简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Dow Jones Price Outlook: Retail Traders Conflicted as Index Rebounds

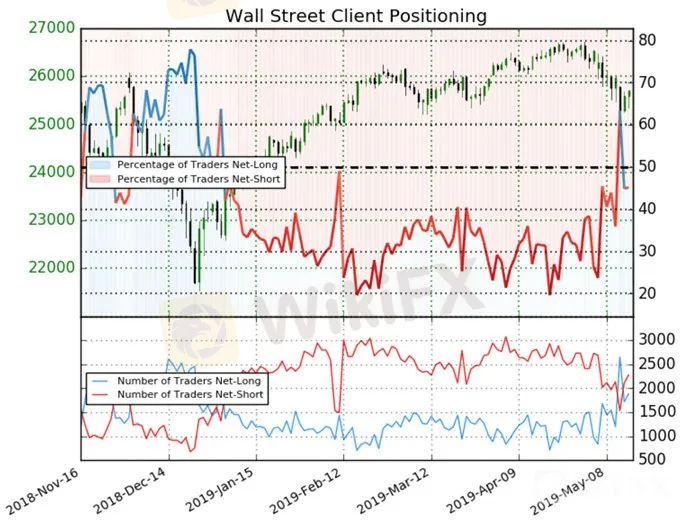

Abstract:After retail traders briefly shifted their net-positioning on Monday, IG clients are once again net-short the Dow Jones Industrial Average.

Dow Jones Price Outlook:

Wednesdays recovery rally did little to convince retail clients of a sustained follow-through as they looked to short the Dow Jones

Despite bullish price action, the Industrial Average remains off -1.15% for the week

Find out how to use IG Client Sentiment Data with one of our Live Sentiment Data Walkthroughs

Dow Jones Price Outlook: Retail Traders Conflicted as Index Rebounds

After a rocky start to the week, US equites have mounted a recovery effort. As of Wednesdays close, the Dow Jones trades -1.15% lower than it opened, compared to the S&P 500 and Nasdaq 100 which trade -1.05% and -1.10% beneath their close last Friday. That said, retail traders have wavered in their positioning on the Dow Jones, whereas sentiment for the S&P 500 has decidedly pessimistic.

For the first time since early January, IG clients were net-long the Dow Jones on Monday – suggesting some traders were optimistic the index‘s descent was over or that trader’s targets were hit. Either way, the optimism didnt last long as shorts came raging back. While we at DailyFX typically view client positioning as a contrarian indicator, the current signal is relatively unclear. That said, traders are much more certain the S&P 500 will continue to lose ground.

View A Brief History of Trade Wars to read about the precedents set in prior economic conflicts.

Despite facing many of the same themes, client positioning on the S&P 500 reveals that traders are overwhelmingly short the index - even amid its 13.5% gain in the year-to-date. Given the conflicting signals from IGCS, traders must look to other tools like technical and fundamental analysis to assist in their decision making.

Dow Jones Price Chart: 1 - Hour Time Frame (May 6 - May 15) (Chart 1)

After two weeks of tumultuousness, the Average was able to drive outside a descending trendline from May 6 only to close marginally beneath, suggesting the level will pose resistance in Thursday trading. Beyond that, bulls will have to negotiate a litany of Fibonacci levels. First the 61.8% at 25,774, followed by the 78.6% at 25,825. Both have stalled price action in the past.

On the other hand, bears will hope to open beneath the trendline from May 6 before testing the 78.6% retracement from March‘s lows to April’s highs. Subsequent support will be offered by a short-term ascending trendline from the swing low on May 13, followed by a band of support derived from the lows on March 25 and 27.

Given the severity of declines during the last two weeks, it is my opinion that the index may be due for consolidation before a more-earnest rebound can be mounted – assuming a relatively stable fundamental landscape. For a deeper look at IG Client Sentiment data and the Dow Jones, sign up for my Sentiment Data Walkthrough Webinar tomorrow. In the meantime, follow @PeterHanksFX on Twitter for other equity insight.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX

Read more: S&P 500 Outlook: ETF Flows Suggest Flight to Currency Market

DailyFX forecasts on a variety of currencies such as the US Dollar or the Euro are available from the DailyFX Trading Guides page. If you‘re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Dow Jones, DAX 30, FTSE 100, S&P 500 Forecasts for the Week

The Dow Jones, DAX 30, FTSE 100 and S&P 500 may look to melt higher ahead of a monumental Fed meeting on Wednesday, but will past peaks look to rebuke a continuation higher?

Dow Jones Forecast: TGT, LOW Earnings Expected to Highlight Trade Wars

After Home Depot (HD) delivered robust second quarter results despite trade war headwinds, the table is set for Lowes (LOW) and Target (TGT) to follow suit.

Dow Jones Suffers Largest Decline in 2019 as Trade War Fears Rage

The Dow Jones Industrial Average sank over 750 points on Monday as the US-China trade war entered a new phase over the weekend which shook investor confidence to the core.

Dow Jones Earnings to Offer Insight on Global Growth & Trade Wars

Two economic activity bellwethers in Caterpillar (CAT) and UPS are slated to report earnings Wednesday morning and investors will look closely for insight on global growth. Boeing (BA) will also report.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

Top 10 Trading Indicators Every Forex Trader Should Know

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

YAMARKETS' Jingle Bells Christmas Offer!

WikiFX Review: Something You Need to Know About Markets4you

Revolut Leads UK Neobanks in the Digital Banking Revolution

Currency Calculator