Score

TSC FX GROUP

United States|1-2 years|

United States|1-2 years| https://www.tscfxgroupltd.com/en

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

United States

United StatesUsers who viewed TSC FX GROUP also viewed..

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

EC Markets

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GTCFX

- 10-15 years |

- Regulated in United Kingdom |

- Straight Through Processing(STP) |

- MT4 Full License

Website

tscfxgroupltd.com

Server Location

United States

Website Domain Name

tscfxgroupltd.com

Server IP

104.21.76.105

Company Summary

| Aspect | Information |

| Company Name | TSC FX GROUP |

| Registered Country/Area | United States |

| Founded Year | 2006 |

| Regulation | Regulated by FinCEN |

| Market Instruments | Forex, Stocks, Indices, Commodities, Cryptocurrencies |

| Account Types | Plus+ Account, Standard Account |

| Minimum Deposit | N/A |

| Maximum Leverage | Up to 500:1 |

| Spreads | Starting at 0.0 pips |

| Trading Platforms | TSC FX Group Ltdtrading platform |

| Customer Support | +1 (646) 466 0111, support@tscfxgroupltd.com |

| Deposit & Withdrawal | Debit cards and bank transfers |

| Educational Resources | Basic news analysis and economic calendar |

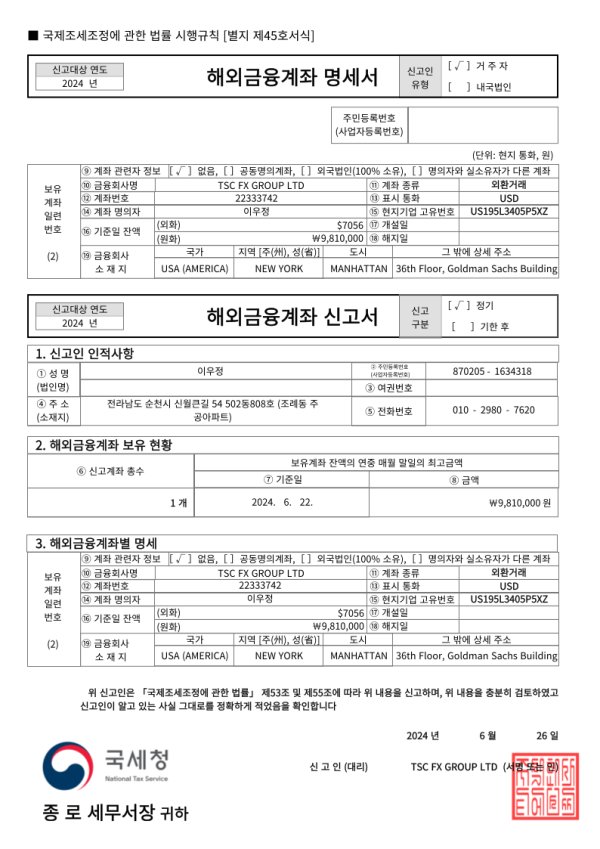

TSC FX GROUP Information

TSC FX GROUP, founded in 2006 and based in the United States, offers a wide range of trading assets including forex pairs, stocks, indices, commodities, and cryptocurrencies.

Regulated by FinCEN for its cryptocurrency activities, the platform provides advanced trading tools and supports 24/7 customer service in both Chinese and English. Traders can choose from two account types—Plus+ and Standard—with competitive spreads starting at 0.0 pips and leverage up to 500:1.

Accessible on Windows, Android, and iOS, TSC FX GROUP accommodates various trading preferences, with a straightforward fee structure and essential educational resources like news analysis and an economic calendar.

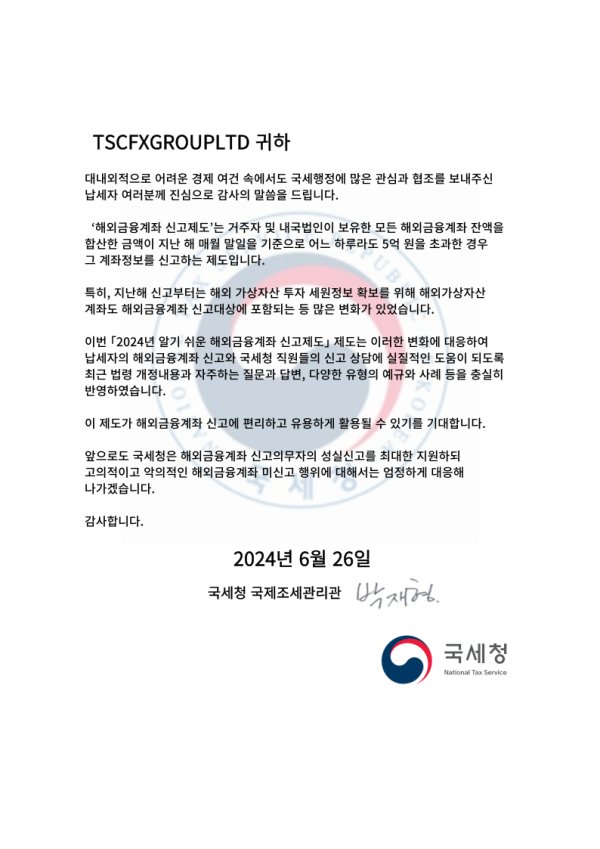

Regulatory Status

TSC FX GROUP is regulated under multiple jurisdictions, holding key licenses that ensure its operations adhere to international financial standards.

It possesses a Crypto License with the ID 31000271795406 issued by the Financial Crimes Enforcement Network (FinCEN) in the United States, confirming its authorization to conduct cryptocurrency-related activities.

Pros and Cons

| Pros | Cons |

| Wide range of trading assets | No specific minimum deposit specified |

| Competitive spreads | Limited payment methods |

| 7/24 customer support | |

| Advanced trading tools | |

| Regulated by FinCEN |

Pros:

- Wide range of trading assets: TSC FX Group offers a wide selection of trading assets, including forex pairs, stocks, indices, commodities, and cryptocurrencies.

- Competitive spreads: The platform provides competitive spreads, such as starting at 0.0 pips for certain forex pairs like AUDUSD or EURUSD. This feature benefits traders by minimizing trading costs and maximizing potential profits, especially during volatile market conditions where tighter spreads can significantly impact trading outcomes.

- 24/7 customer support: TSC FX Group offers around-the-clock customer support in both Chinese and English, ensuring traders can receive assistance and resolve queries promptly.

- Advanced trading tools: The platform is equipped with advanced trading tools that facilitate market analysis, order management, and automated trading strategies. These tools empower traders with the capabilities to execute trades efficiently and optimize their trading strategies based on real-time market data and technical analysis.

- Regulated by FinCEN: TSC FX Group is regulated by the Financial Crimes Enforcement Network (FinCEN) in the United States for its cryptocurrency activities.

Cons:

- No minimum deposit specified: TSC FX Group does not explicitly state a minimum deposit requirement, which can lead to uncertainty for new traders planning their initial investment.

- Limited payment methods: The platform offers limited payment methods, primarily focusing on debit cards and bank transfers for funding accounts. This restriction can inconvenience some traders who prefer alternative payment options.

Market Instruments

You can trade 1000+ products including forex, share CFDs, commodities, indices, and metals with TSC FX Group Ltd TSC FX Group Ltdtrading platforms.

Account Types

TSC FX GROUP provides 2 account types - Plus+ Account and Standard Account.

Plus+ Account

The Plus+ Account at TSC FX GROUP offers a trading environment characterized by ultra-low spreads starting from 0.0 pips, which is highly advantageous for traders focused on high-frequency and high-volume strategies.

With leverage available up to 500:1, this account type is suitable for those who require significant purchasing power and are comfortable managing the associated risks.

The Plus+ Account is particularly beneficial for users who employ automated trading systems or Expert Advisors (EAs), as these tools often perform best in conditions with minimal spreads. The competitive commission of $2.50 per side on FX standard lots further positions this account as a cost-effective option for experienced traders looking to optimize their trading costs while leveraging the potential of forex markets.

Standard Account

The Standard Account at TSC FX GROUP is designed for traders who prioritize simplicity and efficiency in their trading activities. It provides fast trade execution and competitive spreads starting from 0.8 pips without any commission charges, which can appeal to traders who prefer to avoid additional trading costs.

With the same leverage capacity of up to 500:1, the Standard Account serves those who may not need the ultra-low spreads of the Plus+ Account but still seek robust trading conditions. This account type is particularly suitable for beginner to intermediate traders or those who engage in less frequent trading and value straightforward cost structures.

| Feature | Plus+ Account | Standard Account |

| Description | A powerful solution with ultra-low spreads. Suits higher volume and EA traders. | Fast trade execution across tight spreads with a simple commission-free structure. |

| Leverage | Up to 500:1 | Up to 500:1 |

| Spreads | From 0.0 pips | From 0.8 pips |

| Commission | $2.50 per side on FX standard lot | $0.00 |

| Available Base Currencies | AUD, USD, EUR, GBP, NZD, CAD, SGD, CHF, HKD | AUD, USD, EUR, GBP, NZD, CAD, SGD, CHF, HKD |

How to Open an Account?

- Visit the TSC FX GROUP Website:

- Navigate to the official TSC FX GROUP website.

- Click on the “Open Account” button, usually located on the homepage or under the “Account” section.

- Complete the Registration Form:

- Fill in the required personal information, including your full name, email address, phone number, and country of residence.

- Create a secure password for your account.

- Select the preferred account type (Plus+ or Standard) and choose your base currency (options include AUD, USD, EUR, GBP, NZD, CAD, SGD, CHF, HKD).

- Verify Your Identity:

- Upload the necessary identification documents, such as a valid passport or drivers license for identity verification.

- Provide proof of address, which can include utility bills or bank statements dated within the last three months.

- Wait for the verification process to complete, which typically takes a short period once the documents are submitted.

- Fund Your Account:

- Log into your newly created account.

- Navigate to the deposit section and select your preferred funding method (bank transfer, credit/debit card, or e-wallets).

- Follow the prompts to transfer the desired initial deposit to your trading account.

- Once the funds are credited, you can begin trading on the TSC FX GROUP platform.

Leverage

TSC FX GROUP offers maximum leverage of up to 500:1 across its trading accounts. This high leverage allows traders to control large positions with relatively small capital, amplifying both potential gains and risks.

Spreads & Commissions

At TSC FX GROUP, the spreads and commissions vary significantly between the Plus+ and Standard Accounts, offering tailored solutions for different trading strategies and preferences.

Forex Spreads:

For the Plus+ Account, forex spreads start at 0.0 pips, with an average spread of 0.2 pips for major pairs like EURUSD and USDJPY, making it ideal for high-frequency traders.

The Standard Account, on the other hand, offers minimum spreads from 0.8 pips and averages around 1.0 to 1.3 pips for these pairs.

For cross currency pairs like GBPJPY, the Plus+ Account offers an average spread of 1.0 pips, while the Standard Account averages 1.8 pips. Exotic pairs, such as USDCNH, see wider spreads, with the Plus+ Account averaging 5.32 pips and the Standard Account at 6.12 pips.

Commodities Spreads:

For commodities, both account types maintain the same spreads. For instance, trading USOUSD has a minimum and average spread of $0.03. The UKOil-F spreads slightly differ with a minimum of $0.04 and average of $0.041.

Metals Spreads:

Precious metals like gold (XAUUSD) have a minimum spread of $0.06 and an average spread of $0.16, while silver (XAGUSD) maintains a minimum spread of $0.12 and an average of $0.22 across both accounts.

Indices Spreads:

Index trading at TSC FX GROUP shows competitive spreads with the US500 offering a constant spread of 0.5 index points for both account types. The DAX40 index has a minimum spread of 1 and an average of 1.7 points. More volatile indices like the HK50 have spreads averaging 5 points, with a minimum of 4.

Futures Spreads:

For futures, the spreads are also consistent across both accounts. The CHINA50 futures have a fixed spread of 10 index points, and the USDOLLAR futures spread remains at 0.3 index points.

Plus+ Account Commissions:

The Plus+ Account incurs a commission of $2.50 per side on a standard forex lot in USD. Other base currencies like AUD and CAD have equivalent commissions of A$3.00 and CA$3.00, respectively. The commission in EUR and GBP stands at €2.00 and £2.00 per side, reflecting a cost-effective structure for high-volume traders. Commissions for SGD and NZD are SG$3.50 and NZ$3.50, respectively, with CHF set at FR2.50, and HKD at HK$20.

Trading Platform

The TSC FX Group Ltdtrading platform offered by TSC FX Group Ltd encompasses a variety of features tailored for various trading needs.

Available on both desktop and mobile devices, the platform supports trading in stocks, forex, indices, commodities, and precious metals through stock price difference contract options.

It provides advanced tools for order management, chart analysis, and transaction automation, enhancing user capabilities in market analysis and trading execution. The platform's compatibility across Windows, Android, and iOS devices.

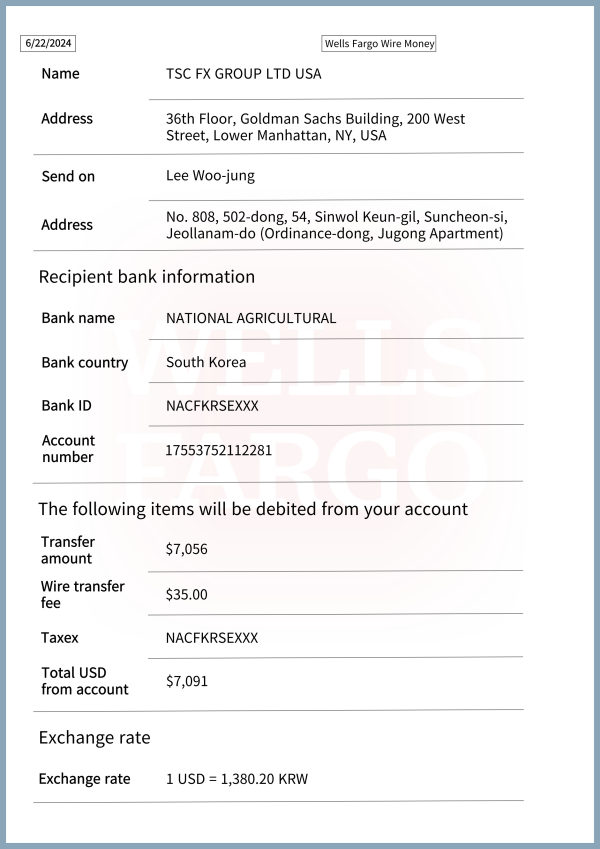

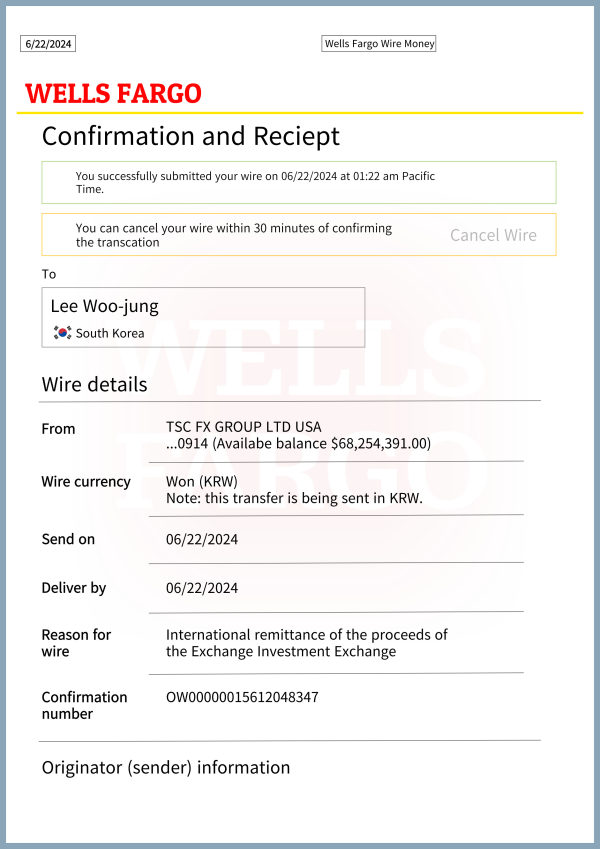

Deposit & Withdrawal

TSC FX Group supports funding accounts through limited methods, primarily debit cards and bank transfers. These options provide flexibility for traders to deposit funds conveniently.

The platform does not specify a minimum deposit requirements.

Customer Support

TSC FX Group Ltd offers 24-hour customer support in Chinese and English throughout the week.

For inquiries, customers can contact them at +1 (646) 466 0111 or email support@tscfxgroupltd.com. Their office is located at 36th Floor, Goldman Sachs Building, 200 West Street, Lower Manhattan, New York, United States of America.

Educational Resources

TSC FX Group Ltd offers educational resources including news analysis, an education hub, and an economic calendar.

These tools help provide traders with essential market insights and economic indicators to make informed trading decisions.

Conclusion

In conclusion, TSC FX GROUP presents a modern trading platform offering a broad array of assets such as forex, stocks, indices, commodities, and cryptocurrencies.

Operating under FinCEN regulation for its cryptocurrency services, it delivers competitive trading conditions with low spreads starting at 0.0 pips and high leverage up to 500:1. The platform supports traders with advanced tools and round-the-clock customer service in multiple languages.

FAQ

What types of trading assets does TSC FX GROUP offer?

TSC FX GROUP offers forex pairs, stocks, indices, commodities, and cryptocurrencies.

Is TSC FX GROUP regulated?

Yes, TSC FX GROUP is regulated by FinCEN for its cryptocurrency activities.

What are the available account types on TSC FX GROUP?

The platform provides two account types: Plus+ Account and Standard Account.

What is the maximum leverage available on TSC FX GROUP?

TSC FX GROUP offers leverage up to 500:1.

What customer support options does TSC FX GROUP provide?

TSC FX GROUP provides 24/7 customer support in Chinese and English.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors.

Keywords

- 1-2 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 2

Content you want to comment

Please enter...

Review 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now