Score

Investico

South Africa|1-2 years|

South Africa|1-2 years| https://www.investico.com/international/

Website

Rating Index

Contact

Licenses

Licenses

Licensed Institution:FARAZ FINANCIAL SERVICES (PTY) LTD

License No.:45518

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

South Africa

South AfricaAccount Information

Users who viewed Investico also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Neex

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

Website

investico.com

Server Location

United States

Website Domain Name

investico.com

Server IP

104.22.14.61

Company Summary

| Aspect | Information |

| Registered Country/Area | South Africa |

| Company Name | Investico |

| Regulation | Unregulated, under scrutiny for licensing issues |

| Minimum Deposit | Varies by account type |

| Maximum Leverage | Up to 1:500 |

| Spreads | Vary by account type |

| Trading Platforms | Web-based MetaTrader 4 (MT4) |

| Tradable Assets | Cryptocurrencies, Currencies, Shares, Commodities, Indices |

| Account Types | Basic, Gold, Platinum, VIP |

| Customer Support | Reported as unresponsive |

| Payment Methods | Credit Card, Electronic Payment, Wire Transfer |

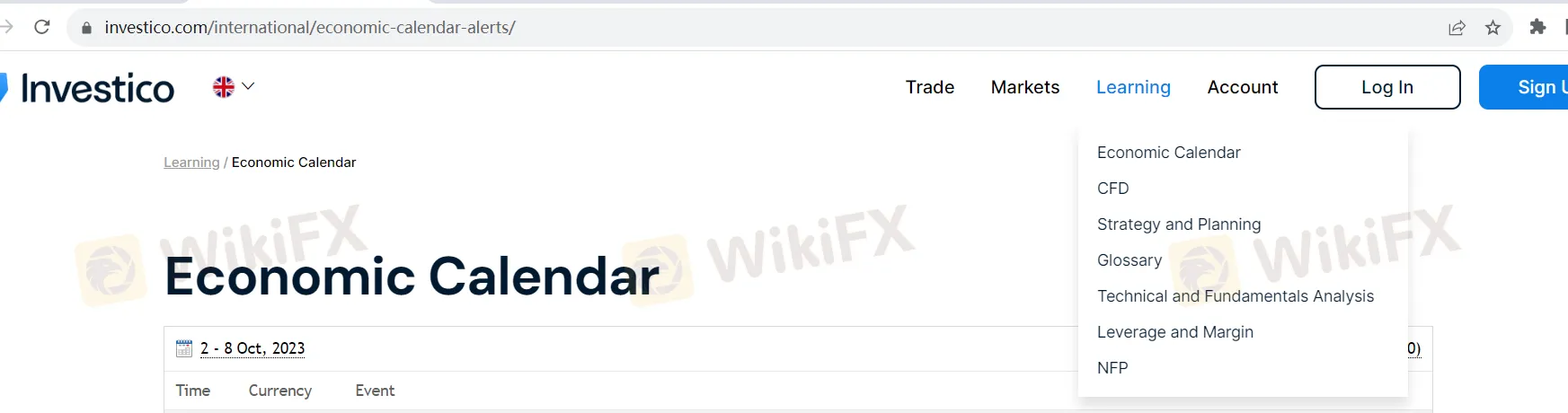

| Educational Tools | Economic Calendar, CFD, Strategy and Planning, Glossary, Technical and Fundamentals Analysis, Leverage and Margin, NFP (Non-Farm Payrolls) |

Overview

Regulation

Unregulated.

Investico is currently under scrutiny for allegedly operating as a broker using a suspicious cloned fake license. The company's activities have raised significant concerns within the industry, with authorities investigating the authenticity of their licensing documentation. Investors and clients are strongly advised to exercise caution and conduct thorough due diligence before engaging with Investico or any similar entities to protect their interests and investments. It is essential to verify the legitimacy of any financial institution or broker to avoid potential scams or fraudulent activities.

Pros and Cons

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

Investico offers a diverse range of market instruments and multiple account types to accommodate traders with varying needs. The platform provides a maximum leverage of up to 1:500 and offers comprehensive educational resources. However, it's important to note that Investico operates without regulatory oversight and is currently under scrutiny for potentially using questionable licensing documentation. Customer support is reported to be unresponsive, and there may be uncertainty regarding commission charges. Additionally, withdrawal fees can apply based on your account type. Traders are advised to exercise caution, conduct due diligence, and carefully consider the pros and cons before engaging with Investico.

Market Instruments

Investico appears to be a fictional or specific investment platform or company that you are referencing. To describe the market instruments that Investico offers, we can break them down as follows:

Cryptocurrencies:

Investico likely provides access to various cryptocurrencies, which are digital or virtual currencies that use cryptography for security. These cryptocurrencies may include well-known options like Bitcoin (BTC), Ethereum (ETH), and others. Investors can trade, buy, or sell these digital assets on the platform.

Currencies:

Investico may offer forex trading, allowing investors to trade fiat currencies like the US Dollar (USD), Euro (EUR), Japanese Yen (JPY), and others. Forex trading involves speculating on the exchange rate fluctuations between currency pairs.

Shares (Equities):

Investico may provide access to shares or equities of publicly traded companies. Investors can buy and sell shares in these companies, becoming partial owners and potentially benefiting from capital appreciation and dividends.

Commodities:

Investico could offer commodities trading, which involves buying and selling physical goods or raw materials like gold, oil, wheat, or coffee. Commodity markets allow investors to speculate on price movements and hedge against inflation.

Indices:

Investico likely enables investors to trade financial indices. These indices represent the performance of a group of underlying assets, such as stocks, bonds, or commodities. Popular indices include the S&P 500, Dow Jones Industrial Average, and NASDAQ Composite. Trading indices allows investors to gain exposure to broader market trends.

Account Types

Investico offers four distinct account types to cater to the varying needs and preferences of its traders: Basic, Gold, Platinum, and VIP. These tiers are designed to provide traders with flexibility in choosing an account that aligns with their trading goals and financial capacity.

Basic Account:

The Basic account is the entry-level option for traders looking to start their journey in the world of online trading. To open a Basic account, traders need a minimum deposit of $250. With this account, traders can enjoy leverage of up to 1:500, allowing for amplified trading positions. Basic account holders have access to floating spreads as low as 3.0 pips for EUR/USD, 3.4 pips for GBP/USD, 3.3 pips for USD/JPY, and $0.12 for Crude Oil. Additionally, Basic account holders receive one free withdrawal per month, making it a cost-effective choice for traders.

Gold Account:

The Gold account is tailored for more experienced traders who are willing to commit a higher initial investment of $25,000. This account type provides the same leverage of up to 1:500 as the Basic account. However, Gold account holders benefit from tighter spreads, with floating spreads as low as 2.7 pips for EUR/USD, 3.1 pips for GBP/USD, 3.0 pips for USD/JPY, and $0.11 for Crude Oil. Traders with Gold accounts also receive one free withdrawal each month.

Platinum Account:

For traders seeking premium features and greater trading power, the Platinum account requires a minimum deposit of $100,000. With leverage up to 1:500, Platinum account holders enjoy the lowest spreads of all account types, starting at 2.1 pips for EUR/USD, 2.5 pips for GBP/USD, 2.4 pips for USD/JPY, and $0.10 for Crude Oil. Additionally, traders with Platinum accounts receive three free withdrawals per month, reducing transaction costs and increasing flexibility.

VIP Account:

Investico's VIP account is the highest tier, designed for the most sophisticated and well-funded traders. To access the VIP account, traders must deposit a substantial amount of $250,000. VIP account holders benefit from the same leverage of up to 1:500 as other account types. They enjoy the tightest spreads, starting at 1.6 pips for EUR/USD, 2.0 pips for GBP/USD, 1.9 pips for USD/JPY, and $0.08 for Crude Oil. The VIP account offers unparalleled advantages, including no withdrawal fees, providing traders with maximum cost efficiency.

In summary, Investico's tiered account system allows traders to choose an account type that aligns with their financial capacity and trading objectives. Whether you're a novice trader looking to get started or an experienced professional seeking premium features, Investico offers a range of options to meet your needs.

Here's a table summarizing the key details of each account type:

| Account Type | Minimum Deposit | Leverage | Lowest Spreads | Free Withdrawals |

| Basic | $250 | Up to 1:500 | EUR/USD 3.0 pips, GBP/USD 3.4 pips, USD/JPY 3.3 pips, Crude Oil $0.12 | 1 per month |

| Gold | $25,000 | Up to 1:500 | EUR/USD 2.7 pips, GBP/USD 3.1 pips, USD/JPY 3.0 pips, Crude Oil $0.11 | 1 per month |

| Platinum | $100,000 | Up to 1:500 | EUR/USD 2.1 pips, GBP/USD 2.5 pips, USD/JPY 2.4 pips, Crude Oil $0.10 | 3 per month |

| VIP | $250,000 | Up to 1:500 | EUR/USD 1.6 pips, GBP/USD 2.0 pips, USD/JPY 1.9 pips, Crude Oil $0.08 | No fees |

Please note that minimum deposit requirements are subject to change, and traders should contact Investico for the most up-to-date information.

Leverage

Investico offers a maximum trading leverage of up to 1:500 for all account types. Leverage allows traders to control larger positions with a smaller amount of capital. With 1:500 leverage, you can trade with up to 500 times your initial deposit. While this can amplify profits, it also increases the risk of losses. Traders should use leverage carefully, employ risk management, and be mindful of market volatility when trading with high leverage.

Spreads and Commissions

Spreads: Investico provides floating spreads, which means that the spreads can vary based on market conditions. The spreads are expressed in pips, which is the smallest price increment in currency trading. The spreads differ across account types, with tighter spreads available for higher-tier accounts. For instance, the Basic account offers spreads as low as 3.0 pips for EUR/USD, while the VIP account provides the tightest spreads, starting at just 1.6 pips for the same currency pair. These varying spreads allow traders to choose an account that aligns with their trading preferences.

Commissions: The information provided does not specify any explicit commissions associated with these account types. It's possible that Investico operates on a spread-only fee structure, where the company earns its revenue from the difference between the buy (ask) and sell (bid) prices of assets, commonly known as the spread. This means that traders do not pay a separate commission per trade but should consider the spread as the cost of their trades.

In summary, Investico offers varying spreads across its account types, with tighter spreads available for higher-tier accounts. The information provided does not indicate any separate commissions for trading. Traders should be aware of the spread costs associated with their chosen account type and consider this factor when making their trading decisions.

Deposit & Withdrawal

Deposit Funds:

Log In: Start by logging in to your Investico trading account.

Access Deposit: Once logged in, navigate to the Deposit section by clicking on the “Deposit” button.

Choose Deposit Method: Investico offers multiple deposit methods for your convenience, including Credit Card, Electronic Payment, and Wire Transfer.

Select Method: Choose the deposit method that suits you best from the available options.

Follow Instructions: Follow the on-screen instructions for your chosen deposit method to initiate the deposit transaction. This may involve providing payment details, such as card information or bank account details.

Withdraw Funds:

Log In: Log in to your Investico trading account.

Access Withdrawal: Go to the “Banking” tab within your account interface, then click on the “Withdrawal” tab.

Specify Withdrawal Amount: Enter the amount you wish to withdraw in the provided field and click on the “Next” button.

Fill in Details: Complete any required fields or forms, which may include specifying your preferred withdrawal method and providing necessary information. Ensure all details are accurate.

Submit Request: After filling in the required information, click on the “Submit” button to initiate the withdrawal request.

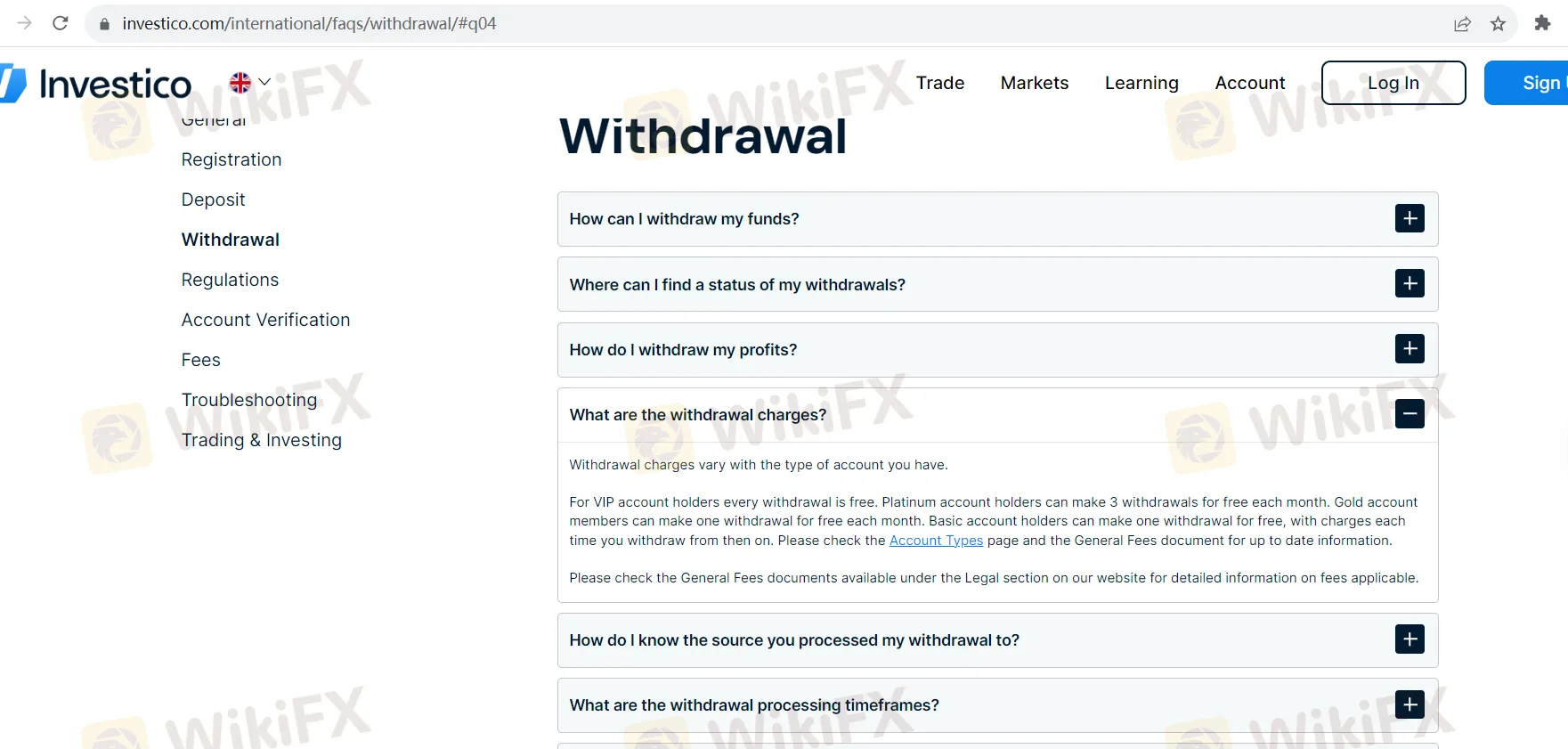

Withdrawal Charges:

Withdrawal charges vary depending on the type of trading account you hold with Investico:

VIP Account: VIP account holders enjoy free withdrawals, meaning there are no charges for withdrawing funds.

Platinum Account: Platinum account holders are entitled to three free withdrawals each month. Additional withdrawals may be subject to charges.

Gold Account: Gold account members can make one free withdrawal per month. Subsequent withdrawals may incur charges.

Basic Account: Basic account holders are permitted one free withdrawal initially, but charges apply to subsequent withdrawals.

It's important to stay informed about withdrawal charges by checking the Account Types page and the General Fees document on Investico's website for the most up-to-date information regarding fees and withdrawal policies.

Trading Platforms

A web-based trading platform, powered by MetaTrader 4 (MT4), is available through Investico. This platform offers traders a user-friendly interface with real-time price charts, technical indicators, and automated trading tools. Traders can use various order types, apply risk management strategies, and access their accounts from anywhere, including on mobile devices. The platform prioritizes security and provides customer support to assist with trading needs. It's a versatile choice for traders to analyze markets, execute trades, and manage their accounts conveniently through a web browser.

Customer Support

Investico's customer support, unfortunately, leaves much to be desired. The lack of responsiveness and efficiency is a significant concern for users seeking assistance. The phone support line, while available, often results in long wait times and frustrating experiences. Emails sent to the provided address, info@investico.com, frequently go unanswered for extended periods, leaving customers in the dark regarding their inquiries or concerns.

The “Chat Now” option, which could be a potential avenue for quick assistance, often leads to frustrating experiences as well. Users report issues with slow response times, unhelpful or automated responses, and a general lack of professionalism in resolving their issues or answering their questions.

Overall, the customer support offered by Investico falls short of expectations, leaving customers feeling neglected and dissatisfied with the level of service provided. It's an area that requires significant improvement to meet the needs and expectations of its user base.

Educational Resources

Investico offers a comprehensive educational resource section that is designed to empower traders with the knowledge and tools they need to make informed investment decisions. This section covers a wide range of topics, catering to traders of all levels of experience.

Economic Calendar: The Economic Calendar is an invaluable tool for traders looking to stay updated on important economic events and announcements that can impact the financial markets. It provides a schedule of key economic releases, such as employment reports, GDP figures, and central bank meetings. By understanding the potential market impact of these events, traders can plan their strategies accordingly.

CFD (Contracts for Difference): Investico's CFD section likely offers in-depth insights into trading CFDs, a popular derivative product. This resource may cover topics like how CFDs work, their advantages and risks, and strategies for trading them effectively. CFDs allow traders to speculate on the price movements of various assets without owning them, making it crucial to understand their intricacies.

Strategy and Planning: Trading strategies are fundamental to success in financial markets. Investico's Strategy and Planning section is likely a treasure trove of information on different trading strategies, risk management techniques, and market analysis approaches. Whether traders are interested in day trading, swing trading, or long-term investing, this resource is expected to offer guidance and insights.

Glossary: The financial world comes with its own jargon and terminology, which can be overwhelming for newcomers. Investico's Glossary serves as a handy reference tool, explaining the meanings of key financial terms, abbreviations, and concepts. It's an essential resource for traders looking to enhance their financial literacy.

Technical and Fundamentals Analysis: Technical analysis and fundamental analysis are two primary methods for evaluating financial assets. Investico's Technical and Fundamentals Analysis sections are likely to provide detailed guidance on how to perform both types of analysis effectively. This may include discussions on chart patterns, indicators, fundamental data, and more.

Leverage and Margin: Leverage and margin are critical aspects of trading, and they come with both opportunities and risks. Investico's Leverage and Margin resource likely educates traders on how to use leverage responsibly, understand margin requirements, and manage risk effectively. This knowledge is crucial for protecting capital while maximizing trading opportunities.

NFP (Non-Farm Payrolls): The Non-Farm Payrolls (NFP) report is a key economic indicator, particularly for forex traders. Investico's NFP section may provide insights into how this report influences currency markets, how to interpret NFP data, and trading strategies around its release.

In conclusion, Investico's educational resources cover a wide spectrum of topics essential for traders' success. Whether traders are beginners looking to build a solid foundation or experienced professionals seeking to refine their strategies, these resources are expected to provide valuable insights and knowledge. By leveraging these educational materials, traders can enhance their understanding of financial markets and make more informed trading decisions.

Summary

Investico is a trading platform offering a range of market instruments, including cryptocurrencies, currencies, shares, commodities, and indices. However, it's essential to note that Investico's regulatory status is currently under scrutiny due to concerns about its licensing documentation. While it provides various account types with different minimum deposits and features, its customer support falls short in terms of responsiveness and efficiency. The educational resources are comprehensive, covering topics such as economic calendars, CFDs, trading strategies, and more. Additionally, Investico offers a web-based trading platform based on MetaTrader 4 (MT4), but users are advised to exercise caution and conduct due diligence when engaging with this platform.

FAQs

Q: Is Investico a regulated broker?

A: No, Investico is currently unregulated and under scrutiny for potentially operating with questionable licensing documentation. Traders are advised to exercise caution and conduct thorough due diligence before engaging with the platform.

Q: What are the account types offered by Investico?

A: Investico offers four account types: Basic, Gold, Platinum, and VIP, catering to traders with varying levels of experience and financial capacity.

Q: How can I deposit funds into my Investico trading account?

A: To deposit funds, log in to your account, click on the “Deposit” button, choose your preferred deposit method (Credit Card, Electronic Payment, or Wire Transfer), and follow the on-screen instructions.

Q: What is the maximum leverage available on Investico?

A: Investico offers a maximum trading leverage of up to 1:500 for all account types, allowing traders to control larger positions with a relatively smaller amount of capital.

Q: Does Investico charge withdrawal fees?

A: Withdrawal fees vary depending on your account type. VIP account holders enjoy free withdrawals, while other account types have varying limits on free withdrawals per month. It's advisable to check the specific account details and fees on the Investico website for the most up-to-date information.

Keywords

- 1-2 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- Suspicious Overrun

- High potential risk

Content you want to comment

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now