Score

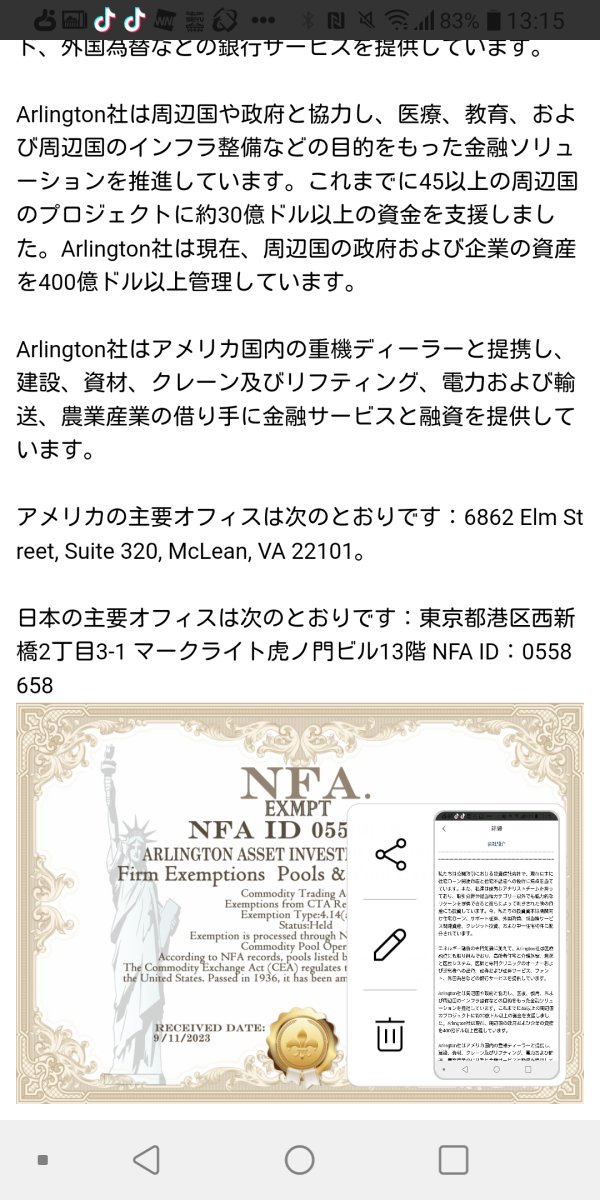

Arlington Asset Investment

United States|1-2 years|

United States|1-2 years| http://aaicltd.com/en

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

United States

United StatesUsers who viewed Arlington Asset Investment also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

VT Markets

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Neex

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

aaicltd.com

Server Location

United States

Website Domain Name

aaicltd.com

Server IP

104.21.33.237

Company Summary

Note: Arlinton Asset Investment's official website - https://aaicltd.com/ is currently inaccessible normally.

| Arlington Asset InvestmentReview Summary | |

| Founded | 2002 |

| Registered Country/Region | United States |

| Regulation | No regulation |

| Market Instruments | Stocks, futures, crude oil, gold, bitcoin, currencies |

| Demo Account | ✅ |

| Leverage | Up to 1:500 |

| Spread | From 0.0 pips |

| Trading Platform | ST5 |

| Min Deposit | $25 |

| Customer Support | 24/5 support |

| Email: support@aaicltd.com | |

Founded in 2002, Arlington Asset Investment is an unregulated broker registered in the United States, offering trading services related to stocks, futures, crude oil, gold, bitcoin, and currencies markets. It offers 3 types of accounts, with a minimum deposit of $25 and a maximum leverage of 1:500.

Pros and Cons

| Pros | Cons |

| Diverse tradable instruments | Inaccessible website |

| Demo accounts available | Lack of regulation |

| Multiple account types | No MT4 or MT5 |

| Low minimum deposit | Only email support |

| Popular payment options |

Is Arlington Asset Investment Legit?

No, it is not regulated by the financial services regulatory authority in the United States, which means that the company lacks regulation from its registration site. Please note the potential risks!

What Can I Trade on Arlington Asset Investment?

Arlington Asset Investment provides several types of products, including stocks, futures, crude oil, gold, bitcoin, and currencies.

| Tradable Instruments | Supported |

| Stocks | ✔ |

| Futures | ✔ |

| Crude Oil | ✔ |

| Gold | ✔ |

| Bitcoin | ✔ |

| Currencies | ✔ |

| Indices | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Type

Arlington Asset Investment offers 3 types of accounts: Comprehensive Account, Finance Account, and Financial STP Account. Moreover, it also provides demo accounts.

| Account Type | Min Deposit | Max Leverage | Trading Assets |

| Comprehensive | $25 | 1:100 | CFD, Indexs |

| Finance | $50 | 1:500 | Forex, commodities, cryptocurrencies |

| Financial STP | $200 | 1:400 |

Leverage

The leverage can be up to 1:500, which is not low. Customers need to consider carefully before investing, because high leverage is likely to bring high potential risks.

Trading Platform

Arlington Asset Investment uses ST5 as its trading platform, and it does not support MT4 or MT5.

| Trading Platform | Supported | Available Devices | Suitable for |

| ST5 | ✔ | Web, PC, mobile | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

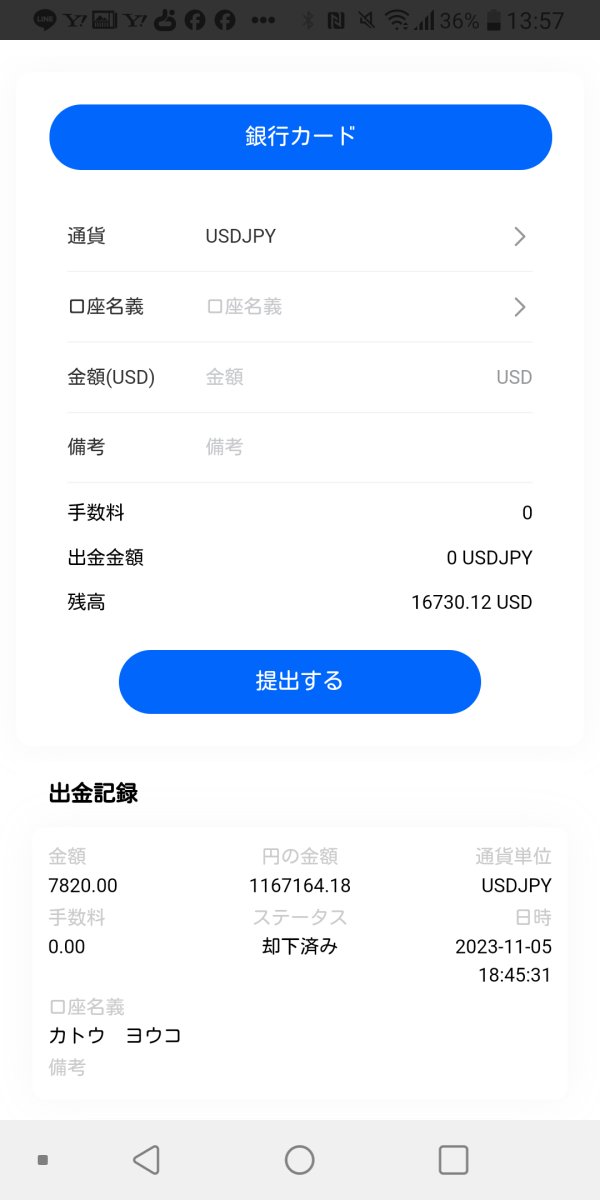

Deposit and Withdrawal

Arlington Asset Investment supports several types of payment options, but it is not clear whether deposit and withdrawal fees are needed or not.

| Payment Option | Processing Time |

| Bank wire transfer | 3-5 business days |

| ACH transfer | 1-2 business days |

| Credit/debit card | Instant |

Keywords

- 1-2 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 8

Content you want to comment

Please enter...

Review 8

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

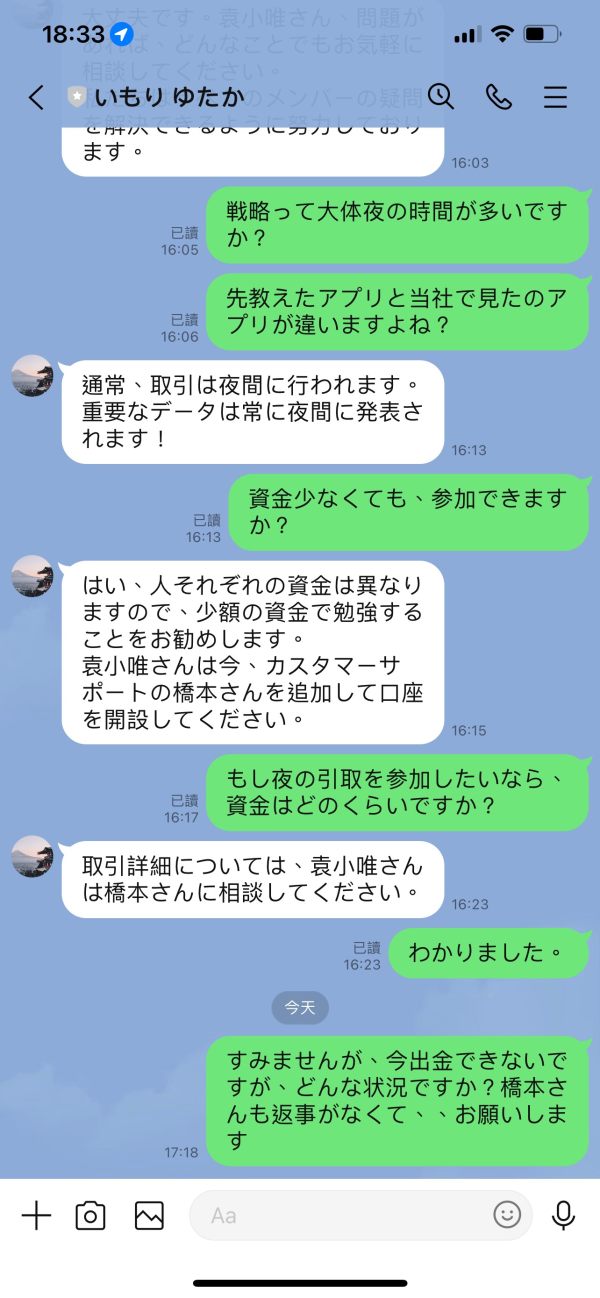

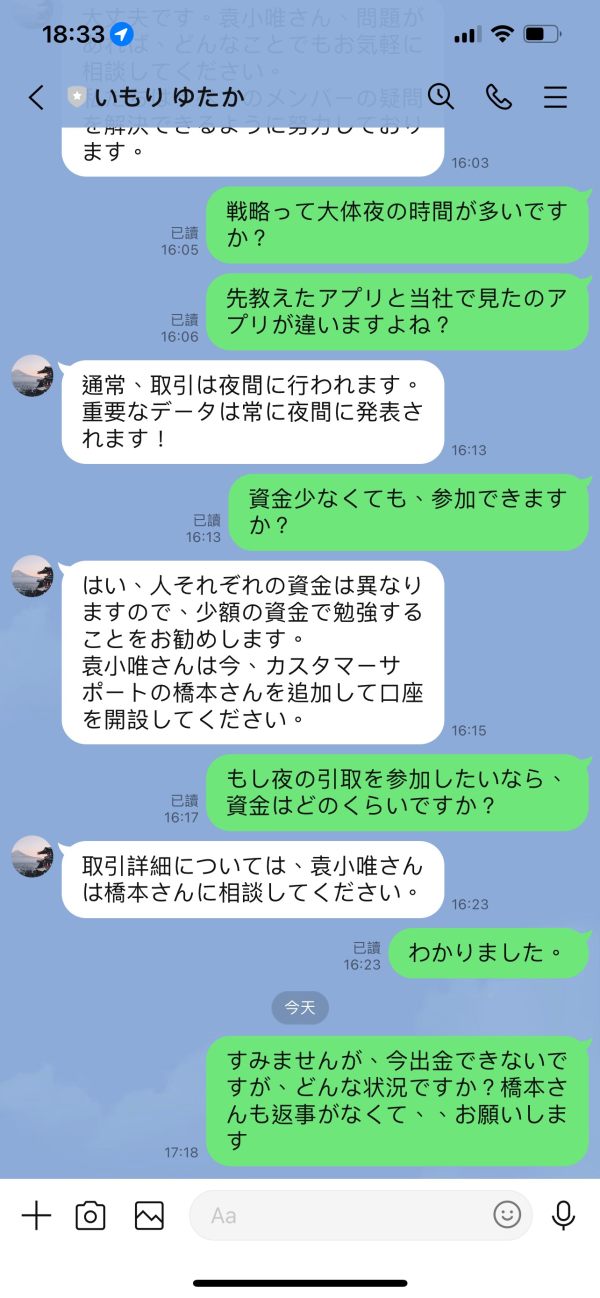

高齢者

Japan

i Arlington Asset Investment i have an account at. i would like to cancel my contract because i cannot withdraw money, but since november 3, 2023, i have been unable to contact japanese employees yutaka imori, yoshihiro baba, eri kawashima, and takayuki kobayashi. i started trading in fx with a small amount, and then i was told that increasing the margin would make my trading go better, so i deposited money again and, including trading profits, my balance was up to $16,730.12. when i applied for a withdrawal of $7,820.00, it was displayed as ``under review,'' and after a while, the entire net worth, including the balance that i had not applied for withdrawal, changed to ``rejected.'' almost at the same time, i became unable to contact the japanese employee mentioned above. currently, the trading platform cloudflare shows aaic error 522. please investigate aaic as you cannot apply for account cancellation and balance refund. we have reported this to the japanese police, but since this is an american company, we would appreciate your cooperation. i have an account with Arlington Asset Investment i would like to cancel my contract, but since november 3, 2023, i have been unable to contact japanese employees yutaka imori, yoshihiro baba, eri kawashima, and takayuki kobayash. at first, i started trading fx with a small amount, and then i was told that trading would be better if i increased the margin, so i deposited the money again, and with the trading profits, etc., now i have a balance of $16730.12. when i applied for a withdrawal of $7,820.00, it was displayed as ``pending'' and after a while, the entire net worth, including the balance that i had not applied for withdrawal, changed to ``rejected.'' almost at the same time, i became unable to contact the japanese employee mentioned above. currently, the trading platform cloudflare shows aaic error 522. please investigate aaic as i cannot apply for account cancellation and balance refund. i have reported this to the japanese police, but since this is an american company, we would appreciate your cooperation .

Exposure

2023-12-25

長谷川 芽郁

Japan

I couldn't make a withdrawal, and the person I contacted didn't respond, so I was kicked out of the group.

Exposure

2023-10-19

長谷川 芽郁

Japan

When I told them I couldn't withdraw money, I was kicked out of the group. The other person doesn't reply either.

Exposure

2023-10-19

Trading gogogo

Cyprus

That said, like any other platforms, there are areas where Arlington Asset Investment could ramp up. More features on the trading platform and a more simplified account-opening procedure, perhaps? However, they're still the kind who'd have 8 out of 10 things right up their alley! They've certainly got my vote!

Neutral

2023-12-01

Matthew Johnson

Malaysia

I've been using Arlington Asset Investment Corp Ltd for a while now, and it's got its strengths. The platform offers a wide range of assets for trading, which is pretty cool. The 24/7 trading access via the ST5 platform is a definite advantage, especially for someone like me who enjoys trading at odd hours. However, I've found the customer support a bit limited—primarily email-based—and wish they had more educational resources for those looking to learn more about trading. Overall, it's a decent platform with room for improvement.

Neutral

2023-11-08

FX1498588027

United States

Recently signed up with Arlington Asset. The $25 minimum to start is a no-brainer, and I'm loving the variety—stocks, crypto...

Positive

06-21

FX1524107455

United States

One particularly profitable run I had was while trading the GBP/JPY pair. Based on their precise trading signals, I predicted an upcoming bullish market. I initiated a long position and thanks to their rapid-executing platform, my trade was executed right at the ideal moment. With the upward trend, I came away with a hefty profit, making it one of my most memorable trades with Arlington Asset Investment! The account opening process was a breeze - uncomplicated and efficient. Their supportive customer service team was always ready to assist, making me feel valued and heard.

Positive

2023-11-30

Alexander12

United Kingdom

Arlington Asset Investment's my trading partner. They've been hustlin' since '02, regulated by FinCEN. Diverse assets, low spreads, and the ST5 platform's my go-to. But, customer support's email-only – a bit old-school. Limited education, but account options fit different wallets.

Positive

2023-11-14