简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

S&P 500 Grasps at New Highs as Retail Traders Fear Past Declines

Abstract:Investors may be more cognizant of risk as the S&P 500 approaches levels that marked previous peaks. Mutual fund flows reveal that retail traders have looked to reduce exposure even as the index climbs.

S&P 500 Outlook Talking Points:

标准普尔500指数展望谈话要点:

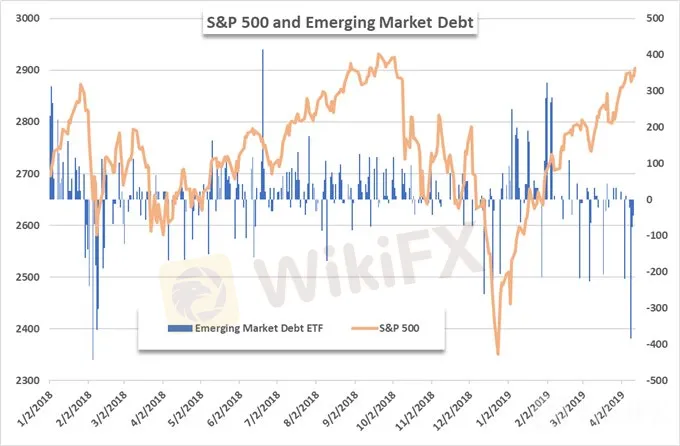

A key risk asset saw considerable outflows this week that were surpassed only by outflows in February 2018

本周关键风险资产出现大量外流仅在2018年2月被资金流出超过

While the S&P 500 presses higher, retail traders attempt to call the top

当标准普尔500指数走高时,零售交易者试图调用顶部

{3}

S&P 500 Grasps at New Highs as Retail Traders Fear Past Declines

标准普尔500指数创下新高,因零售交易商担心过去下跌

As the S&P 500 looks to retest all-time highs, market participants may be more sensitive to risk this time around. With the S&P 500 approaching levels that preceded prior declines in February and September of 2018, investors are keen to investigate each threat to the bullish trend.

由于标准普尔500指数重新测试历史新高,这次市场参与者可能对风险更敏感。随着标准普尔500指数逼近2018年2月和9月先前下跌之前的水平,投资者热衷于调查看涨趋势的每一个威胁。

One such threat may be the emerging market bond ETF (EMB). The fund saw its largest outflow since February 5, 2018 and the S&P 500 subsequently slumped about 1%. After the streak of outflows was finished and the fund registered its next net inflow (10 days later) the S&P 500 had sunk 4.4%. During the streak, the fund saw nearly $2.2 billion leave its coffers.

一个这样的威胁可能是新兴市场债券ETF(EMB)。该基金自2018年2月5日以来出现了最大的资金流出,随后标准普尔500指数下跌约1%。在资金流出完成且基金注入下一个净流入(10天后)后,标准普尔500指数下跌4.4%。在连线期间,该基金将近22亿美元离开其金库。

Despite the considerable risk-off mood that swept over markets during this period, the S&P 500 rebounded by roughly 2.8% over the following four weeks. It is important to note that previous outflows for the fund trailed declines in the S&P 500 which reduces the efficacy of the fund as a leading indicator and with that in mind, the cause for concern due to the outflow is seriously mitigated.

尽管在此期间风靡市场的风险相当大,但标准普尔500指数反弹约2.8%在接下来的四周内。值得注意的是,基金之前的资金流出量下降,标准普尔500指数下跌,这降低了基金作为领先指标的效率,考虑到这一点,由于资金外流引起关注的原因得到了严重缓解。

Further, EMB flows were largely unbothered by the index‘s decline in September and recorded net inflows through the end of 2018. In fact, Tuesday’s outflow from EMB may be due to a report from the IMF which highlighted emerging market debt as an area of global weakness. While the longer-term implications of emerging market weakness are certainly worrisome, it seems a stretch to pin the outflow as a precursor to another S&P 500 retracement.

此外,EMB流量在很大程度上不受指数9月下跌的影响,并且在2018年底录得净流入。实际上,周二从EMB流出可能是由于国际货币基金组织的报告强调新兴市场债务是全球弱势地区。虽然新兴市场疲软的长期影响肯定令人担忧,但将资金外流作为另一个标准普尔500指数回撤的前兆似乎是一个延伸。

View Client Sentiment Data provided by IG to spot hidden trends and signals. To learn more about the tool, sign up for one of our Live Webinar Walkthroughs.

查看客户情绪数据IG发现隐藏的趋势和信号。要了解有关该工具的更多信息,请注册我们的实时网络研讨会演练。

Similarly, mutual fund flows – typically indicative of retail trader funds – have seen roughly $9.70 billion in outflows last week, with the vast majority from equities. The data gathered by the Investment Company Institute bolsters a bullish case – as we typically take a contrarian view to retailer sentiment. This research is compounded by our own findings at IG.

同样,共同基金流量(通常表明零售交易商基金)的流出量约为97亿美元上周,绝大多数来自股票。投资公司研究所收集的数据支持看涨情况 - 因为我们通常采取逆向观点来看待零售商的情绪。我们在IG的研究结果加剧了这项研究。

Over the past few weeks, IG retail traders have only increased their short exposure to the S&P 500. During this time, the S&P 500 pressed higher - unbothered by global growth and other concerns. With the advent of earnings season, a string of positive earnings from JP Morgan, Wells Fargo and PNC Bank have set high standards for upcoming reports. Follow @PeterHanksFX on Twitter for equity insight and earnings season updates.

过去几周,IG零售交易商仅增加了对标准普尔500指数的空头回补。这一次,标准普尔500指数走高 - 不受全球增长和其他担忧的影响。随着收益季节的到来,摩根大通,富国银行和PNC银行的一系列正收益为即将发布的报告设定了高标准。

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

S&P 500 Price Outlook: Value Stocks Outperform Momentum, Tech Lags

After breaking outside of its August range, the road higher seemed to be laid out for the S&P 500, but tech and momentum stocks have been largely absent from the rally effort.

S&P 500 Forecast: Stocks Threaten Breakdown as TLT ETF Soars

The S&P 500 fluctuated between losses and gains on Thursday before finishing narrowly higher. Meanwhile, investors continued to clamor for safety in bonds.

Dow Jones, DAX 30, FTSE 100 Forecasts for the Week Ahead

As trade wars and monetary policy look to maintain their position at the helm, markets will be offered insight on another major theme that could rattle fragile sentiment.

S&P 500 Forecast: Stocks Rebound, but will the Recovery Continue?

After plummeting at the open, the S&P 500 mounted a relief effort during Wednesday trading to eventually close in the green. While the rebound was encouraging, can it surmount nearby resistance?

WikiFX Broker

Latest News

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

Dukascopy Bank Expands Trading Account Base Currencies

UK Sets Stage for Stablecoin Regulation and Staking Exemption

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

STARTRADER Issues Alerts on Fake Sites and Unauthorized Apps

Italy’s CONSOB Blocks Seven Unregistered Financial Websites

Bitfinex Hacker Ilya Lichtenstein Sentenced to 5 Years in Prison

Currency Calculator