简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

USDCAD Rate Searches for Support, RSI Flirts with Oversold Territory

Abstract:USDCAD may continue to exhibit a bearish behavior over the remainder of the week as the Relative Strength Index (RSI) flirts with oversold territory.

Canadian Dollar Talking Points

USDCAD trades to a fresh yearly-low (1.3055) as the Canadian economy appears to be outperforming its US counterpart, and the exchange rate may continue to exhibit a bearish behavior over the remainder of the week as the Relative Strength Index (RSI) flirts with oversold territory.

USDCAD Rate Searches for Support, RSI Flirts with Oversold Territory

USDCAD continues to search for support following the Federal Reserve meeting as fresh data prints coming out of the US indicate a slowing economy, and it seems as though it will only be a matter of time before the Federal Open Market Committee (FOMC) switches gears as the central bank alters the forward guidance for monetary policy.

The fresh updates to the ADP Employment survey does not bode well for the highly anticipated Non-Farm Payrolls (NFP) report as the gauge shows a 102K expansion in private-sector employment versus forecasts for a 140K print in June.

The ISM Non-Manufacturing survey highlights a similar dynamic as the employment component narrows to 55.0 from 58.1 in May, and signs of slower job growth may push the Fed to insulate the economy as “many FOMC participants now see that the case for a somewhat more accommodative policy has strengthened.”

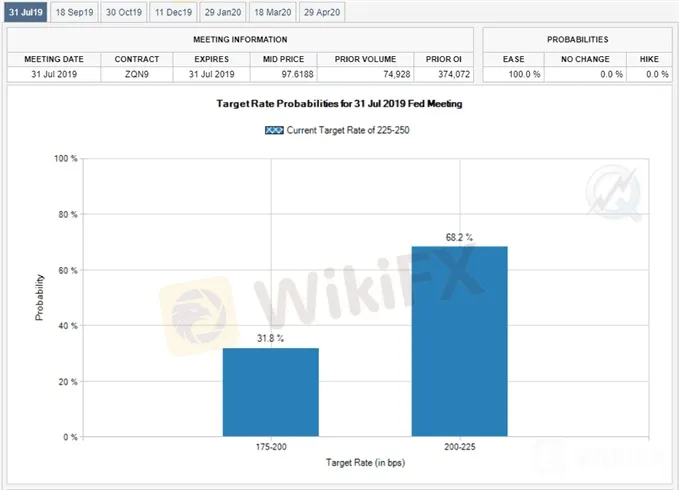

In turn, Fed Fund futures continue to reflect a 100% probability for at least a 25bp reduction on July 31, and Chairman Jerome Powell and Co. may come under pressure to reverse the four rate hikes from 2018 as US President Donald Trump tweets “we need rates cuts, & easing.”

In contrast, the Bank of Canada (BoC) may continue to endorse a wait-and-see approach at the next meeting on July 10 as Canada unexpectedly posts a trade surplus of 0.76B in May, and it seems as though Governor Stephen Poloz and Co. may keep the benchmark interest rate on hold throughout 2019 as “recent data have reinforced Governing Councils view that the slowdown in late 2018 and early 2019 was temporary.”

As a result, the diverging paths for monetary policy may continue to drag on USDCAD, with the exchange rate at risk of exhibiting a more bearish behavior over the near-term as it snaps the upward trend from earlier this year.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

USD/CAD Rate Daily Chart

Broader outlook for USDCAD is no longer constructive as the advance from the April-low (1.3274) stalls ahead of the 2019-high (1.3665), with the break of trendline support raising the risk for a further decline in the exchange rate.

Downside targets are still on the radar as USDCAD clears the February-low (1.3068), with a break/close below 1.3020 (50% expansion) opening up the Fibonacci overlap around 1.2970 (78.6% retracement) to 1.2980 (61.8% retracement).

Will keep a close eye on the Relative Strength Index (RSI) as it flirts with oversold territory, with a break below 30 raises the risk for a further decline in USDCAD as the bearish momentum gathers pace, but failure to push into oversold territory raises the risk for a rebound in the exchange rate.

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Dollar stands tall as Fed heads toward taper

The dollar held within striking distance of the year's peaks on the euro and yen on Wednesday, as investors looked for the Federal Reserve to begin unwinding pandemic-era policy support faster than central banks in Europe and Japan.

Gold Price, Silver Price Jump After Saudi Arabia Oil Field Attacks

Gold and silver turned sharply higher after the weekend‘s drone attacks on Saudi oil fields saw tensions in the area ratchet higher with US President Donald Trump warning Iran that he is ’locked and loaded.

FX Week Ahead - Top 5 Events: August Canada Inflation Report & USD/CAD Rate Forecast

The August Canada inflation report (consumer price index) is due on Wednesday, September 18 at 12:30 GMT.

EURUSD Fails to Test 2019 Low, RSI Flashes Bullish Signal After ECB

EURUSD fails to test the 2019-low (1.0926) following the ECB meeting, with the Relative Strength Index (RSI) breaking out of the bearish formation carried over from June.

WikiFX Broker

Latest News

JUST Finance and UBX Launch Multi-Currency Stablecoin Exchange

XM Revamps Website with Sleek Design and App Focus

Global Shift in Cryptocurrency Taxation: Italy and Denmark Chart New Paths

Webull Introduces 24/5 Overnight Trading to Extend U.S. Market Access

TradingView & Mexico’s Uni. Partnership, to Enhance Financial Education

Something You Need to Know About SogoTrade

eToro Launches Global-Edge Smart Portfolio: A Balanced Approach to Growth and Stability

Darwinex advises traders to update MT4 & 5

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Broker Review: Is Exnova Legit?

Currency Calculator