简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

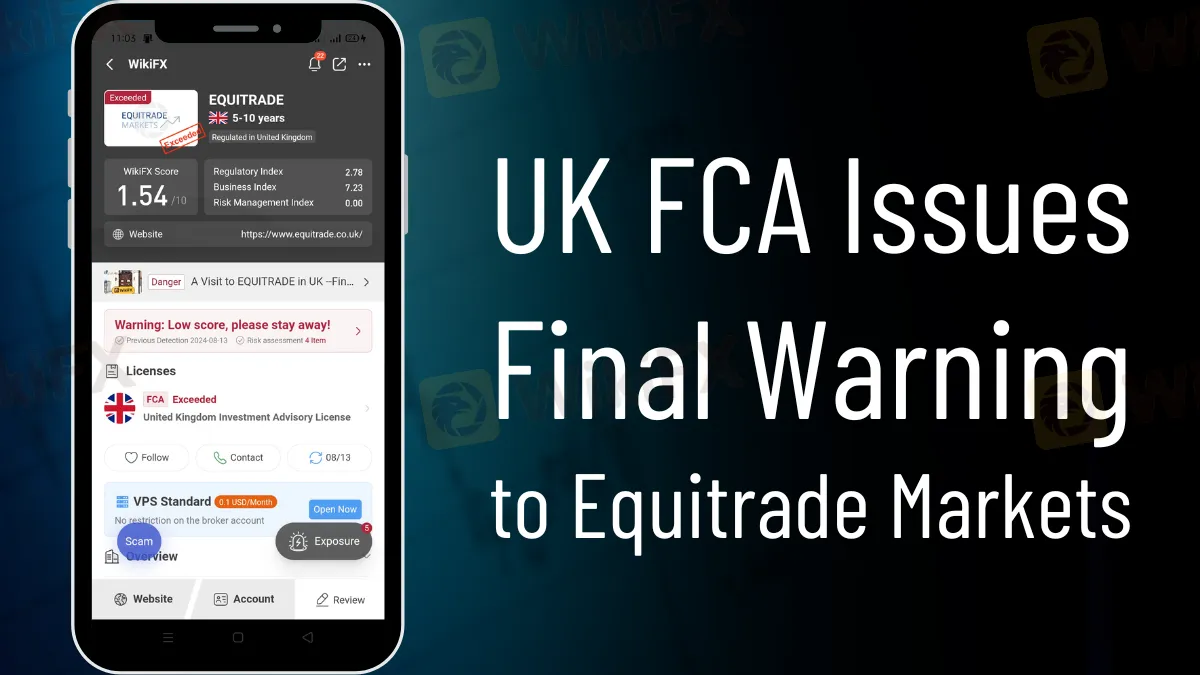

UK FCA Issues Final Warning to Equitrade Markets

Abstract:The UK FCA has issued a final warning to Equitrade Markets, revoking its license due to serious regulatory breaches and lack of compliance.

The UK Financial Conduct Authority (FCA) has taken serious action against Equitrade Markets Ltd, issuing a Decision Notice revoking the firm's Part 4A authorization. This decision comes after the FCA conducted a comprehensive investigation and determined that Equitrade Markets has continuously failed to fulfill the regulatory criteria necessary to operate as a financial service provider in the UK.

The FCA's decision is based on concerns that Equitrade Markets does not meet the appropriateness Threshold Condition, which is a key criterion for all regulated organizations. The Authority found that the business is not a “fit and proper” entity, owing to its inability to conduct its activities soundly and responsibly. This conclusion demonstrates the FCA's commitment to ensuring that all enterprises under its authority operate honestly and responsibly.

One of the primary points raised by the FCA is Equitrade Markets' continuous inability to comply with the regulatory duty to submit the requisite Returns. Despite several inquiries from the FCA, the business failed to meet its duties, indicating a lack of transparency and collaboration. This non-compliance immediately breaches Principle 11 of the FCA's Principles for Businesses, which requires enterprises to be open and helpful with the regulator.

The FCA's final warning underscores that Equitrade Markets' major shortcomings, notably in terms of suitability, have led to the unavoidable conclusion that the company is not conducting its business in a way that guarantees its affairs are handled appropriately. As a result, the FCA found that Equitrade Markets did not fulfill the Threshold Conditions for having a Part 4A permit and, therefore, canceled its license.

In parallel, industry watchdog WikiFX has been aggressively monitoring companies like as Equitrade Markets. The broker presently has a poor WikiFX rating of 1.54, which reflects its lack of regulation and failure to renew its FCA licence. WikiFX's continual efforts to identify untrustworthy brokers give useful information for investors, allowing them to make more educated selections.

Note of Awareness

Investors should use care when engaging with financial service providers. Before participating in financial activities, it is essential to establish a firm's regulatory status.

About WikiFX

WikiFX is a worldwide broker regulatory inquiry tool that offers detailed information on brokers, including regulatory status and client comments. WikiFX seeks to safeguard investors by providing clear and trustworthy information on financial service companies globally.

Concerned about your investments? Check the regulatory status and reviews of Equitrade Markets brokers on WikiFX to make informed decisions and protect your assets.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Malaysian influencer Hu Chang Mun, widely known as Ady Hu, has been detained in Taiwan for his alleged involvement in a fraudulent operation. The 31-year-old, who was reported missing earlier in December, was located by Taiwanese authorities after suspicions arose regarding his activities.

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

Discover how MultiBank Group, a global leader in financial derivatives, secured three prestigious awards at Traders Fair Hong Kong 2024, highlighting its innovative trading solutions and industry excellence.

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Discover how CySEC resolved compliance issues with Charlgate Ltd, the operator of Fxview, through a €50,000 settlement. Explore the investigation, regulatory measures, and CySEC's new website designed for improved accessibility and transparency.

TradingView Launches Liquidity Analysis Tool DEX Screener

Discover TradingView's DEX Screener, a powerful tool for analyzing decentralized exchange trading pairs. Access metrics like liquidity, trading volume, and FDV to make smarter, data-driven trading decisions.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Top 10 Trading Indicators Every Forex Trader Should Know

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Currency Calculator