简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Finalto Adds Taiwanese Dollar to NDFS Portfolio

Abstract:Finalto said today that it has added Taiwan's dollar to its trading platform, expanding its non-deliverable forwards (NDFs) offering.

The advancement provides Finalto customers in Asia and other countries with better access to growing markets, while also increasing efficiency and reducing operational complexity.

The Taiwanese dollar has become a popular proxy for Asian market dangers caused by Russia's invasion of Ukraine. Finalto claims that the move would assist it to satisfy the hedging and execution requirements of its corporate and institutional customers, which include local banks, pension funds, hedge funds, brokers, and end users, for real Asian FX and non-deliverable futures transactions.

Furthermore, customers benefit from enhanced counterparty risk management and greater capital efficiency, since liquidity and access are confined to end users, increasing dependability.

NDFs account for a modest fraction of total FX activity, but the product has grown rapidly in recent years since it allows traders to trade spot FX in limited markets where currencies are not deliverable. NDFs differ from conventional monetary products in that there is no central exchange or delivery. Rather, cash settlement is based on the difference between the exchange rate at the time of the deal and the exchange rate at maturity.

“Taiwan's currency lost 10% versus its US equivalent in 2022, its worst loss in 25 years as Fed rate rises bolstered the greenback,” said Neil Wilson, Chief Markets Analyst at Finalto. In response to the strengthening dollar, Taiwan's currency fell to its lowest level in more than five years, with the country's central bank aggressively intervening in the market to arrest the slide. Since then, the Taiwan dollar has recovered somewhat as USD longs unwind positions on anticipation that the Fed would reduce and cease rate rises.

Finalto has continually focused on improving its product over the last several months, resulting in the prize for Best B2B Liquidity Provider (Prime of Prime) at the FMLS22 Awards, barely five months after earning the same honor at the Ultimate Fintech Awards in June.

Finalto offers a comprehensive variety of services and solutions to help build the ideal technological proposal for a brokerage firm. This contains a whole end-to-end solution that incorporates front-end platforms, back-office administration, risk management tools, pricing tools, and improved connectivity.

Meanwhile,

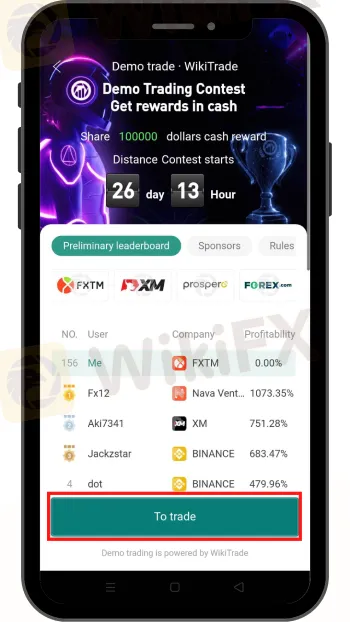

WikiFX has launched “The First Ever Demo Forex Trading World Cup 2023” and win as much as “$100,000”.

How To Join!

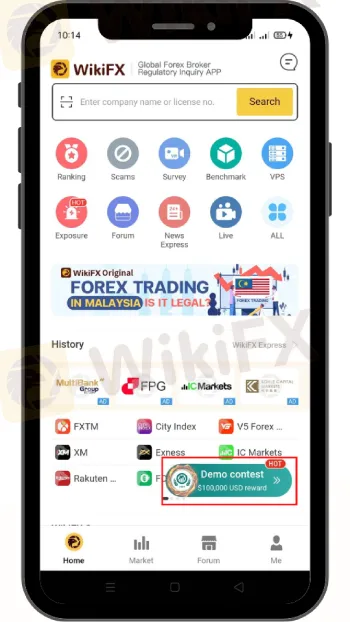

Download and install the WikiFX App on your smartphone through the link https://bit.ly/3wL2KqJ or from the App Store or Google Play Store.

Once installed tap the “Demo Contest” button that appears on the screen

Create an account by “Signing Up” or “Register”

Once all is done, click on the “Trade Button”

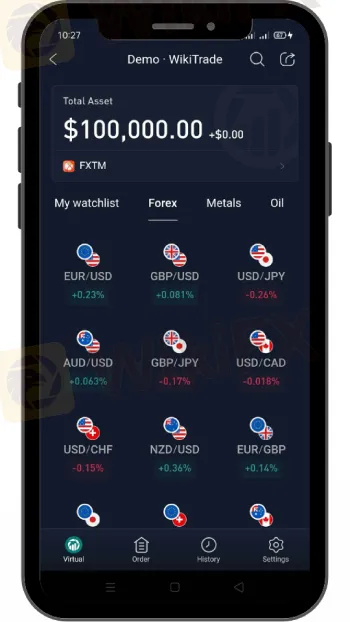

You should see the trading platform and may select the trading instruments you wanted to trade.

Good luck and enjoy your trading experience!

Install the WikiFX App on your smartphone to stay updated on the latest news.

Download link: https://www.wikifx.com/en/download.html?source=fma3

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Doo Financial Expands Regulatory Reach with Offshore Licenses in BVI and Cayman Islands

According to the report, Doo Group, a prominent Singapore-based online brokerage firm, has strengthened its global presence by securing new offshore licenses for its brokerage brand, Doo Financial. The company recently announced that entities under the Doo Financial umbrella have been granted licenses by two key offshore regulatory bodies: the British Virgin Islands Financial Services Commission (BVI FSC) and the Cayman Islands Monetary Authority (CIMA).

Why is there so much exposure against PrimeX Capital?

In recent months, PrimeX Capital, a Forex and CFD broker established in 2022, has become a subject of concern in the trading community. However, despite these enticing features, the broker's reputation has been severely tarnished by multiple complaints and a troubling lack of regulatory oversight.

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Forex broker scams continue to evolve, employing new tactics to appear credible and mislead unsuspecting traders. Identifying these fraudulent schemes requires vigilance and strategies beyond the usual advice. Here are five effective methods to help traders assess the legitimacy of a forex broker and avoid potential pitfalls.

Doo Financial Obtains Licenses in BVI and Cayman Islands

Doo Financial, a subsidiary of Singapore-based Doo Group, has expanded its regulatory footprint by securing new offshore licenses from the British Virgin Islands Financial Services Commission (BVI FSC) and the Cayman Islands Monetary Authority (CIMA).

WikiFX Broker

Latest News

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

YAMARKETS' Jingle Bells Christmas Offer!

Why is there so much exposure against PrimeX Capital?

Doo Financial Expands Regulatory Reach with Offshore Licenses in BVI and Cayman Islands

MTrading’s 2025 "Welcome Bonus" is Here

Doo Financial Obtains Licenses in BVI and Cayman Islands

CFI’s New Initiative Aims to Promote Transparency in Trading

Currency Calculator