Score

Dominion Markets

Comoros|2-5 years|

Comoros|2-5 years| https://www.dominionmarkets.com/index.php

Website

Rating Index

Influence

Influence

B

Influence index NO.1

Brazil 5.60

Brazil 5.60Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Comoros

ComorosAccount Information

Users who viewed Dominion Markets also viewed..

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Vantage

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Sources

Language

Mkt. Analysis

Creatives

Website

dominionmarkets.com

Server Location

United States

Website Domain Name

dominionmarkets.com

Server IP

192.185.46.39

Company Summary

| Registered in | St. Vincent and the Grenadines |

| Regulated by | No effective regulation at this time |

| Year(s) of establishment | 2-5 years |

| Trading instruments | 55 Forex currency pairs, 35 Cryptocurrency pairs, 64 stocks, 11 indices, metals and commodities. |

| Minimum Initial Deposit | $100 |

| Maximum Leverage | 1:500 leverage for Forex, 1:100 leverage for Indices and Metals, 1:30 leverage for all Cryptocurrency pairs and 1:20 leverage for stocks |

| Minimum spread | 0.0 pips onwards |

| Trading platform | MT5, Webterminal |

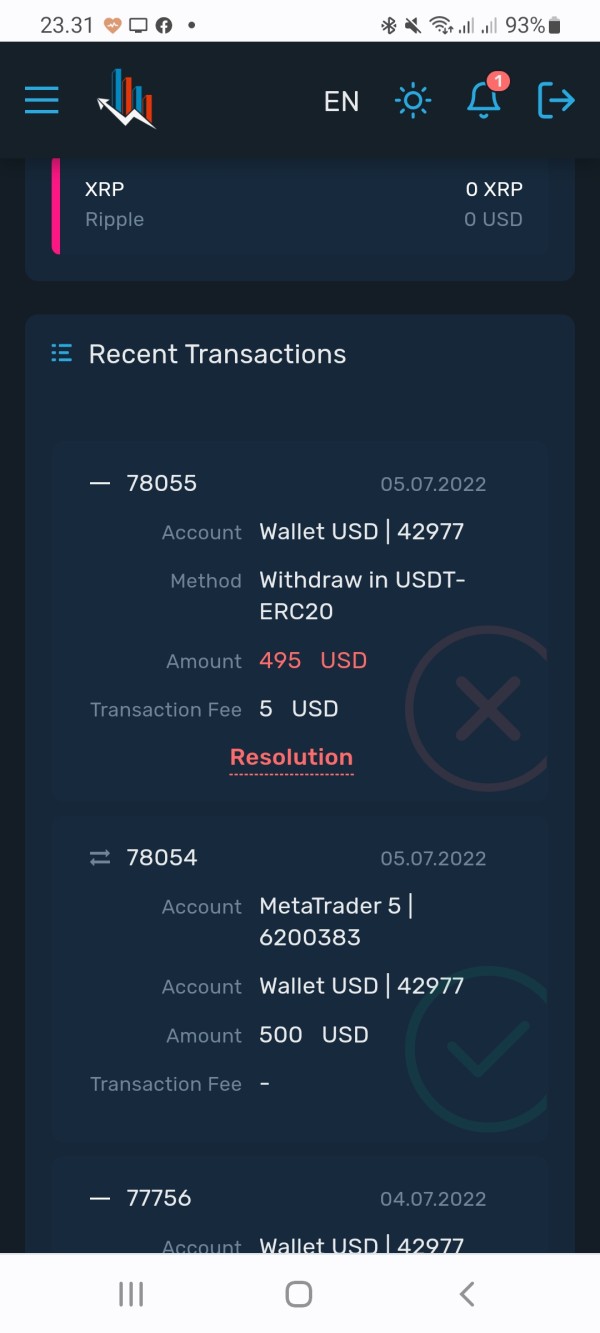

| Deposit and withdrawal method | Bitcoin, Ethereum, Ripple, Dash, BitcoinCash, Litecoin and many more cryptocurrencies; credit card, bank transfer |

| Customer Service | 24/5, Email, phone number, address, live chat |

| Fraud Complaints Exposure | Yes |

| Negative balance protection | Yes |

It is important to note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

Pros and cons of Dominion Markets

Pros:

Wide range of financial instruments available for trading, including forex, indices, metals, cryptocurrencies, and stocks.

Competitive maximum leverage settings, with up to 1:500 for forex trading.

Convenient and fast deposit options, including cryptocurrency and credit/debit card payments.

Same-day cryptocurrency withdrawals and no withdrawal limits.

Extensive educational resources available on the website, including market analysis and useful articles.

Negative balance protection offered, which means traders wont lose more than their account balance in certain circumstances.

Cons:

Lack of regulation and oversight by major financial authorities, as the company is registered in Saint Vincent and The Grenadines.

Limited customer support options, with no phone support and a relatively inactive social media presence.

Relatively high minimum deposit requirements compared to other online brokers.

What type of broker is Dominion Markets?

| Advantages | Disadvantages |

| Dominion Markets offers tight spreads and fast execution due to its Market Making model. | As a counterparty to its clients' trades, Dominion Markets has a potential conflict of interest that may lead to decisions that are not in the best interest of its clients. |

Dominion Markets is a Market Making (MM) broker, which means that it acts as a counterparty to its clients in trading operations. That is, instead of connecting directly to the market, Dominion Markets acts as an intermediary and takes the opposite position to its clients. As such, it can offer faster order execution speed, tighter spreads and greater flexibility in terms of the leverage offered. However, this also means that Dominion Markets has a certain conflict of interest with their clients, as their profits come from the difference between the bid and ask price of assets, which could lead to them making decisions that are not necessarily in the best interests of their clients. It is important for traders to be aware of this dynamic when trading with Dominion Markets or any other MM broker.

General information and regulation of Dominion Markets

Dominion Markets is an online trading platform that offers access to global financial markets, including Forex, Stocks, Commodities, and Cryptocurrencies. The company is based in Saint Vincent and The Grenadines, with an office located at Suite 305, Griffith Corporate Centre, Beachmont. Dominion Markets provides clients with a range of trading tools, educational resources, and customer support services to help them make informed trading decisions. With a focus on security, reliability, and transparency, Dominion Markets aims to provide clients with a seamless trading experience.

In the following article, we will analyze the characteristics of this broker in all its dimensions, providing you with easy and well-organized information. If you are interested, read on.

Market instruments

| Advantages | Disadvantages |

| Diverse range of instruments to trade including forex, cryptocurrencies, stocks, and commodities | Unregulated broker with no effective oversight |

| Opportunity to diversify investment portfolio | Limited educational resources on how to trade various instruments |

| Access to major currency pairs as well as exotic pairs | Limited analysis and research tools provided |

| Ability to trade popular cryptocurrencies | No option for trading bonds |

| Access to a range of global stocks | No option to trade options |

| Opportunity to trade major indices | No social trading platform |

| Access to a range of metals and commodities |

Dominion Markets provides a diverse range of instruments for trading, including 55 Forex currency pairs, 35 Cryptocurrency pairs, 64 stocks, 11 indices, metals and commodities. This variety of instruments offers traders the opportunity to diversify their investment portfolio and potentially increase their returns. Traders have access to major and exotic currency pairs, popular cryptocurrencies, a range of global stocks, major indices, metals, and commodities. However, it is important to note that Dominion Markets is an unregulated broker with no effective oversight, which may be a disadvantage for some traders who prefer a more regulated trading environment. Additionally, the broker does not provide much in the way of educational resources or analysis tools, which may be a drawback for beginner traders.

Spreads and commissions for trading with Dominion Markets

Standard STP account:

No commission

spread from 1.0 pips

PRO account:

Commission: $3.5 per 1 lot *one way

spread from 0.0 pips

Trading accounts available in Dominion Markets

Standard STP account:

Perfect for novice traders who want simple, direct market access with no commissions

No commission

spread from 1.0 pip

Metatrader 5 platform

Discretionary traders

100$ starting deposit

Leverage up to 500:1

Minimum trading size 0.01

200+ currency pairs

Major indicies

One click trading

All trading styles

Expert advisors allowed

Hedging allowed

PRO account:

Designed for the experienced trader who requires deep liquidity and tight spreads

Commission: $3.5 per 1 lot *one way

spread from 0.0 pips

Metatrader 5 platform

Scalpers & EAs

100$ starting deposit

Leverage up to 500:1

Minimum trading size 0.01

200+ currency pairs

Major indicies

One click trading

All trading styles

Expert advisors allowed

Hedging allowed

Dominion Markets offers two types of accounts, the Standard STP account and the PRO account, catering to both novice and experienced traders. The Standard STP account is designed for novice traders who require simple and direct market access, with no commissions charged and a low initial deposit of $100. With a spread starting from 1.0 pip and leverage up to 500:1, this account is suitable for all trading styles and allows expert advisors and hedging. On the other hand, the PRO account is designed for experienced traders who require deep liquidity and tight spreads, with a commission of $3.5 per 1 lot (one way) and a spread starting from 0.0 pips. Both accounts have a minimum trading size of 0.01 and offer access to over 200 currency pairs and major indices, with the MetaTrader 5 platform and one-click trading. However, Dominion Markets has limited account options and payment methods, and is not regulated by any major authority.

Trading platform(s) that Dominion Markets offers

Dominion Markets offers traders two platform options - the MT5 and Webterminal platforms. The MT5 platform is a popular choice among traders due to its advanced features and ability to support algorithmic trading through Expert Advisors. The platform is available on multiple devices, making it easy for traders to access the markets from any location. However, the platform has a steeper learning curve and may not be ideal for beginners. The Webterminal platform is a more basic version of the MT5 platform and may lack some advanced features. Additionally, it may be less secure compared to the desktop version of the platform.

Maximum leverage of Dominion Markets

| Advantages | Disadvantages |

| Potential for higher returns | Increased risk of significant losses |

| Allows for more flexibility in trading strategies | Requires careful risk management |

| May increase trading volume and profitability | Can lead to margin calls and forced position liquidations |

| Can be useful for experienced traders with sound risk management | Inexperienced traders may be tempted to over-leverage their positions |

| Can help to amplify small price movements into significant profits | Higher leverage may result in wider bid-ask spreads |

The maximum leverage is a crucial dimension in forex trading that can greatly impact your trading experience. Dominion Markets offers different maximum leverage settings for various instruments, ranging from 1:20 to 1:500. The highest leverage is offered for forex trading, which can allow for potentially higher returns and more flexibility in trading strategies. However, it also comes with increased risk, requiring careful risk management to avoid significant losses, margin calls, and forced position liquidations. The high leverage offered may be beneficial for experienced traders with sound risk management skills but could lead to potential problems for inexperienced traders who may be tempted to over-leverage their positions. Additionally, higher leverage can result in wider bid-ask spreads, which can increase transaction costs.

Deposit and Withdrawal: methods and fees

| Advantages |

| Wide range of deposit options including Crypto, credit/debit cards, and bank transfers |

| Low minimum deposit amounts |

| Same-day Crypto withdrawals |

| No maximum limit for withdrawals |

| Ability to cancel withdrawal requests while still pending |

| Disadvantages |

| Fees charged for Crypto deposits |

| Minimum deposit amounts for certain payment methods |

| Bitcoin transactions can take time to arrive in the account |

| Withdrawals can be delayed due to blockchain traffic |

Dominion Markets offers a variety of deposit and withdrawal options for its clients, including Crypto, credit/debit cards, and bank transfers. The minimum deposit amounts are relatively low, while there is no maximum limit for withdrawals. Same-day Crypto withdrawals are also available, and clients can cancel their withdrawal requests while still pending. However, fees are charged for Crypto deposits, and there are minimum deposit amounts for certain payment methods. Bitcoin transactions can also take some time to arrive in the account, while withdrawals can be delayed due to blockchain traffic. Overall, Dominion Markets provides a convenient and flexible payment system for its clients.

Educational resources in Dominion Markets

| Advantages | Disadvantages |

| Provides valuable education | Educational resources may not be exhaustive |

| Access to market analysis | Educational resources may not be applicable to all traders |

| Helpful articles for traders | Some educational resources may be outdated |

| Can improve trading skills | Some traders may prefer other educational resources |

Dominion Markets offers a range of educational resources, including market analysis and helpful articles. These resources can be beneficial to traders looking to improve their knowledge and skills in trading. The market analysis can provide valuable insights into market trends and help traders make informed trading decisions. The helpful articles cover a range of topics and can provide traders with useful tips and strategies to improve their trading performance. However, some traders may prefer other educational resources outside of Dominion Markets, and the educational resources may not be applicable to all traders, as each trader has different needs and preferences. Additionally, some educational resources may be outdated, and the resources may not be exhaustive.

Customer service of Dominion Markets

| Advantages | Disadvantages |

| 24/5 customer support available via email and live chat | No phone support available |

| Clear and detailed FAQ section on website | Limited social media presence |

| Physical address provided for transparency | No dedicated customer service page on website |

| Personalized account managers available for higher-tier clients | Limited information available on account managers' qualifications and expertise |

Dominion Markets offers several customer care options to clients. The company provides 24/5 customer support via email and live chat, allowing clients to reach out to the support team for assistance with any queries or issues they may have. The website also has a comprehensive FAQ section that covers various topics such as account registration, deposits and withdrawals, and trading conditions. The physical address of the company is also provided, indicating transparency and accountability. Personalized account managers are available for higher-tier clients, which can provide a more personalized experience. However, Dominion Markets does not offer phone support and has limited social media presence. Additionally, there is no dedicated customer service page on the website, making it challenging for clients to find relevant information.

Conclusion

In conclusion, Dominion Markets is a well-established online trading platform that offers various financial instruments such as forex, cryptocurrencies, stocks, and indices. With their user-friendly interface, competitive spreads, fast execution, and an array of educational resources, Dominion Markets provides a suitable environment for traders of all levels of experience. However, their regulatory status and lack of information about their team and ownership may be a concern for some potential users. Nevertheless, Dominion Markets aims to provide a seamless and secure trading experience for their clients, offering multiple payment methods and same-day crypto withdrawals. Overall, if you are looking for a diverse range of trading opportunities with low fees, Dominion Markets is a platform worth considering.

Frequently asked questions about Dominion Markets

Question: What is Dominion Markets?

Answer: Dominion Markets is an online trading platform that offers access to a wide range of financial instruments such as Forex, Indices, Metals, Cryptocurrencies, and Stocks.

Question: What are the available account types on Dominion Markets?

Answer: Dominion Markets offers two account types: standard ETP and pro. Each account has different features and benefits to suit different trading needs.

Question: Can I deposit funds using crypto on Dominion Markets?

Answer: Yes, Dominion Markets accepts a range of cryptocurrencies such as BTC, ETH, LTC, and more, for deposits.

Question: What is the minimum amount required to make a deposit on Dominion Markets?

Answer: The minimum deposit for Crypto deposits is $50, while for other payment methods, it is $100.

Question: What leverage does Dominion Markets offer for trading instruments?

Answer: Dominion Markets offers different maximum leverage settings for different trading instruments. For Forex, the maximum leverage is 1:500, while for Indices and Metals, it is 1:100. Cryptocurrency pairs have a maximum leverage of 1:30, and stocks have a maximum leverage of 1:20.

Question: What is the process for withdrawing funds on Dominion Markets?

Answer: Clients can withdraw funds from Dominion Markets through same-day crypto withdrawals, or via credit card or bank transfer. The minimum amount for withdrawals is $50.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Regional Brokers

- High potential risk

Review 28

Content you want to comment

Please enter...

Review 28

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

FX4215208230

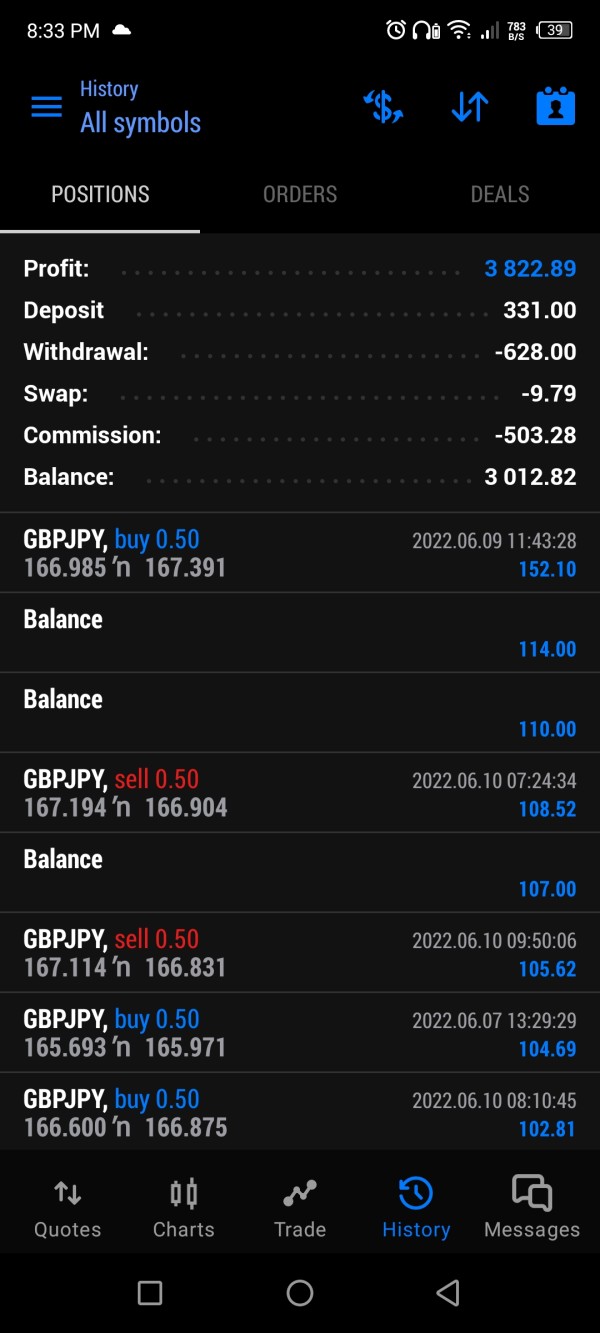

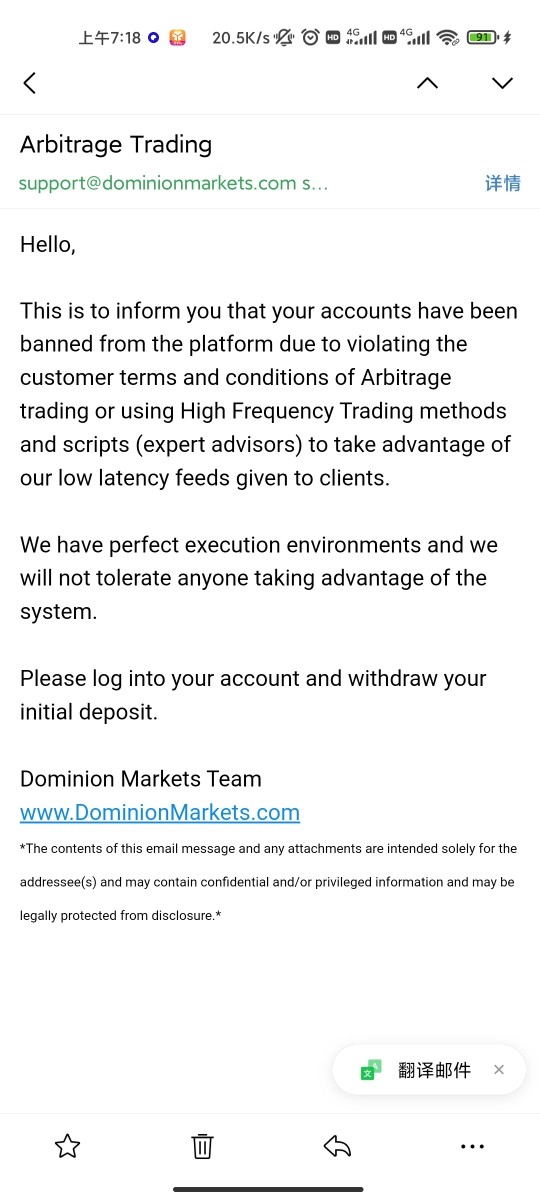

Indonesia

dominion market 100% DD broker and scam beware if the withdrawal of funds is close to 100% capital. without notification your money can not be withdrawn WD for various reasons dominion market broker will blame your open position. This broker will initially withdraw you for a deposit, it seems easy to trade for profit. then the funds are frozen unilaterally. Beware.....

Exposure

2022-07-09

FX1447807322

Pakistan

3000 usd in profit and account has been suspended by stating that I use expert advisors which I didn't and provided them all evidences on email.. No response at all.. Where to complain

Exposure

2022-06-12

天字贰号

Hong Kong

Deposit 480dollars and withdraw 300 dollars after making profit. The account still has 456 dollars, but it cannot be withdrawn. The profit was not given nor the principle. The email was not replied. It is not understandable. They should at least provide an explaination for the problem. Such a big company, should not do it to my principle. My trading account is 6194684. I hope to resolve it ASAP.

Exposure

2022-03-29

蜂鸟金融

Hong Kong

The platform does not allow to withdraw. Please help. I was placing orders and trading normally.

Exposure

2022-03-11

USDT@

United Arab Emirates

Just wanted to share my thoughts about Dominion Markets. A word of caution, there isn't any sturdy regulation in place at the moment. Positive side! They've got a smorgasbord of trading instruments - adding a lot of colors to your trading canvas. They run the MT5 and Webterminal platforms - efficient tools for trading deeds. If trading crypto is your cup of tea, then their deposit and withdrawal methods have got you covered. However, stay vigilant, as they've received a few fraud complaints knocking at their door.

Neutral

2023-12-01

FX1485573802

United States

I've been charting the financial market waters with Dominion Markets and here's my take. About regulations, they're floating a bit in the twilight zone. So make sure, you've got your seat belt buckled. Got to say this - they've cast quite a net when it comes to trading instruments. Heck, they've got everything from Forex and cryptos, to stocks and indices. But do note, the leverage game varies across the board - it’s as high as 1:500 for Forex and as toned down as 1:20 for stocks. They've got MT5 and Webterminal to aid your trading voyage.

Neutral

2023-11-30

Aderwar

Turkey

Dominion Markets is an excellent choice for traders who want access to a wide variety of tradable assets. They have a great selection of assets to choose from, and their minimum deposit is very reasonable.

Positive

07-16

fawaz1330

United Arab Emirates

Apart from regulated broker, the dominion market is more convenient and transparent comparing to the other platform with other broker. Deposit from and withdrawal to direct bank account take time even then claim 1 or 2 days but by crypto way of deposit and withdrawal works easily within a day. recently they have introduced commission free account with 1.0 pip in gold, this is used by most of the Arab world traders who looks for commission free and swap free account. Instant Execution of trade in economic news time.

Positive

2023-05-31

FX3124110821

Pakistan

The Best Broker I have used. I have been trading for 6 month now. Everything works very smoothly. the whole experience fantastic, combine that with low spread and customer service is awesome they are always to respond and willing to help. I've never had a problem Depositing fund, withdrawing funds, opening account I recommend it

Positive

2023-03-19

FX7002026772

Japan

I moved over form another big brand broker. Only reason was there was no MT5. I guess there was no upgrade but came to Dominion due to their MT5 platform and claims of great latency lol.. No complaints so far

Positive

2023-03-19

Rogerfri

South Africa

I've been with DM since they went live and I've had good service with them. The support team gets back to me in a timely fashion. And I just made my first withdrawal thru crypto and it went through in about an hour but it all worked out.

Positive

2023-03-19

Finncormac

Nigeria

Just recently used my commissions to get Market Fluidity.. At first I thought giving incentives with commissions was just a marketing scheme but lol I really got access to the database ! Really appreciate it guys.. you rock ! Just recently used my commissions to get Market Fluidity.. At first I thought giving incentives with commissions was just a marketing scheme but lol I really got access to the database ! Really appreciate it guys.. you rock !

Positive

2023-03-19

Mickeymizel

United States

No other CEO of any other company will have a relationship to you and be your mentor. Invaluable knowledge and experience you receive. No other company also will reward you and allow you to use their commissions to exchange for education or devices to help you manage risk.

Positive

2023-03-19

Andyhamzat

United States

This broker is what retail traders need and offers and entire package catered to traders. Low spreads, competitive commissions and even benefits of using commission for further education or tools. You can use your commission to gain training or purchase the risk management tool magic keys! I have never seen brokers allow you to use expenses to learn more! Very innovative with amazing service.

Positive

2023-03-19

FX8803106620

United Kingdom

Only because of Raja on youtube livestreams i have switched over to Dominion broker. Honestly, I have no idea about other bad reviews but crypto deposits for me have been pretty quick ! I only did a test withdrawal once to see how quick it takes, it was after 5 hours which is not bad. Hopefully I can do more withdrawals of profits soon. Thanks Raja .. running a good platform here

Positive

2023-03-19

Markjac

United States

What a fantastic forex broker. I am not a professional trader but they have islamic accounts which are swap free. Their spreads are also pretty good. However I will be switching to a PRO account since i dont deal with swaps anyway, also the pro account spreads are much lower. thanks guys !!

Positive

2023-03-19

Russellville

Singapore

Best broker in the industry.. For many reasons: 1- while you are trading you can use your commissions as an incentive for having magic keys one of the best risk management tool in the market or getting access to market fluidity the best forex education that simplifies trading into price action only vision to the market 2- best executions in the market. 3- very low to near zero spreads on pro accounts. 4- your ability to choose your account type and leverage that suits you.

Positive

2023-03-19

FX7366789852

United States

Good service.

Positive

2023-03-18

Johnnycake

Philippines

I’ve been using Dominion Markets since it first opened, my experience has always been great AND fast from depositing, to trading, to withdrawing. With competitive ECN spreads, VERY low commissions per lot, and incredible customer service. Look no further and start trading with Dominion Markets today. Choose (Crypto) if your country is not listed during registration

Positive

2023-03-18

Barbarados

Cyprus

Very good broker. One of the lowest spreads I have seen out of all the other brokers. Never had any problems depositing nor withdrawing with crypto.

Positive

2023-03-17