简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Understanding Forex Trading Signals

Abstract:Gain a comprehensive understanding of Forex trading signals and their role in the foreign exchange market. Learn how to use signals effectively and find the right broker with the help of the WikiFX App. Download now to stay updated on the latest news and ensure safe trading.

Introduction

In the fast-paced world of foreign exchange (Forex) trading, staying informed and making timely decisions is crucial. Forex trading signals are critical in assisting traders in identifying prospective chances to purchase or sell currency pairs. This article seeks to offer a thorough explanation of Forex trading signals, including what they are, how they function, who produces them, their dependability, and how they may be used efficiently. Additionally, we will explore the main functions of the WikiFX App and its role in finding the right broker while ensuring safety and preventing scams.

What are Forex Trading Signals?

Forex trading signals are indications or recommendations that traders use to decide when to enter or leave transactions. These signals are generated by a range of techniques, including technical analysis, fundamental analysis, and a combination of the two. They provide traders with valuable insights into potential trading opportunities, including specific currency pairs, trade directions (buy or sell), entry prices, stop loss levels, and take profit levels.

How do Forex Trading Signals Work?

Forex trading signals operate by offering traders essential information related to potential trading opportunities. Traders receive these signals through various channels, such as email, SMS, or dedicated trading platforms. Once a signal is received, traders analyze the provided information and decide whether to execute the trade based on their trading strategy and risk tolerance. The signals serve as a guide, assisting traders in making informed decisions regarding their trading activities.

Who Provides Forex Trading Signals?

Forex trading signals can be provided by a range of sources. Experienced individual traders often share their signals with others through social media platforms or specialized websites. Additionally, there are trading software programs available that generate signals based on predefined algorithms and market conditions. Furthermore, specialized Forex signal service providers offer subscription-based services, providing traders with a constant stream of trading signals.

How Reliable are Forex Trading Signals?

The reliability of Forex trading signals can vary significantly. It largely depends on the source of the signal and the strategy employed to generate it. It's important to remember that no signal can guarantee a profitable trade every time. Traders should exercise caution and conduct their due diligence when evaluating the reliability of signals. It is advisable to consider the track record and reputation of the signal provider, as well as perform additional analysis to validate the signals before making trading decisions.

How can I Use Forex Trading Signals?

Forex trading signals can be effectively utilized to inform trading decisions. Upon receiving a signal, traders typically analyze the information provided, considering factors such as market conditions, technical indicators, and risk management strategies. It is essential to incorporate these signals into an overall trading strategy and align them with personal trading goals and risk tolerance. Traders should view the signals as a tool for analysis rather than blindly relying on them for trading decisions.

Are Forex Trading Signals Suitable for Beginners?

While Forex trading signals can provide valuable insights, they should not replace education and understanding of the Forex market. Beginners may find signals helpful as a reference point for analysis as part of their learning process. Beginners, on the other hand, must supplement their expertise with additional learning tools such as instructional publications, trade classes, and mentoring. This all-encompassing strategy will allow novices to hone their abilities and get a thorough grasp of Forex trading.

Can I Automate My Trading Using Forex Signals?

Yes, it is possible to automate trading using Forex signals. Some traders utilize automated systems known as Expert Advisors (EAs) or Forex robots to automatically execute trades based on predefined Forex trading signals. These systems may be designed to follow particular trading strategies, entry and exit criteria, and risk management settings. However, while utilizing automated systems, it is critical to use care and periodically analyze their performance to ensure they correspond with your trading aims and react to changing market circumstances.

The Main Function of the WikiFX App

The WikiFX App serves as a valuable tool for traders in the Forex market. Its primary role is to give traders a comprehensive platform for researching and locating the best broker for their trading requirements. The app has an easy-to-use design and a variety of information on various brokers, such as their regulatory status and licenses.

Steps for Finding the Right Broker using the WikiFX App:

Step 1: Open the WikiFX App on your smartphone.

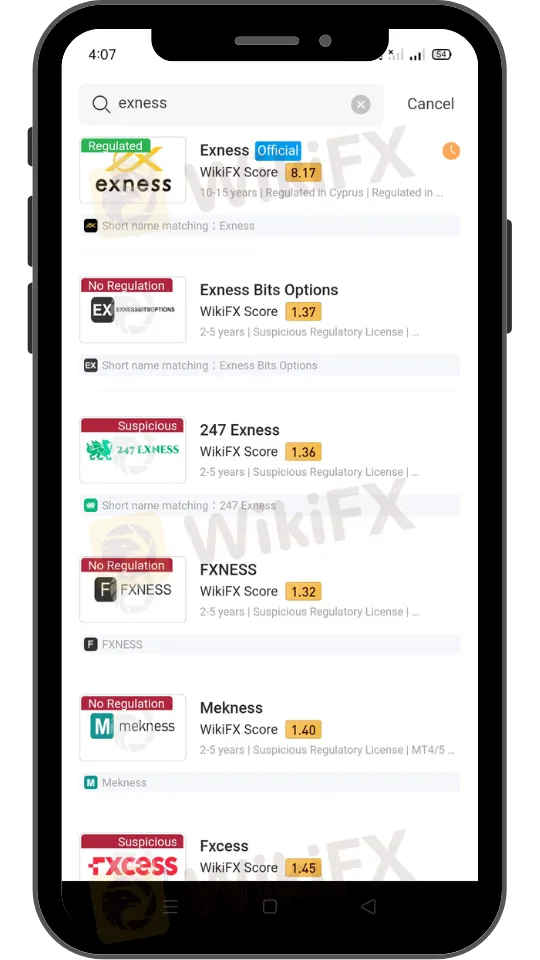

Step 2: Use the search function within the app to look for the name of your preferred broker. For example, if you are interested in Exness, type “Exness” in the search bar.

Step 3: Upon conducting the search, you will likely see a list of brokers with similar names. One of the notable features of the WikiFX App is that it not only lists regulated brokers but also provides information about unregulated brokers. This allows users to verify brokers easily without having to visit official regulatory websites. Simply tap or click on your preferred broker from the list.

Step 4: Once you access the broker's page on the app, you will find all the essential information you need to evaluate the broker. This includes detailed information about the broker's regulatory status and the licenses it holds. You can also find additional details such as the broker's trading conditions, customer reviews, and overall rating.

How does WikiFX Prevent Scams from Fraud Brokers?

One of the primary concerns for traders in the Forex market is the risk of encountering fraudulent brokers. The WikiFX App takes significant measures to prevent scams and protect traders from unscrupulous practices. The app employs a rigorous screening process to verify the legitimacy and regulatory status of brokers. It collects information from reputable sources, such as regulatory organizations, in order to give accurate and up-to-date data about brokers.

Furthermore, the app has a rating system that enables users to submit comments and discuss their broker experiences. This user-generated material is critical in assisting traders in making educated choices and avoiding bogus brokers. The WikiFX App also regularly updates its database to ensure that users have access to the latest information and warnings about potential scams.

Conclusion

Access to credible information and resources is critical in the volatile world of Forex trading. Forex trading signals give traders significant insights into prospective trading opportunities; nevertheless, traders must exercise prudence and do extensive investigation before making trading choices. The WikiFX App serves as a valuable tool for traders, offering a comprehensive platform to research and find the right broker. Traders may use this software to confirm they are working with registered brokers, get access to important information, and protect themselves from any fraud. Install the WikiFX App on your smartphone to keep up to speed on the newest news and make sound trading choices.

Download link: https://www.wikifx.com/en/download.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Related broker

Read more

Top 10 Trading Indicators Every Forex Trader Should Know

Master the top 10 Forex trading indicators to analyze real-time Forex quotes, trends, and market signals. Learn strategies to boost accuracy and avoid mistakes.

Why Do You Feel Scared During Trade Execution?

Trade execution is a pivotal moment for traders. It is when analysis turns into action, and potential profits or losses become reality. However, for many traders, this moment is accompanied by fear. Why does this happen, and how can you address it?

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

In the midst of financial innovation and regulation, WikiGlobal, the organizer of WikiEXPO, stays abreast of industry trends and conducts a series of insightful and distinctive interviews on pivotal topics. We are delighted to have the privilege of inviting Simone Martin for an in-depth conversation this time.

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

Discover how MultiBank Group, a global leader in financial derivatives, secured three prestigious awards at Traders Fair Hong Kong 2024, highlighting its innovative trading solutions and industry excellence.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Top 10 Trading Indicators Every Forex Trader Should Know

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Scope Markets Review: Trustworthy or Risky?

Currency Calculator