Score

IFC Markets

Cyprus|5-10 years|

Cyprus|5-10 years| https://www.ifcmarkets.com/

Website

Rating Index

MT4/5 Identification

MT4/5

Full License

IFCMarketsLtd-Demo

Influence

A

Influence index NO.1

Germany 7.50

Germany 7.50MT4/5 Identification

MT4/5 Identification

Full License

Netherlands

NetherlandsInfluence

Influence

A

Influence index NO.1

Germany 7.50

Germany 7.50Contact

Single Core

1G

40G

1M*ADSL

- The number of the complaints received by WikiFX have reached 8 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

Basic information

Cyprus

CyprusAccount Information

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed IFC Markets also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FBS

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

MiTRADE

- 10-15 years |

- Regulated in Australia |

- Market Making(MM)

Sources

Language

Mkt. Analysis

Creatives

Website

Most visited countries/areas

Turkey

South Africa

Nigeria

Bulgaria

ifcmfx.com

Server Location

United States

Website Domain Name

ifcmfx.com

Server IP

172.67.189.92

ifcm.co.uk

Server Location

United States

Website Domain Name

ifcm.co.uk

Server IP

172.67.156.40

fxifcm.asia

Server Location

United States

Website Domain Name

fxifcm.asia

Server IP

172.67.132.236

Genealogy

VIP is not activated.

VIP is not activated.Company Summary

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

| IFC Markets Review Summary in 10 Points | |

| Founded | 2006 |

| Registered Country/Region | Cyprus |

| Regulation | CYSEC (exceeded), FSC (offshore regulatory), LFSA (suspicious clone) |

| Market Instruments | Currency Pairs, Precious Metals, Continuous Index CFDs, Stock CFDs, and Cryptocurrency CFD |

| Demo Account | Available |

| Leverage | 1:400 |

| EUR/USD Spread | Fixed (from 1.8) and Floating (from 0.4) Spreads |

| Trading Platforms | NetTradeX, MT4, MT5 |

| Minimum deposit | $1 |

| Customer Support | 24/7 multilingual live chat, phone, email |

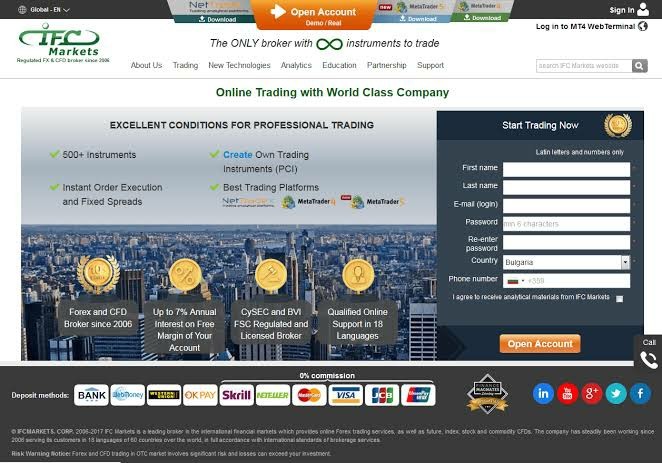

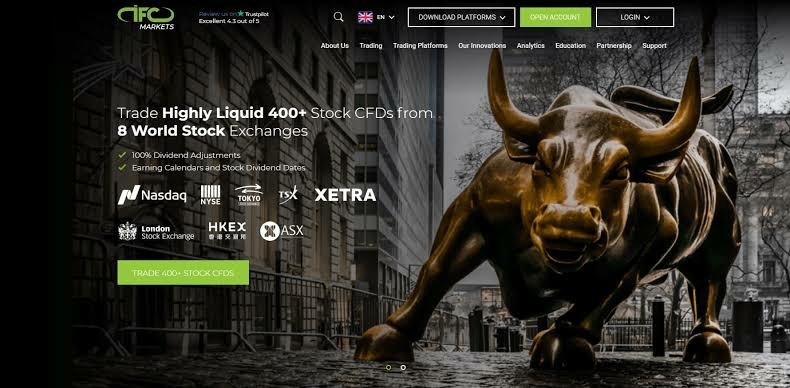

What is IFC Markets?

IFC Markets is an international online broker that provides a wide range of financial instruments and trading services to clients worldwide. The company offers various trading instruments, including currency pairs, commodities, indices, stocks, and cryptocurrencies through multiple trading platforms, including NetTradeX, MetaTrader 4, and MetaTrader 5. However, IFC Markets operates as an unregulated broker, and traders should exercise caution and conduct thorough research before engaging in any trading activities.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

IFC Markets offers a wide range of trading instruments, multiple trading platforms, and educational resources, providing traders with flexibility and opportunities for learning. The availability of various deposit and withdrawal methods, as well as 24/7 customer support, adds convenience for traders.

However, the lack of regulation raises concerns about investor protection and the reported instances of scams and withdrawal issues highlight potential risks. The limited information on spreads and commissions may also make it difficult for traders to assess trading costs accurately.

| Pros | Cons |

| • Wide range of trading instruments | • Operates as an unregulated broker |

| • Multiple trading platforms | • United States, BVI, Japan and Russian residents are excluded |

| • Demo accounts and Islamic Accounts/SWAP-free accounts available | • Reports of scams and withdrawal issues |

| • Various deposit and withdrawal methods | • Limited information available about specific spreads and commissions |

| • Rich educational resources | |

| • Multilingual customer support available 24/7 |

Please note that the information provided is based on the available data and may not reflect the complete picture of the pros and cons of IFC Markets. It's always recommended to conduct thorough research and exercise caution when choosing a broker for trading activities.

IFC Markets Alternative Brokers

Trading 212 - for traders seeking a user-friendly platform with a wide range of tradable instruments and a commission-free trading model.

TrioMarkets - for experienced traders looking for competitive spreads, multiple account types, and access to various trading platforms.

XGLOBAL Markets - for traders who prioritize competitive pricing, fast execution, and a diverse range of financial instruments for trading.

There are many alternative brokers to IFC Markets depending on the specific needs and preferences of the trader. Some popular options include:

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Is IFC Markets Safe or Scam?

IFC Markets is a forex and CFD broker that holds licenses from various regulatory authorities, including CySEC (Cyprus Securities and Exchange Commission), FSC (British Virgin Islands Financial Services Commission), and LFSA (Labuan Financial Services Authority). However, the CySEC license is exceeded, the FSC license is from an offshore jurisdiction, and the LFSA license is a suspicious clone.

It's important to note that having multiple licenses does not necessarily guarantee the safety or legitimacy of a broker. Traders should exercise caution when dealing with brokers that have offshore licenses or licenses from less reputable jurisdictions. It's recommended to conduct thorough research, consider the broker's reputation, and carefully assess the risks before engaging in any trading activities.

Market Instruments

IFC Markets provides a wide range of trading instruments to cater to the diverse needs of its clients. Traders can access over 650 instruments, including currency pairs, precious metals like gold and silver, continuous index CFDs, stock CFDs, and cryptocurrency CFDs.

Currency pairs offer opportunities to trade major, minor, and exotic pairs, allowing traders to participate in the global forex market. Precious metals provide an alternative investment option and a hedge against inflation. Continuous index CFDs enable traders to speculate on the performance of popular stock indices, while stock CFDs allow for trading on the price movements of individual company shares. Additionally, the inclusion of cryptocurrency CFDs allows traders to gain exposure to the volatile and rapidly evolving digital asset market.

Accounts

To meet different types of investors' investment needs and trading experience, IFC Markets offers two live account types. The Beginner account is designed for novice traders and requires a minimum deposit of 1 USD, 1 EUR, or 100 JPY. This account type provides access to a range of trading instruments and features, allowing beginners to start their trading journey with a smaller initial investment.

The Standard account, on the other hand, is suitable for more experienced traders and requires a minimum deposit of 1000 USD, 1000 EUR, or 100,000 JPY. It offers additional benefits and features, including access to more trading instruments, tighter spreads, and personalized customer support.

In addition to live accounts, IFC Markets also offers demo accounts for practice and testing strategies, as well as Islamic Accounts/SWAP-free accounts for clients who adhere to Islamic finance principles. These account options provide flexibility and cater to the diverse needs of traders at different skill levels.

Leverage

IFC Markets provides its clients with leverage options of up to 1:400. Leverage allows traders to control larger positions in the market with a smaller amount of capital. With a leverage ratio of 1:400, traders can amplify their potential profits or losses by 400 times. While leverage can enhance trading opportunities, it is important to note that it also carries higher risks. Higher leverage increases the potential for both gains and losses, and traders should exercise caution and employ risk management strategies when utilizing leverage.

IFC Markets' offering of high leverage provides traders with the flexibility to adjust their trading strategies and access a larger market exposure, but it is crucial for traders to have a thorough understanding of leverage and its implications before engaging in leveraged trading activities.

Spreads & Commissions

IFC Markets offers competitive spreads to its clients. Traders have the option to choose between fixed spreads and floating spreads. The fixed spreads start from 1.8 pips, providing traders with a clear and consistent cost of trading. On the other hand, the floating spreads start from as low as 0.4 pips, allowing traders to potentially benefit from tighter spreads during periods of market volatility or when liquidity is high.

One advantage of trading with IFC Markets is that they do not charge any hidden commissions on trades. This means that traders can have greater transparency and clarity regarding their trading costs. By offering competitive spreads and transparent fee structures, IFC Markets aims to provide traders with a cost-effective trading environment.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission |

| IFC Markets | fixed spreads from 1.8 pips and floating spreads from 0.4 pips | no hidden commissions |

| Trading 212 | from 0.9 pips | $0 |

| TrioMarkets | from 0.0 pips | $7 per lot round turn |

| XGLOBAL Markets | from 0.1 pips | $0 |

Please note that spreads and commissions can vary depending on market conditions, account type, and trading platform. It is always advisable to check with the broker directly for the most accurate and up-to-date information regarding spreads and commissions.

Trading Platforms

IFC Markets offers traders NetTradeX, the market-leading MT4 and MT5 trading platforms. Both MT4 and MT5 are the most popular forex trading platforms on the market, and both support iOS, Android, and tablet versions, allowing traders to trade flexibly. NetTradeX is IFC Markets' proprietary trading platform, offering a user-friendly interface and a range of advanced trading tools. It is designed to cater to the needs of both beginner and experienced traders.

MT4 and MT5, on the other hand, are popular and widely used platforms in the industry. They offer comprehensive charting capabilities, advanced order management tools, and a wide range of technical indicators and expert advisors for automated trading.

The availability of multiple platforms allows traders to choose the one that best suits their trading preferences and strategies.

See the trading platform comparison table below:

| Broker | Trading Platform |

| IFC Markets | NetTradeX, MetaTrader 4, MetaTrader 5 |

| Trading 212 | Trading 212 |

| TrioMarkets | MetaTrader 4, MetaTrader 5, cTrader |

| XGLOBAL Markets | MetaTrader 4, MetaTrader 5, XGLOBAL Mobile Trader |

Please note that this information is subject to change, and it's always recommended to verify the availability of specific trading platforms with the respective brokers directly.

Deposits & Withdrawals

IFC Markets offers a diverse range of deposit and withdrawal options to cater to the needs of its clients. Traders can choose from various methods such as International Bank Transfer, bank cards (Visa/MasterCard), Pasargad Novin, Cryptocurrencies, TopChange, Perfect Money, Boleto, Bitwallet, WebMoney, ADVCash, and Fasapay.

IFC Markets minimum deposit vs other brokers

| IFC Markets | Most other | |

| Minimum Deposit | $1 | $100 |

The minimum deposit and withdrawal amounts, fees, and processing times may vary depending on the chosen method. It is recommended to refer to the provided screenshots or consult the IFC Markets website for detailed information on each payment option.

Customer Service

IFC Markets is committed to providing comprehensive customer support to assist its clients. With 24/7 availability, traders can reach out to the support team through various channels, including 19 languages live chat, phone, email, Skype, WhatsApp, Telegram, Messenger, or by requesting a callback. This wide range of communication options ensures that clients can choose the method that is most convenient for them.

Additionally, IFC Markets maintains an active presence on popular social media platforms such as Twitter, Facebook, Instagram, YouTube, and LinkedIn, allowing clients to stay updated on the latest news and developments. Furthermore, an FAQ section is available on the website, providing answers to frequently asked questions and assisting traders in finding quick solutions to common queries.

Overall, IFC Markets' customer service is considered reliable and responsive, with various options available for traders to seek assistance.

| Pros | Cons |

| • Multiple communication channels | N/A |

| • 24/7 multilingual customer support availability | |

| • Live chat support | |

| • Social media presence and interaction |

Education

IFC Markets places great emphasis on providing educational resources to support traders of all skill levels. Their educational offerings include a variety of materials designed to enhance traders' knowledge and skills. Video tutorials are available, offering step-by-step guidance on various trading topics. Additionally, Forex and CFD trading books provide in-depth information and insights into market analysis, trading strategies, and risk management.

Traders can also benefit from the Trader's Glossary, which contains a comprehensive list of terms and definitions commonly used in the financial markets. For those who seek a more structured learning experience, the IFCM Trading Academy offers courses tailored to different levels of expertise, including beginner, intermediate, and expert.

User Exposure on WikiFX

On our website, you can see that some reports of scams and unable to withdraw. Traders are encouraged to carefully review the available information and consider the risks associated with trading on an unregulated platform. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Conclusion

In conclusion, IFC Markets offers a diverse range of trading instruments, multiple trading platforms, and educational resources, providing traders with opportunities for growth and flexibility. The availability of various deposit and withdrawal methods, along with responsive customer support, adds convenience to the trading experience.

However, the lack of regulatory licenses and reports of scams and withdrawal issues raise concerns about the safety and reliability of the broker. Traders should carefully evaluate the risks associated with trading on an unregulated platform and consider alternative options with stronger regulatory oversight.

Frequently Asked Questions (FAQs)

| Q 1: | Is IFC Markets regulated? |

| A 1: | No. The CYSEC license is exceeded, the FSC license is offshore regulatory, and the LFSA license is a suspicious clone. |

| Q 2: | At IFC Markets, are there any regional restrictions for traders? |

| A 2: | Yes. It does not provide services for United States, BVI, Japan and Russian residents. |

| Q 3: | Does IFC Markets offer demo accounts? |

| A 3: | Yes. |

| Q 4: | Does IFC Markets offer the industry leading MT4 & MT5? |

| A 4: | Yes. It supports NetTradeX, MT4 and MT5. |

| Q 5: | What is the minimum deposit for IFC Markets? |

| A 5: | The minimum initial deposit to open an account is 1 USD | 1 EUR | 100 JPY. |

| Q 6: | Is IFC Markets a good broker for beginners? |

| A 6: | No. It is not a good choice for beginners. Though it advertises well, dont forget the truth that IFC Markets is unregulated. |

Keywords

- 5-10 years

- Regulated in Malaysia

- Regulated in Cyprus

- Regulated in The Virgin Islands

- Straight Through Processing(STP)

- Common Financial Service License

- Retail Forex License

- MT4 Full License

- MT5 Full License

- Self-developed

- Global Business

- Suspicious Overrun

- High potential risk

- Offshore Regulated

News

News WIKIFX REPORT: IFC Markets adds four new Crypto Currency pairs

IFC Markets allows clients to replenish instruments at any time, and traders all over the world can trade CFDs on the most prominent cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Ripple (XPR), with a broker 24 hours a day, 7 days a week. Traders can even design their own fake instruments using IFC Markets' GeWorko Portfolio Quoting Method.

2022-06-02 12:10

News WikiFX report: List of financial instruments you can trade on IFC Markets

What you can trade on IFC Markets? There are more than 1000 financial instruments you can access from one platform.

2022-04-22 15:30

News #S-IBM Stock CFDs - Trading Suspended

Due to corporate events related to the shares of International Business Machines Corporation, CFD trading on #S-IBM shares will be temporarily suspended from 4th Nov., 2021. All open positions for #S-IBM will be closed at the market closing price on 03/11/2021. In the future, trading will be allowed.

2021-11-11 16:58

Review 11

Content you want to comment

Please enter...

Review 11

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

abdalslam Ibrahim

Lebanon

ok no withdrawal not

Exposure

2023-03-03

安哥的影子

Hong Kong

I have been using this platform for nearly 6 years. Although the delay has been fixed for more than 3 seconds, but I don’t trade much, I deposit and withdraw funds occasionally, and use it as a stock hedging. I lost a total of 30,000 US dollars on this platform, and it doesn’t matter if I lose. Recently, I used EA to place orders with friends. I only traded once every 20-30 minutes, and I got a few thousand dollars back. Last week, 2 accounts closed with more than $10,000. Yesterday Monday night, I found out that the funds in my account were applied for withdrawal. A total of $11,100, and now there are only a few thousand left. I checked the records and asked about customer service. He said that the funds were withdrawn to the BTC wallet, but I clearly did not apply for deposits in BTC or other digital currencies before, and I did not accept the withdrawal of funds in this way. They just said my member center password, they didn't give me the record IP of the application, they just said it was a different country. I have 100,000 doubts in my heart, why would someone withdraw money from my account if I recover a little bit? Why did the platform process the withdrawal application without confirming the wallet address? Emailed them CS, but still no reply ‧ Even if the password was stolen, reset should be fine, now they suspended my login and didn't send me daily transaction records. I am very concerned about the safety of my funds.

Exposure

2022-04-19

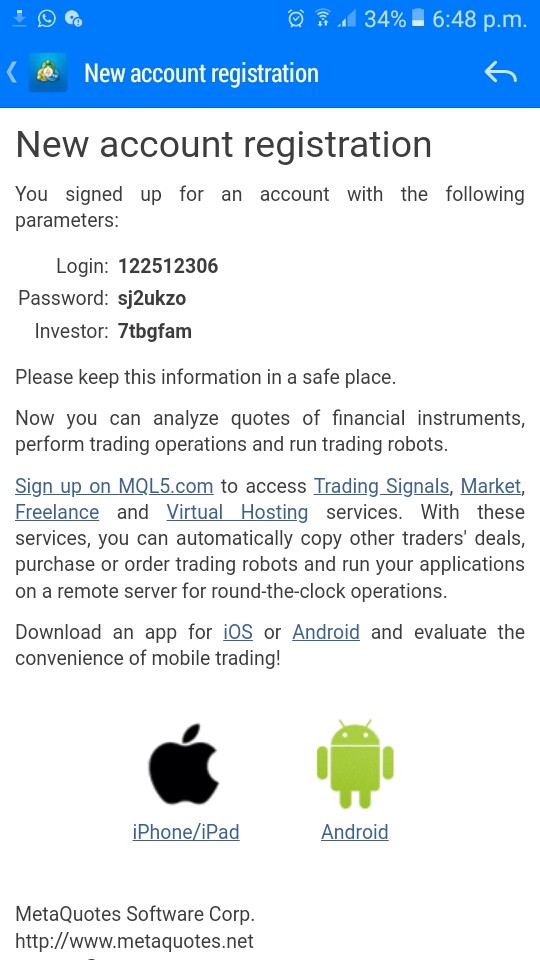

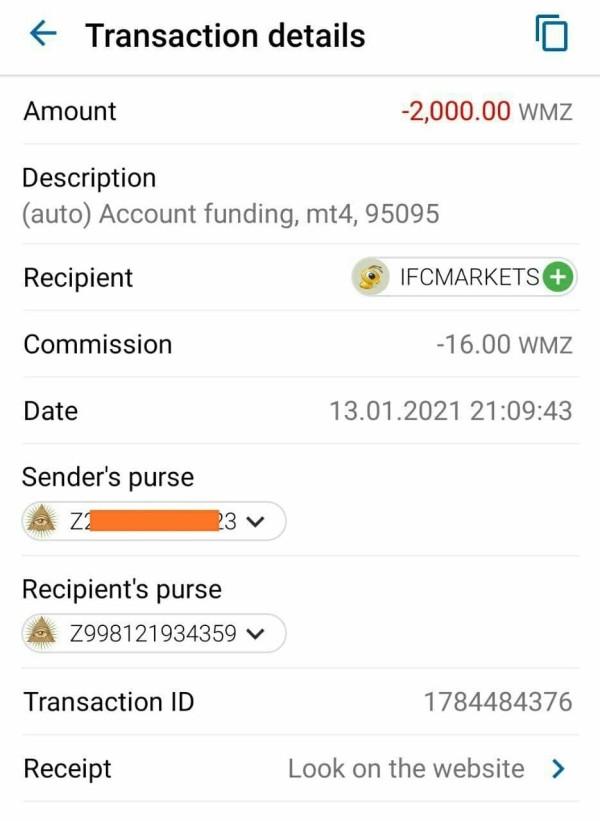

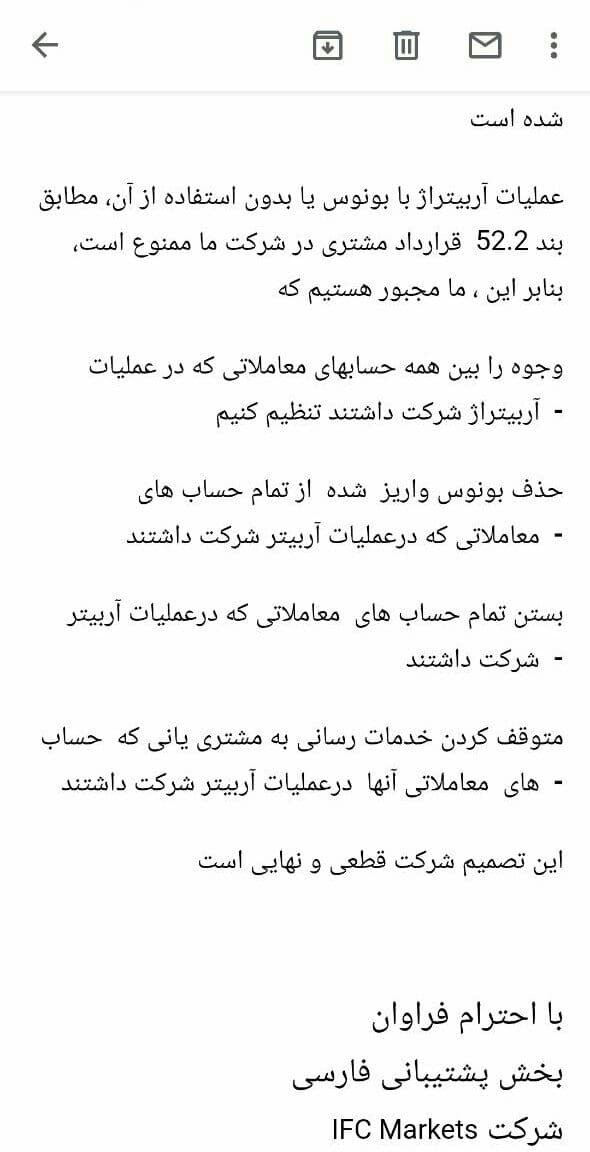

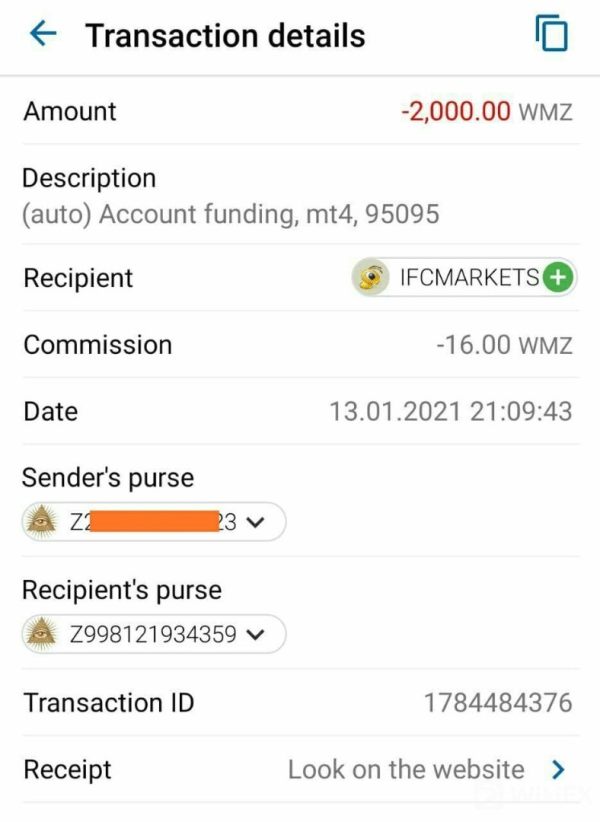

Talal baig66941

Pakistan

I am opening this case against IFCMarkets Broker I opened a live account with this broker and funded my account via webmoney with the amount of 2000$ (13th Jan 2021 ) and I also received 600$ bonus after only 12 hours I found out that my account has been blocked and I received an email that my account has been closed because of Arbitrage !!!! the note is that I did not open any trade on my account at all !!!! the most important note in this case is that IFCMarkets blocked.

Exposure

2021-09-29

gustavo_fring

Malaysia

I opened a live account with this broker and funded my account via WebMoney with an amount of $2,000, and then I received a $600 bonus. After only 12 hours, I found out that my account had been blocked and received an email claiming that my account had been closed because of Arbitrage! But I did not open any trade on my account at all. The most important note, in this case, is that the Broker blocked my whole balance and they did not allow me to withdraw my initial deposit ($2,000). They referred me to section 5.2 of the client agreement and claimed that they had the right to block my account, ALL of my balance, and even my INITIAL DEPOSIT! I really can not understand what is going on here...I even did not open any trade on my account. This clearly is a SCAM!!!

Exposure

2021-09-14

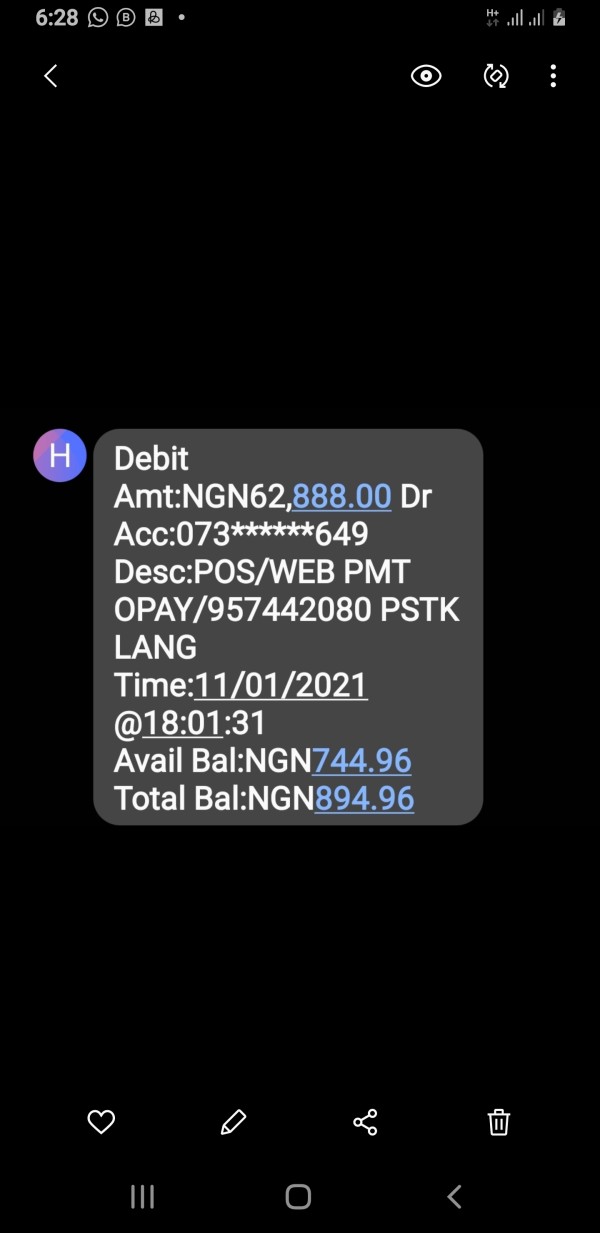

FX1828126555

Nigeria

I deposited 62,888 BUT THEY HAVE DIS ACTIVATE MY ACCOUNT I CANT DO ANY THING WITH IT DONT INSVEST WITH THEM.

Exposure

2021-09-14

Andy loh

Malaysia

I am opening this case against IFCMarkets BrokerI opened a live account with this broker and funded my account via webmoneywith the amount of 2000$ and I also received 600$ bonusafter only 12 hours I found out that IFCMarkets blocked my whole balance andthey are not allowing my to make withdrawal my Initial deposit ( 2000$ )

Exposure

2021-09-13

gustavo_fring

Malaysia

I opened a live account with this broker and funded my account via WebMoney with an amount of $2,000 , and then I received a $600 bonus. After only 12 hours, I found out that my account had been blocked and received an email claiming that my account had been closed because of Arbitrage! But I did not open any trade on my account at all. The most important note, in this case, is that the broker has blocked my whole balance and they did not allow me to withdraw my initial deposit ($2,000). They referred me to section 5.2 of the client agreement and claimed that they had the right to block my account, ALL of my balance, and even my INITIAL DEPOSIT! I really can not understand what is going on here...I even did not open any trade on my account. This clearly is a SCAM!!!

Exposure

2021-09-02

Hà Đào Hiếu

Japan

Stupid

Exposure

2020-08-01

FX1286573346

South Africa

I am trading with IFC Markets for quite a long time and I recommend this broker. Never had major issues. Everything works fast and smooth.

Neutral

2023-02-24

LaLa123

Netherlands

It offers three types of accounts for traders to choose from. I opted for the Premium account because it has larger leverage, which allows me to gain larger profits with less capital. As the saying goes, one must take risks for substantial rewards.

Positive

2023-12-13

FX1122377873

Nigeria

Official website is simple to use, the trading software is fantastic, and the interface and installation are breezes. All content available in numerous languages, and the customer service is excellent.

Positive

2022-12-10