简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

In light of the Turkish presidential election, FOREX.com warns about TRY rate fluctuations

Abstract:FOREX.com Japan has issued a warning to its clients concerning potential market swings in the wake of the upcoming Turkish elections.

FOREX.com Japan, a retail Forex and CFD broker, has issued a warning to its clients concerning potential market swings in the wake of the upcoming Turkish elections. Presidential and parliamentary elections are scheduled to take place in the Republic of Türkiye on May 14, with the market opening on May 15 anticipated to deviate significantly from the closing price on May 12.

As a result, sudden fluctuations in Forex rates, including the Turkish Lira (TRY), are also possible. For TRY pairs, spreads may widen for a certain period following the start of trading until the market stabilizes. During times of significant spread widening and liquidity decline, trades may be executed at unexpected prices. Additionally, market fluctuations may cause spreads to widen or result in temporary price delivery stops for other currency pairs.

FOREX.com is advising its customers to remain vigilant regarding the possibility of sudden fluctuations in swap points and market prices and to exercise prudence in managing their positions and funds. FOREX.com may also implement measures such as widening spreads, restricting positions, and increasing maintenance margin rates due to increased market volatility and decreased liquidity.

About FOREX.com

FOREX.com is a retail foreign exchange broker that provides trading services in foreign exchange (Forex) and other financial instruments such as contracts for difference (CFDs). The company was established in 2001 and has its headquarters in Bedminster, New Jersey, USA, and also operates through its subsidiaries in other regions, including FOREX.com Japan.

FOREX.com provides its clients with access to global financial markets through advanced trading platforms, offering a range of trading tools, educational resources, and market research. The company's trading platforms enable clients to trade Forex, CFDs, and other financial instruments, with features such as real-time quotes, charting tools, and analytical tools.

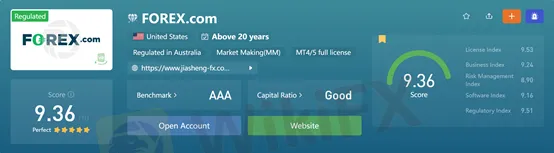

FOREX.com is regulated by several financial authorities, including the US Commodity Futures Trading Commission (CFTC), the National Futures Association (NFA), and the Financial Conduct Authority (FCA) in the United Kingdom, ensuring that the company adheres to strict regulatory standards in its operations. WikiFX has given this broker a high score of 9.36/10.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

What Every Trader Must Know in a Turbulent Market

The global financial markets are no strangers to periods of uncertainty, and recent weeks have been a testament to their unpredictable nature. Heightened volatility across major indices, including the US stock market, has left traders reassessing their strategies as they face both opportunities and risks.

NovaTech FX Scams Revealed - Hard to Withdraw Money

NovaTech, a trading platform that has recently gained considerable attention after its sudden collapse. The U.S. Securities and Exchange Commission (SEC) imposed penalties on the platform, its founders, and several major promoters. Here Let's explore this platform by examining its background and the underlying logic of its fraud scheme, and outline some key warning signs that investors should watch for when encountering similar platforms in the future.

Forex Brokers vs. Crypto Exchanges: Which Is Safer for Traders?

The world of trading offers two major platforms: forex brokers and cryptocurrency exchanges. Both provide opportunities, but they also come with risks. Traders often wonder which is the safer option. While some lean towards traditional forex brokers, others trust the decentralised nature of crypto exchanges. Let us know if you are #TeamForex or #TeamCrypto!

The Yuan’s Struggle: How China Plans to Protect Its Economy

China introduced new measures on Monday to support its weakening currency, the yuan, amidst mounting economic and political pressures. The government announced plans to boost foreign exchange reserves in Hong Kong and ease borrowing restrictions for companies to improve capital flows.

WikiFX Broker

Latest News

90 Days, Rs.1800 Cr. Saved! MHA Reveals

The Yuan’s Struggle: How China Plans to Protect Its Economy

LiteForex Celebrates Its 20th Anniversary with a $1,000,000 Challenge

Misleading Bond Sales Practices: BMO Capital Markets Fined Again by SEC

Italy’s Largest Bank Intesa Sanpaolo Enters Cryptocurrency Market

What Every Trader Must Know in a Turbulent Market

Forex Brokers vs. Crypto Exchanges: Which Is Safer for Traders?

Could TikTok U.S. Be Sold to Elon Musk to Avoid a Ban?

$600B Gold Reserves in Pakistan's Indus River Could Reshape Economy

XTB Secures UAE and Indonesia Licenses, Expands in 2025

Currency Calculator