简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

EURUSD Rate Eyes Monthly-Low as Germany Warns of Economic Slump

Abstract:EURUSD extends the decline from the previous week and approaches the monthly-low (1.1027) as the Bundesbank, Germanys central bank, warns of an economic “slump.”

Euro Rate Talking Points

EURUSD extends the decline from the previous week as the Bundesbank warns of an economic “slump,” and the weakening outlook for the Euro area may continue to drag on the exchange rate as it puts pressure on the European Central Bank (ECB) to support the monetary union.

EURUSD Rate Eyes Monthly-Low as Germany Warns of Economic Slump

EURUSD approaches the monthly-low (1.1027) as Germanys central bank warns “economic activity could decline slightly again in the current quarter,” and signs of a looming recession may push the ECB to implement more non-standard measures as the central bank struggles to achieve its one and only mandate for price stability.

It seems as though the ECB will continue to push monetary policy into unchartered territory even though the central bank prepares to launch another round of Targeted Long-Term Refinance Operations (TLTRO) in Septemberas Governing Council member Madis Muller insists that the weakening outlook “may mean that the central bank will have to add stimulus.”

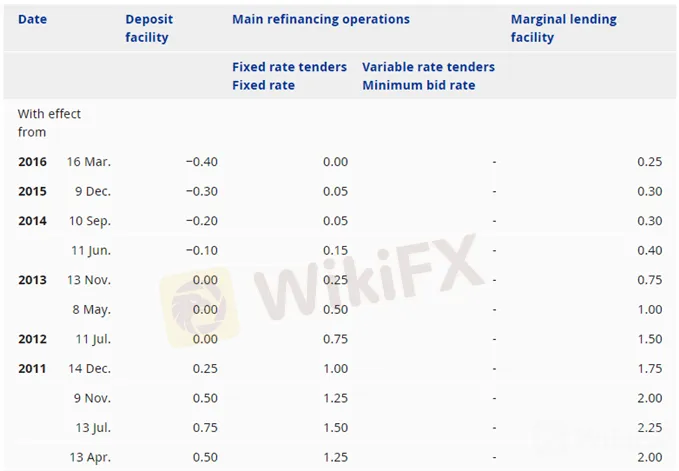

In turn, a growing number of Governing Council officials may show a greater willingness implement a negative interest rate policy (NIRP) for the Main Refinance Rate, its flagship benchmark for borrowing costs, and the account of the ECBs July meeting may ultimately prepare European households and businesses for a more accommodative stance as the central bank “stands ready to adjust all of its instruments, as appropriate, to ensure that inflation moves towards its aim in a sustained manner.”

However, it remains to be seen if the Governing Council will make a major announcement at the next meeting on September 12 as President Mario Draghi steps down at the end of October.

With that said, the monthly opening range sits on the radar for EURUSD, with recent price action raising the risk for a run at the August-low (1.1027) as the exchange rate searches for support.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss key themes and potential trade setups surrounding foreign exchange markets.

EUR/USD Rate Daily Chart

Source: Trading View

The broader outlook for EURUSD is clouded with mixed signals as the exchange rate clears the May-low (1.1107) following the Federal Reserve rate cut in July, with the 1.1100 (78.6% expansion) handle no longer offering support.

The Relative Strength Index (RSI) highlights a similar dynamic as the oscillator fails to retain the upward trend from earlier this year, with the oscillator now tracking a bearish formation.

As a result, the rebound from the monthly-low (1.1027) may continue to unravel amid the string of failed attempts to close above the Fibonacci overlap around 1.1190 (38.2% retracement) to 1.1220 (78.6% retracement).

Need a break/close below 1.1040 (61.8% expansion) to open up the downside targets, with the next area of interest coming in around 1.0950 (100% expansion) to 1.0980 (78.6% retracement).

For more in-depth analysis, check out the 3Q 2019 Forecast for Euro

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other markets the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Crude Oil Prices at Risk if US Economic Data Cool Fed Rate Cut Bets

Crude oil prices may fall if upbeat US retail sales and consumer confidence data cool Fed rate cut bets and sour risk appetite across financial markets.

EURUSD Fails to Test 2019 Low, RSI Flashes Bullish Signal After ECB

EURUSD fails to test the 2019-low (1.0926) following the ECB meeting, with the Relative Strength Index (RSI) breaking out of the bearish formation carried over from June.

Gold, Crude Oil Prices at Risk if ECB, US CPI Cool Stimulus Hopes

Gold and crude oil prices may be pressured if the ECB underwhelms investors dovish hopes while higher US core inflation cools Fed rate cut expectations.

EURUSD Rate Rebound Unravels as Attention Turns to ECB Meeting

EURUSD gives back the rebound from earlier this month, with the Euro at risk of exhibiting a more bearish behavior as the ECB is expected to deliver a rate cut.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Top 10 Trading Indicators Every Forex Trader Should Know

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Currency Calculator