Score

LCM

Turkey|5-10 years|

Turkey|5-10 years| https://www.lcmfx.com/

Website

Rating Index

Influence

Influence

D

Influence index NO.1

Vietnam 2.83

Vietnam 2.83Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Turkey

TurkeyAccount Information

Users who viewed LCM also viewed..

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

EC Markets

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

AUS GLOBAL

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

Website

lcmfx.com

Server Location

Singapore

Website Domain Name

lcmfx.com

Server IP

149.28.143.47

Company Summary

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

| LCM Review Summary in 10 Points | |

| Founded | N/A |

| Registered Country/Region | Turkey |

| Regulation | No license |

| Market Instruments | FX, commodities, indices and stock CFDs |

| Demo Account | N/A |

| Leverage | 1:1000 |

| EUR/USD Spread | From 1.2 pips (Std) |

| Trading Platforms | MT5 |

| Minimum Deposit | N/A |

| Customer Support | 24/7 multilingual live chat, phone, email, online messaging, Messenger |

What is LCM?

LCM, also known as London Currency Markets, is an offshore ECN/STP broker registered in Turkey, and advertises that it offers trading in FX, Commodities, Indices and Stock CFDs through the MT5 platform. However, LCM currently doesnt hold any valid regulatory license to operate financial services.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

LCM has its pros and cons, which should be carefully considered by traders. On the positive side, the broker offers a wide range of market instruments and competitive spreads, providing traders with flexibility in their trading strategies. The availability of the popular MT5 trading platform and multilingual customer support adds convenience for traders. Additionally, fee-free funding options and the provision of demo accounts are beneficial for traders looking to explore the platform before committing real funds.

However, the lack of regulation and reports of potential withdrawal issues and scams are significant drawbacks that raise concerns about the broker's trustworthiness and reliability. Traders should exercise caution and conduct thorough research before engaging with LCM.

| Pros | Cons |

| • Wide range of market instruments | • Lack of regulation |

| • Multiple account types | • Reports of potential withdrawal issues and scams |

| • Provision of demo accounts | • Residents of North Korea, United States, Puerto Rico, Canada, Japan, Iran, Iraq, Lebanon, and Turkey are excluded |

| • Competitive spreads | • No info on minimum deposit |

| • Commission-free accounts available | |

| • Availability of MT5 trading platform | |

| • Popular payment methods supported | |

| • Fee-free funding options | |

| • 24/7 multilingual customer support |

LCM Alternative Brokers

OANDA - A highly reputable and regulated forex broker with advanced trading platforms, making it a reliable choice for traders of all levels.

FOREX TB - A user-friendly and regulated broker offering a wide range of trading instruments, suitable for both beginner and experienced traders.

Markets.com - A well-established broker with a comprehensive set of trading tools and educational resources, making it a good option for traders seeking educational support.

There are many alternative brokers to LCM depending on the specific needs and preferences of the trader. Some popular options include:

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Is LCM Safe or Scam?

As LCM lacks valid regulation, it raises concerns about the safety and legitimacy of the broker. Regulation by reputable authorities provides a level of oversight and protection for traders. The absence of regulation means there is no independent entity monitoring LCM's operations, compliance with industry standards, and client fund protection. This increases the risk for traders, as there may be a lack of transparency and accountability. It is essential for traders to carefully evaluate and consider the risks associated with trading on an unregulated platform like LCM before making any investment decisions.

Market Instruments

LCM offers traders a comprehensive range of market instruments across different asset classes. In the foreign exchange (FX) market, traders can access a wide variety of currency pairs, including major, minor, and exotic pairs. This allows for diverse trading opportunities and the ability to capitalize on global currency movements.

In addition to FX, LCM provides access to various commodities. Traders can participate in the commodities market by trading popular assets such as gold, silver, crude oil, natural gas, and agricultural products. These commodities offer opportunities for hedging against inflation, diversification, and speculation based on supply and demand dynamics.

LCM also offers trading in indices, which represent the performance of a basket of stocks from a specific market or sector. Traders can speculate on the movement of major indices such as the S&P 500, FTSE 100, DAX 30, and others. Trading indices allows investors to take positions on broader market trends and potentially benefit from the performance of multiple companies within a specific market.

Furthermore, LCM provides stock CFDs (Contracts for Difference) that allow traders to speculate on the price movements of individual stocks without owning the underlying asset. This provides flexibility and the opportunity to trade stocks from various global exchanges, including major companies in the US, Europe, and other regions.

Accounts

LCM offers a range of account types to cater to the diverse needs and preferences of traders. The account types available include Standard, Zero Spread, Fixed Spread, and VIP accounts, all of which are swap-free, making them suitable for traders adhering to Islamic principles.

The Standard account is designed for traders who prefer a traditional trading experience. It provides access to a wide range of trading instruments and typically offers competitive spreads.

The Zero Spread account is tailored for traders seeking low-cost trading. It offers tight spreads with no additional commission charges. This account type is suitable for traders who value transparency and want to minimize trading costs.

The Fixed Spread account is suitable for traders who prefer stability in their trading costs. It offers fixed spreads on trading instruments, allowing traders to know their costs upfront. This account type may be preferred by traders who want consistency in their trading expenses, regardless of market volatility.

LCM also offers a VIP account for high-volume traders or those with larger account sizes. The VIP account provides additional benefits, such as personalized services, dedicated account managers, and tailored trading conditions. This account type is designed to meet the specific needs of experienced and professional traders.

While the minimum deposit requirement for the LCM account types is not mentioned, it is common for brokers to have varying minimum deposit requirements for each account type. Traders are advised to contact LCM directly or refer to their official website for precise details regarding the minimum deposit requirement for each account type.

Leverage

The leverage LCM offers, however, is not okay - 1:1000 is too much for retail traders, as a majority of the regulatory bodies out there have ruled. Leverage is a tool that allows traders to control larger positions in the market with a smaller amount of capital. For example, with a leverage ratio of 1:1000, traders can control a position that is 1000 times larger than their actual account balance.

The availability of high leverage can be appealing to traders who seek the potential for higher returns on their investments. It allows them to trade larger volumes and potentially amplify their profits. However, it's important to note that leverage is a double-edged sword. While it can magnify gains, it can also amplify losses. Traders must exercise caution and have a solid risk management strategy in place when utilizing high leverage.

It's worth mentioning that trading with high leverage requires a good understanding of the market, risk management techniques, and a disciplined approach to trading. Traders should carefully consider their risk tolerance, financial situation, and trading experience before utilizing high leverage.

Spreads & Commissions

The spread and commission vary on the account type. The spread refers to the difference between the bid and ask price of a financial instrument, and it represents the cost of trading for traders. LCM provides competitive spreads across its different account types.

For the Standard account, the spread starts from 1.2 pips, but no additional commission charges. The Fixed Spread account offers spreads starting from 1.5 pips, and also, commission is free.

The Zero account stands out with its spread starting from 0.0 pips, which indicates tighter spreads and potentially lower trading costs. However, it's important to note that this account type charges a commission of $10 per round lot. Traders who value tighter spreads and are comfortable with paying a commission might find the Zero account appealing.

Lastly, the VIP account offers competitive spreads starting from 0.6 pips, providing traders with potentially lower trading costs compared to the other account types. Importantly, there are no additional commissions charged for trades made with the VIP account, making it an attractive option for traders looking for tight spreads without commission fees.

| Account Type | Standard | Zero | Fixed Spread | VIP |

| Spreads from | 1.2 pips | 0.0 pips | 1.5 pips | 0.6 pips |

| Commission | $0 | $10 per round lot | $0 | $0 |

It's crucial for traders to consider their trading strategy, frequency of trades, and their preference for spreads versus commissions when choosing the most suitable account type. Evaluating the overall trading costs, including both spreads and commissions, can help traders make informed decisions and optimize their trading experience with LCM.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread (pips) | Commission (per lot) |

| LCM | 1.2 (Std) | No commission (Std) |

| OANDA | 0.9 | No commission |

| FOREX TB | 1.0 | $6 |

| Markets.com | 0.6 | No commission |

Please note that the spread and commission values provided are indicative and can vary depending on market conditions and account types. It's always recommended to check with the brokers directly or their official websites for the most up-to-date information.

Trading Platforms

LCM provides its clients with access to the popular MetaTrader5 (MT5) trading platform. MT5 is a widely recognized and trusted platform in the industry, known for its advanced features and user-friendly interface. With MT5, traders have the flexibility to access their trading accounts on various devices and operating systems, ensuring convenience and seamless trading experiences.

For Windows and OS X users, LCM offers a downloadable version of the MT5 platform. This allows traders to install the software directly on their computers and access a comprehensive set of tools and features. The desktop version provides real-time price quotes, advanced charting capabilities, multiple timeframes, and a wide range of technical indicators for in-depth market analysis.

LCM also offers the MT5 WebTrader, which is a web-based platform accessible through a web browser. This allows traders to access their accounts and trade from any device with an internet connection, without the need for downloading or installing any software. The WebTrader retains most of the functionalities available in the desktop version, enabling traders to monitor their positions, place trades, and analyze markets conveniently.

For traders who prefer to trade on the go, LCM provides MT5 mobile applications for Android and iOS devices. These mobile apps offer a user-friendly interface and allow traders to access their accounts, monitor the markets, execute trades, and manage positions from their smartphones or tablets. The mobile platform provides real-time price quotes, interactive charts, and essential trading tools to support traders' decision-making process even when they are away from their computers.

By offering the MT5 platform in multiple versions, LCM ensures that traders have flexibility and accessibility to trade in a way that suits their preferences and lifestyles. The platform's advanced features, reliable execution, and user-friendly interface contribute to a seamless trading experience for LCM clients across different devices and operating systems.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| LCM | MT5 |

| OANDA | OANDA Trade, MT4 |

| FOREX TB | WebTrader, Mobile App, MT4 |

| Markets.com | WebTrader, Mobile App, MT4 |

Deposits & Withdrawals

LCM provides its clients with a convenient and hassle-free deposit and withdrawal process. The broker offers a variety of fee-free funding options, ensuring that traders can easily add funds to their trading accounts. Clients can choose from options such as local transfers, Visa, MasterCard, Neteller, Skrill, Qiwi wallet, and Fasapay. These options cater to different preferences and allow for quick and secure transactions. However, a 10% transfer fee will be charged for withdrawals. Traders should consider this fee when planning their withdrawals.

LCM minimum deposit vs other brokers

| LCM | Most other | |

| Minimum Deposit | N/A | $100 |

Customer Service

LCM offers 24/7 multilingual support, ensuring that traders can seek assistance at any time, regardless of their geographical location. The support team can be reached through various channels, including live chat, phone, email, online messaging, and Messenger, allowing for quick and convenient communication.

In addition to direct contact options, LCM maintains an active presence on various social networks, including Twitter, Facebook, Instagram, YouTube, and LinkedIn. This enables clients to stay updated with the latest news, market insights, and educational content provided by the broker. The FAQ section available on the website serves as a valuable resource, offering answers to commonly asked questions and providing self-help solutions.

Overall, LCM demonstrates a strong commitment to customer service by offering round-the-clock support, multiple communication channels, and an engaging presence on social media platforms. The broker's customer-centric approach ensures that clients can receive prompt assistance, stay informed, and have a positive trading experience.

| Pros | Cons |

| • 24/7 live chat availability | N/A |

| • Multilingual and multi-channel support | |

| • Social media presence for additional updates | |

| • FAQ section offered |

Note: These pros and cons are subjective and may vary depending on the individual's experience with LCMs customer service.

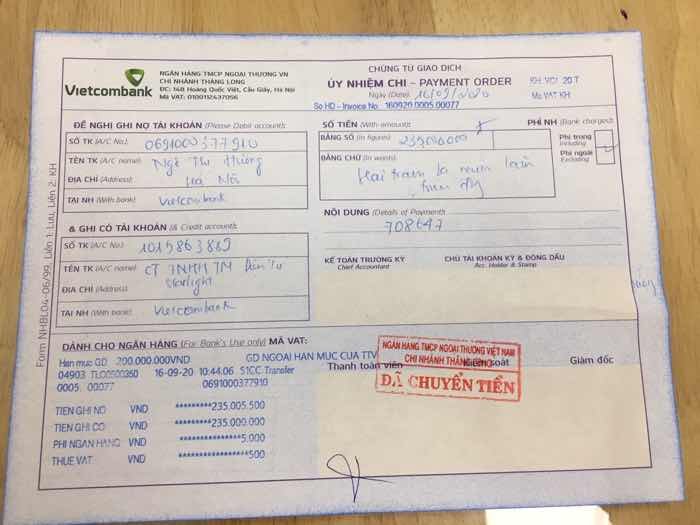

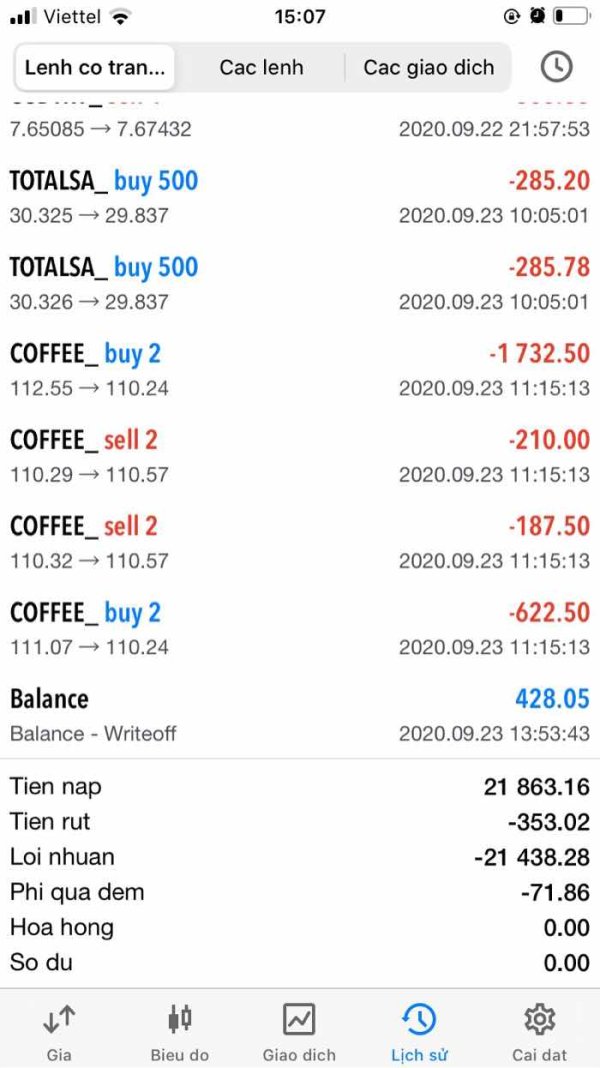

User Exposure at WikiFX

On our website, you can see that reports of unable to withdraw, severe slippage and scams. Traders are encouraged to carefully review the available information and consider the risks associated with trading on an unregulated platform. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Conclusion

In conclusion, LCM is a forex broker that offers a wide range of market instruments and competitive trading conditions. However, it is important to note that LCM operates without proper regulation, which poses a significant risk to traders. While the broker provides access to the popular MT5 trading platform, offers diverse account types, and features a multilingual customer support team, the lack of regulation and reports of potential issues with withdrawals and scams raise concerns about the safety and reliability of the platform. Traders should exercise caution and carefully evaluate the risks associated with trading on an unregulated platform before considering LCM as their broker of choice.

Frequently Asked Questions (FAQs)

| Q 1: | Is LCM a regulated broker? |

| A 1: | No. It has been verified that this broker currently has no valid regulation. |

| Q 2: | At LCM, are there any regional restrictions for traders? |

| A 2: | Yes. LCM does not offer its services to residents of certain jurisdictions such as North Korea, United States, Puerto Rico, Canada, Japan, Iran, Iraq, Lebanon, Turkey. |

| Q 3: | Does LCM offer the industry leading MT4 & MT5? |

| A 3: | Yes. It supports MT5. |

| Q 4: | Is LCM suitable for beginner traders? |

| A 4: | No. It is not a good choice for beginners. Though it advertises well, it lacks valid regulation, and even no minimum deposit requirement revealed. |

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 34

Content you want to comment

Please enter...

Review 34

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

FX1508727066

Vietnam

It has been over two weeks

Exposure

2021-06-12

FX4027310731

Vietnam

Who invests in these exchanges: LCM, GKFX, Acx, Asx, DK trading, Nik capital, swissmes...Stop immediately, just before the account can burn. I have been knocked down. LCM intentionally burned the account for $15,000, then both the IB and the technicians blocked the phone number and cancelled the Zalo phone number 0979080840

Exposure

2021-05-17

FX4027310731

Vietnam

I was slapped LCM deliberately burned 15,000 [d83d][dcb2]My account information on the exchange LCM Forex:-Trading Platform: MT5-ID: 708647-Server: LCM LLC-LIVE-Tel 0979080840

Exposure

2021-05-10

FX4027310731

Vietnam

LCM deliberately wiped out my account with 15k and then close the communication

Exposure

2021-05-07

FX3002449957

Vietnam

LCM让工作人员使用伪造的文件欺骗客户,欺骗客户提取奖,最终无法提取。他们提供的错误资讯意见,欺骗客户,让他们的投资打水漂。我用了2k付咨询费,投资赔掉了5k。我的Zalo:0974117835。

Exposure

2021-02-13

FX1054584862

Vietnam

The IB gave the wrong order in the market, the number of lots was high compared to my account while the market was volatile. I asked if iB was okay, the IB said it was okay. And left until negative, most of the IB capital called me and say top up in case of negative money to save the account.

Exposure

2021-01-21

FX3891143388

Vietnam

I deposited $500. And then I had applied for a withdrawal but I didn't get my withdrawals after two days. The broker said they were considering solutions but they didn't take any actions. It has been pending.

Exposure

2021-01-14

FX8827548372

Vietnam

I can't withdraw my funds or bonus. You should stay away from this platform

Exposure

2021-01-07

FX1590212211

Vietnam

I wanna withdraw funds but they make my account wiped out. This is a fraud platform

Exposure

2020-12-11

Tran Nhan Chinh

Vietnam

The witdhrawal hasn't been to my account for three days

Exposure

2020-11-19

FX2727873782

Vietnam

Induce investors to deposit a lot. Unable to withdraw.

Exposure

2020-11-01

FX2727873782

Vietnam

Cheat users of much money

Exposure

2020-10-31

FX4255817594

Vietnam

Induce customers to deposit by making him earn money.

Exposure

2020-10-30

FX1910871914

Vietnam

They will burn your account. It you profit one order, you'll lose in the following orders.

Exposure

2020-10-30

FX4212809422

Vietnam

Forex trading slippage appeared as the market fluctuated when I was trading, terribly expanding the spread. I bought a large amount of oil.

Exposure

2020-10-06

FX1413372446

Vietnam

My MT5: 708185.I opened an account on 09/09/2020 and closed on September 24. I knew a teacher, and he taught us on Thursday. He recommended this platform to us and said 100% profit. I deposited twice and lost $2,400 in total. I hope you can help me handle this problem.

Exposure

2020-09-25

FX2595007002

Vietnam

This is not a new scam. When you deposit in LCM, you should know, 1. Can't withdraw 2. Make your account wiped out

Exposure

2020-09-21

hi26491

Vietnam

I invested and lost money within three days.

Exposure

2020-09-14

FX1924379998

Vietnam

I invested 500$ and lost.

Exposure

2020-09-08

hi26491

Vietnam

I invested from 7,000 to 16,000 But my account was wiped out. The platform has a sign of staling customer's money. Be careful.

Exposure

2020-09-05