简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

EURUSD Fails to Test 2019 Low, RSI Flashes Bullish Signal After ECB

Abstract:EURUSD fails to test the 2019-low (1.0926) following the ECB meeting, with the Relative Strength Index (RSI) breaking out of the bearish formation carried over from June.

EUR/USD Rate Talking Points

欧元兑美元汇率谈话要点

EURUSD fails to test the 2019-low (1.0926) even though the European Central Bank (ECB) unveils a slew of new measures to insulate the monetary union, and recent price action foreshadows a larger rebound in the exchange rate as the Relative Strength Index (RSI) breaks out of the bearish formation carried over from June.

尽管欧洲央行(ECB)推出一系列新股,欧元兑美元未能测试2019年低位(1.0926)确保货币联盟隔离的措施,以及最近的价格行动预示着汇率将出现更大的反弹,因为相对强弱指数(RSI)突破了6月份结转的利空形态。

EURUSD Fails to Test 2019 Low, RSI Flashes Bullish Signal After ECB

欧元兑美元未能在2019年测试低位,RSI在欧洲央行之后闪现看涨信号

The initial reaction to the ECB meeting was short-lived, with EURUSD tagging a fresh September-high (1.1087), and the break of the monthly opening range may foster a larger recover in the exchange rate even though the Governing Council continues to endorse a dovish forward guidance for monetary policy.

对欧洲央行会议的初步反应是短暂的,欧元兑美元标志着9月新高(1.1087)尽管理事会继续支持货币政策的温和前瞻性指引,但月度开盘价的突破可能会促使汇率大幅回升。

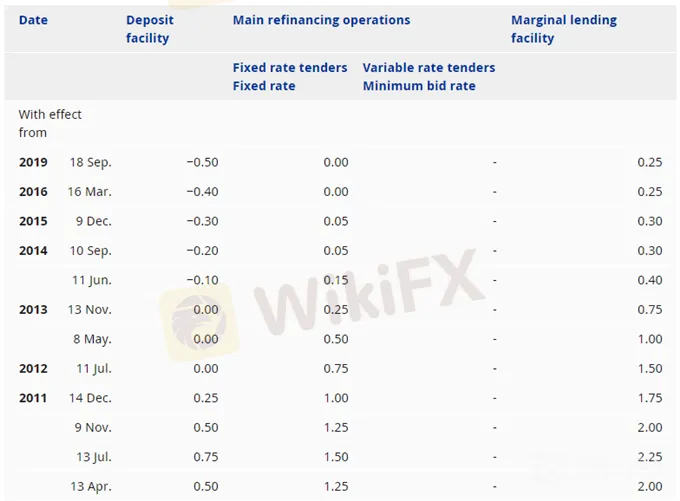

The fresh round of Targeted Long-Term Refinance Operations (TLTRO) along with the EUR 20B/month in asset purchases should help to mitigate the downside risks surrounding the monetary union, but the ECB may continue to venture into uncharted territory as the Governing Council insists that that Euro area interests rates are expected to “remain at their present or lower levels until we have seen the inflation outlook robustly converge to a level sufficiently close to, but below, 2%.”

新一轮目标长期再融资操作(TLTRO)以及每月20亿欧元的资产购买应有助于缓解货币联盟的下行风险,但欧洲央行可能继续冒险进入未知领域,因为理事会坚持认为该欧元区在我们看到通胀前景强劲收敛至足够接近但低于2%的水平之前,预计利率将“维持在目前或更低水平。”

Nevertheless, the new batch of non-standard measures is likely to push the ECB to the sidelines as President Mario Draghi departs from the central bank at the end of October, and the Governing Council may largely endorse a wait-and-see approach at the next meeting on October 24 as “underlying inflation is expected to increase, supported by our monetary policy measures, the ongoing economic expansion and robust wage growth.”

然而,由于总统马里奥·德拉吉于10月底离开中央银行,新一批非标准措施可能会推动欧洲央行保持观望,理事会可能会在很大程度上在10月24日的下一次会议上支持观望,因为“我们的货币政策措施,持续的经济扩张和强劲的工资增长支持了基础通胀预期增长。”

{7}

With that said, attention now turns to the Federal Open Market Committee (FOMC) interest rate decision on September 18 as Fed Fund futures continue to reflect overwhelming expectations for a 25bp reduction, and it remains to be seen if Chairman Jerome Powell and Co. will embark on a rate easing cycle as President Donald Trumpargues that the “the Federal Reserve should get our interest rates down to zero or less.”

{7}

In turn, back-to-back Fed rate cuts along with a dovish forward guidance may keep EURUSD afloat, with recent price action foreshadowing a larger rebound as the exchange rate breaks out of the monthly opening range.

反过来,美联储连续降息以及温和的前瞻性指引可能会使欧元兑美元维持下去,最近的价格行动预示着随着汇率突破每月开盘价,反弹幅度更大。

EUR/USD Rate Daily Chart

欧元兑美元汇率每日图表

Source: Trading View

来源:交易视图

Keep in mind, the broader outlook for EURUSD is tilted to the downside as the exchange rate clears the May-low (1.1107) following the Federal Reserve rate cut in July, with the 1.1100 (78.6% expansion) handle no longer offering support.

请记住,随着汇率清除5月低点,欧元兑美元的更广阔前景倾向于下行(1.1107)继美联储7月降息后,1.1100(78.6%扩张)处理不再提供支持。

However, recent developments in the Relative Strength Index (RSI) point to a larger rebound in the exchange rate as the oscillator breaks out of the downward ward trend carried over June.

然而,近期发展相对强弱指数(RSI)指向汇率反弹的较大反弹,因为振荡器突破了6月份的下行趋势。

In turn, the failed attempt to test the 2019-low (1.0926) may open up the topside targets as EURUSD tags a fresh monthly-high (1.1087), but need a break/close above the 1.1100 (78.6% expansion) handle to bring the 1.1140 (78.6% expansion) region on the radar.

反过来,尝试测试2019-低点(1.0926)失败的尝试可能打开上行目标,因为欧元兑美元标记新的月度高点(1.1087),但需要突破/收盘高于1.1100(78.6%扩大)处理将1.1140(78.6%扩展)区域带到雷达上。

Next area of interest comes in around 1.1190 (38.2% retracement) to 1.1220 (78.6% retracement) followed by the Fibonacci overlap around 1.1270 (50% expansion) to 1.1290 (61.8% expansion).

下一个区域吨在1.1190附近(38.2%的回撤位)到1.120(78.6%回撤位)随后斐波纳契重叠1.1270(扩张50%)至1.1290(扩张61.8%)。

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Dollar stands tall as Fed heads toward taper

The dollar held within striking distance of the year's peaks on the euro and yen on Wednesday, as investors looked for the Federal Reserve to begin unwinding pandemic-era policy support faster than central banks in Europe and Japan.

Gold Price, Silver Price Jump After Saudi Arabia Oil Field Attacks

Gold and silver turned sharply higher after the weekend‘s drone attacks on Saudi oil fields saw tensions in the area ratchet higher with US President Donald Trump warning Iran that he is ’locked and loaded.

Crude Oil Prices at Risk if US Economic Data Cool Fed Rate Cut Bets

Crude oil prices may fall if upbeat US retail sales and consumer confidence data cool Fed rate cut bets and sour risk appetite across financial markets.

Gold, Crude Oil Prices at Risk if ECB, US CPI Cool Stimulus Hopes

Gold and crude oil prices may be pressured if the ECB underwhelms investors dovish hopes while higher US core inflation cools Fed rate cut expectations.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

YAMARKETS' Jingle Bells Christmas Offer!

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

WikiFX Review: Something You Need to Know About Markets4you

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

Currency Calculator