简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

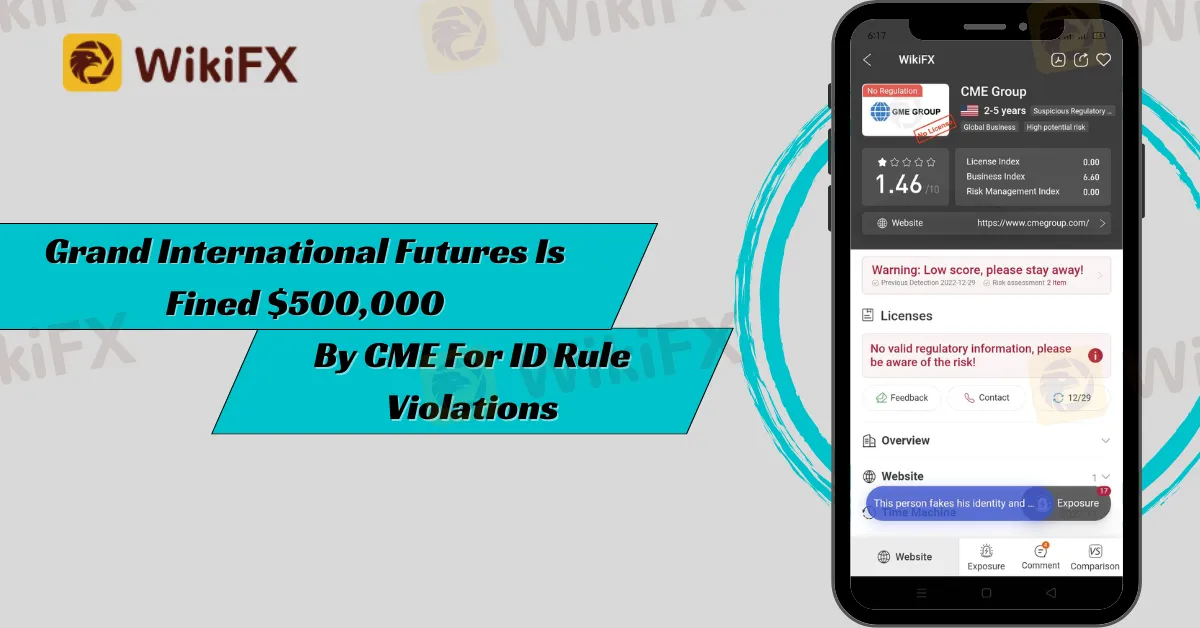

Grand International Futures Is Fined $500,000 By CME For ID Rule Violations

Abstract:Grand International Futures Company Limited has been fined $500,000 by the Chicago Mercantile Exchange (CME) as a disciplinary action for breaking the trading venue's regulations regarding client identity.

Grand International Futures Company Limited has been fined $500,000 by the Chicago Mercantile Exchange (CME) as a disciplinary action for breaking the trading venue's regulations regarding client identity.

The CME has fined Grand International Futures.

The compensation offer was made after a panel of the Chicago-based derivatives exchange giant's corporate conduct committee discovered various infractions in Grand's methods of providing trading services, according to the official release.

Every client of a clearing member who uses CME's systems must be uniquely identified. “To access Globex, each person must need a unique operator ID. ”In no instance may a person enter or authorize an individual to place an order using an operator ID other than the individual's own unique operator ID, the CME warned.

Image

Grand, on the other hand, failed to have suitable policies and processes in place for the development, maintenance, and monitoring of operator identifications for its clients from 3 February 2020 to 17 February 2021. The corporation allowed its clients to generate their operating identifications with the help of a third-party software supplier, who was unable to identify the customer who utilized the operator identifications. Furthermore, the system permitted several clients to use the same operator identifier to place orders.

“The Panel discovered that by permitting its clients to frequently establish operator IDs via a third-party software provider, Grand lost its capacity to identify and monitor those customers who transmitted communications to the Exchange using these operator IDs,” the CME stated.

The CME Group is a major US derivatives trading venue.

CME is one of the United States two main derivatives exchange venues. Its sales for the third quarter of the current fiscal year climbed by 11% to $1.11 billion, with a net income of $719 million compared to $574 million the previous year. The quarterly numbers were boosted by a 26% increase in trading activity on the platform.

Meanwhile, CME is working to expand its product offerings. It launched retail event contracts, which are trading products similar to binary options, in September.

Find out more CME Group news here: https://www.wikifx.com/en/dealer/5331695987.htmlStay tuned for more Financial news.

Download and install the WikiFX App from the download link below to stay updated on the latest news, even on the go.

Download link: https://www.wikifx.com/en/download.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

WikiFX Review: Is Ultima Markets Legit?

Ultima Markets has played a significant role in the forex trading industry for decades. WikiFX created a comprehensive review to help you better understand this broker. We will analyze its reliability based on specific information, regulations, etc. Let’s get into it.

WikiFX Review: Is FXTRADING.com still reliable?

FXTRADING.com is an online brokerage firm that offers trading services for various financial instruments such as forex, cryptocurrencies, shares, commodities, spot metals, energies, and indices. WikiFX has comprehensively reviewed this broker by analyzing its regulations, specific information, etc. so that you have a deep understanding of this broker.

Financial Educator “Spark Liang” Involved in an Investment Scam?!

A 54-year-old foreign woman lost her life savings of RM175,000 to an online investment scam that promised high returns within a short timeframe. The scam was orchestrated through a Facebook page named "Spark Liang."

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

Starting from January 1, 2025, Russia will implement a comprehensive ban on cryptocurrency mining in 10 regions for a period of six years. The ban will remain in effect until March 15, 2031.

WikiFX Broker

Latest News

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

YAMARKETS' Jingle Bells Christmas Offer!

Why is there so much exposure against PrimeX Capital?

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

Two Californians Indicted for $22 Million Crypto and NFT Fraud

WikiFX Review: Is Ultima Markets Legit?

Colorado Duo Accused of $8M Investment Fraud Scheme

MTrading’s 2025 "Welcome Bonus" is Here

Malaysia Pioneers Zakat Payments with Cryptocurrencies

Currency Calculator