Score

GCG ASIA

Switzerland|5-10 years|

Switzerland|5-10 years| https://www.guardiancapitalag.asia/

Website

Rating Index

Influence

Influence

C

Influence index NO.1

Taiwan 4.64

Taiwan 4.64Contact

Licenses

Licenses

Licensed Institution:GCG ASIA PTY LTD

License No.:631970726

Single Core

1G

40G

1M*ADSL

- This broker has been verified to be illegal and all of its licences have expired, and it has been listed in WikiFX's Scam Brokers list. Please be aware of the risk!

Basic information

Switzerland

SwitzerlandUsers who viewed GCG ASIA also viewed..

Neex

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

AUS GLOBAL

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

Decode Global

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

VT Markets

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Company Summary

| Aspect | Information |

| Registered Country/Area | China |

| Founded Year | 2-5 years ago |

| Company Name | Guardian Capital AG |

| Regulation | Regulated in Australia (license revoked) |

| Minimum Deposit | Not disclosed (advised to avoid due to revoked licenses) |

| Maximum Leverage | 1:100 |

| Minimum Trade | 0.01 lots |

| Spreads | Low spreads on EUR/USD (0.1 pips) |

| Trading Platforms | Meta Trader 4 (MT4) |

| Tradable Assets | Not specified |

| Account Types | Not specified |

| Customer Support | Email (enquiry@guardiancapitalag.asia) |

| Payment Methods | Bank transfers |

| Educational Tools | Not specified |

Risk Warning

GCG ASIA is just a Ponzi Scheme, which refers to the use of the “principle of value multiplication”. In the form of rolling or static fund circulation, it uses the money of the next member to pay to the present one, which is essentially a pyramid scheme with the distinction of hidden, deceptive and socially harmful.

By calling on the common person's desire for money, fraudsters on the platform begin raising funds underground. Since this kind of platform mostly will abscond after 1 or 2 years, the fund-raising mode just can exist for less than 3 years.

General Information

GCG ASIA, a trading name of Guardian Capital AG, is an online broker, the company behind called Guardian Capital AG, with the founding time and actual address not disclosed to all.

The company's official website is currently down, and it is reported to have engaged in fraudulent practices, such as operating as a Ponzi scheme. The Australia Securities & Investment Commission (ASIC) revoked GCG ASIA's license in 2019, indicating a lack of compliance with regulatory requirements. Additionally, the platform has received numerous complaints from users, including issues with fund withdrawals and suspicions of fraudulent activities. Due to these warnings and risks associated with GCG ASIA, it is strongly advised to avoid this platform.

The specific market instruments offered by GCG ASIA are not clearly stated or accessible without access to their official website. The leverage offered by GCG ASIA is a maximum of 1:100, allowing clients to control larger positions in the market with a smaller amount of capital. The platform claims to offer low spreads on the EUR/USD currency pair, but given the platform's illegitimate status, the reliability of such claims is questionable. The minimum deposit requirement is undisclosed, but it is highly recommended to avoid engaging with an illegal broker like GCG ASIA due to the associated risks. The platform primarily supports deposit and withdrawal methods through bank transfers, and it claims to provide the Meta Trader 4 (MT4) trading platform.

Overall, GCG ASIA has a negative reputation, with multiple warnings from regulatory authorities and numerous complaints from users. It is crucial to prioritize the security and protection of funds by choosing regulated and reputable brokers instead.

Pros and Cons

GCG ASIA, a brokerage platform also known as Guardian Capital AG, is associated with several significant drawbacks and risks. The platform's fraudulent and scam nature leaves no room for any identified pros. On the other hand, there are several cons that highlight the platform's untrustworthiness. GCG ASIA had its license revoked by ASIC and has been flagged as a scam broker. There are suspicions of the platform being involved in a Ponzi scheme, and its regulatory status is abnormal. Transparency regarding market instruments is lacking, and numerous complaints have been filed against the platform. These factors indicate the need for caution and avoidance when considering GCG ASIA as a brokerage option.

| Pros | Cons |

| None identified due to its fraudulent and scam nature | License revoked by ASIC |

| Listed as a scam broker | |

| Suspicion of being involved in a Ponzi scheme | |

| Abnormal regulatory status | |

| Lack of transparency regarding market instruments | |

| Numerous complaints filed against the platform |

Is GCG ASIA Legit?

Based on the information provided, GCG ASIA PTY LTD, the licensed institution mentioned, had its license revoked by the Australia Securities & Investment Commission (ASIC). The license was revoked on February 28, 2019. GCG ASIA PTY LTD is listed as a Common Business Registration and was regulated by Australia.

The information also states that GCG ASIA is a Ponzi scheme, which means it operates by using funds from new investors to pay returns to existing investors. This is a fraudulent practice and is considered a scam. The platform has been listed as an illegal broker and all of its licenses have expired. It has been flagged by WikiFX as a scam broker, and there have been numerous complaints against it in the past three months.

Furthermore, the regulatory status of GCG ASIA with ASIC is abnormal, indicating that it is not in compliance with regulatory requirements. The broker also exceeds the business scope regulated by ASIC. Given these warnings and risks associated with GCG ASIA, it is advised to stay away from this platform.

Market Instruments

It appears that the specific market instruments offered by GCG ASIA are not clearly stated or accessible. Without access to their official website, it is challenging to provide detailed information about the range of instruments available for trading on their platform. It is crucial for a brokerage to clearly outline the instruments it offers, including stocks, currencies, commodities, or other financial products, as this information is essential for potential investors to make informed decisions.

Leverage

GCG ASIA offers a maximum leverage of 1:100. Leverage refers to the ability to control a larger position in the market with a smaller amount of capital. In the case of GCG ASIA, clients are allowed to trade with leverage of up to 100 times their invested capital.

Spreads

GCG ASIA claims to offer low spreads on the currency pair EUR/USD for their standard account type. The typical spread for this pair is stated to be as low as 0.1 pips. Spreads refer to the difference between the buying (ask) price and selling (bid) price of a currency pair, and they represent the cost of trading.

Minimum Deposit

The minimum initial deposit requirement is not disclosed. Since GCG ASIA is an illegal broker, traders should stay away from this broker no matter what the initial deposit amount.

Minimum Trade

The minimum trade requirement of GCG ASIA is 0.01 lots. A lot is a standardized unit in trading, representing a specific quantity of a financial instrument. In this case, GCG ASIA allows traders to execute trades with a minimum size of 0.01 lots.

Deposit & Withdrawal

GCG ASIA, or GuardianCapitalAG.asia, offers a deposit and withdrawal method primarily through bank transfers. This means that users can fund their trading accounts by transferring money from their bank accounts directly to their GCG ASIA account. Bank transfers are a common and widely accepted method for depositing funds into trading platforms, as they provide a secure and reliable way to transfer money. It is important to note that the specific details and processes involved in making deposits and withdrawals through bank transfers may vary, and users should consult the platform's guidelines or contact customer support for precise instructions.

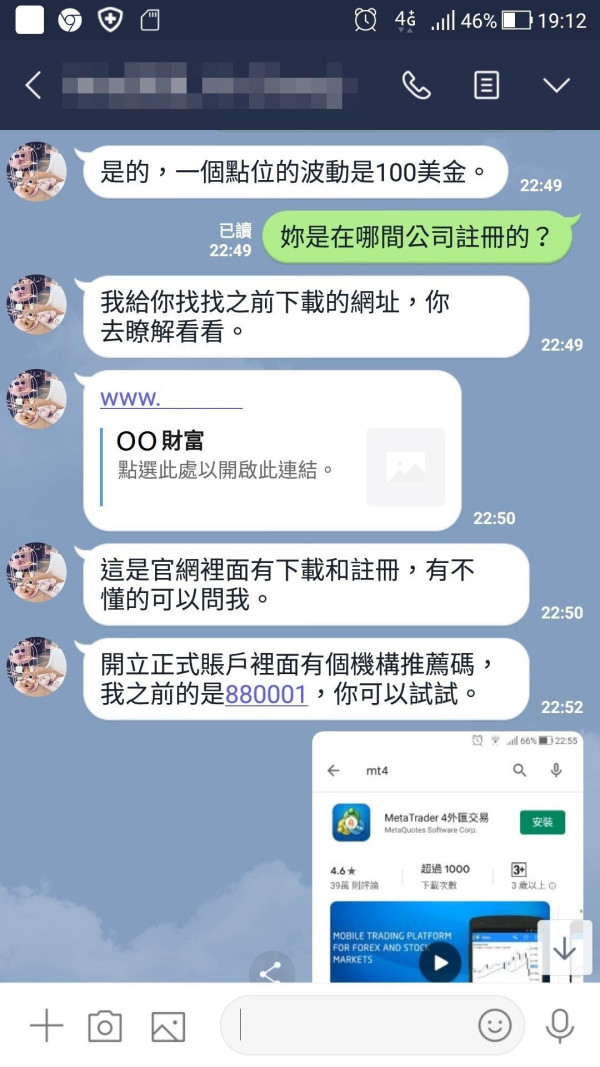

Trading Platforms

GCG ASIA claims to provide the Meta Trader 4 (MT4) trading platform, which is a widely recognized and popular trading platform in the industry. MT4 is known for its user-friendly interface and comprehensive features, making it suitable for both novice and experienced traders. It offers a range of trading tools, including advanced charting capabilities, technical indicators, and automated trading options.

| Pros | Cons |

| Provides the widely recognized and popular Meta Trader 4 (MT4) trading platform | Claims and actual availability of the MT4 platform need verification |

| MT4 is known for its user-friendly interface and comprehensive features, suitable for both novice and experienced traders | Lack of transparency regarding other available trading platforms |

| Offers a range of trading tools, including advanced charting capabilities, technical indicators, and automated trading options | Uncertainty regarding the reliability and stability of the platform |

Customer Support

GCG ASIA provides customer support primarily through email communication. The designated email address for inquiries is enquiry@guardiancapitalag.asia. However, the platform does not disclose additional contact information such as telephone numbers or the company address, which are commonly provided by transparent brokers. This limited mode of contact may raise concerns for customers seeking direct and immediate assistance.

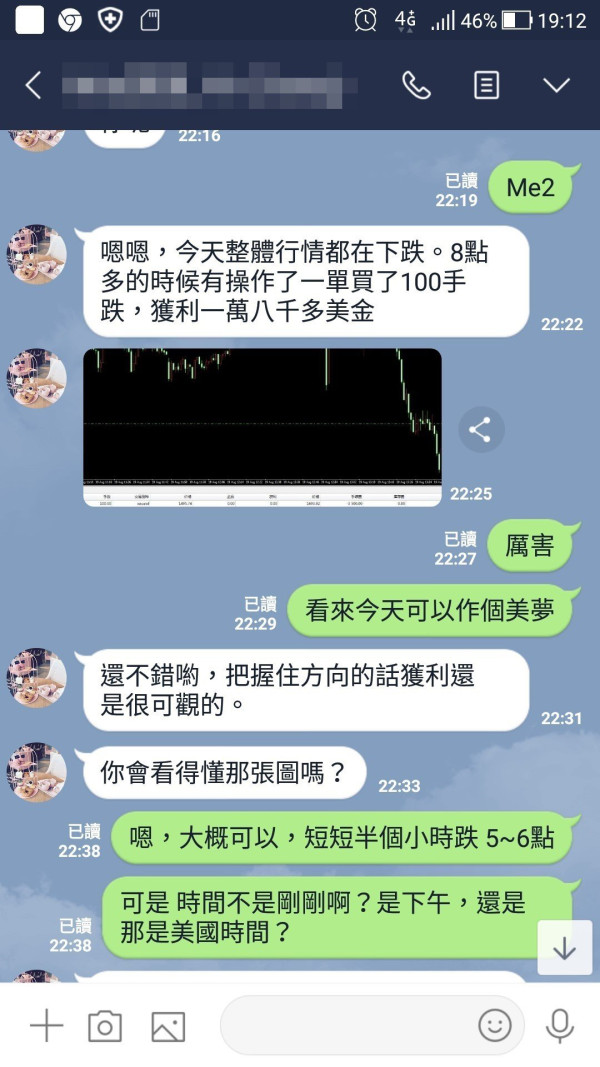

Reviews

According to the reviews on WikiFX, GCG ASIA has received numerous negative comments and complaints from users. Some of the common issues raised include being unable to withdraw funds, being scammed and losing money, and encountering difficulties with the digital banking platform associated with GCG ASIA. Many users reported that the platform would request additional investments or upgrades in order to process withdrawals, leading to suspicions of fraudulent activities. There were also claims of GCG ASIA being involved in a pyramid scheme and the revelation of fraudulent practices by the platform's leaders. Overall, the reviews indicate a high level of dissatisfaction and caution regarding GCG ASIA, with users warning others to stay away from the platform.

Conclusion

In conclusion, GCG ASIA is a platform that has raised several red flags and concerns. The licensed institution associated with GCG ASIA, GCG ASIA PTY LTD, had its license revoked by the Australia Securities & Investment Commission (ASIC). It has been labeled as a Ponzi scheme, operating by using funds from new investors to pay existing investors, which is considered fraudulent. The platform has been listed as an illegal broker, and all of its licenses have expired. Multiple complaints have been filed against GCG ASIA, indicating a lack of trust and satisfaction among users. The regulatory status with ASIC is abnormal, suggesting non-compliance with regulatory requirements. The lack of clarity regarding market instruments and undisclosed minimum deposit requirements further raise concerns. It is strongly advised to avoid engaging with GCG ASIA due to the significant risks associated with this platform.

FAQs

Q: Is GCG ASIA a legitimate broker?

A: No, GCG ASIA is not a legitimate broker. Its license has been revoked, and it has been flagged as a scam broker with numerous complaints.

Q: What market instruments does GCG ASIA offer?

A: The specific market instruments offered by GCG ASIA are not clearly stated or accessible.

Q: What leverage does GCG ASIA provide?

A: GCG ASIA offers a maximum leverage of 1:100.

Q: What are the spreads offered by GCG ASIA?

A: GCG ASIA claims to offer low spreads, as low as 0.1 pips for the EUR/USD currency pair.

Q: What is the minimum deposit for GCG ASIA?

A: The minimum deposit requirement for GCG ASIA is undisclosed, but it is strongly advised to avoid this broker due to revoked licenses and illegal activities.

Q: What is the minimum trade size for GCG ASIA?

A: The minimum trade size for GCG ASIA is 0.01 lots.

Q: How can I deposit and withdraw funds from GCG ASIA?

A: GCG ASIA primarily offers bank transfers as a deposit and withdrawal method. Consult the platform's guidelines or contact customer support for specific instructions.

Q: What trading platform does GCG ASIA provide?

A: GCG ASIA claims to provide the Meta Trader 4 (MT4) trading platform.

Q: How can I contact GCG ASIA customer support?

A: GCG ASIA provides customer support primarily through email communication at enquiry@guardiancapitalag.asia.

Q: What do reviews say about GCG ASIA?

A: Reviews indicate numerous complaints about GCG ASIA, including issues with fund withdrawals, scams, and involvement in fraudulent activities. Users caution against using the platform.

Keywords

- Scam Brokers

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- Australia Common Business Registration Revoked

- Suspicious Overrun

- High potential risk

News

News 'Datuk' among 10 individuals arrested over bogus forex investment scheme

The police arrested 10 individuals, including a man carrying the title "Datuk", for their suspected involvement in fraudulent forex investment schemes in five states on Saturday (Jan 1).

2022-01-06 11:59

News Cops bust forex scam syndicate, seize RM127mil worth of watches and gold

A Datuk is among 10 arrested for alleged links to a Forex investment scam involving losses of at least RM2.94mil.

2022-01-06 10:36

Review 89

Content you want to comment

Please enter...

Review 89

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

FX1013954989

Taiwan

I was cheated by the scammer and lost my money.

Exposure

2021-09-30

明明就19912

Hong Kong

A lot of scams here. Keep asking u to invest. You need to pay for your upgrade if u wanna withdraw funds!

Exposure

2021-03-22

FX1034001553

Hong Kong

I was cheated into investing over 50,000 RMB, which could not be withdrawn. What can I do to get my money back?

Exposure

2021-02-13

FX3429668275

Hong Kong

Chen Wei, GCG’s behind-the-scenes boss, the others are all on the platform. Chen Wei was filed and pursued because of the Wanwei coin fraud. This person has long organized a fraud platform in Malaysia to defraud Chinese investors.

Exposure

2021-01-27

FX3486079607

Hong Kong

Can't withdraw funds since October 20. Besides, our withdrawals are transferred back to other wallets in the account, infriging investors' rights.

Exposure

2020-12-02

心飞扬

Hong Kong

The GIB digital bank is all fake. Withdrawals open only 5 months have been opened in the past two years. Around the month, the others are not withdrawing money for various reasons, and the principal cannot be withdrawn at all! Those who make money are the bosses, such as Xiaokai, Huang Jianqiu (Principal Huang). At present, the two leaders have successfully cashed out! At the end of the year, all the upper-levels are preparing to divide money to prevent investors from withdrawing. At present, all the withdrawal channels are closed. If you want to withdraw, you must invest more money. It is raised at about 10% per month, and then it is raised in January and February to find a reason to withdraw. If you want to withdraw cash, you must invest again!

Exposure

2020-11-17

王利92363

Hong Kong

GCG ASIA asked members to invest $500 to register digital bank. Now there are many problems with the digital bank. You can't withdraw.

Exposure

2020-11-15

徐登护

Hong Kong

Is GCG ASIA existing now? Can’t withdraw in digital bank, either.

Exposure

2020-10-29

和和气气

Hong Kong

The pyramid scheme by GCG, the former name of GIB, is revealed as follows: 1.GCG, which started its operation at the end of December 2018, began to block investor withdrawals on a large scale from April 2019. 2. Mr. Qiu, head of GCG, was arrested by the Cambodian police in May 2019. Later, a so-called GCG general manager Mr. Zheng launched 5-5 or 6-4 orders, inflicting heavy losses on a large number of members! 3. Before absconding, GCG promised members that the withdrawal problem will be fixed if they invest US$500 to register for the GIB Digital Bank. However, the investors were still unable to withdraw money. The registration fee later increased to US$1,000. 4. GCG rebranded itself to GIB (Global Investment Bank) after it scammed 50% of GCG members’ deposits and plotted to scam the rest in the next three years. 5. Moreover, 90% of the profits in GCG members’ accounts in the past year or so were swindled with the remaining 10% left to continue their scam. 6. Currently, GIB continues to publicize its fraudulent money-raising scheme in the hope of joining the Fortune Global 500 companies!

Exposure

2020-10-01

和和气气

Hong Kong

1.GCG ASIA was opened at the end of December, 2018. And 111 gave no access to withdrawal since April, 2019. 2.Fuhao Qiu was arrested by Cambodian police in May, 2019. The so-called president Zheng cheated a lot of money by consignment business 3.GCG ASIA promised that the withdrawal problem can be solved after depositing $500 to register GIB digital bank before it absconded. In fact, the users still can’t withdraw and swindle members out of $500 instead. 4.111 was renamed GIB and pocked half of its members’ money, releasing the half money within three years. 5.90% profits of members were stolen by GCG ASIA 6.Now GCG ASIA still ballyhoos its fraud programs. The way GCG ASIA cheated can rank top 500 in the world!

Exposure

2020-09-19

和和气气

Hong Kong

1.111 was opened at the end of December, 2018. And GCG ASIA gave no access to withdrawal since April, 2019. 2.Fuhao Qiu was arrested by Cambodian police in May, 2019. The so-called president Zheng cheated a lot of money by consignment business 3.GCG ASIA promised that the withdrawal problem can be solved after depositing $500 to register GIB digital bank before it absconded. In fact, the users still can’t withdraw and swindle members out of $500 instead. 4.GCG ASIA was renamed GIB and pocked half of its members’ money, releasing the half money within three years. 5.90% profits of members were stolen by GCG ASIA 6.Now 111 still ballyhoos its fraud programs. The way GCG ASIA cheated can rank top 500 in the world!

Exposure

2020-09-18

俊儿47812

Hong Kong

I deposited in April, 2019 and I can’t withdraw. It’s said that something happened to the boss! I met another leader in September, 2020 and asked me to open an account of digital banking to withdraw! I deposited 50,000! He told me that if I paid $1,500 for an account of digital banking I can withdraw all the money and my account balance was over 600,000 now. It feels fake!

Exposure

2020-09-16

浅景深深

Hong Kong

Unable to withdraw. It's said all the funds were transferred to GIB digital bank. Scam!

Exposure

2020-09-05

和和气气

Hong Kong

After scamming me of $500, GCG ASIA absconded.

Exposure

2020-08-20

心飞扬

Hong Kong

It is simply a fraud. The rich Qiu has absconded with clients’ money. The unleash of the fund needs 3 years. It is a rip-off.

Exposure

2020-07-25

Eleven years

Hong Kong

GCG ASIA claimed to solve the withdrawal problem as long as the digital bank was established. But now it has absconded. It still has 3 years to go before the withdrawal is available. I just want to take my fund back. But I am required to add fund.

Exposure

2020-07-22

一个哥

Hong Kong

After the digital bank was set up, GCG ASIA absconded. The withdrawal process needs 3 years. Does the bank still exist?

Exposure

2020-07-22

陆昇-专业祛斑祛痘祛痣

Hong Kong

It is definitely a fraud. It established the so-called digital bank, only to covet your fund. After that, another bait is waiting for you.

Exposure

2020-07-19

FX2694527972

Hong Kong

It is a fraud. Stay away.

Exposure

2020-07-19

㏑£

Hong Kong

GCG ASIA always holds off the the withdrawal. Now it claims to cooperate with GIB to establish a digital bank. Actually, those videos are shot in advance.

Exposure

2020-07-19