简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Top 5 Events: March Australia Jobs Report & AUDJPY Price Forecast

Abstract:The March Australia jobs report is due on Thursday, April 18 at 01:30 GMT.

Talking Points:

谈话要点:

- The March Australia jobs report is due on Thursday, April 18 at 01:30 GMT.

- 3月澳大利亚就业报告将于4月18日星期四格林威治标准时间01:30公布。

{2}

- Overall, the Australian jobs market only has seen two months of contraction since October 2016.

{2}

- Retail tradersremain net-short AUDJPY, and have increased their net-short positions over the past week.s

- 零售交易商仍然是净空头澳元兑日元,并增加了他们的净空头过去一周的职位。

Join me on Mondays at 7:30 EDT/11:30 GMT for the FX Week Ahead webinar, where we discuss top event risk over the coming days and strategies for trading FX markets around the events listed below.

星期一美国东部时间7:30 /格林威治标准时间11:30 30分参加FX周向网络研讨会,我们将讨论即将到来的顶级事件风险围绕下列事件交易外汇市场的日子和策略。

04/18 THURSDAY | 01:30 GMT | AUD Employment Change and Unemployment Rate (MAR)

04/18周四|格林尼治标准时间01:30澳元就业变化和失业率(MAR)

Despite ongoing trade tensions between its largest trading partners, the Australian economy has continued to chug along, steadily adding jobs for eight consecutive months. If the Bloomberg News survey is correct, March will make it nine months in a row with positive jobs growth. Australian employment is due to have increased by 15K in March after adding 4.6K jobs in February. Overall, the Australian jobs market only has seen two months of contraction since October 2016.

尽管其最大贸易伙伴之间持续存在贸易紧张局势,但澳大利亚经济仍在继续增长,并连续八个月稳步增加就业岗位。如果彭博新闻调查是正确的,那么March将连续九个月实现就业增长。 2月份增加4.6万个就业岗位后,3月份澳大利亚就业人数将增加15,000人。总体而言,澳大利亚就业市场自2016年10月以来仅出现两个月的萎缩。

With the unemployment rate set to hold at 5.1%, the Reserve Bank of Australia is simply looking for more evidence that the labor market remains a source of stability, particularly as wage growth remains weak and topline inflation pressures have only started to stabilize across developed economies.

随着失业率维持在5.1%,澳大利亚储备银行只是在寻找更多的证据表明,劳动力市场仍然是稳定的来源,特别是当工资增长仍然疲软,而且发达经济体的通胀压力只能开始趋于稳定。

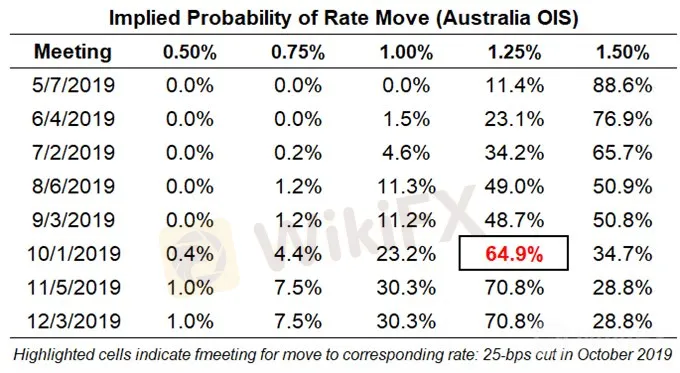

Like the Reserve Bank of New Zealand, the RBA is stuck in neutral when it comes to policy expectations for the first half of the year: according to overnight index swaps, there is only a 23.1% chance of a 25-bps rate cut in June; and there is a 64.9% chance of a 25-bps cut by December 2019.

赞对于新西兰储备银行而言,澳大利亚央行在今年上半年的政策预期中处于中立状态:根据隔夜指数掉期,6月份降息25个基点的可能性仅为23.1%;到2019年12月,有64.9%的机会减少25个基点。

Pairs to Watch: AUDJPY, AUDNZD, AUDUSD

需要关注的对象:澳元兑日元,澳元兑美元,澳元兑美元

AUDJPY Technical Forecast: Daily Price Chart (January 2018 to April 2019) (Chart 1)

Following the Yen flash crash in January, AUDJPY prices have been consolidating in a sideways pattern, but may finally be breaking to the topside. The range between 77.50 and 79.85 has given way to a bullish breakout,with the range providing a measured move up to 82.20. Before 82.20, however, AUDJPY bulls may have to contend with the descending trendline from the 2018 swing highs, which come in closer to 81.65/90 over the coming week.

继1月份日元大跌之后,澳元兑日元价格一直在横盘整理,但最终可能突破上部。在77.50和79.85之间的区间已经让位于看涨突破,该区间提供了一个可测量的上涨至82.20。然而,在82.20之前,澳元兑日元多头可能不得不应对2018年摆动高点的下行趋势线,未来一周接近81.65 / 90.

IG Client Sentiment Index: AUDJPY (April 12, 2019) (Chart 2)

IG客户情绪指数:AUDJPY(2019年4月12日)(图2)

Retail trader data shows 37.6% of traders are net-long with the ratio of traders short to long at 1.66 to 1. In fact, traders have remained net-short since April 3 when AUDJPY traded near 79.338; price has moved 1.3% higher since then. The number of traders net-long is 0.6% higher than yesterday and 5.3% lower from last week, while the number of traders net-short is 24.9% lower than yesterday and 11.2% higher from last week.

零售交易者数据显示,37.6%的交易者为净多头,交易者比例较短事实上,自4月3日澳元兑日元交易于79.338附近以来,交易商仍然保持净空头。此后价格已上涨1.3%。交易商净多头比昨天增加0.6%,比上周减少5.3%,而交易商净空头数比昨天减少24.9%,比上周增加11.2%。

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests AUDJPY prices may continue to rise. Positioning is less net-short than yesterday but more net-short from last week. The combination of current sentiment and recent changes gives us a further mixed AUDJPY trading bias.

我们通常采取逆向观点来观察市场情绪,而且交易商净空头表明澳元兑日元价格可能继续上涨。定位比昨天的净空头少,但比上周更多的净空头。当前情绪和近期变化的结合使我们对澳元兑日元的交易偏差进一步加剧。

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Australian Dollar Technical Outlook Ahead: AUD/USD, AUD/CAD, EUR/AUD

Australian Dollar facing mixed signals vs. USD, CAD and EUR. AUD/USD may reverse higher on support, AUD/CAD ranging. EUR/AUD downtrend remains despite recent consolidation.

AUD/USD Clings to Support After Chinese CPI and PPI Surge Higher

AUSTRALIAN DOLLAR, AUD/USD, CHINESE INFLATION – TALKING POINTS

Forex Economic Calendar Week Ahead: Fed Meeting, New Zealand GDP, Australia Jobs & More

Three central bank meetings are on the calendar over the coming week, including the Federal Reserve and the Bank of Japan.

Australian Dollar Ticks Up as RBA Holds Key Rate Unchanged

The Australian Dollar probed higher as the RBA kept its benchmark OCR interest rate unchanged at 1 percent and signaled it may not be in a hurry to cut again.

WikiFX Broker

Latest News

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

Dukascopy Bank Expands Trading Account Base Currencies

UK Sets Stage for Stablecoin Regulation and Staking Exemption

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

STARTRADER Issues Alerts on Fake Sites and Unauthorized Apps

Italy’s CONSOB Blocks Seven Unregistered Financial Websites

Bitfinex Hacker Ilya Lichtenstein Sentenced to 5 Years in Prison

Currency Calculator