Score

VC GROUP

Hong Kong|5-10 years|

Hong Kong|5-10 years| http://www.vcgroup.com.hk/Module/portal/zL2-6_en-US.aspx

Website

Rating Index

Contact

Licenses

Licenses

Licensed Institution:VC Futures Limited

License No.:ADK142

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Hong Kong

Hong KongUsers who viewed VC GROUP also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

EC Markets

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

AUS GLOBAL

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

Website

vcgroup.com.hk

Server Location

Hong Kong

Website Domain Name

vcgroup.com.hk

Website

WHOIS.HKIRC.HK

Company

-

Server IP

218.255.5.66

Company Summary

| VC GROUP Review Summary | |

| Founded | 1986 |

| Registered Country/Region | Hong Kong |

| Regulation | SFC (Revoked) |

| Products & Services | Securities trading, corporate finance and asset management |

| Demo Account | Unavailable |

| Trading Platforms | N/A |

| Minimum Deposit | N/A |

| Customer Support | Phone, fax and email |

What is VC GROUP?

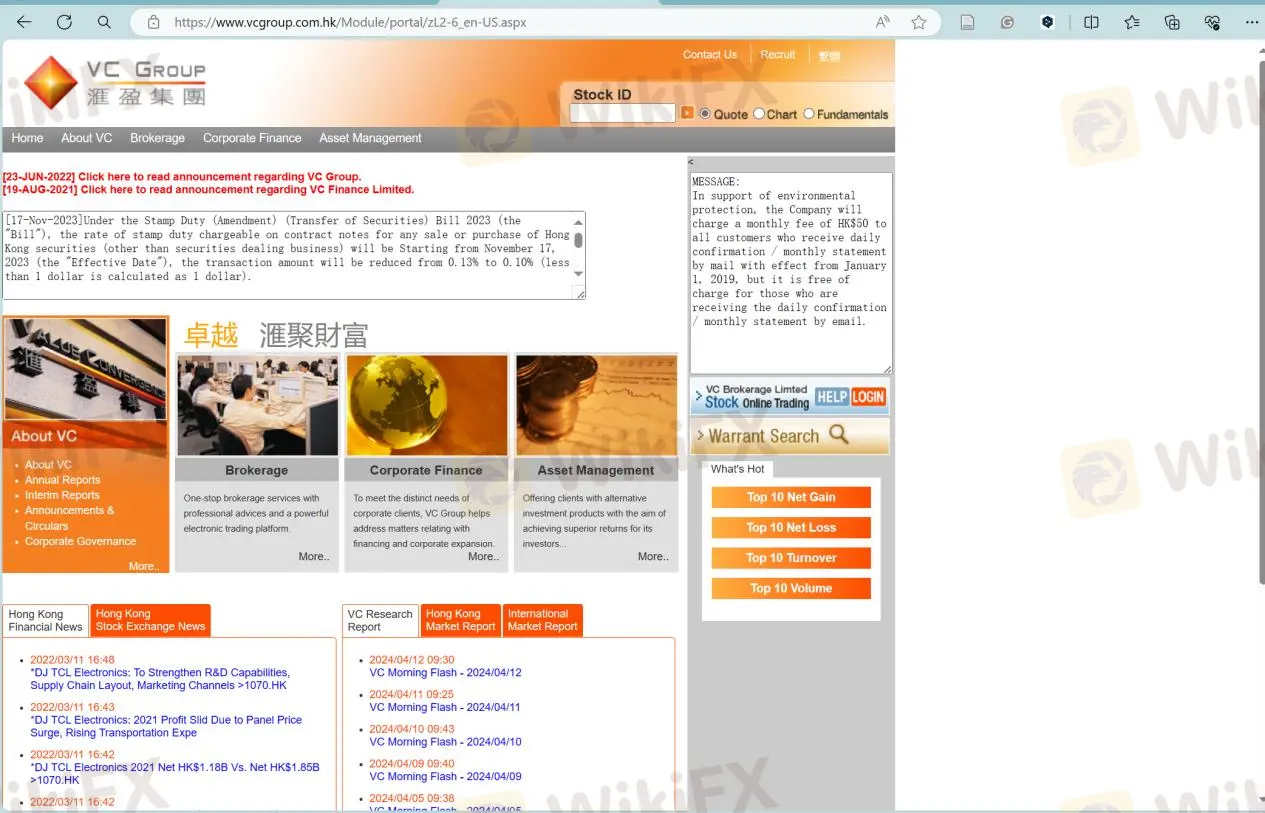

VC GROUP, established in 1986 and headquartered in Hong Kong, falls under the regulatory oversight of SFC, although its regulatory status is currently marked as revoked. Despite this, VC GROUP continues to offer a variety of financial services, including securities trading, corporate finance, and asset management.Clients can access customer support via phone, fax, and email.

If you are interested, we invite you to continue reading the upcoming article where we will thoroughly assess the broker from various angles and present you with well-organized and succinct information. By the end of the article, we will provide a concise summary to give you a comprehensive overview of the broker's key characteristics.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

Pros:

- Established Reputation: VC GROUP has been operating since 1986, indicating a long-standing presence in the financial services industry, which may instill confidence in clients.

- Diverse Financial Services: The company offers a range of financial services, including securities trading, corporate finance, and asset management, catering to various client needs and preferences.

Cons:

- SFC (Revoked): The fact that VC GROUP's regulatory status is marked as revoked raises significant concerns about its compliance and operational practices, potentially eroding trust among clients.

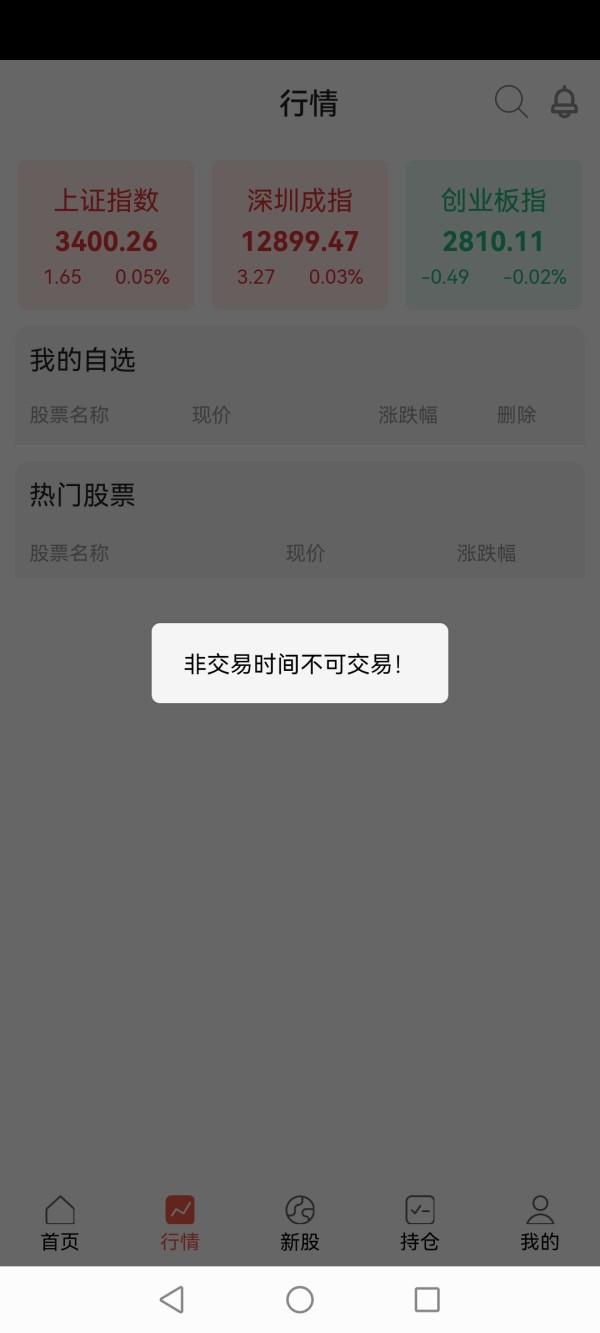

- Issues with Withdrawals: Recent reports indicate problems with withdrawals on VC GROUP's platform, suggesting potential operational inefficiencies or liquidity issues that could negatively impact clients' access to their funds and overall satisfaction with the service.

- Unclear Trading Conditions: Lack of clarity regarding trading accounts, funding methods, and the trading platform can lead to confusion and frustration among clients, hindering their trading experience and decision-making process.

Is VC GROUP Legit or a Scam?

The Securities and Futures Commission (SFC) in Hong Kong, China, with a license specifically for dealing in futures contracts under the number ADK142, currently faces an unusual regulatory situation, as its official regulatory status has been revoked. This indicates significant regulatory concerns impacting its operations, leading to the withdrawal of its official standing.

Products & Services

VC GROUP offers a comprehensive suite of financial services tailored to meet the diverse needs of its clients:

- Securities Trading: VC Futures facilitates the trading of both local and overseas securities, providing investors with access to a wide range of investment opportunities. They also offer margin financing to leverage investments, placing and sub-underwriting services, securities research, securities lending, and trading of futures, options, derivatives, and structured products.

- Corporate Finance: The Corporate Finance Department specializes in providing financial services related to corporate finance and business expansion. This includes mergers and acquisitions (M&A), corporate restructuring, and advisory services.

- Asset Management: The Asset Management Department of VC Group offers a range of alternative investment products to investors.

Fees & Commissions

VC GROUP offers a range of financial services, each associated with specific fees catering to the diverse needs of its clients.

For securities trading in the Hong Kong market, clients can expect various charges. These include commission fees, which are a minimum of 0.25% of the gross transaction value (with a minimum of HK$100), a contract stamp duty of 0.1% (rounded up to the nearest dollar), a transaction levy of 0.0027% of the gross transaction value, a trading fee of 0.00565% of the gross transaction value, and a clearing fee of 0.002% (with a minimum of HK$2 and a maximum of HK$100).

| Fee Type | Charge |

| Commission | Minimum 0.25% of gross transaction value (Min. HK$100) |

| Contract Stamp | 0.1% of gross transaction value (rounded up) |

| Transaction Levy | 0.0027% of gross transaction value |

| Trading Fee | 0.00565% of gross transaction value |

| Clearing Fee | 0.002% of gross transaction value (Min. HK$2, Max. HK$100) |

Additionally, there are fees related to banking and cash handling. For instance, telegraphic transfers incur a charge of HK$100 for local transactions and HK$250 for overseas transactions, while returned cheques carry a fee of HK$100 per cheque. Stock-related services like stock withdrawals or deliveries also involve specific charges, such as HK$100 per counter for stock withdrawals and HK$5.00 per transfer deed for physical stock deposits.

| Fee Type | Charge |

| Telegraphic Transfers (Local) | HK$100 per transaction |

| Telegraphic Transfers (Overseas) | HK$250 per transaction |

| Returned Cheques | HK$100 per cheque |

| Stock Withdrawals | HK$100 per counter |

| Physical Stock Deposits | HK$5.00 per transfer deed |

Custodial services provided by VC GROUP, including monthly CCASS charges and dividend collection, also have associated fees. For instance, custody is generally free of charge, but there's a handling charge of HK$0.012 per board or odd lot. Dividend collection incurs a 0.5% charge on the gross dividend amount (with a minimum of HK$10 and a maximum of HK$10,000) and a HK$1.50 fee per board or odd lot.

Other services, such as IPO applications, CCASS sub-account fees, and reprinting of statements, come with their own respective charges. For instance, IPO applications cost HK$50 for cash applications and HK$100 for financing applications. Additionally, there's a HK$50 monthly fee for CCASS sub-accounts and a HK$30 charge for reprints of previous monthly statements.

| Fee Type | Charge |

| Custody Handling | HK$0.012 per board or odd lot |

| Dividend Collection | 0.5% of gross dividend amount (Min. HK$10, Max. HK$10,000)HK$1.50 per board or odd lot |

| IPO Applications | HK$50 for cash applicationsHK$100 for financing applications |

| CCASS Sub-Account Fees | HK$50 monthly fee |

| Statement Reprints | HK$30 per reprint of previous monthly statement |

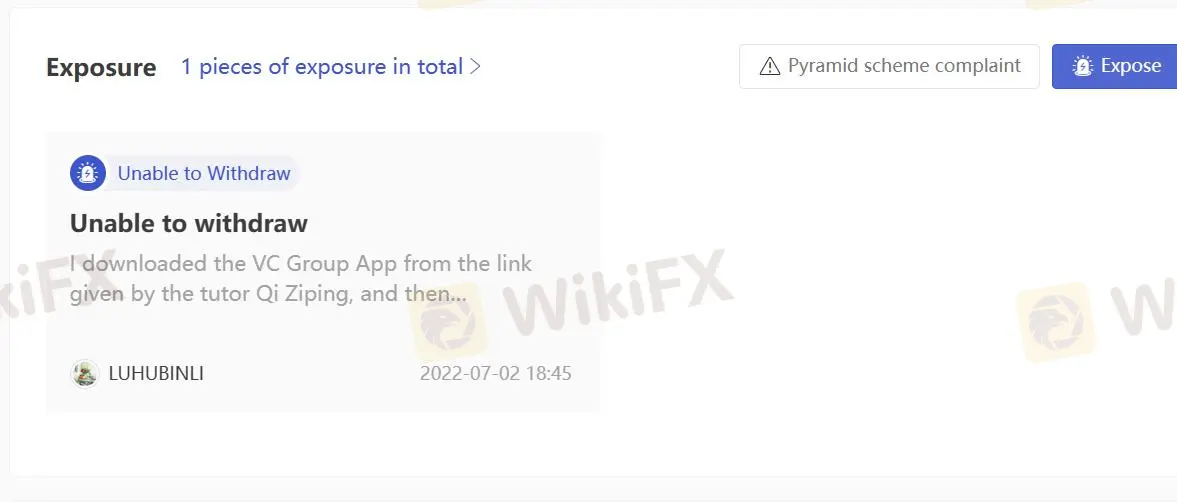

User Exposure on WikiFX

On our website, you can see a report of unable to withdraw. Traders are encouraged to carefully review the available information and consider the risks associated with trading on an unregulated platform. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Customer Service

Customers can visit their office or get in touch with customer service line using the information provided below:

Telephone: (852) 2101-8163

Fax: (852) 2913-6373

E-mail: info@vcgroup.com.hk

Address: 6th Floor, Centre Point, 181 – 185 Gloucester Road, Wanchai, Hong Kong

Conclusion

In conclusion, VC GROUP presents a complex situation with both positive and negative aspects. Its long-standing presence in the financial industry and diverse range of services can appeal to clients seeking comprehensive financial solutions. However, the company's revoked regulatory status, issues with withdrawals, and lack of clarity regarding trading conditions raise significant concerns about its reliability and transparency.

Frequently Asked Questions (FAQs)

| Question 1: | Is VC GROUP regulated by any financial authority? |

| Answer 1: | No. It has been verified that this broker currently has no valid regulation. |

| Question 2: | How can I contact the customer support team at VC GROUP? |

| Answer 2: | You can contact via telephone: (852) 2101-8163, fax: (852) 2913-6373 and e-mail: info@vcgroup.com.hk. |

| Question 3: | Does VC GROUP offer demo accounts? |

| Answer 3: | No. |

| Question 4: | What services and products VC GROUP provides? |

| Answer 4: | It provides securities trading, corporate finance and asset management. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- Hong Kong Dealing in futures contracts Revoked

- High potential risk

Review 2

Content you want to comment

Please enter...

Review 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now