简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

US Dollar May Rise vs NOK if Norges Bank Trims Hawkish Outlook

Abstract:The US Dollar may rise vs the Norwegian Krone if the Norges Bank scales back its hawkish outlook against the backdrop of slower regional and global growth.

US DOLLAR, NORWEGIAN KRONE, NORGES BANK – TALKING POINTS

Norges Bank rate decision, commentary may sink Norwegian Krone

Monetary authorities may pivot away from previous hawkish stance

US Dollar may extend gains vs Krone if Nordic markets get spooked

See our free guide to learn how to use economic news in your trading strategy!

The Norwegian Krone may be in for a painful session ahead if the Norges Bank cools rate hike expectations for the rest of the year. Up until recently, it was one of the most hawkish central banks in the developed world. However, slower global growth and weakening demand out of Europe may be eroding confidence that the Norwegian economy can withstand an environment of tightened credit conditions.

Specter of Slowing Growth is Haunting Europe

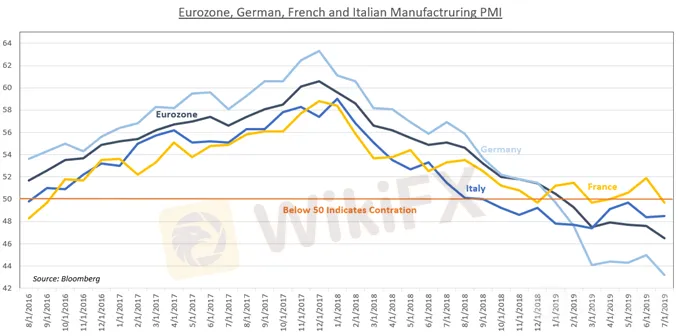

As Norway‘s largest trading partner – and destination for over eighty percent of the country’s exports – European demand is critical to the wealth of the Norwegian economy. Policymakers in Oslo are growing hot under the collar as a German ZEW survey data reached alarming-low levels and preliminary reports showed Europes largest economy likely contracted in the second quarter.

Norways petroleum-based economy is inherently at the mercy of changes in global sentiment due to its strong link to crude oil prices that are fickle by nature. The Norwegian Krone and benchmark OBX equity index frequently move in tandem with Brent, which might explain why the central bank is reconsidering its tightening cycle. Weaker crude oil prices are a downside risk for inflation and may warrant a change in policy.

ICE Brent Crude Oil, Norway OBX Benchmark Equity Index

OBX chart created using TradingView

Looking at market implied policy rates on August 14 versus the historical reading in July shows a downward shift across all the various tenors. This suggests investors are anticipating significant trouble ahead to such a degree that it will warrant a reversal of the Norges Banks tightening cycle. It appears that the central bank is now finally succumbing to the pressure of its peers, and NOK will likely suffer as a result.

Gloomy Premonitions Ahead

FX TRADING RESOURCES

Join a free webinar and have your trading questions answered

Just getting started? See our beginners guide for FX traders

Having trouble with your strategy? Heres the #1 mistake that traders make

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

What's happening with the US Dollar? Why do countries ditch USD?

As several nations focus on enhancing their currencies, the dominance of the US dollar in the global monetary system is declining. Nouriel Roubini, also known as “Doctor Doom” for accurately forecasting the 2008 global financial crisis, recently warned that the dollar’s position as the primary reserve currency in the world is at risk. This warning is proving accurate, as the world’s major emerging economies have agreed to ditch USD for trade!

What's happening with the US Dollar? Is it losing its dominance?

As several nations focus on enhancing their currencies, the dominance of the US dollar in the global monetary system is declining. Nouriel Roubini, also known as “Doctor Doom” for accurately forecasting the 2008 global financial crisis, recently warned that the dollar’s position as the primary reserve currency in the world is at risk. This warning is proving accurate, as the world's major emerging economies have agreed to ditch US dollar for trade!

GemForex - weekly analysis

The week ahead: US Dollar struggles to find demand

US Dollar Outlook: USD Upside Stalling, Risk of Larger Setback

USD Losing its Appeal Temporarily Eyes on August and March Peaks for Support

WikiFX Broker

Latest News

JUST Finance and UBX Launch Multi-Currency Stablecoin Exchange

XM Revamps Website with Sleek Design and App Focus

TradingView & Mexico’s Uni. Partnership, to Enhance Financial Education

Something You Need to Know About SogoTrade

Global Shift in Cryptocurrency Taxation: Italy and Denmark Chart New Paths

Webull Introduces 24/5 Overnight Trading to Extend U.S. Market Access

eToro Launches Global-Edge Smart Portfolio: A Balanced Approach to Growth and Stability

Darwinex advises traders to update MT4 & 5

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Crypto Scammer Pleads Guilty in $73 Million “Pig Butchering” Fraud

Currency Calculator