简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Apex Legal Limited Losses License

Abstract:Apex Legal Limited's recent license revocation by the UK's Financial Conduct Authority (FCA) on January 5, 2024, unveils regulatory concerns over the firm's lack of engagement in authorized activities, reflecting broader shifts in the FCA's approach towards ensuring active compliance in the financial sector.

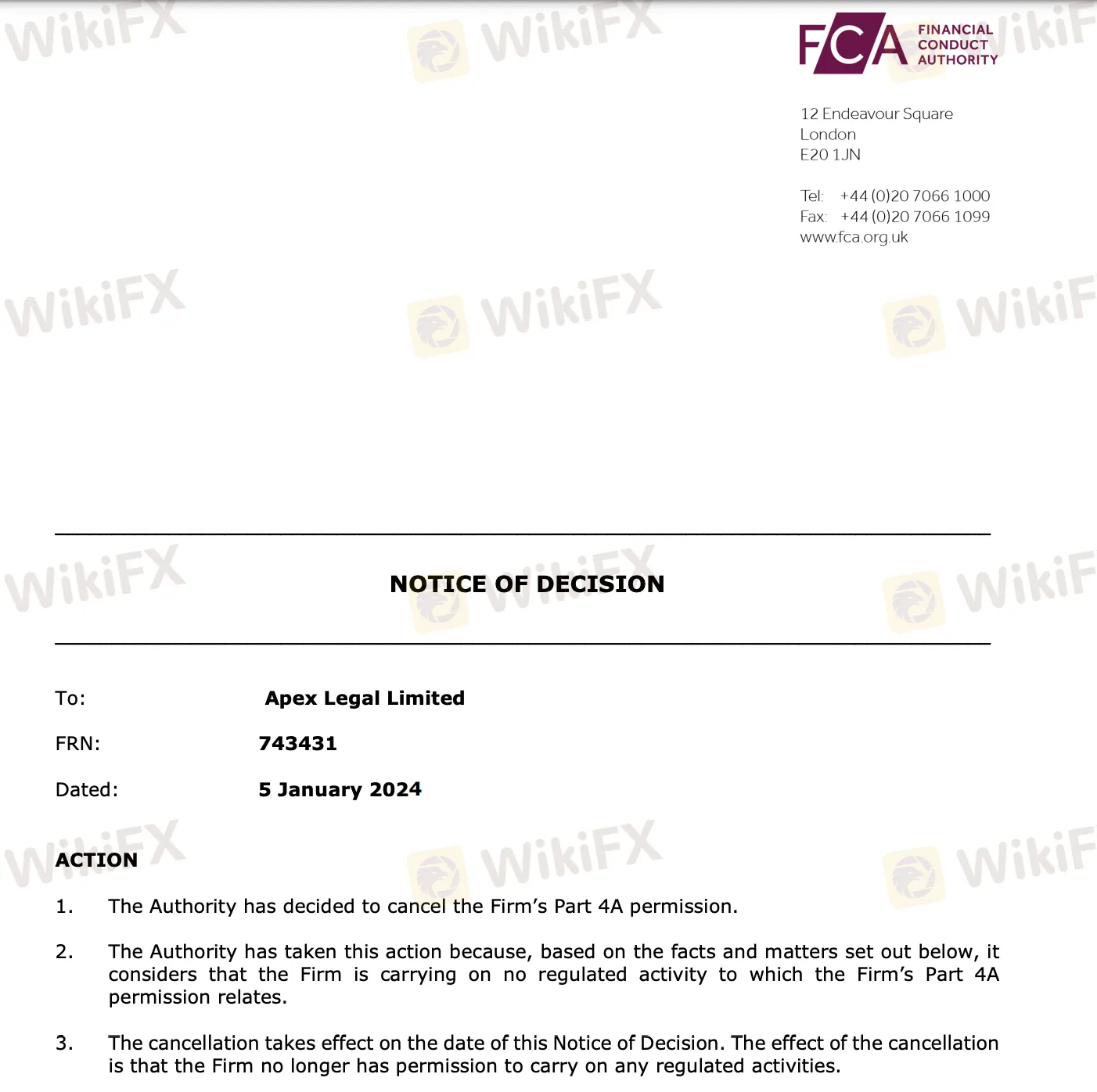

The UK's Financial Conduct Authority (FCA) officially revoked Apex Legal Limited's Part 4A permission, effective January 5, 2024, as the Authority observed the firm's lack of engagement in any regulated activities covered by its Part 4A permission.

Apex Legal obtained FCA authorization on September 1, 2016, enabling specific regulated activities such as arranging investments, assisting in insurance contracts, acting as an agent in investments, organizing transactions in investments, and agreeing to regulated activity.

The FCA issued two notices to Apex Legal, expressing concerns about the firm's non-engagement in regulated activities aligned with its Part 4A permission and proposed cancellation. Despite these notices, Apex Legal did not take the required specified actions.

Information obtained from FCAs official website: https://www.fca.org.uk/publication/decision-notices/apex-legal-limited-2024.pdf

Consequently, the FCA decided to cancel Apex Legal's Part 4A permission. This decision aligns with the FCA's recent efforts to protect consumers by rescinding unused financial licenses across the UK. The regulatory changes empower the FCA to cancel licenses within 28 days, a significant shift from the previous 12-month timeline. This approach aims to ensure active participation in regulated activities by licensed firms, emphasizing the risk of losing licenses for non-compliance.

The FCA emphasizes that dormant licenses could mislead consumers, citing cases where firms with inactive licenses attracted investors to unregulated products, resulting in substantial financial losses. Recent data shows that in 2023, the regulator revoked licenses from 1,266 firms for failing to meet minimum authorization standards, indicating a doubled firm cancellation rate compared to the previous year.

In a landscape where financial regulations and firm compliance are crucial, staying informed is essential. To remain up-to-date with broker-related developments like this, leveraging the free WikiFX mobile application and official website is your best option. WikiFX serves as the ultimate destination for all broker-related inquiries and information. By downloading the app or visiting our official website, users gain access to comprehensive and real-time updates, making WikiFX your indispensable tool to navigate the dynamic world of brokers with confidence and clarity. Stay informed, stay empowered with WikiFX!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Why is there so much exposure against PrimeX Capital?

In recent months, PrimeX Capital, a Forex and CFD broker established in 2022, has become a subject of concern in the trading community. However, despite these enticing features, the broker's reputation has been severely tarnished by multiple complaints and a troubling lack of regulatory oversight.

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Forex broker scams continue to evolve, employing new tactics to appear credible and mislead unsuspecting traders. Identifying these fraudulent schemes requires vigilance and strategies beyond the usual advice. Here are five effective methods to help traders assess the legitimacy of a forex broker and avoid potential pitfalls.

Doo Financial Obtains Licenses in BVI and Cayman Islands

Doo Financial, a subsidiary of Singapore-based Doo Group, has expanded its regulatory footprint by securing new offshore licenses from the British Virgin Islands Financial Services Commission (BVI FSC) and the Cayman Islands Monetary Authority (CIMA).

CFI’s New Initiative Aims to Promote Transparency in Trading

A new programme has been launched by CFI to address the growing need for transparency and awareness in online trading. Named “Trading Transparency+: Empowering Awareness and Clarity in Trading,” the initiative seeks to combat misinformation and equip individuals with resources to evaluate whether trading aligns with their financial goals and circumstances.

WikiFX Broker

Latest News

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

YAMARKETS' Jingle Bells Christmas Offer!

Why is there so much exposure against PrimeX Capital?

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

MTrading’s 2025 "Welcome Bonus" is Here

Doo Financial Obtains Licenses in BVI and Cayman Islands

CFI’s New Initiative Aims to Promote Transparency in Trading

Currency Calculator