Score

Daiwa

Japan|15-20 years|

Japan|15-20 years| http://www.daiwa.jp/

Website

Rating Index

Capital Ratio

Capital Ratio

Good

Capital

Influence

A

Influence index NO.1

Japan 9.22

Japan 9.22Capital Ratio

Capital Ratio

Good

Capital

Influence

Influence

A

Influence index NO.1

Japan 9.22

Japan 9.22Contact

Licenses

Licenses

Licensed Institution:大和証券株式会社

License No.:関東財務局長(金商)第108号

Single Core

1G

40G

1M*ADSL

Basic Information

Japan

JapanUsers who viewed Daiwa also viewed..

FBS

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Sources

Language

Mkt. Analysis

Creatives

Website

daiwa.jp

Server Location

United States

Website Domain Name

daiwa.jp

Website

WHOIS.JPRS.JP

Company

JAPAN REGISTRY SERVICES

Domain Effective Date

2007-03-02

Server IP

104.127.203.201

Company Summary

| DaiwaReview Summary | |

| Founded | 2007-03-02 |

| Registered Country/Region | Japan |

| Regulation | Unregulated |

| Products | Domestic stocks/Bonds/US Stocks/Wrap Accounts/Investment trusts/the Current lPO/the Current PO/NISA |

| Customer Support | Social Media: Twitter, Facebook |

Daiwa Information

Daiwa is a securities company registered in Japan that provides various products and services with five major features are online trading, shop and contact center support, complete investment information and trading tools, a wide variety of Internet seminars, proprietary high-value-added services, and rich products.

Is Daiwa Legit?

Daiwa is authorized and regulated by the Financial Services Agency(FCA) with license No.関東財務局長(金商)第108号, making it safer than regulated brokers.

What products does Daiwa provide?

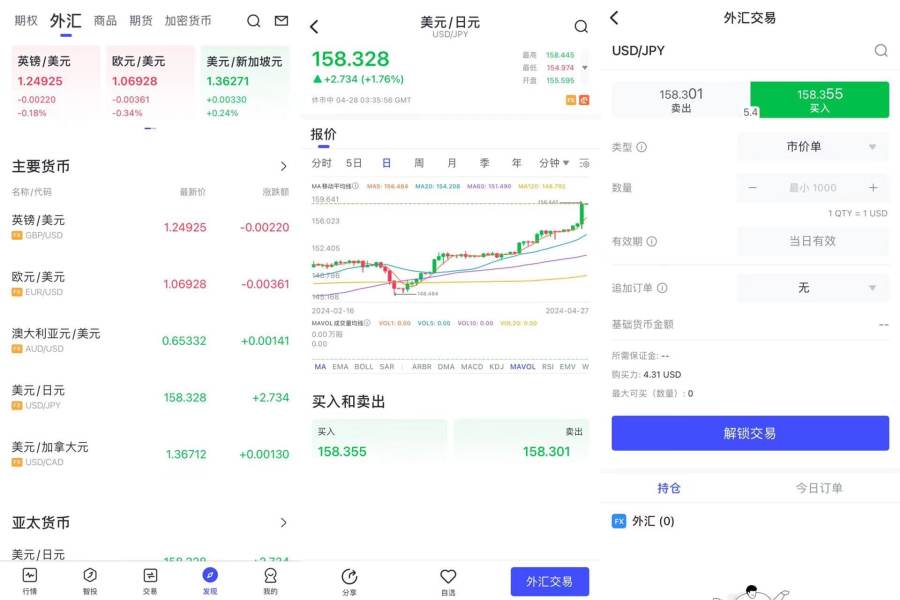

Daiwa offers access to various products, including Domestic stocks, Bonds, US Stocks, Wrap Accounts, Investment trusts, the Current lPo (Initial Public Offering) Stock Schedule, the Current Po (public offering/sale of shares) handling schedule list, NISA, and more.

Deposit and Withdrawal

Customers can deposit and withdraw money through Daiwa Next Bank (DaiwaTwin account), bank transfers, online transactions, and affiliated ATM (Yamato Card).

Keywords

- 15-20 years

- Regulated in Japan

- Retail Forex License

- Medium potential risk

Review 6

Content you want to comment

Please enter...

Review 6

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

我行

Hong Kong

The customer service is out of contact

Exposure

2020-12-15

孙东方

Hong Kong

Wide range of financial products and services are offered without any minimum deposit amount requirement, you can invest any amount as you want. But they end here..the trading condition is not transparent enough! The broker says that it does charge some commissions for forex trading, but not specified. They also don’t bother to refer anything about the leverage..

Neutral

2022-11-18

刘家

Hong Kong

A long-established broker providing diversified range of prodcuts and servcies, average customer support for if you have any inquiries, no online support team available......

Neutral

2022-11-15

FX1732221901

Argentina

I have been using Daiwa since 2020 and have no reason to change to another broker. Customer service has been excellent, and depositing and withdrawing funds is a breeze - never had issues. I will remain with them as long as they continue to provide excellent trading conditions for their users.

Positive

2024-08-26

AA资治通鉴

Morocco

The company is older than me, so I thought it must be a good company to last this long. After 2 months of experience, I think their general trading conditions are very good, like free deposit and withdrawal, no minimum deposit requirement, and various instruments available.

Positive

2022-11-22

Miguel Pinesela

Hong Kong

GOOD👍!

Positive

2022-11-16