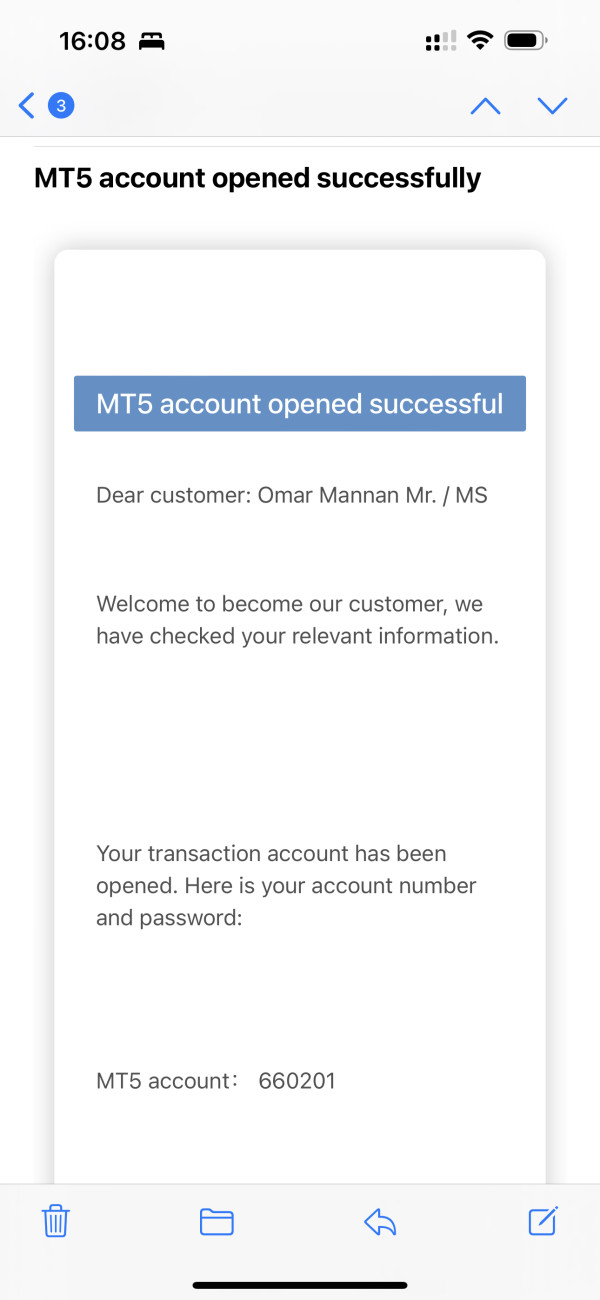

I was contracted by Viber to register the group as they have over 200 people crowed group everyone talking about it how great platform is it . girl calm Wendy contract me and talk to her lots of time over the phone also I was convince to invest over all for Rocket project I hav invested £50000 and start trading with company call Wintersnowx . after few weeks is Chnage to GSM company still trading with MT5 and few weeks later it’s Change to OBFX and traded for month made 508 usd total . in return of withdraw they clear my account and block my account without access . all the money was vanish from account also . need support and help to recycler the funds as well as warn to people about fraud . this company and group of people play some game to take your money . simply they are farud . Wintersnowx WintersnowFX . GSM OBFX this all Company are same and they all fake and fraud . I have full pack of evidence for communication , emails , MT5 account details and account details . also evidence of company and money deposit through BInace . I hope I will get some help .

Exposure

2023-01-22

FX1212733337

Saudi Arabia

He's a crook. He closed my account and there was 4000 dollars in it

Exposure

2023-01-14

FX57947855

United States

During the time I was investing on this platform, I made about $51000, GSM formally called wintersnow using their online platform, I was unable to withdraw. My deposit was swiftly transferred to my wallet when I submitted a chargeback through Cyb3rNub/net . my account manager executed trades without my knowledge because I have little knowledge of trading. This company have scammed a lot of people and they are not stopping soon

Exposure

2023-01-06

Tommy54353

United Kingdom

This company is a scam company. They told me to give out money within 1-3 working days. They just found various reasons not to give out, and then closed my account, and I couldn’t get in. Then I changed the account password, and they can still do whatever they want. Into my account, all the amount in my transaction was lost, and then they withdrew all the remaining money to their account, and said that it was my own operation that framed me for the loss. Look, God will definitely bring retribution

Exposure

2022-12-29

FX244677432

United Kingdom

I have deposited $340,000 to this broker GSM when i request to withdraw profit they told me that i have to pay personal income tax before i could withdraw

Exposure

2022-11-04

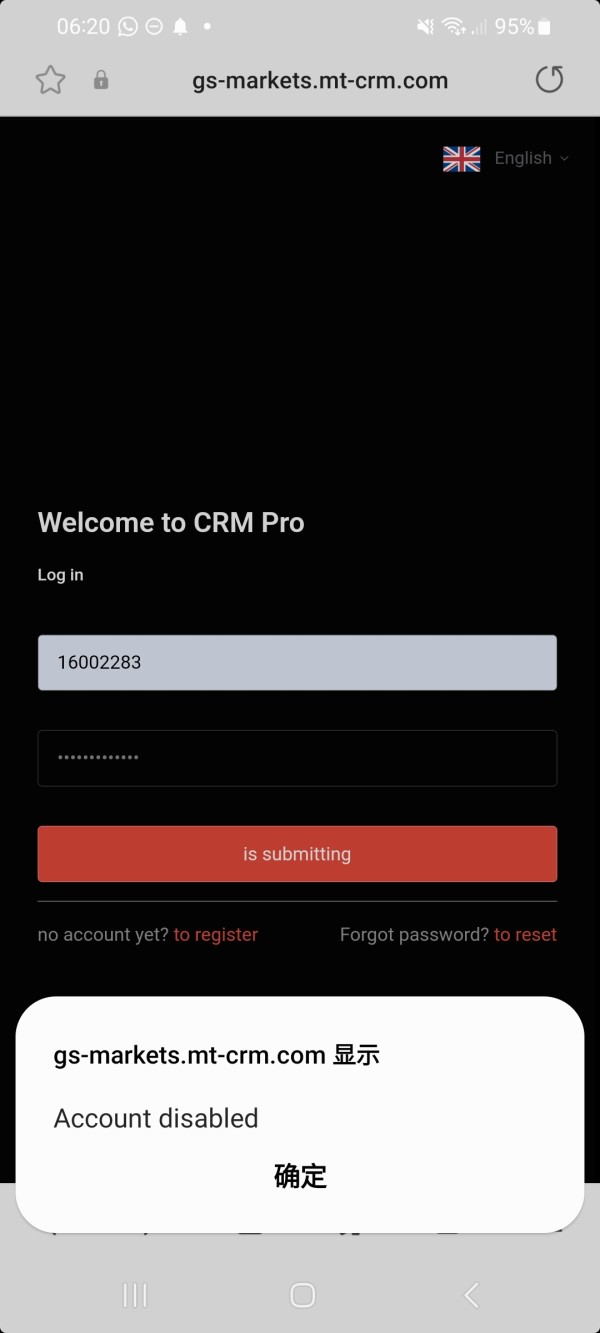

Abby9157

Oman

I registered my account with this company (GSM) and made a large deposit to them. I started trading on mt5 platform. When I wanted to withdraw my money, they started inventing stories for me, and every time I sent them an amount they asked me a new story and kept doing it. I finally realized it is a fake and misleading company and they closed my account and I couldn't open my mt5 account. Until today I don't get my money back. Among them, I don't know if you can help me withdraw my money from this fake company, this is my account with them.950558

Exposure

2022-11-01

Mr773

Saudi Arabia

I registered in Grand signal markets limited by MetaTrader 5 for two months now I want to withdraw my money but they told me can’t withdraw until you transfer more money .. What I can do now ? Who can help me ?

Exposure

2022-10-30

Fx3578064

Australia

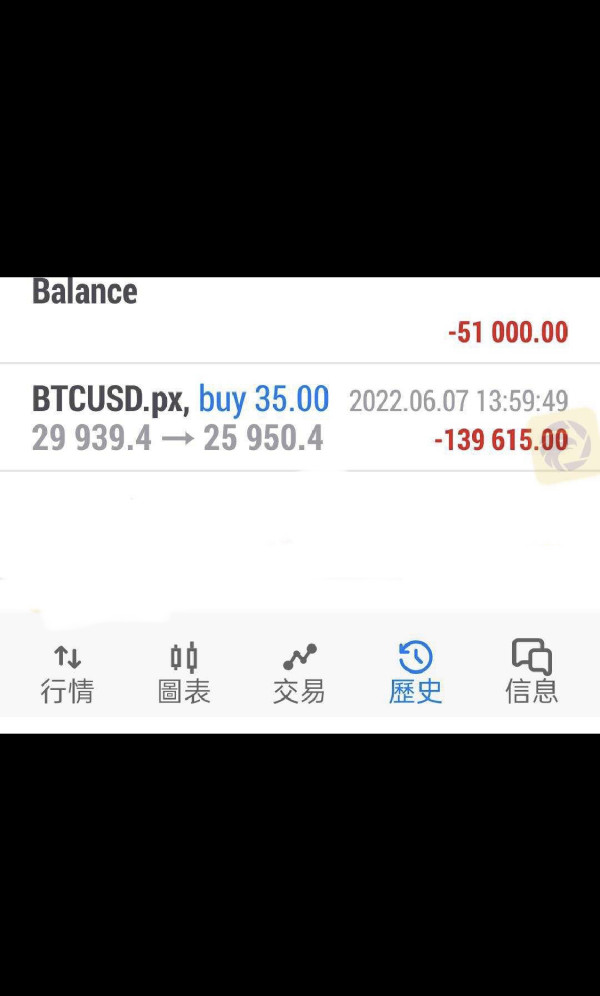

They denied my withdrawal and closed my account on the grounds of suspicious behaviour, sending me emails that follows as their justification. Security checks were conducted on my trading account, and they were forced to stop it as a result of suspicious activity on it which i don’t understand . They assured me that all of my deposits would be returned, and I gave them my beneficiary account information in text form so they could transfer my funds which they rejected it was devastating when i realize it’s a scam this is second time posting about GSM my uploaded photo explained further.

Exposure

2022-10-26

Hasegawa

United States

I traded with GSM and was close to losing it all brutally. I had invested in february and traded with them all through till august but they wanted me to keep trading or risk losing the entire investment i managed to initiate withdrawal eventually but it wasn't through GSM

Exposure

2022-10-26

Fx4679443

United Kingdom

GSM held my $56,000 money hostage without showing any regret, and nobody will told me what to expect. They requested more money as a deposit to help me increase my investment, but when they rejected it, I requested a little withdrawal of my profit. Even though I had completed all of my paper work correctly, the withdrawal did not happen. of AssetsClaimBack . (Without their services, they would have kept my money forever). Instead, look for a different legitimate broker most online investment firm are scam

Exposure

2022-10-24

Евгений Пикунов

Russia

The presented withdrawal receipt is not real.

Exposure

2022-10-20

lung6586

Taiwan

The 65,819USD in my account was swindled by this platform.

Exposure

2022-10-02

FX5743883

United States

GSM is a scam broker I requested a withdrawal a month ago, but it was never processed, they sent me an email saying that because I might have a low balance in my account after withdrawing, I was advised to deposit before requesting a withdrawal. But even after following their request to keep depositing the money the withdrawals were not processed. I started trading and there was a huge delay in my orders and slippage, that's why asked for a withdrawal. It's been 2 weeks and I haven't gotten any more replies!!! Stay away!

Exposure

2022-09-25

YKK2828

Taiwan

Hong Kong netizens were induced to download Binance, metatrade5, and the traders were GSM lunboux limited, Naturalseven limited, and they were unable to withdraw funds in the end.

Exposure

2022-09-24

lung6586

Taiwan

The original account of 65819USD disappeared for no reason, even the mailbox URL could not be found and the platform disappeared for no reason

Exposure

2022-09-24

Tay1

Turkey

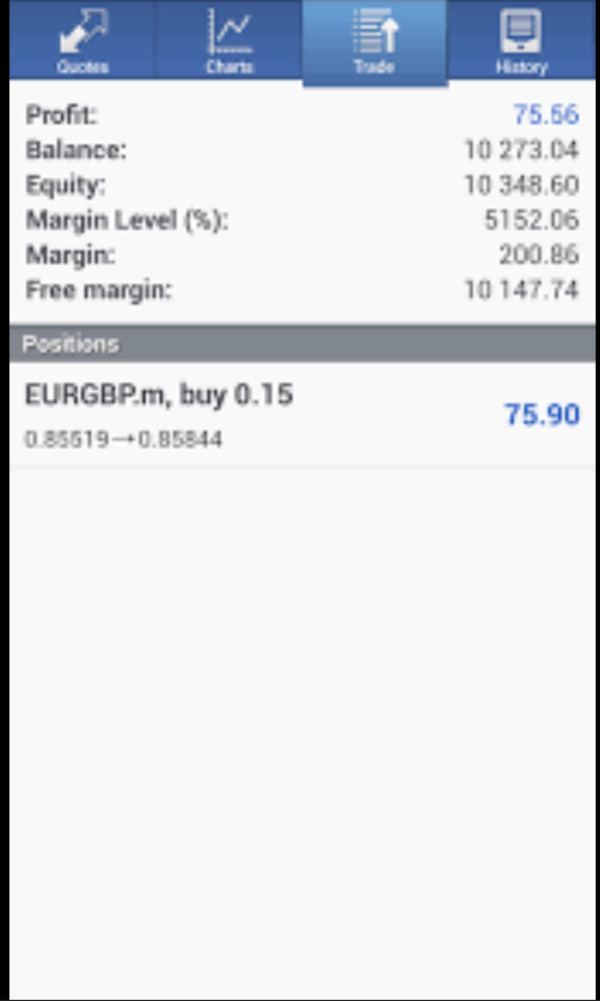

this company is not to be trusted at all, withdrawal was a very big problem, my name here aided and did it. first photo here

Exposure

2022-09-24

FX5743883

United States

Unable to withdraw with GSM is all scam stay away from them big liners and trade manipulator

Exposure

2022-09-23

Withdraw by Finrecoup

United States

wish i read the reviews more closely, GSM previously known to be wintersnowFx asked for a tax deposit for me to withdraw my money then reduced my balance to the absolute minimum and blamed it on the volatility of the market

Exposure

2022-09-23

Nick94770

Singapore

I was introduced to MetaTrader 5 by my online friend and opened an account at Wintersnow Limited and made a 10000USD deposit. Wintersnow Limited informed me that Broker changed from Wintersnow-Server to GrandSignalMarkets-Server; I logged in with the new account and the account funds remain unchanged; I deposited up to 42000USD. I requested the withdrawal from my account on 24th August 2022, the Platform Customer Service requested a 5% of service fee; and Platform Customer Service told me that I was unable to withdraw my fund without paying the 5% service fee. My friend and I paid the service fees on 26th August 2022 and the Platform Customer Service told me that I would receive the withdrawal after 2 working days. I realized that I am unable to log in to my account since 29th August 2022. The fraud platform Grand Signal Markets Limited allows trade and does not allow fund withdrawal. The account cannot be logged in and the Platform Customer Service disappeared. I sent a few emails to them and no reply from them.

Exposure

2022-09-16