简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

【MACRO Alert】The aftershocks from the policy decisions by the Bank of Japan have yet to subside – investors are now looking to the upcoming release of the CPIreport to find new opportunities

Abstract:The market turmoil caused by the Bank of Japan's policy adjustments is still to be watched, and investors are already looking for new opportunities, closely monitoring the upcoming U.S. CPI report. This report may affect the Federal Reserve's interest rate decisions and trigger market fluctuations. Despite uncertainties, investments in the technology sector and market adjustments provide opportunities for investors seeking value. The emphasis of Federal Reserve officials on labor market data and

The recent policy adjustments by the Bank of Japan have become a focal point of attention in the global financial market. Former Bank of Japan director Makoto Sakurai stated that, considering the market turmoil following the interest rate hike and the uncertainty of Japan's economic recovery, it is unlikely that the policy rate will be raised again within this year. This view aligns with market expectations, as the overnight index swap market shows that traders' expectations for an interest rate hike before the end of the year have significantly decreased.

On July 31st, the Bank of Japan decided to raise the policy rate cap from 0.1% to 0.25%, an unexpected move that triggered market turmoil. The strong tone of Bank of Japan Governor Haruhiko Kuroda and his concerns about the U.S. economy were considered to be driving forces behind the surge of the yen. However, subsequent soothing remarks by Bank of Japan Deputy Governor Shinichi Uchida, along with a cautious attitude towards the normalization of monetary policy, provided a certain degree of stability to the market.

Market participants are closely monitoring the communication methods and policy direction of the Bank of Japan. Sakurai criticized Kuroda's communication style at the press conference, believing that it failed to effectively convey the central bank's stance of continuing to maintain a loose policy, leading to market misunderstandings about the continuous rise in interest rates. Despite this, the Japanese stock market experienced a record three-day plunge in early August, with a market value loss of up to 1.1 trillion U.S. dollars. This downturn provided a new buying opportunity for bullish investors, especially for those stocks that had previously risen too much and are now more attractively priced. Although the sudden interest rate hike by the Bank of Japan caught traders off guard, its subsequent statements helped to curb the sudden rise of the yen, eliminating a key threat to the stock market rebound.

The uncertainty of the global economy, especially the fluctuations in U.S. labor market data, has also affected the Japanese stock market. However, the huge investment in artificial intelligence infrastructure by major technology companies has brought a glimmer of hope to the market. Investors now recognize that the monetary policies of Japan and the United States have entered a new phase. The Nikkei index has fallen by 12% since the end of June, and the Japanese chip index has fallen sharply from its high point at the beginning of the year. Market analysts believe that the current valuation level provides investors with an opportunity to buy low.

The derivatives market remains positive about the Japanese stock market, with the position growth rate of bullish Nikkei index options outpacing bearish options, indicating that market expectations for a rebound are strengthening. However, risks still exist, especially in the case of potential conflicts in policy direction between the Bank of Japan and the Federal Reserve.

Despite facing various pressures, investors' confidence in the Japanese stock market has not been completely lost. Ben Bennett, the head of Asian investment strategy at Legal & General Investment Management Ltd., said that although the excessive crowding of positions is one of the reasons to avoid Japanese stocks, investors may increase positions after the market adjustment. Overall, the policy changes of the Bank of Japan and the market's violent reaction have provided investors with the opportunity to re-evaluate and adjust their investment strategies. Against the backdrop of global economic uncertainty, the adjustment of the Japanese stock market may bring new opportunities for value-seeking investors.

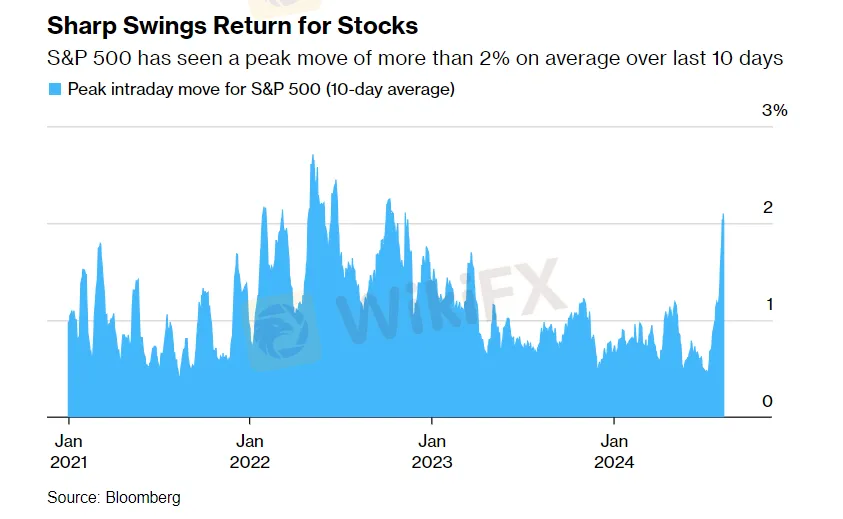

In addition, Wall Street is about to usher in a climax of the summer, and market participants are closely watching the upcoming release of the U.S. Consumer Price Index (CPI) report, hoping that this report will provide the necessary basis for the Federal Reserve to lower interest rates at the September meeting. The market is expected to see greater volatility. Last week, the volatility index of the S&P 500 Index (SPX), the CBOE Volatility Index (VIX), rose to the highest level since the peak of the 2020 pandemic due to market turmoil.

According to data from Citigroup, traders expect the S&P 500 index to fluctuate by as much as 1.2% when the upcoming CPI data is announced. Rocky Fishman, founder of derivatives analysis company Asym 500, pointed out that the options market has not released a signal that the stock market crisis has been lifted. Although historically, buying stocks when volatility is high is a good strategy, the market's reaction to the CPI report will be key.

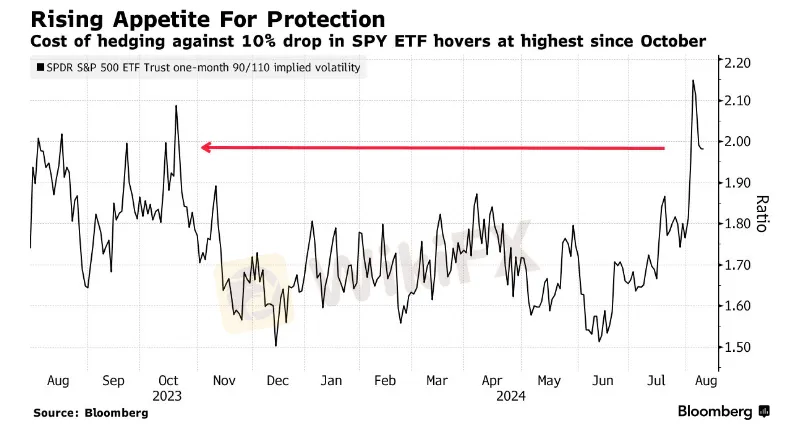

In addition, to prevent a stock market downturn, investors are paying a higher cost to purchase put options for the SPDR S&P 500 ETF Trust (SPY). Data shows that this is twice the cost of purchasing call options. Investors are also paying attention to the market trend after the speech by Federal Reserve Chairman Jerome Powell at the Jackson Hole Economic Symposium and the release of Nvidia's earnings report. If Powell's speech at the symposium or the CPI data boosts the market, it may indicate the number of rate cuts in the coming year.

Thomas Urano, co-chief investment officer of Sage Advisory, said that the market is at a turning point, and bad economic news is now seen as good news because it may prompt the Federal Reserve to adjust its policy. However, if economic data continues to be sluggish, the stock market may face further fluctuations. Federal Reserve officials are increasingly concerned about labor market data, especially employment. Mary Daly, President of the Federal Reserve Bank of San Francisco, emphasized that the slowdown in the labor market needs to be avoided to the extent of a recession.

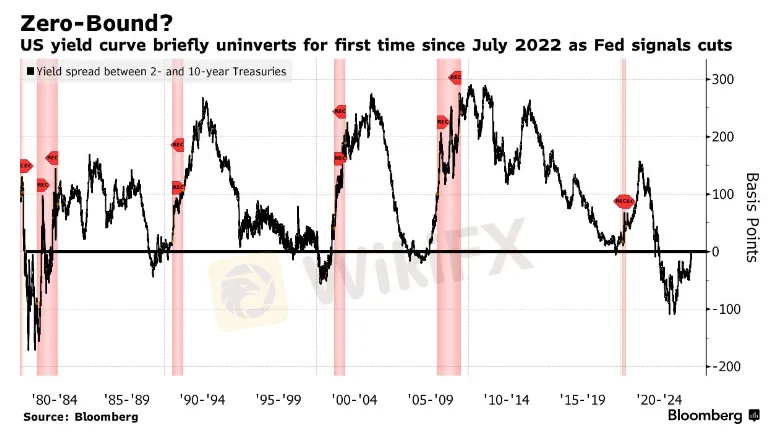

The gap between the U.S. 2-year and 10-year Treasury bond yields once returned to normal, but soon inverted again. This phenomenon has often predicted an economic recession in the past, although its reliability is now questioned. Thomas Salopek, head of strategy at J.P. Morgan, expects that due to concerns about economic growth, the stock market may experience more pain and significant fluctuations.

Foreseeably, traders are waiting for the CPI report, and economists expect the core CPI, excluding food and energy, to rise by 0.2% month-on-month and 3.2% year-on-year, approaching the Federal Reserve's 2% inflation target. If the CPI reading deviates significantly from expectations, it may trigger a new round of market turmoil. Brooke May, managing partner of Evans May Wealth, warned that if the Federal Reserve cuts interest rates significantly due to an economic slowdown, it is usually unfavorable for stock returns historically, but she also expects the stock market to experience more fluctuations in the coming weeks.

The market turmoil caused by the Bank of Japan's policy adjustments is still to be watched, and investors are already looking for new opportunities, closely monitoring the upcoming U.S. CPI report. This report may affect the Federal Reserve's interest rate decisions and trigger market fluctuations. Despite uncertainties, investments in the technology sector and market adjustments provide opportunities for investors seeking value. The emphasis of Federal Reserve officials on labor market data and the fluctuations in Treasury bond yields indicate the complexity of the economic outlook.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Bitcoin in 2025: The Opportunities and Challenges Ahead

BI Apprehends Japanese Scam Leader in Manila

Join the Event & Level Up Your Forex Journey

Is There Still Opportunity as Gold Reaches 4-Week High?

Bitcoin miner\s claim to recover £600m in Newport tip thrown out

Good News Malaysia: Ready for 5% GDP Growth in 2025!

Breaking News! Federal Reserve Slows Down Interest Rate Cuts

Beware: Pig Butchering Scam Targeting Vulnerable Individuals

This Economic Indicator Sparks Speculation of a Japan Rate Hike!

Dutch Law Student Arrested for €4.5 Million Crypto Scam

Currency Calculator