简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

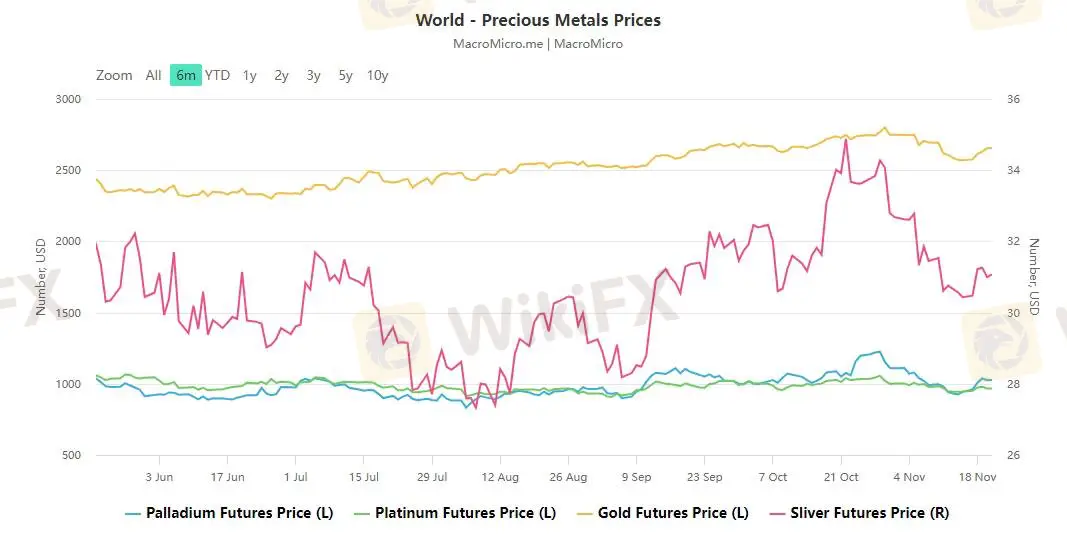

【MACRO Insight】 Global Precious Metals Market Analysis: Investment Prospects of Silver and Gold

Abstract:The recent escalation of the situation between Russia and Ukraine has triggered global investors concerns about the threat of nuclear war, prompting many people to seek investment methods to maintain

The recent escalation of the situation between Russia and Ukraine has triggered global investors' concerns about the threat of nuclear war, prompting many people to seek investment methods to maintain and increase value. According to the report “Silver's Strategic Advantages: Responding to Tectonic Shifts in Global Markets” commissioned by the Silver Association and written by Capitalight Research Inc., silver has become an ideal investment choice during these difficult times.

The report states that global silver demand is expected to exceed 1.2 billion ounces in 2024, highlighting the metal's enduring appeal and strategic importance to institutional portfolios. The surge in demand is not only due to continued strength in industrial consumption and a recovery in jewelry and silverware demand, but also that silver demand is expected to reach a new record in 2024. In addition, the expected increase in demand will be faced with supply constraints, with supply expected to fall by 1% to 1 billion ounces, increasing the deficit to 265.3 million ounces in 2024.

Silver prices have significantly outperformed many other commodities since March 2020, thanks to a combination of industrial demand, investment interest and macroeconomic factors. The post-epidemic environment has driven a surge in investment demand for silver as a hedge against inflation and economic uncertainty. Silver's key role in the booming renewable energy sector, especially in the production of solar panels, and its growing use in electronics have further supported its prices.

Meanwhile, UBS Group's latest forecast shows that gold prices will rise to $2,900 an ounce by the end of next year, echoing Goldman Sachs' forecast, which also expects gold prices to rise further as central banks increase their gold reserves. UBS analysts Levi Spry and Lachlan Shaw said in a report that gold prices may have a consolidation period before rising again due to a stronger dollar and concerns that more U.S. fiscal stimulus measures may lead to higher interest rates. They said that gold prices will rise further to $2,950 an ounce by the end of 2026.

“The US 'red wave', strong diversified investment demand and ongoing global uncertainty will continue to support gold prices,” said UBS analysts. They said the rise in gold prices “should be driven by continued strategic gold allocations and official sector buying, against a backdrop of volatile macroeconomic conditions and persistent geopolitical risks.”

Goldman Sachs this week forecast that gold prices will rise to $3,000 an ounce by the end of next year. The optimistic outlook depends on increased demand from central banks and investor inflows into exchange-traded funds (ETFs) following the Federal Reserve's rate cuts. UBS also pointed to the possibility of monetary authorities further increasing their gold holdings. “Central banks tend to buy physical gold bars and may continue to increase their gold reserves to diversify and respond to geopolitical tensions and sanctions risks,” the report said. “Many central banks still have low gold reserves as a percentage of total assets.”

Complex geopolitics also boosted gold, with Russian President Vladimir Putin lowering the threshold for a nuclear strike on Tuesday to respond to a wider range of conventional attacks. A few days ago, there were reports that Washington allowed Ukraine to use US-made weapons to carry out a deep strike against Russia. Ilya Spivak, head of global macro at Tastylive, said, “The US authorization and Russia's response could lead to nuclear war, which is increasing market uncertainty and boosting safe-haven assets such as gold.”

In addition, later this week, several Fed officials are expected to reveal the path of the Fed's future rate cuts. Currently, traders see a 58.9% chance of a 25 basis point rate cut in December. Recent strong data and tariffs proposed by President-elect Trump suggest that interest rates will remain higher for longer.

Spivak added that the market is adjusting expectations for the Federal Reserve to cut interest rates next year as inflation is becoming a bigger concern, which could be negative for gold. Meanwhile, Kansas City Fed President Schmid said it is still uncertain how far interest rates can go down, although the initial rate cut was a vote of confidence that inflation is returning to the 2% target.

Against the backdrop of the ever-changing global financial market, the importance of silver and gold as safe-haven assets has become increasingly prominent. Silver's dual advantages of industrial demand and safe-haven properties, as well as gold's status as a traditional safe-haven asset, indicate that the precious metals market will usher in an active investment cycle. Investors should pay close attention to geopolitical dynamics, global economic policies, and changes in market demand to seize opportunities in precious metals investment.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Ontario launches major US ad campaign amid Trump's tariff threat

Capital.com Collaborated with Amazon in the UAE

ActivTrades Gains Regulatory License in Mauritius

Ripple’s RLUSD Stablecoin Expected to Launch in NY by Dec. 4

Apple Pay, Google Pay Eyeing Launch in the Philippines

easyMarkets Kicks Off the Start of Its Trade with the Champions Competition

Businessman Pleads Guilty to $5.9M Ponzi Scheme

Philippines Warns Public of Get-Rich-Quick Scams This Christmas

Know Ins & Outs of Prop Trading Firms

Malaysian Loses RM2.6 Million to Online Investment Scam

Currency Calculator