简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

US Dollar Likely to Find Excuse for Gains in Jobs Report

Abstract:The US Dollar seems likely to find an excuse for further gains in Februarys US employment data while sentiment trends set the tone elsewhere in

TALKING POINTS – US JOBS DATA, DOLLAR, YEN, EURO, EC

German, French and Italian data may reinforce dovish ECB tone

US Dollar likely to find an excuse for gains in February jobs report

Stocks inability to rally on monetary stimulus boost looks ominou

German factory orders as well as French and Italian industrial production data headline a relatively muted European economic calendar. Downbeat outcomes echoing the trend toward underperformance on Eurozone statistical releases in recent months may ratify yesterdays dovish ECB policy announcement, weighing on the Euro and stoking global slowdown fears to the detriment of broader risk appetite.

Lasting follow-through seems unlikely however. Mario Draghi and company have probably made the point that continental Europe is in a tough spot convincingly enough yesterday, at least for now. That might see traders looking ahead to Februarys US employment data for the next major catalyst and withholding directional conviction in the interim.

Job creation is expected to slow, with nonfarm payrolls posting a 180k increase after Januarys hefty 304k rise. The jobless rate is expected to tick lower to 3.9 percent however, while wage inflation accelerates to 3.3 percent. Taken together, that points to shrinking slack in the labor market, which could plant the seeds of doubt in the recent dovish shift in Fed policy expectations.

If realized results bear this out, the US Dollar is likely to rise. The risk of disappointment is meaningful however. Indeed, US data outcomes have broadly deteriorated relative to baseline forecasts in recent weeks, hinting that analysts‘ models are overstating the economy’s vigor. A soggy outcome may still buoy the Greenback however as sentiment sours, engaging the currencys haven appeal.

Performance across the rest of the G10 FX space may reflect familiar risk on vs. off divisions. Data painting a relatively encouraging picture of the worlds largest economy might inspire a bit of backtracking on defensive bets, boosting the cycle-linked commodity currencies and weighing on the Japanese Yen. Figures that rattle already jittery investors may yield the opposite results.

What are we trading? See the DailyFX teams top trade ideas for 2019 and find out!

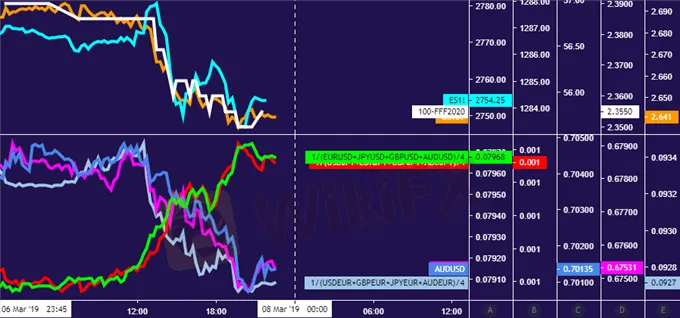

CHART OF THE DAY – STOCKS DROP DESPITE ECB STIMULUS BOOST

A sense of urgency in boosting monetary policy support might have been expected to be cheered by markets pining for a rescue as global headwinds mount. In fact, I said as much ahead of yesterdays ECB rate decision. As it happened, President Draghi and company so thoroughly spooked investors that shares (S&P 500 futures, turquoise line), yields (US 10-year, orange line), AUD/USD and NZD/USD (blue and purple lines) plunged. Traders must be in a foul mood indeed, with the bar for a positive turn in sentiment now seemingly set uncomfortably high.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Global Market Volatility and Strategic Moves by Major Economies and Companies

Global markets face volatility with significant declines in US and Asian stocks due to central bank rate decisions and economic uncertainties. JPMorgan's recession forecast, and Cathie Wood's tech stock acquisitions. Additionally, geopolitical tensions, market shifts in New York and Thailand, and rising energy prices in Europe highlight the diverse factors influencing the global financial landscape.

Weekly Analysis: XAU/USD Gold Insights

Gold prices have been highly volatile, trading near record highs due to various economic and geopolitical factors. Last week's weak US employment data, with only 114,000 jobs added and an unexpected rise in the unemployment rate to 4.3%, has increased the likelihood of the Federal Reserve implementing rate cuts, boosting gold's appeal. Tensions in the Middle East further support gold as a safe-haven asset. Technical analysis suggests that gold prices might break above $2,477, potentially reachin

Dovish Fed’s Statement Hammers Dollar

The highly anticipated Fed’s interest rate decision was disclosed yesterday, hammering the dollar’s strength lower as Fed Chief Jerome Powell explicitly signalled that a September rate cut is possible. The U.S. central bank is balancing both inflation and recession risks, with interest rates adjusted to curb inflation while maintaining a solid labour market.

<Part 2> GTSE Global Market Dynamics: Key Developments

Global markets face significant changes. China's financial sector caps salaries under Xi Jinping's "common prosperity" policy, affecting the yuan and major financial stocks. India's entry into the JPMorgan Emerging Markets Bond Index boosts investment and strengthens the rupee. Nike's weak outlook suggests a U.S. economic slowdown. Japan's yen nears a 40-year low, prompting potential stabilization efforts. Hong Kong faces judicial concerns, impacting its financial stability.

WikiFX Broker

Latest News

AI-Driven Fraud: Social Media Fraud Reportedly Soars 28%

HKEX to Open Riyadh Office in 2025, Strengthening Ties Between China and the Middle East

Hong Kong Exchange Pioneers Asia's First EU-Compliant Crypto Index

STARTRADER PRIME: Your Trusted Partner in Institutional Liquidity Solutions

J.P. Morgan Leads with Five Awards in Global $7.5 Trillion FX Market

DON’Ts DURING US Election 2024

Trump vs. Harris: Whose policies are Better for US stock investors?

MyTrade Founder Guilty of Crypto Manipulation

Can Blockchain Technology Protect Your Money from Risk?

Hong Kong Court Rules in Favor of Investors in JPEX Case

Currency Calculator