简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Old trick for escape? Omega Pro allegedly transfers its members to another company.

Abstract:According to reports, OmegaPro, always with the excuse of the alleged "hacking" announces that it will transfer its members to another already established "company".

According to reports, OmegaPro, always with the excuse of the alleged “hacking,” announces that it will transfer its members to another already established “company.” We still need more information to confirm this issue, and we do not know what this “company” is yet. Thus, WikiFX welcomes investors to offer relevant evidence so that we can together air OmegaPro's dirty laundry in public.

About Omega Pro

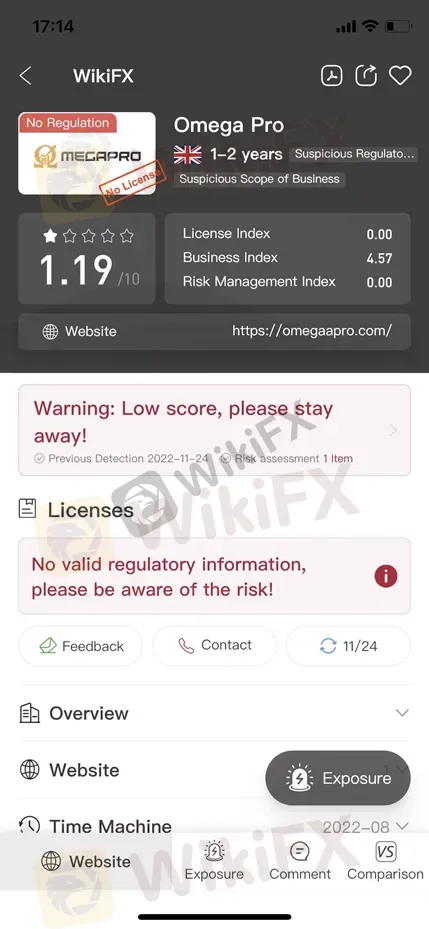

Omega Pro is a forex broker whose main target market is rooted in Africa. This broker has a special strong existence in the Spanish-speaking world. However, according to much feedback, this broker is getting involved in a Ponzi Scheme. And it is not trustworthy as you may think it is. It is not regulated and WikiFX has given it a fairly low score of 1.19/10. Please be aware of the risks.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

Discover how MultiBank Group, a global leader in financial derivatives, secured three prestigious awards at Traders Fair Hong Kong 2024, highlighting its innovative trading solutions and industry excellence.

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Discover how CySEC resolved compliance issues with Charlgate Ltd, the operator of Fxview, through a €50,000 settlement. Explore the investigation, regulatory measures, and CySEC's new website designed for improved accessibility and transparency.

TradingView Launches Liquidity Analysis Tool DEX Screener

Discover TradingView's DEX Screener, a powerful tool for analyzing decentralized exchange trading pairs. Access metrics like liquidity, trading volume, and FDV to make smarter, data-driven trading decisions.

Doo Financial Expands Reach with Indonesian Regulatory Licenses

PT. Doo Financial Futures, a subsidiary of the global financial services brand Doo Group, has secured regulatory approval from Indonesia’s Badan Pengawas Perdagangan Berjangka Komoditi (BAPPEBTI).

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Top 10 Trading Indicators Every Forex Trader Should Know

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Scope Markets Review: Trustworthy or Risky?

Currency Calculator