简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

US Dollar May Rise on Growth Angst. S&P 500 Earnings to Fall?

Abstract:The US Dollar may rise on haven demand amid worries about slowing global economic growth. Early results show earnings for S&P 500 companies are on pace to fall.

TALKING POINTS – US DOLLAR, YEN, BANK OF AMERICA, ZEW, S&P 500

谈话要点 - 美元,日元,美国银行,ZEW,标准普尔500指数

Downbeat RBA meeting minutes trigger risk-off G10 FX response

低迷的澳大利亚央行会议纪要引发G10外汇风险回落

German ZEW, US industrial production, BofA results due ahead

德国ZEW,美国工业生产,美国银行业绩提前到期

{3}

A downbeat tone in minutes from Aprils RBA meeting triggered a broadly risk-off response from financial markets, as expected. The Australian Dollar plunged alongside its similarly sentiment-sensitive Canadian and New Zealand counterparts while the anti-risk US Dollar and Japanese Yen gained. Crude oil tellingly fell with Treasury bond yields.

一个悲观的基调正如预期的那样,4月份澳大利亚央行会议的会议纪要引发了金融市场广泛的风险回应。澳大利亚元与其同样情绪敏感的加拿大和新西兰同行一道暴跌,同时抗风险美元和日元上涨。据报道,中央银行讨论了可能需要降息的情况,加强了近期官方言论的温和转变,原油显然随国债收益率而下跌。{/ p>

Looking ahead, Germany‘s ZEW survey of analysts’ sentiment and US industrial production figures may amplify global slowdown fears. Macro data flow out of both countries has tended to underperform relative to baseline forecasts in recent months. The first-quarter earnings report form Bank of America may add to pressure if it echoes yesterdays lackluster results from Goldman Sachs and Citigroup.

展望未来,德国ZEW对分析师情绪和美国工业生产数据的调查可能会放缓全球经济放缓的担忧。近几个月来自这两个国家的宏观数据流量往往低于基线预测。美国银行的第一季度收益报告可能会增加压力,如果它与昨天高盛和花旗集团的低迷结果相呼应。

What are we trading? See the DailyFX teams top trade ideas for 2019 and find out!

我们交易的是什么?查看DailyFX团队的最高交易2019年的想法并找出答案!

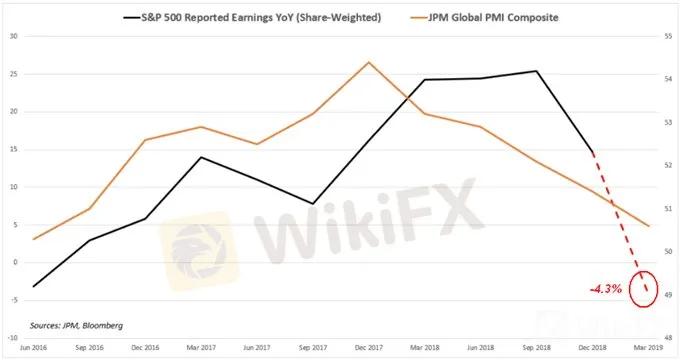

CHART OF THE DAY – S&P 500 EARNINGS ON PACE TO FALL IN FIRST QUARTER

一天的图表 - 标准普尔500指数第一季度的收益

The on-going slide in global growth may bring the first quarter of negative corporate earnings growth in three years. JPMorgan Global PMI data shows the pace of expansion in nonfarm activity has been slowing since the beginning of last year. Data from Bloomberg reveals that this began to show up in the performance companies comprising the bellwether S&P 500 stock index in the fourth quarter of 2018.

全球经济增长的持续下滑可能会在三年内带来企业盈利增长的第一季度。摩根大通全球PMI数据显示了扩张的步伐自去年年初以来,非农业活动一直在放缓。彭博社的数据显示,2018年第四季度开始出现包括领头羊标准普尔500股票指数在内的表现公司。

The drop appears to be accelerating, with first-quarter results published thus far implying earnings are on pace to fall 4.3 percent on-year. It is important not to overstate this. After all, just under 7 percent of the companies represented in the index have reported thus far. That means a more benign outcome may yet be in the cards. A more malignant one is likewise a possibility however.

下跌似乎正在加速,首先是截至目前公布的四分之一业绩意味着盈利同比下降4.3%。重要的是不要夸大这一点。毕竟,到目前为止,该指数中只有不到7%的公司报告过。这意味着可能会有更好的结果。然而,更恶性的也是可能的。

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Global Market Volatility and Strategic Moves by Major Economies and Companies

Global markets face volatility with significant declines in US and Asian stocks due to central bank rate decisions and economic uncertainties. JPMorgan's recession forecast, and Cathie Wood's tech stock acquisitions. Additionally, geopolitical tensions, market shifts in New York and Thailand, and rising energy prices in Europe highlight the diverse factors influencing the global financial landscape.

Dovish Fed’s Statement Hammers Dollar

The highly anticipated Fed’s interest rate decision was disclosed yesterday, hammering the dollar’s strength lower as Fed Chief Jerome Powell explicitly signalled that a September rate cut is possible. The U.S. central bank is balancing both inflation and recession risks, with interest rates adjusted to curb inflation while maintaining a solid labour market.

<Part 2> GTSE Global Market Dynamics: Key Developments

Global markets face significant changes. China's financial sector caps salaries under Xi Jinping's "common prosperity" policy, affecting the yuan and major financial stocks. India's entry into the JPMorgan Emerging Markets Bond Index boosts investment and strengthens the rupee. Nike's weak outlook suggests a U.S. economic slowdown. Japan's yen nears a 40-year low, prompting potential stabilization efforts. Hong Kong faces judicial concerns, impacting its financial stability.

<Part 1> GTSE Global Market Dynamics: Key Developments

Global markets face significant changes. China's financial sector caps salaries under Xi Jinping's "common prosperity" policy, affecting the yuan and major financial stocks. India's entry into the JPMorgan Emerging Markets Bond Index boosts investment and strengthens the rupee. Nike's weak outlook suggests a U.S. economic slowdown. Japan's yen nears a 40-year low, prompting potential stabilization efforts. Hong Kong faces judicial concerns, impacting its financial stability.

WikiFX Broker

Latest News

High-Potential Investments: Top 10 Stocks to Watch in 2025

US Dollar Insights: Key FX Trends You Need to Know

Why Is Nvidia Making Headlines Everywhere Today?

Discover How Your Trading Personality Shapes Success

FINRA Charges UBS $1.1 Million for a Decade of False Trade Confirmations

Bitcoin in 2025: The Opportunities and Challenges Ahead

BI Apprehends Japanese Scam Leader in Manila

Big News! UK 30-Year Bond Yields Soar to 25-Year High!

SQUARED FINANCIAL: Your Friend or Foe?

Join the Event & Level Up Your Forex Journey

Currency Calculator