简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

ASIC’s Having New Rules for Foreign Brokers

Abstract:ASIC, the Australian Securities and Investments Commission, is attempting to tighten regulations for international financial services firms operating in Australia. This attempt of ASIC is aimed to seal regulatory gaps as many brokers believe that they are not regulated in Australia and are therefore exempt from the nation's registration requirements.

ASIC, the Australian Securities and Investments Commission, is attempting to tighten regulations for international financial services firms operating in Australia. Foreign brokers who work with Australian retail clients starting in October 2024 will probably need to record their domestic transactions to the Australian authorities.

The derivatives transactions guidelines were initially put forth by ASIC in a consultation document that was released in November 2020, and more clarifications were subsequently provided in a follow-up consultation paper that was published in May 2022. According to a response paper it published last month, it has completed the new guidelines.

According to Sophie Gerber, a Principal at the law firm Sophie Grace and the Co-CEO of TRAction Fintech, ASIC is likely to step up its enforcement to ensure that those brokers comply with Australian laws where necessary if brokers are targeting Australian clients in any way, in addition to their current activities.

This attempt of ASIC is aimed to seal regulatory gaps as many brokers believe that they are not regulated in Australia and are therefore exempt from the nation's registration requirements. The implementation of the new regulations will codify ASIC's enforcement obligations into Australian law, failing which the companies risk receiving a cease-and-desist order.

All financial services businesses that have been granted an Australia Financial Services (AFS) licence are currently under the supervision of ASIC. However, there is no legal restriction on offshore brokers or financial services companies accepting Australian customers.

Nevertheless, the market has altered dramatically since the current ASIC regulations were adopted in 2015. The new regulations' revision now demonstrates the regulator's larger interest in the business dealings Australian retail clients have with overseas brokers.

ASIC also made sure that the impending rules had a broad scope. Any business that operates out of Australia (regardless of the customers it is onboarding), accepts or has accepted Australian retail clients, or seeks Australian clients must make sure that it has a current understanding of the standards before doing so and moving forward.

“We think that once the regulations are implemented and ASIC commences its enforcement procedures, there will eventually be a change in how foreign brokers interact with Australian clients. If a company already has an AFSL in its group structure, it may steer Australian clients to that entity and forbid them from joining any other group entity where they may be doing so at the moment”, Gerber further explained.

The new reporting regulations' implementation schedule was carefully considered as well. It is in line with the impending EMIR Refit, which will go into effect in the first quarter of 2024, enabling multinational corporations to allocate their resources for changes to transaction reporting at once.

One of the well-known financial market regulators is ASIC. As a result of ASIC's recent limits on the retail trading industry, the new regulations will soon be implemented. Holders of an AFS licence may only use additional marketing restrictions and leverage up to a 30:1 ratio. Additionally, the regulator has temporarily prohibited retail binary options from being offered and sold.

“At a time when other authorities across the world are beginning to look more closely at the offshore activities of corporations they are regulating (or their other group entities), such as UK and St. Vincent's, ASIC is implementing these additional measures. Since product intervention and leverage restrictions effectively moved retail activity overseas, there appears to be a definite attempt by regulators to reassert some control over it”, Gerber added.

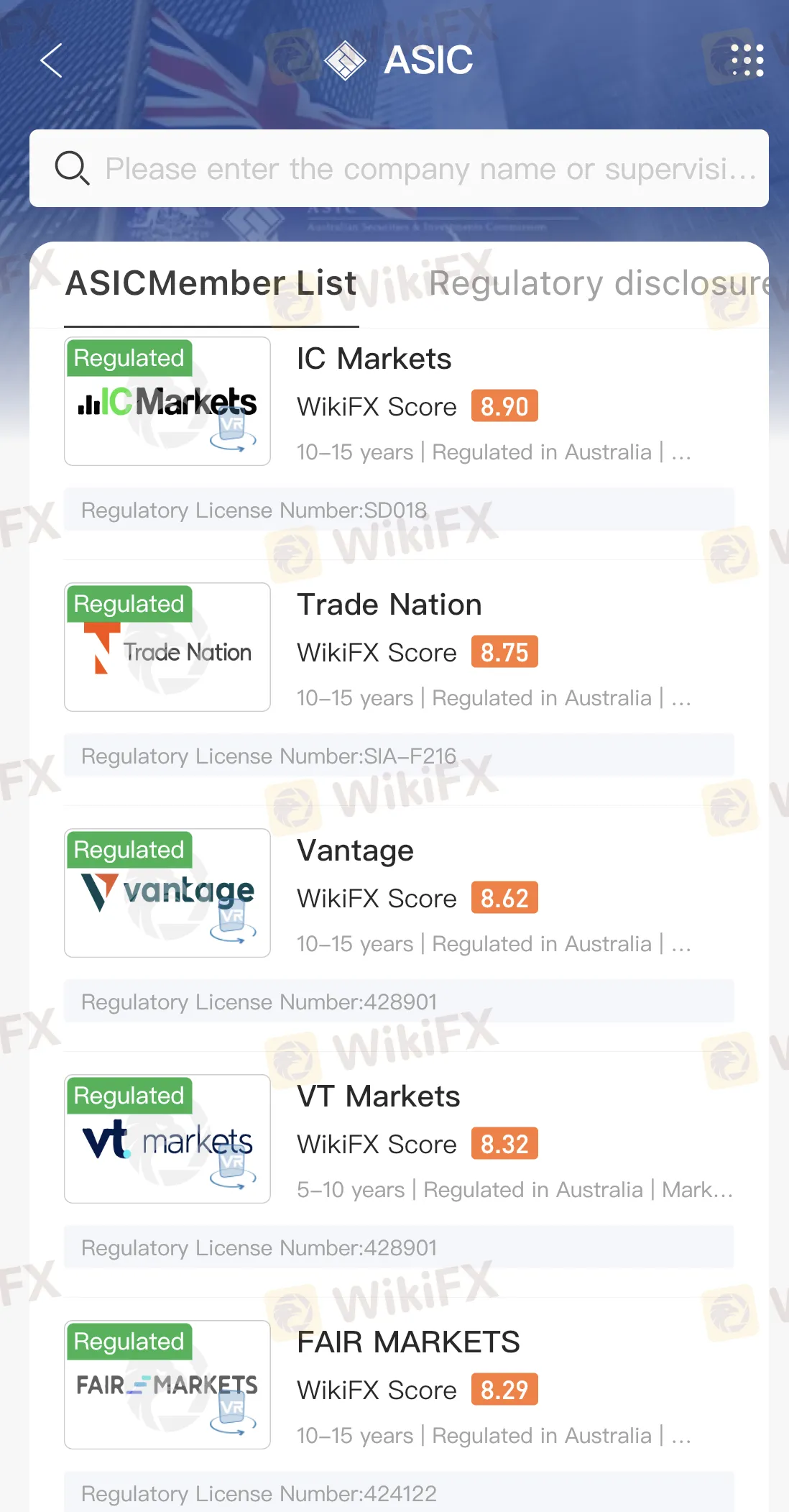

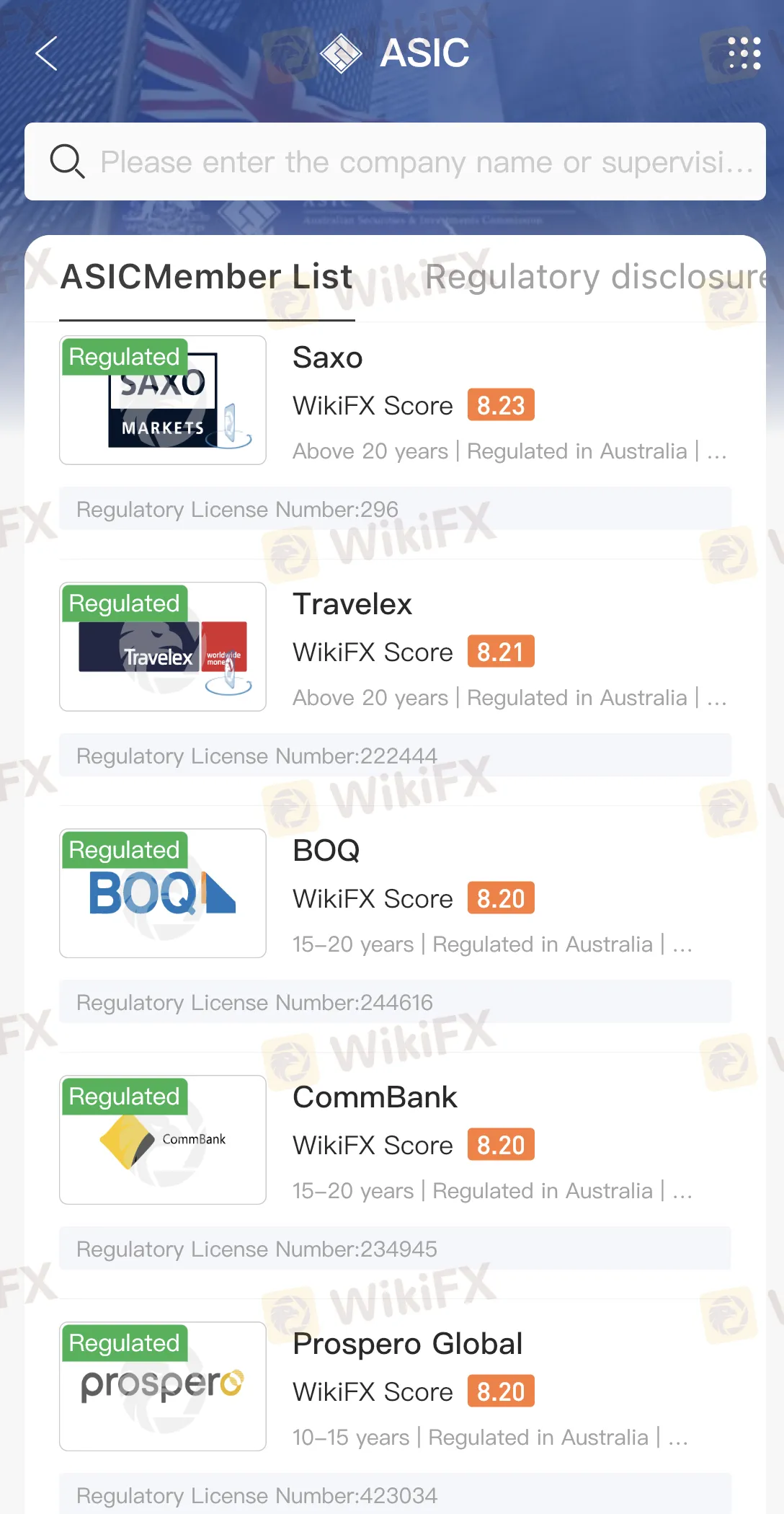

To find out more brokers that are currently regulated by ASIC, download the WikiFX mobile app to do this in just a few seconds!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Top 10 Trading Indicators Every Forex Trader Should Know

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Scope Markets Review: Trustworthy or Risky?

Currency Calculator