简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

KVB Market Analysis | 31 July: USD/JPY Holds Near 152.50 as Markets Eye BoJ and Fed Decisions

Abstract:The USD/JPY pair hovers around 152.50, just above a three-month low, as traders anticipate the Bank of Japan's policy decision, expecting a 10-basis-point rate hike and bond-buying tapering, which supports the Yen. A slight recovery in the US Dollar has paused the pair's rise, with the Dollar Index near 104.50 ahead of the Federal Reserve's meeting, where rates are expected to stay unchanged but with dovish guidance.

Product: XAU/USD

Prediction: Increase

Fundamental Analysis:

Gold price is consolidating its previous day's strong gains, holding above the $2,400 mark during the Asian session on Wednesday. Traders are waiting for more cues about the Fed's policy path before making a directional move, with the focus on the upcoming FOMC meeting outcome.

Gold struggled to regain the $2,400 mark on Tuesday, trading just below the threshold as the market assesses news from the US, including the JOLTS report and the rise in the Consumer Confidence Index.

The focus remains on upcoming central bank decisions, with the Bank of Japan potentially discussing raising rates and reducing government bond purchases. Investors are also hoping the Fed will provide clues on a potential September rate cut.

Technical Analysis:

From a technical perspective, the bearish potential for gold (XAU/USD) appears limited. In the daily chart, the pair is trading just below a still bullish 20-day moving average, while the longer-term moving averages maintain an upward slope well below the current level. Technical indicators remain neutral, with the metal confined to a tight range for the second consecutive day.

In the near term, the 4-hour chart shows a neutral-to-bullish outlook. The pair is trading just above the 50% Fibonacci retracement of the June/July rally at $2,388.25, while still contained between directionless moving averages. However, the technical indicators have picked up modestly within positive levels, suggesting a potential upside bias.

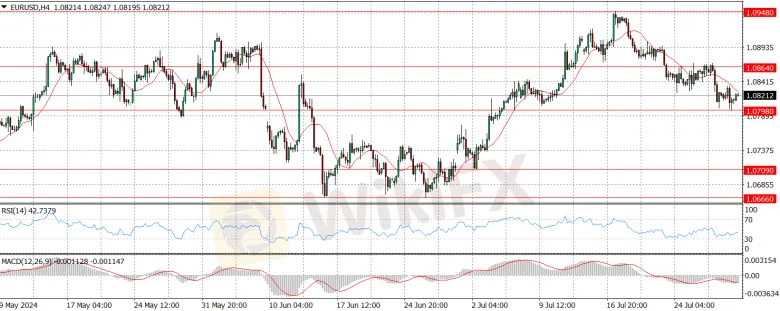

Product: EUR/USD

Prediction: Decrease

Fundamental Analysis:

The EUR/USD pair is consolidating its losses around 1.0815 during the early Asian session, amid risk-aversion and weaker-than-expected preliminary Q2 GDP from Germany. The pair charted modest losses on Tuesday, building on the prior session's pullback, as investors remain cautious ahead of the upcoming Federal Reserve decision.

The US dollar was unable to sustain its early gains, particularly in response to the Japanese yen's rebound after speculation that the Bank of Japan may signal further policy tightening. Yields on both US and German bonds declined as investors anticipate rate cuts from the Fed and ECB.

On the data front, Germany's flash inflation rose more than expected, while its GDP unexpectedly contracted. The broader Eurozone GDP growth, however, came in above estimates.

Technical Analysis:

On the downside, the EUR/USD pair's next targets are the weekly low of 1.0798, the 100-day moving average at 1.0794, the June low of 1.0666, and the May low of 1.0649.

On the upside, the initial resistance is the July high of 1.0948, followed by the March top of 1.0981 and the critical 1.1000 level.

The pair's bearish bias is likely to return if it remains below the 200-day moving average at 1.0821. The four-hour chart shows some acceleration in the negative bias, with support at 1.0864, 1.0798, and 1.0709. The RSI has rebounded to around 40.

Product:USD/JPY

Prediction: Decrease

Fundamental Analysis:

The USD/JPY pair oscillates near 152.50, above a recent three-month low, as traders await the crucial Bank of Japan (BoJ) policy decision. The markets are discounting a greater chance of a rate hike, which is supporting the Japanese Yen (JPY) and acting as a headwind for the currency pair.

Going forward, investors will focus on the BoJ meeting, where policymakers are expected to hike rates by 10 basis points and announce plans to taper bond-buying operations, further boosting the Yen's appeal.

Meanwhile, a slight recovery in the US Dollar has temporarily halted the major's upside. The US Dollar Index moves higher to near 104.50 as investors turn cautious ahead of the Federal Reserve's policy meeting, where officials are expected to leave rates unchanged but maintain a dovish interest rate guidance.

Technical Analysis:

The USD/JPY pair is trading within a tight range, holding above the crucial support of 156.00 on Monday's European session. Investors are focused on the upcoming interest rate decisions by the Bank of Japan (BoJ) and the Federal Reserve (Fed), scheduled for Wednesday.

The BoJ is expected to raise interest rates, which could support the Japanese Yen and act as a headwind for the USD/JPY pair. Meanwhile, the Fed is anticipated to leave rates unchanged but provide guidance on future monetary policy, which will be closely monitored by the markets.

Traders are adopting a cautious stance, waiting for the outcomes of these key central bank meetings before making any significant moves in the USD/JPY pair.

Product: GBP/USD

Prediction: Decrease

Fundamental Analysis:

The GBP/USD pair is trading defensively near 1.2840 during early Asian hours on Wednesday, as investors remain cautious ahead of the Federal Reserve's interest rate decision on the same day, followed by the Bank of England's policy meeting on Thursday.

The pair touched a nearly three-week low below 1.2810 earlier this week but has since retraced some of the losses, though the technical outlook is yet to point to an extended recovery.

Investors seem reluctant to take any major positions in the GBP/USD pair ahead of the central bank announcements. The upcoming US economic data, like the Consumer Confidence Index and JOLTS Job Openings, could also impact the pair's movements.

Technical Analysis:

The GBP/USD pair is trading slightly below a descending trend line, currently located at 1.2860. The Relative Strength Index (RSI) on the 4-hour chart also remains slightly below 50, indicating a lack of buyer interest.

On the downside, the pair faces interim support at 1.2830 (50% Fibonacci retracement), followed by 1.2800-1.2790 (psychological level and 200-period SMA) and 1.2750 (static level).

If the GBP/USD clears the 1.2860 level and stabilizes above it, the next resistance could be at 1.2880 (38.2% Fibonacci retracement) and then 1.2900 (100-period SMA).

The overall technical picture suggests a consolidation phase, with buyers and sellers lacking clear direction at the moment.

Market Analysis Disclaimer:

The market analysis provided by KVB Prime Limited is for informational purposes only and should not be construed as investment advice or a recommendation to buy or sell any financial instrument. Trading forex and other financial markets involves significant risk, and past performance is not indicative of future results.

KVB Prime Limited does not guarantee the accuracy, completeness, or timeliness of the information provided in the market analysis. The content is subject to change without notice and may not always reflect the most current market developments or conditions.

Clients and readers are solely responsible for their own investment decisions and should seek independent financial advice from qualified professionals before making any trading or investment decisions. KVB Prime Limited shall not be liable for any losses, damages, or other liabilities arising from the use of or reliance on the market analysis provided.

By accessing or using the market analysis provided by KVB Prime Limited, clients and readers acknowledge and agree to the terms of this disclaimer.

RISK WARNING IN TRADING

Transactions via margin involve products that use leverage mechanisms, carry high risks, and are certainly not suitable for all investors. THERE IS NO GUARANTEE OF PROFIT on your investment, so be wary of those who guarantee profits in trading. You are advised not to use funds if you are not prepared to incur losses. Before deciding to trade, ensure that you understand the risks involved and also consider your experience.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Exness Lowers XAUUSD Spreads by 10% for Better Gold Trading

Exness reduces XAUUSD spreads by 10%, offering professional traders, investors, and analysts improved gold trading conditions with lower costs and better reliability.

KVB Market Analysis | 30 August: JPY Strengthens Against USD Amid Strong Q2 GDP and BoJ Rate Hike Speculation

The Japanese Yen (JPY) strengthened against the US Dollar (USD) on Thursday, boosted by stronger-than-expected Q2 GDP growth in Japan, raising hopes for a BoJ rate hike. Despite this, the USD/JPY pair found support from higher US Treasury yields, though gains may be capped by expectations of a Fed rate cut in September.

KVB Market Analysis | 29 August: Gold Price Recovers as Market Eyes US Rate Cuts and Geopolitical Tensions

Gold prices (XAU/USD) rebounded on Thursday after dipping below $2,500 per ounce. Expectations of US interest rate cuts and ongoing political and geopolitical tensions are boosting demand for gold, as lower rates reduce the opportunity cost of holding the non-yielding metal.

KVB Market Analysis | 28 August: Yen Strengthens on BoJ Rate Hike Hints; USD/JPY Faces Uncertainty

The Japanese Yen rose 0.7% against the US Dollar after BoJ Governor Kazuo Ueda hinted at potential rate hikes. This coincided with a recovery in Asian markets, aided by stronger Chinese stocks. With the July FOMC minutes already pointing to a September rate cut, the US Dollar might edge higher into the weekend.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

Top 10 Trading Indicators Every Forex Trader Should Know

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

YAMARKETS' Jingle Bells Christmas Offer!

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

Currency Calculator