Score

STORM AGE CAPITAL

Australia|2-5 years|

Australia|2-5 years| https://ttmons.com

Website

Rating Index

Contact

Licenses

Licenses

Licensed Institution:STORM AGE CAPITAL FINANCIAL PTY LTD

License No.:001295630

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

Australia

AustraliaUsers who viewed STORM AGE CAPITAL also viewed..

EC Markets

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

IronFX

- 15-20 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

ttmons.com

Website Domain Name

ttmons.com

Server IP

104.21.64.69

stormagecapital.com

Server Location

United States

Website Domain Name

stormagecapital.com

Server IP

172.67.185.122

Company Summary

| Aspect | Information |

| Company Name | STORM AGE CAPITAL |

| Registered Country/Area | Australia |

| Founded Year | 2022 |

| Regulation | Unregulated |

| Minimum Deposit | 5-10USD |

| Spreads | As low as 0.0 pips |

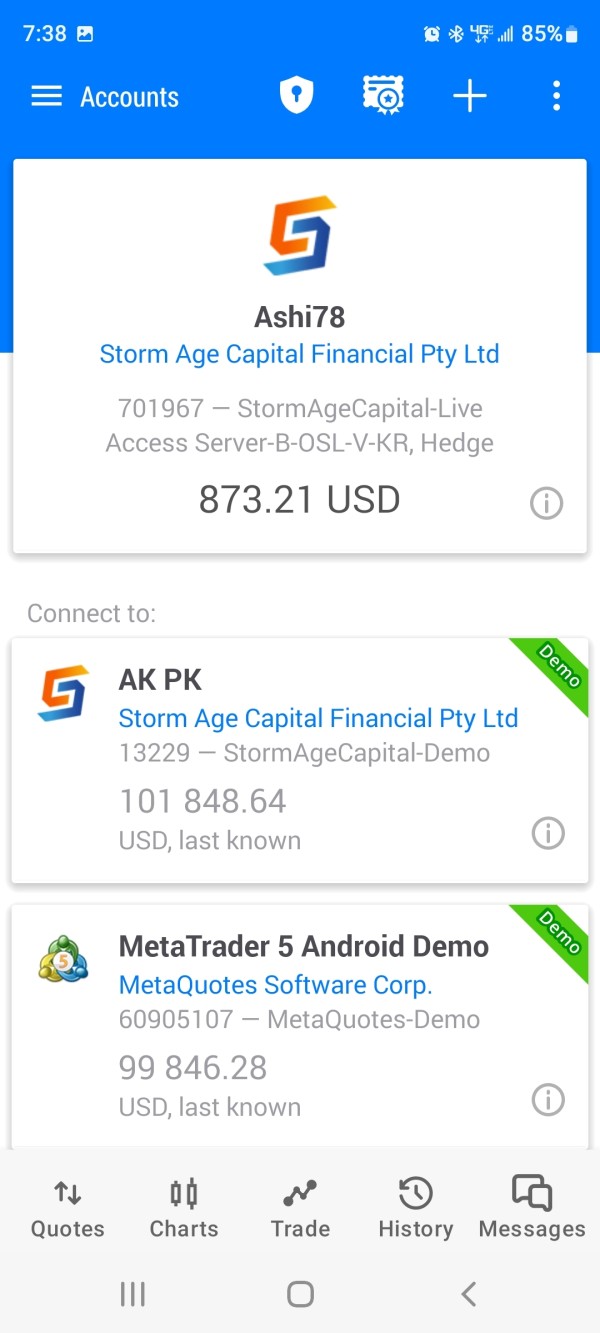

| Trading Platforms | MetaTrader 4 (MT4) and MetaTrader 5 (MT5) |

| Tradable Assets | Forex, Commodities, Indices, Shares |

| Account Types | Personal account |

| Customer Support | Phone, email, and social media |

| Deposit & Withdrawal | cryptocurrencies, PayPal, Neteller or Sofort |

| Educational Resources | Tutorials,articles |

Overview of STORM AGE CAPITAL

STORM AGE CAPITAL, founded in 2022 in Australia, offers diverse trading options on its dedicated platform, including Forex, Commodities, Indices, and Shares. With competitive spreads as low as 0.0 pips and a personal account type tailored for individual traders, it stands out in the trading community. A strong emphasis on customer support is evident with channels like phone, email, and social media.

Additionally, they provide traders with educational resources such as tutorials and articles. However, potential investors should note that STORM AGE CAPITAL is unregulated, warranting caution and thorough research before engaging.

Is STORM AGE CAPITAL Legit or a Scam?

STORM AGE CAPITAL claims to be regulated under the jurisdiction of Australia's ASIC with the license number: 001295630. However, upon verification, it's evident that its regulatory status is abnormal, with its official regulatory status being “Revoked” by ASIC.

Given this critical information, the legitimacy of STORM AGE CAPITAL is highly questionable. Investors and traders are strongly advised to exercise caution and be aware of the associated risks when dealing with this broker.

Pros and Cons

| Pros | Cons |

| Broad Asset Range | Unregulated |

| Competitive Spreads | Limited Account Types |

| Dedicated Trading Platform | Potential Geographical Limitations |

| Multiple Customer Support Channels | Reliance on a Singular Platform |

| Educational Resources | Regulatory Concerns |

Pros of STORM AGE CAPITAL:

Broad Asset Range: STORM AGE CAPITAL offers a diverse portfolio of tradable assets including Forex, Commodities, Indices, and Shares. This provides traders with a variety of options to diversify their investments.

Competitive Spreads: The firm boasts of spreads as low as 0.0 pips, which can be very attractive for traders looking to minimize costs associated with trading.

Dedicated Trading Platform: Having its own dedicated trading platform, STORM AGE CAPITAL may offer unique features, tools, or user experiences that could differentiate them from competitors.

Multiple Customer Support Channels: With phone, email, and social media as contact options, customers have a variety of ways to seek help or information, enhancing their overall experience.

Educational Resources: Offering tutorials and articles indicates a commitment to trader education, helping clients improve their trading skills and knowledge.

Cons of STORM AGE CAPITAL:

Unregulated: Being unregulated can be a significant concern. Regulated brokers are subject to rules and oversight designed to protect traders, ensuring transparency and fairness.

Limited Account Types: Offering only a personal account might limit options for different kinds of traders, such as institutional investors or those seeking specific features catered to different trading styles.

Potential Geographical Limitations: Being registered in Australia, there could be limitations for traders in other regions or countries, depending on their local laws or the broker's operational areas.

Reliance on a Singular Platform: While having a dedicated trading platform can be an advantage, it also means traders are limited to the tools and features of that specific platform, without the option to use other popular platforms they might be familiar with.

General Unknowns: With no specific information on other aspects like their fee structures, leverage options, or security measures, potential traders would need to delve deeper before making a decision.

Market Instruments

Exploring the diverse world of financial trading, STORM AGE CAPITAL offers various marktet instruments for traders. These avenues include:

Forex (Foreign Exchange): This involves trading currency pairs, capitalizing on the fluctuations of one currency against another.

Commodities: These can range from hard commodities like gold, oil, and metals to soft commodities such as agricultural products like wheat, coffee, and cotton.

Indices: Indices represent a portfolio of stocks from a particular market or sector. Trading on indices allows investors to speculate on the overall movement of a basket of stocks without having to buy each stock individually.

Shares: Trading shares means buying and selling stakes in specific companies. This allows traders to capitalize on the performance of individual companies.

These instruments offer a range of opportunities for traders, catering to different risk appetites, strategies, and market interests. As with any trading, it's essential for traders to understand each instrument's nuances and risks.

Account Types

The only specified account type provided by STORM AGE CAPITAL is the personal account. Potential traders should always conduct due diligence and seek more detailed information before considering opening any account with a broker.

How to Open an Account?

Opening an account in STORM AGE CAPITAL is a straightforward process that can be completed in a few simple steps:

Visit the Website: Navigate to the official STORM AGE CAPITAL website. Ensure you're on the genuine site to avoid potential phishing or fake sites.

Registration: Find and click on the registration or sign-up button. This will lead you to an account registration form where you'll be asked to provide personal information such as your name, email address, phone number, and possibly other relevant details.

Agree to Terms: Before finalizing the registration, you might be presented with terms and conditions. Read these thoroughly, and agree with them if you're satisfied. (The terms and conditions provided by STORM AGE CAPITAL might lack specific legal details, as mentioned in the information you provided.)

Account Verification: Some brokers require verification of your identity and address for compliance purposes. You might be asked to upload certain documents, such as a copy of your passport or ID and a recent utility bill. However, it's unclear if STORM AGE CAPITAL has this process, given its unregulated status.

Deposit Funds: Once your account is set up, you'll likely need to deposit funds to start trading. Navigate to the deposit section and choose your preferred method of deposit.

Spreads & Commissions

STORM AGE CAPITAL offers competitive spreads, which can be advantageous for traders looking to minimize trading costs. Traders should inquire directly with the broker or check their platform for specifics on commissions, as these can vary based on account type, trading volume, or other factors.

It's always essential for potential clients to understand the full cost structure, including any hidden fees or charges, before committing to any broker.

Trading Platform

For traders looking to utilize STORM AGE CAPITAL's offerings, these platforms promise a comprehensive trading environment.

MetaTrader 4 (MT4): Recognized globally as a pioneering forex trading platform, MT4 is a product of MetaQuotes Software and has become the primary choice for many in the trading community. It boasts an easy-to-navigate interface suitable for both novice and veteran traders. The platform is enriched with multiple time frames, advanced charting, and over 30 technical indicators for comprehensive market analysis. Notably, its Expert Advisors (EA) feature allows for the creation and execution of automated trading strategies. Additionally, MT4's adaptability lets traders modify its appearance, incorporate third-party tools, and even develop unique technical indicators.

MetaTrader 5 (MT5): As MT4's successor, MT5 offers an expanded array of features, making it appealing to forex traders and those exploring other financial markets. MT5 supports trading in various assets like stocks, commodities, and futures, setting it apart from its predecessor. It provides enhanced charting tools, a broader set of technical indicators, and an in-built economic calendar. The Depth of Market feature showcases real-time market depth, outlining current prices and volumes of pending orders. Moreover, MT5 is powered by the MQL5 scripting language, enabling the development of advanced EAs and indicators, which further amplifies its automated trading capacities.

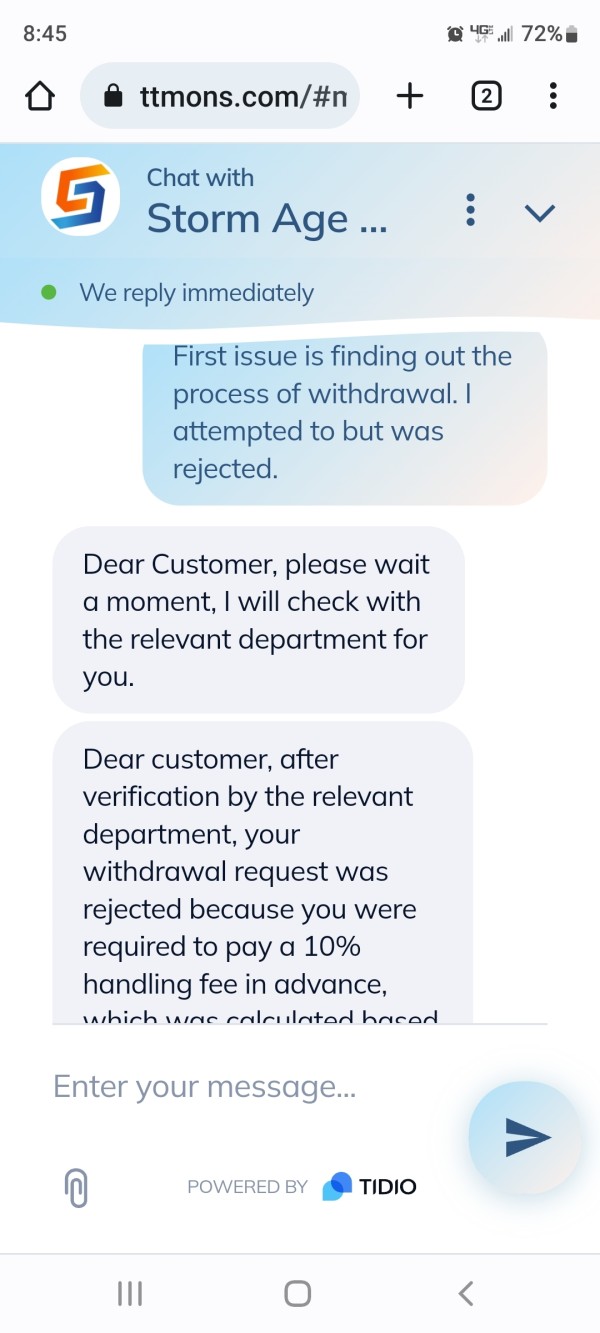

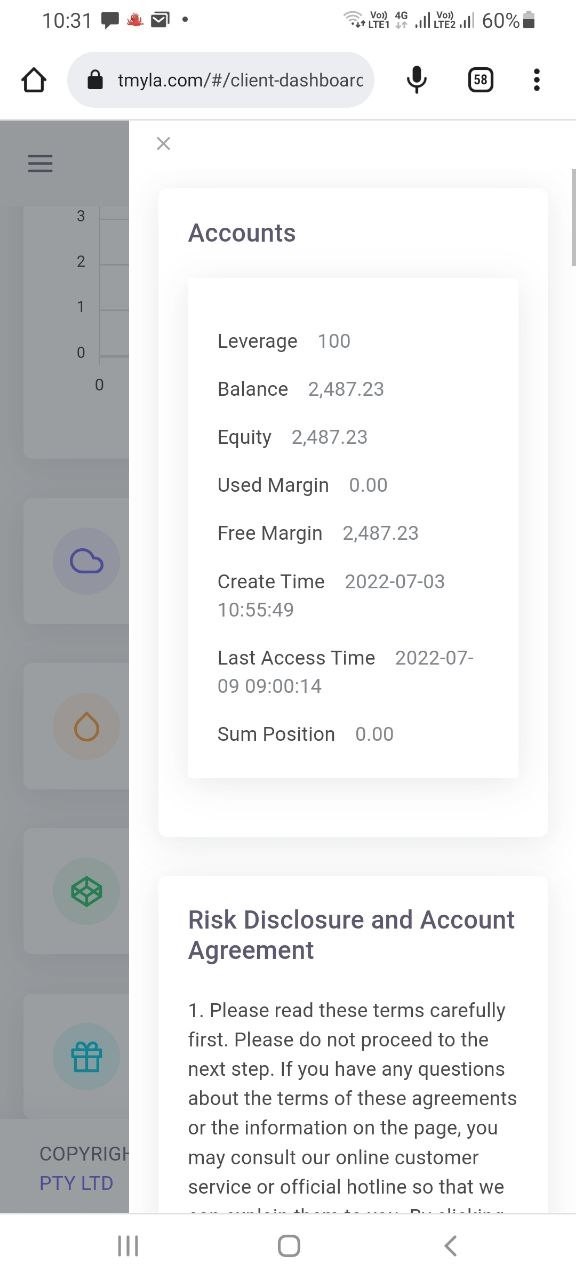

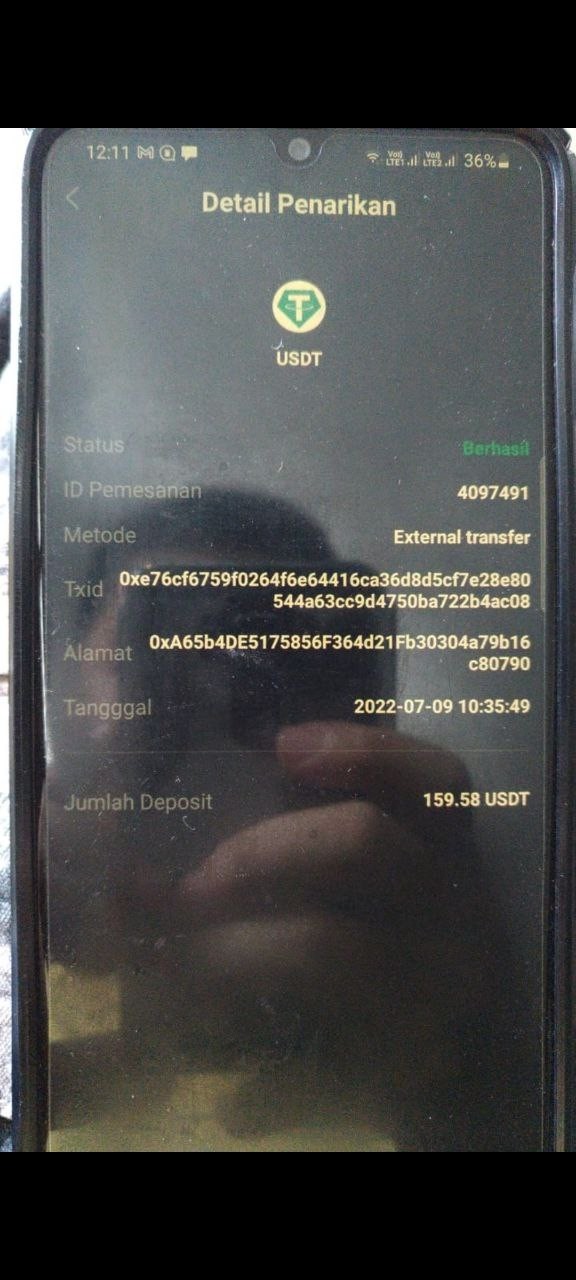

Deposit & Withdrawal

STORM AGE CAPITAL has made its stance clear regarding the accepted payment modes: the only method acknowledged and accepted is cryptocurrencies. This decision resonates with tactics observed in financial fraud schemes. The very nature of cryptocurrencies offers those with nefarious intentions a cloak of anonymity, thus making tracing transactions an arduous task.In STORM AGE CAPITAL, thE entry point can be as low as 5-10 USD Additionally, such a method also robs the aggrieved party of the right to request chargebacks or refunds, should they realize they have been duped.

Brokers Comparision

When comparing the trading platforms of STORM AGE CAPITAL, FTD, and STAR NET, several key differences emerge. FTD stands out as the only platform among the three that is regulated, specifically by the FSA, which can offer traders an added layer of protection and credibility. In terms of leverage, FTD provides up to 1:100, while STAR NET offers a higher leverage of up to 1:400. STORM AGE CAPITAL sets its leverage based on individual accounts. As for spreads, STORM AGE CAPITAL and STAR NET both promise competitive rates with 0 pips and 0.6 pips respectively, whereas FTD has spreads starting at 2 pts. Lastly, the minimum deposit required is clearest with STORM AGE CAPITAL and STAR NET, demanding 5-10USD and 0.01 respectively, while FTD hasn't specified a particular amount. Traders should evaluate these factors in light of their trading preferences and risk tolerance.

| Aspect | STORM AGE CAPITAL | FTD | STAR NET |

| Regulation | Unregulated | FSA | Unregulated |

| Maximum Leverage | Set in individual account | Up to 1:100 | Up to 1:400 |

| Spreads | 0 pips | 2 pts | 0.6 pips |

| Minimum Deposit | 5-10USD | Not specified | 0.01 |

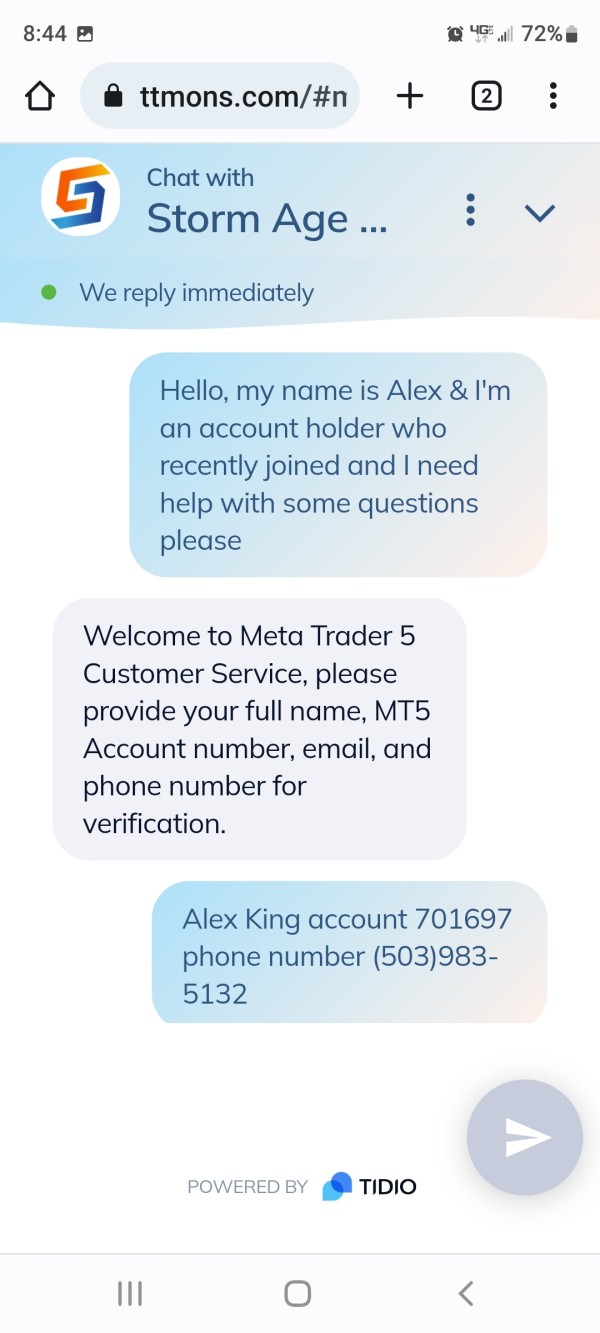

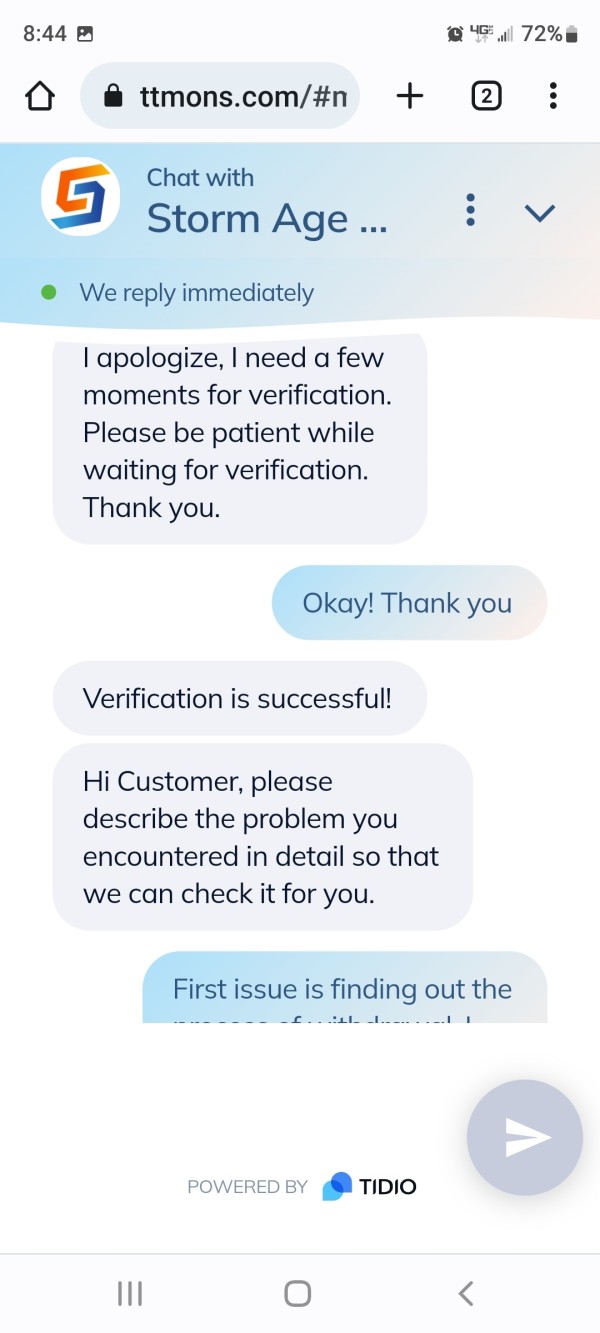

Customer Support

STORM AGE CAPITAL FINANCIAL PTY LTD, abbreviated as STORM AGE CAPITAL, is a company registered in Australia. They have established their online presence through two websites: ttmons.com and stormagecapital.com. For those seeking further information or having specific queries, customers can browse a dedicated section of Frequently Asked Questions (FAQs) on their platform. This section features answers to common inquiries from past users

Conclusion

STORM AGE CAPITAL, under the entity STORM AGE CAPITAL FINANCIAL PTY LTD, presents itself as a financial broker, but upon closer scrutiny reveals multiple red flags. The company lacks transparency regarding its regulatory status, provides scant details about its ownership, and its associated websites show deficiencies typical of many online scams.

Its absence of clear trading platforms and conditions, coupled with its limited cryptocurrency-only payment method, raises significant concerns. Potential investors are urged to exercise caution and conduct thorough research before engaging with this or any similar platform.

FAQs

Q: Is STORM AGE CAPITAL a regulated entity?

A: The platform does not provide clear details about its regulatory status.

Q: What trading platforms does STORM AGE CAPITAL offer?

A: The website provides well-known platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5).

Q: How can I deposit or withdraw funds with STORM AGE CAPITAL?

A: STORM AGE CAPITAL accepts only cryptocurrencies for transactions. It's crucial for potential investors to be cautious, as cryptocurrency transactions can be irreversible and don't offer the same protections as other conventional payment methods.

Q: I've heard concerns about the legitimacy of STORM AGE CAPITAL. Is it safe to invest with them?

A: Based on the red flags observed, including the lack of regulatory information, absence of clear trading platforms, and limited payment methods, potential investors should exercise caution.

Q: What is the minimum deposit required to start trading with STORM AGE CAPITAL?

A: STORM AGE CAPITAL offers a low minimum deposit requirement, sometimes as low as 5-10 USD.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- Australia Appointed Representative(AR) Revoked

- High potential risk

Review 5

Content you want to comment

Please enter...

Review 5

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

AK058

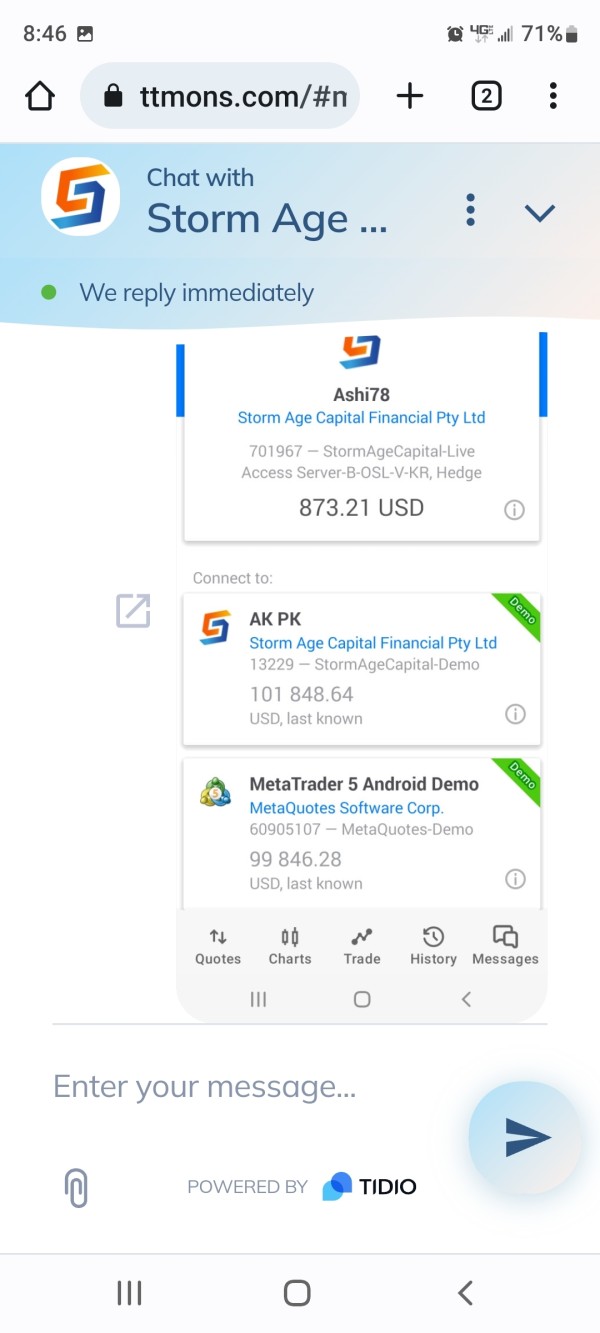

United States

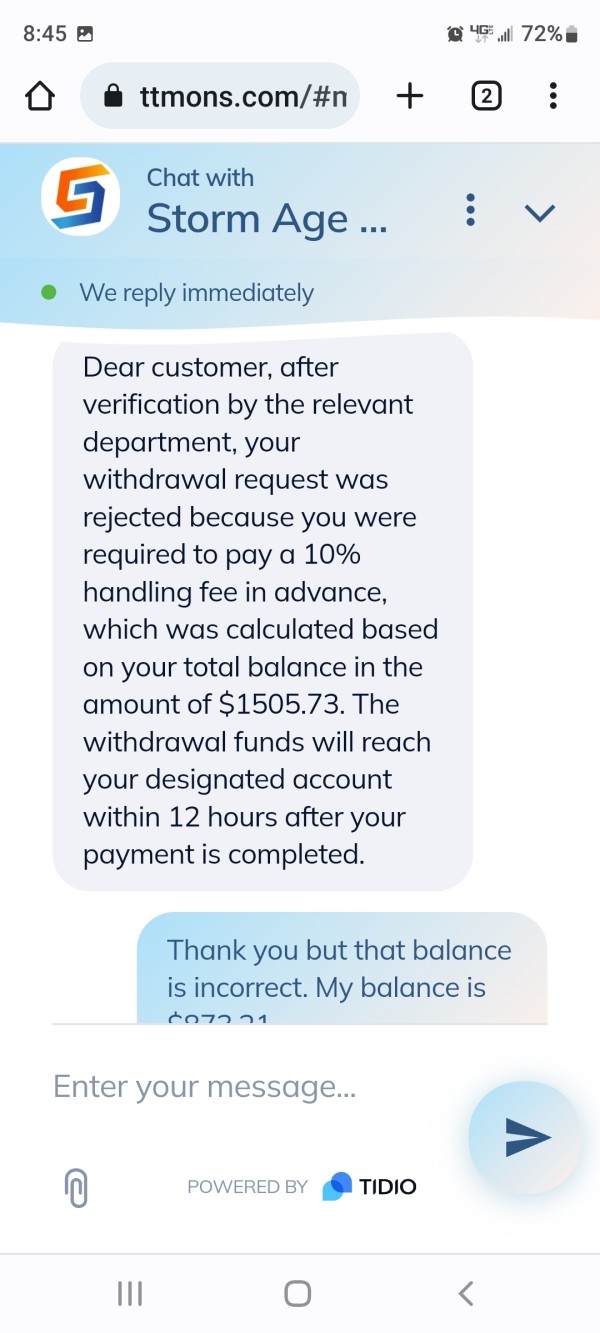

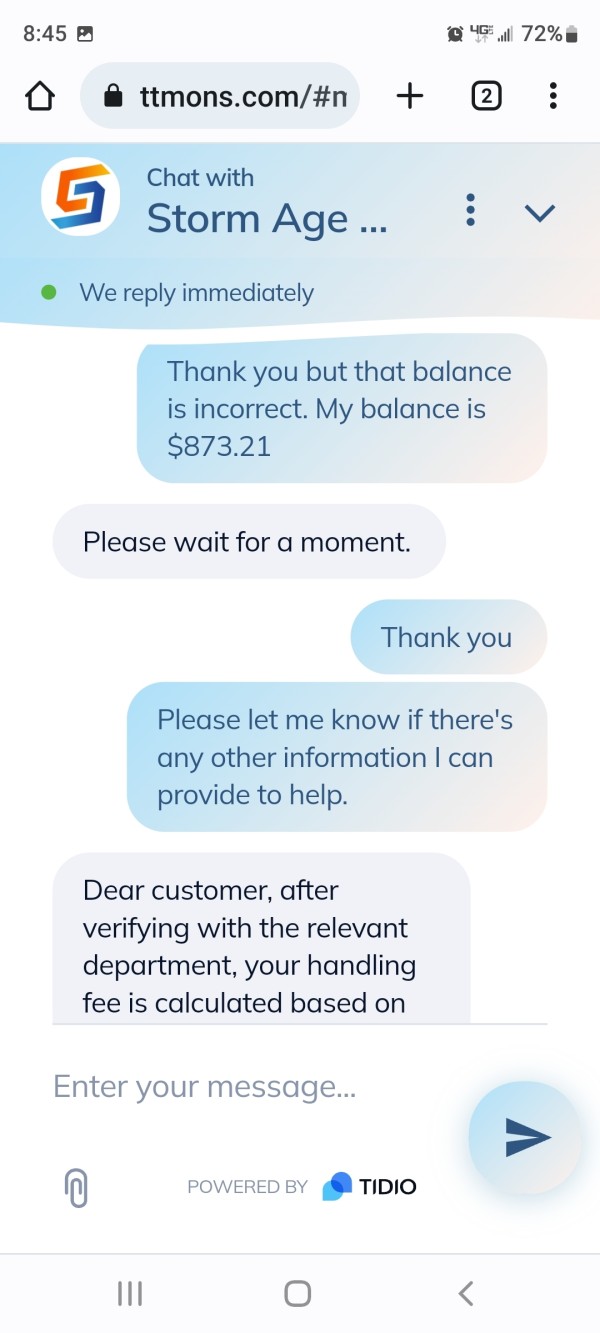

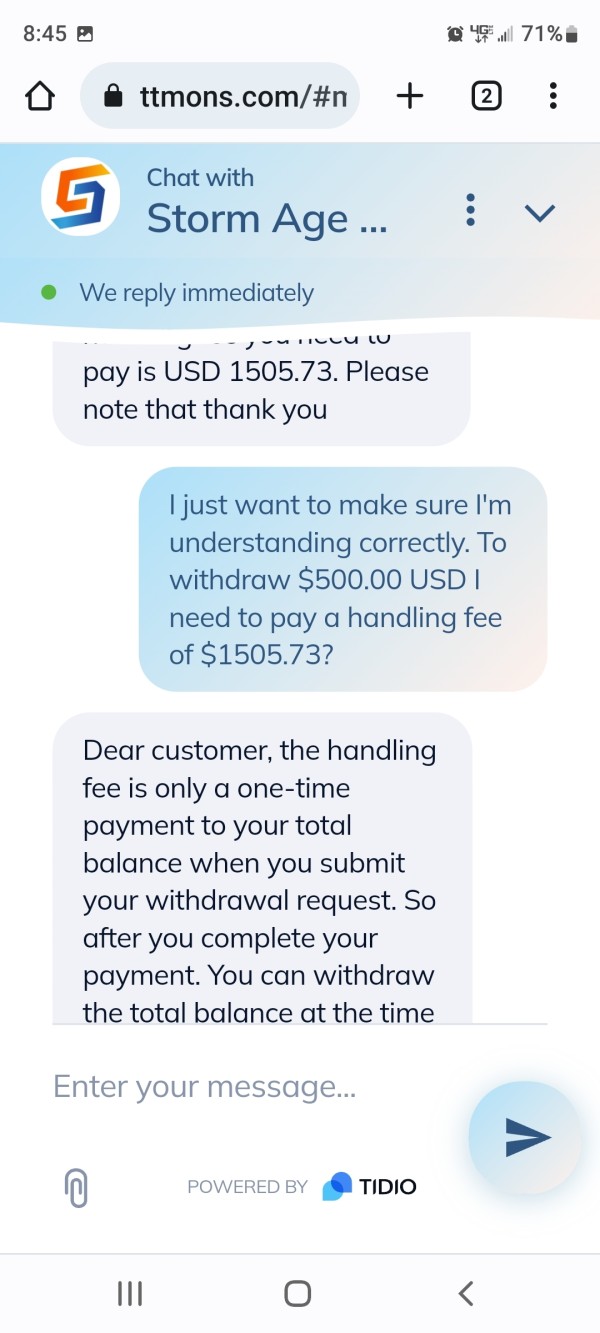

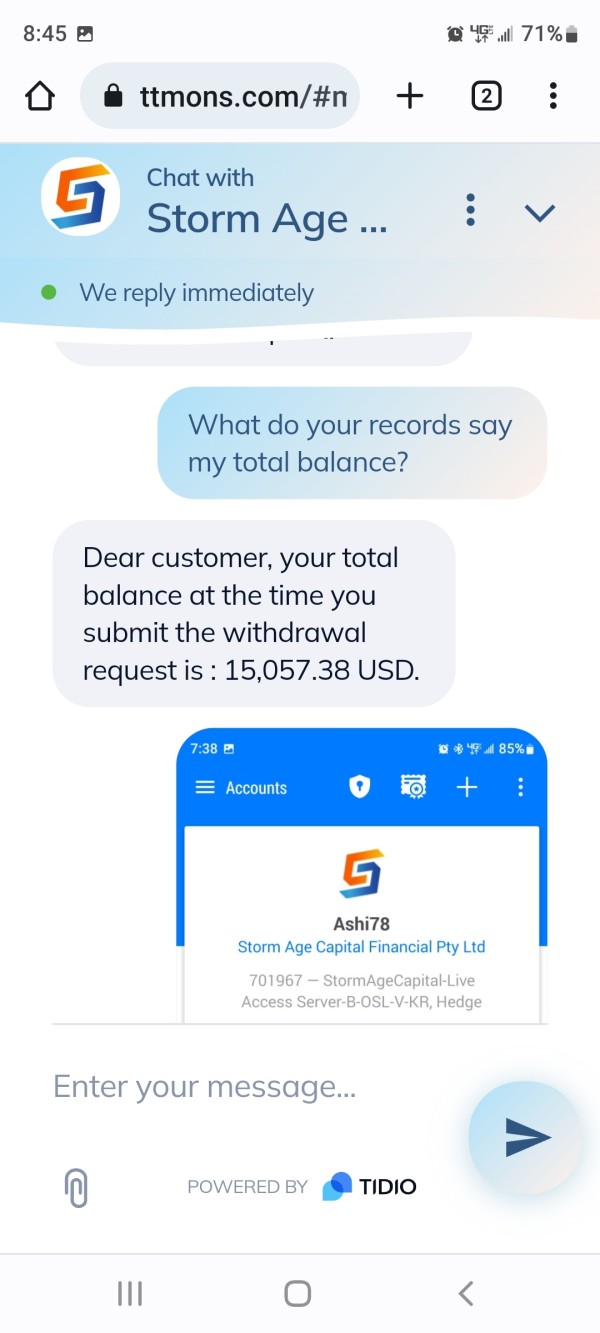

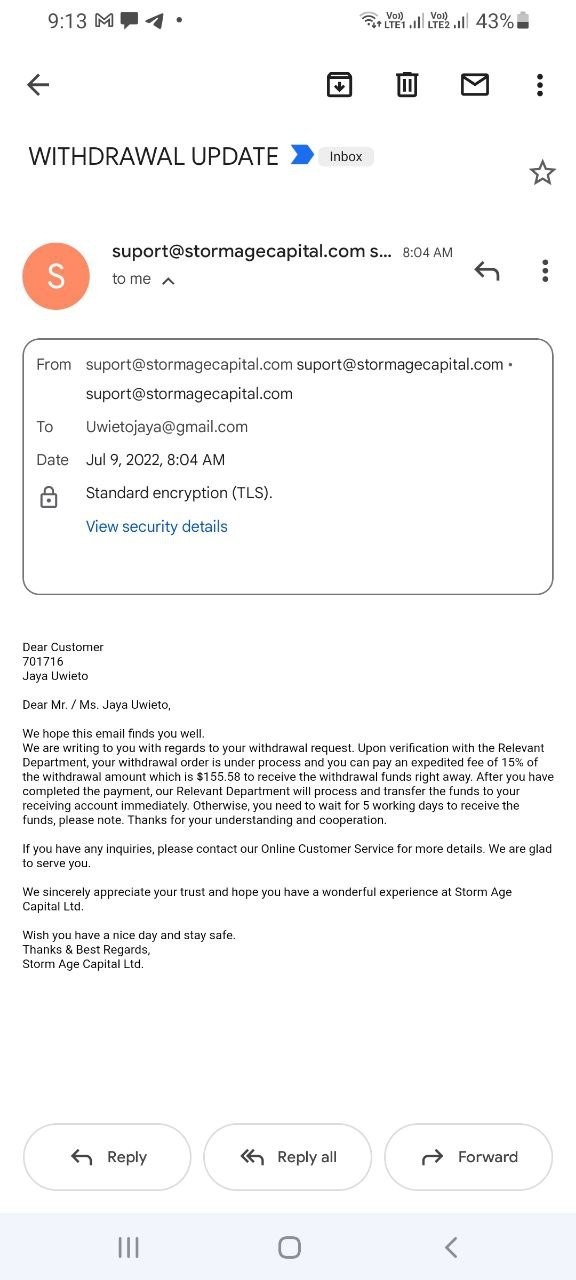

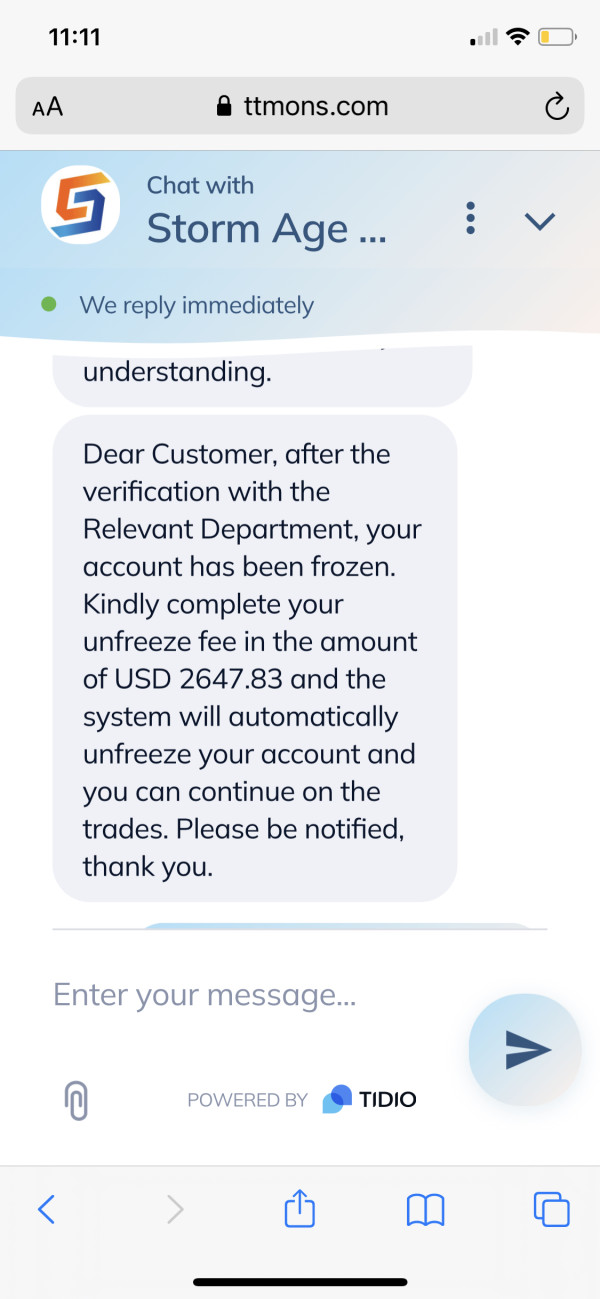

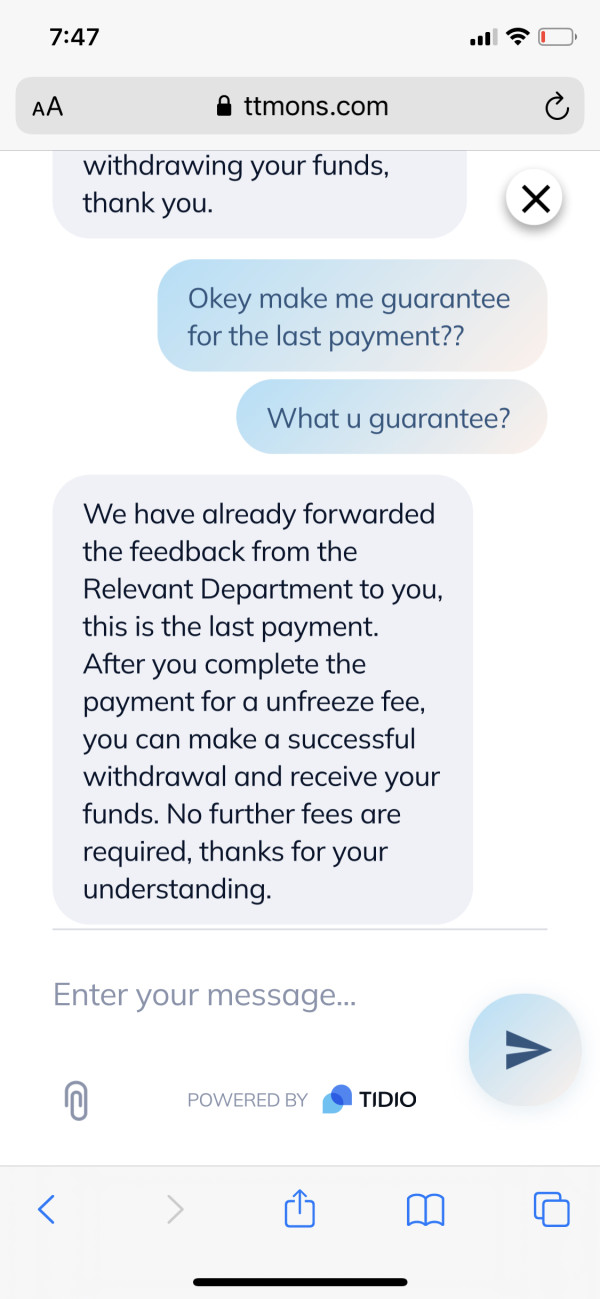

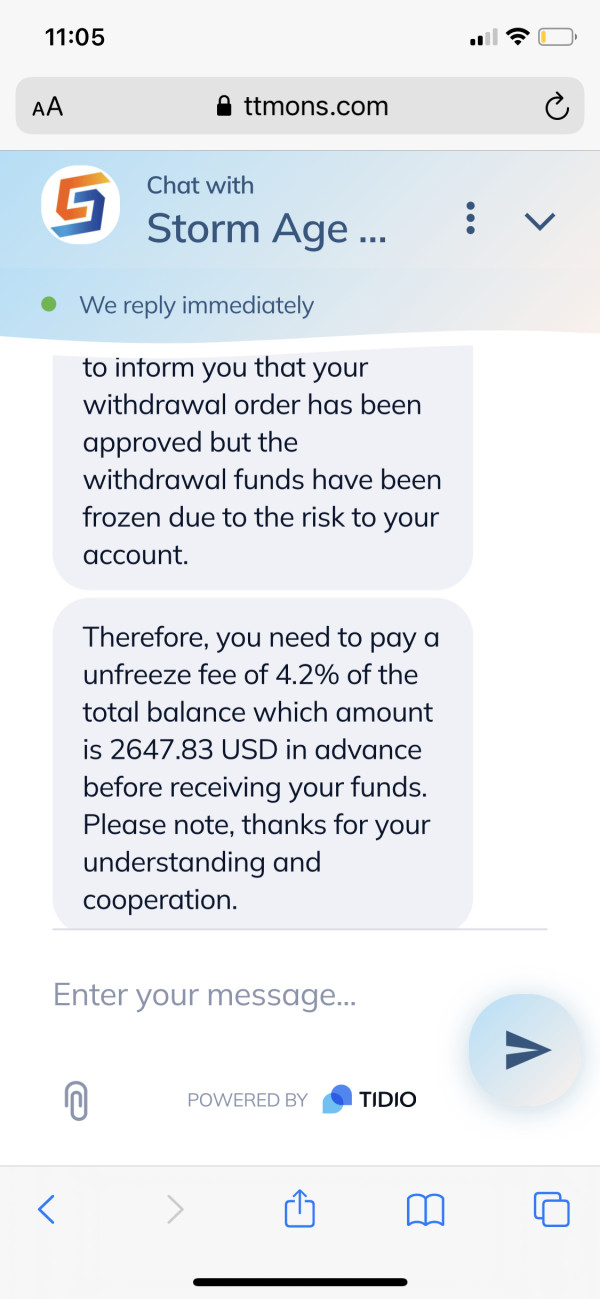

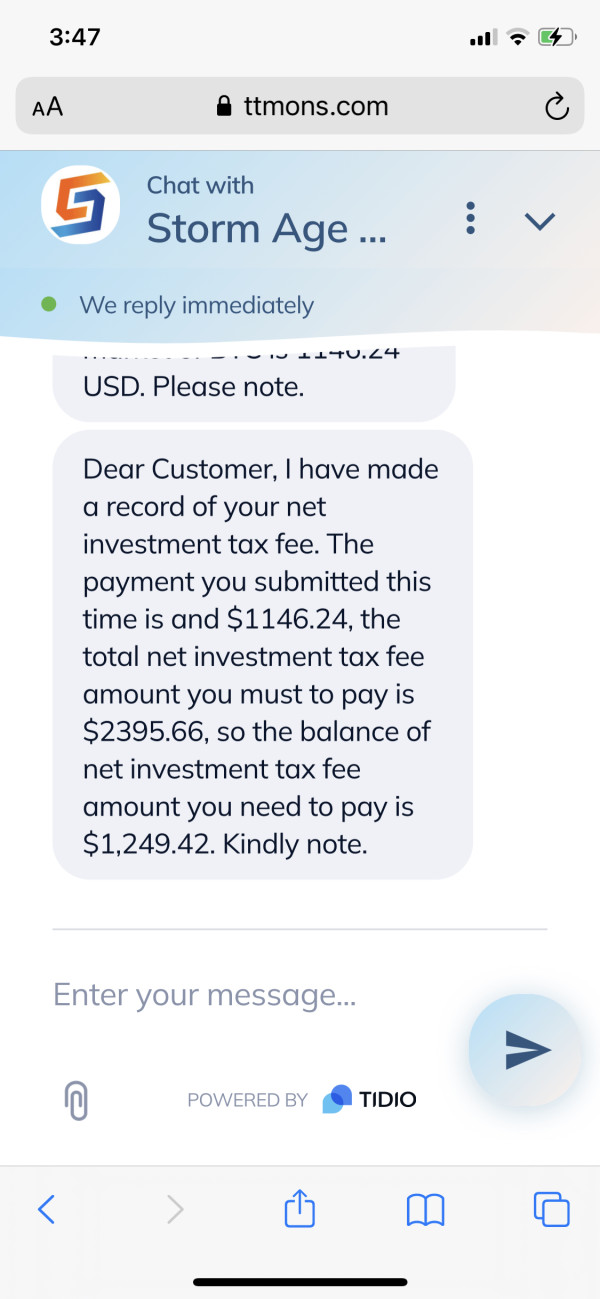

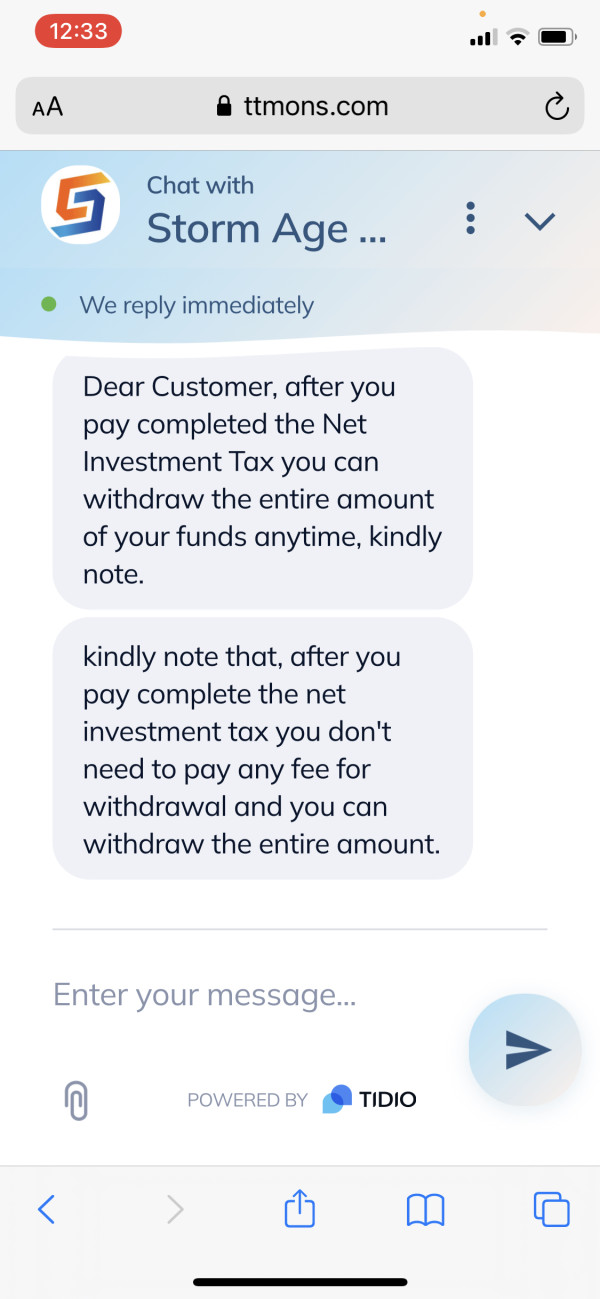

Hello, my name is Alex King. I was talked into setting up an account with Storm Age Capital from a person I met online. Account number is 701967. Everything seemed normal but against my better judgment I was into joining a trading app to build up money. Recently I found out the person whom talked me into this is a scammer. I am very concerned that the money I deposited into my Storm Age account will be lost! I contacted customer service through a chat option on their website. My conversation was concerning. It would take me multiple attempts to ask for Contact phone numbers and now looking back they don't even identify themselves. I am wanting to close this account and if I can recover any of my funds. I am out of pocket only $660.00. Please let me know if you need me to provide anything else. I could only provide part of my conversation due to picture upload limits Thank you!

Exposure

2022-08-03

Mateo22074955

United States

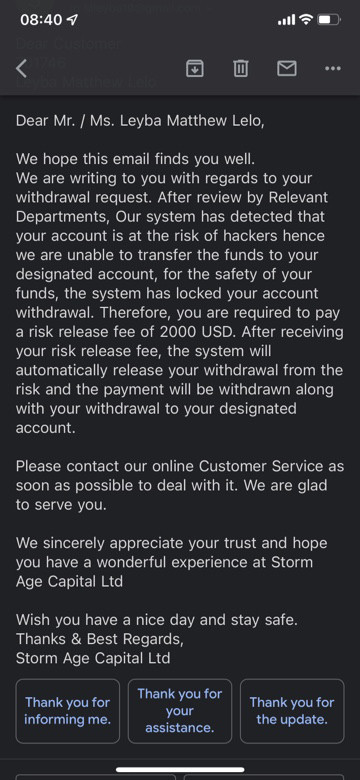

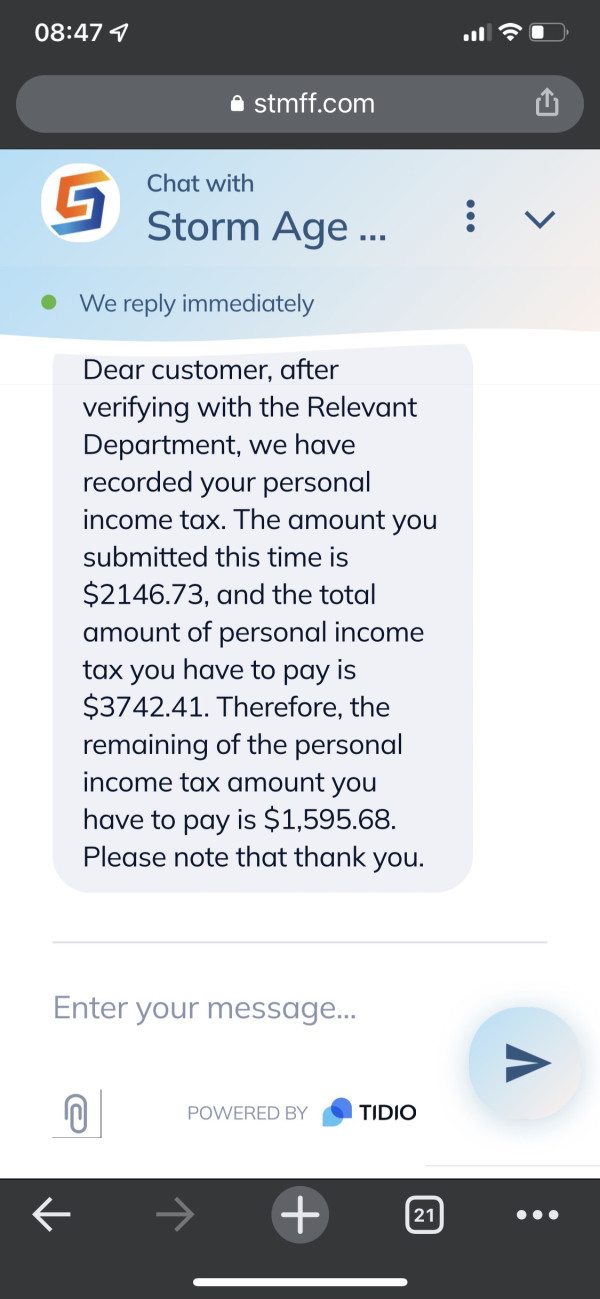

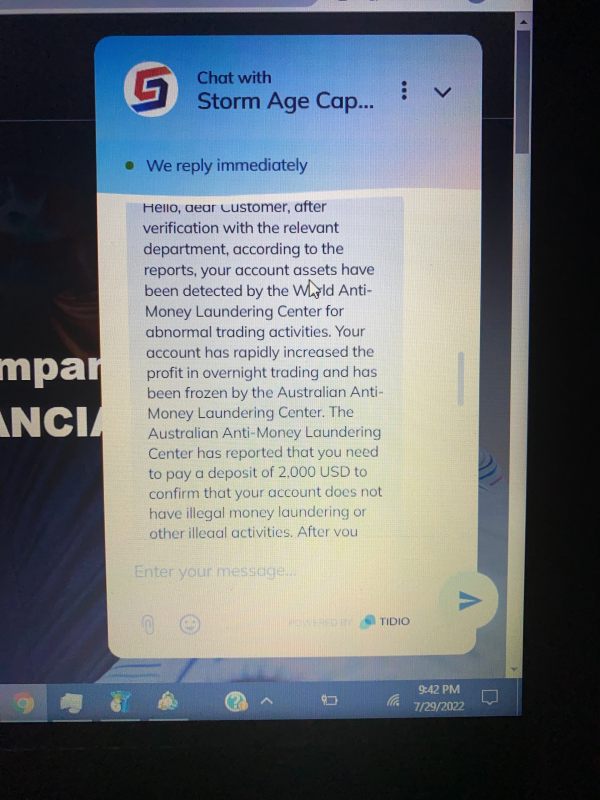

they keep telling me I have to pay all these bs fees.

Exposure

2022-07-31

CuanCuan

Indonesia

They're scam Broker, don't trade here. You will not able to withdraw your money, they will ask you for the fee or tax. Even after you paid the tax they will find another reason to not let you withdraw the money

Exposure

2022-07-10

moleh11

United States

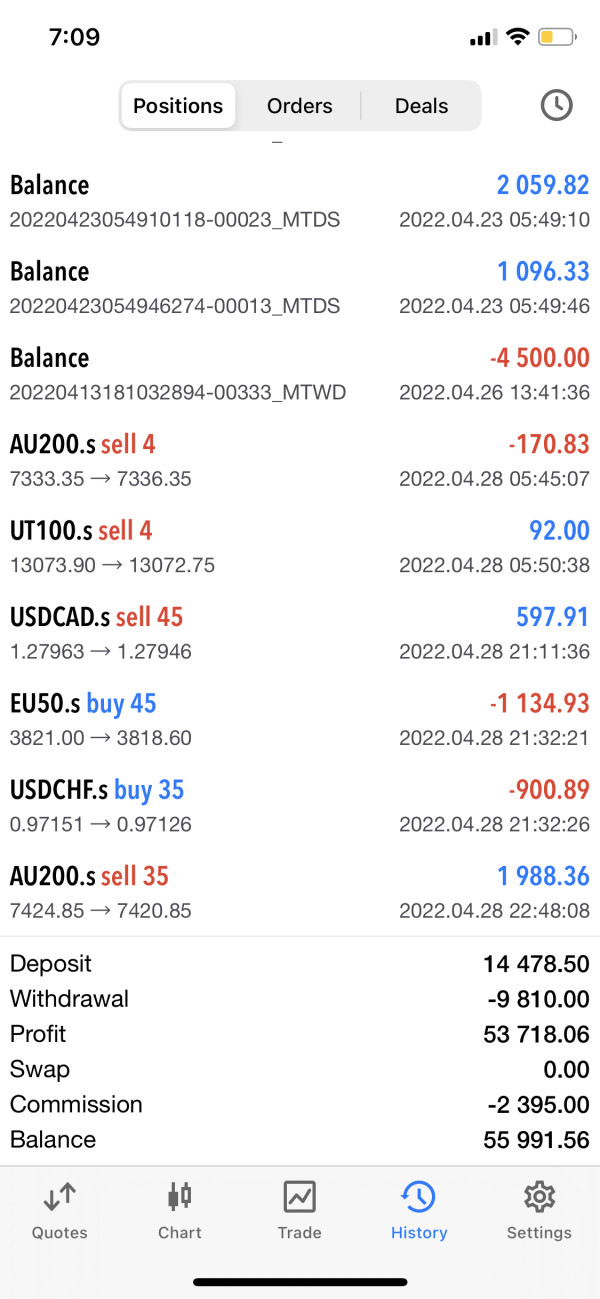

I suspect that this is a scammed broker, I'm a big account user who wants to withdraw funds, subject to fees up to 4 times but also can't withdraw, I don't want to pay the last fees because he lied to me, he said the 4x fees were fees that had to be paid last and could received the withdrawal, but he still asked for $2600 fees, my money was stuck in the account and couldn't be withdrawn because I didn't pay fees, I was really suspicious and confused, what is this game and scam.

Exposure

2022-05-06

moleh11

United States

the broker keeping try to take fees until 4 time when I requested withdraw, and also they dont give the bank address or specific location, i money in that account more than $50000

Exposure

2022-04-29