简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Dow Jones Earnings to Offer Insight on Global Growth & Trade Wars

Abstract:Two economic activity bellwethers in Caterpillar (CAT) and UPS are slated to report earnings Wednesday morning and investors will look closely for insight on global growth. Boeing (BA) will also report.

Dow Jones Forecast:

Traders will look to earnings from Caterpillar (CAT) and UPS to glean information on the state of global and domestic growth

The largest component of the Dow Jones, Boeing (BA), is also due to report before market open

Interested in earnings season? Learn about the key facts and why it is important to the stock market

Dow Jones Forecast: Index to Take Cues from Major Earnings Reports

The Dow Jones climbed near record highs on Tuesday after it was revealed US negotiators would travel to Beijing next week in an attempt to resolve the ongoing trade dispute. The resultant optimism bolstered the Average following a string of mixed earnings from companies like Coca Cola (KO) and Lockheed Martin (LMT). As Wednesday approaches, Caterpillar, UPS and Boeing will take position as the Industrial Averages key corporate influencers.

Caterpillar to Offer Insight on Global Growth

Caterpillar is often viewed as a bellwether for the global economy as investors view heavy machinery demand as an indicator for construction activity and therefore growth. With that said, CAT warned last quarter of waning demand in China – which aligned with slowing growth in the country – alongside increased competition in Asia. The headwinds conjoined to pressure the machinery manufacturer lower and shares have made little progress in the quarter since.

Caterpillar (CAT) Stock Price Chart: Daily Time Frame (October 2018 – July 2019) (Chart 1)

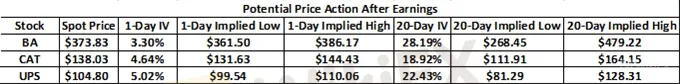

Implied volatility for CAT shares is expectedly heightened ahead of earnings, with options pricing suggesting a 4.6% move in either direction. Coincidentally, the implied price range encompasses two key technical levels at each end of the range. To the topside, a descending trendline from January 2018 will look to keep a lid on CAT shares around $143 – where it collides with a nearby Fibonacci level. Conversely, Caterpillar shares will look to the 200-day moving average around $132 for support if earnings seriously disappoint.

UPS & Boeing Earnings to Highlight Trade Wars

While Caterpillar will offer useful information on the state of global growth, United Parcel Service (UPS) and Boeing (BA) are likely to deliver updates on the state of another headwind facing equity markets – trade wars. That said, each stock faces a different challenge under the umbrella of the larger theme.

UPS

The revenue of United Parcel Service is largely tied to global shipping and package delivery trends. Thus, lower economic activity due to slowing growth or widespread trade conflicts will look to weigh on the companys profit. UPS leadership will likely offer commentary on both these themes and their respective outlooks.

UPS Stock Price Chart: Daily Time Frame (January 2018 – July 2019) (Chart 2)

Boeing & Airbus Debacle Continues

Dow Jones heavyweight – Boeing (BA) – faces a much more specific trade war threat as the EU and United States continue to lobby for their respective airplane manufacturer at the WTO. An exchange of tariffs and counter-tariffs have seen two of the world‘s largest economies trapped in a trade conflict spanning months. After facing another round of potential tariffs from the United States, the European Union has expressed a willingness to respond by placing levies on goods with close ties to President Trump’s base. For more information on this conflict, follow @PeterHanksFXon Twitter.

Alongside the issues with the European Union, Boeing continues to grasp for an answer to the issue in its 737 Max models which resulted in two fatal crashes. Just last week, Boeing announced a $4.9 billion payment associated with the grounding of the model. As long as the 737 Max remains unfit for flight, airlines will seek compensation for lost profit. In summation, BA faces a series of headwinds and as the largest member of the Dow Jones, could put significant pressure on the Index if results disappoint.

Boeing (BA) Stock Price Chart: Daily Time Frame (January – July) (Chart 3)

Perhaps to the chagrin of bears, Boeing stock enjoys a nearby confluence of support in the $365 area marked by the 200-day moving average and ascending trendline from June. While fundamental themes will remain the primary drivers behind the stocks price action, technical levels will look to exert any influence they can muster in an attempt to stall price in either direction. As these three large-cap stocks look to flex their muscle over the broader Dow Jones Index, check out the weekly technical forecast for the Dow Jones, Nasdaq 100 and DAX 30 for important price levels.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

【MACRO Alert】The possibility of Trump winning the election is closely linked to market conditions! Could Japan become a big winner from this?

Although the market has responded positively to the prospect of Trump's possible re-election, and the Japanese stock market has shown an upward trend as a result, investors should also remain cautious and pay attention to the long-term impact of the election results on global economic policies and market sentiment. As strategist Tomo Kinoshita pointed out, while short-term market dynamics may be closely related to the election results, ultimately, the fundamentals of companies, economic data, an

Commodity prices Surge as Geopolitical Tension Rise

he market saw muted activity as both the U.S. and the U.K. observed public holidays in yesterday's session. The dollar index (DXY) edged lower, failing to hold above the 104.50 level. This decline comes as the market anticipates signs of cooling U.S. inflation ahead of the PCE reading due on Friday. Meanwhile, the U.S. Securities and Exchange Commission (SEC) announced a reduction in Wall Street settlement times, aiming to complete transactions in a single day.

Market Focus on Earnings Report

As we head into the second quarter earnings report season, the U.S. equity market is poised to capture significant attention. Recent geopolitical events, particularly the unconfirmed reports of an explosion in Iran's third-largest city last Friday, have injected volatility into commodities prices and bolstered the appeal of safe-haven assets like the U.S. dollar and Japanese Yen.

Daily Market Newsletter - February 8, 2024

Recap of Global Market Trends and Trading Opportunities

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

YAMARKETS' Jingle Bells Christmas Offer!

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

SEC Approves Hashdex and Franklin Crypto ETFs on Nasdaq

Currency Calculator