简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Alert! Be aware of Unlicensed FX Broker Raiffeisen Centrobank

Abstract:Despite its growing popularity, investment in the currency market poses scam threats due to increasing numbers of non-regulated brokers.

While authorities keep cautioning investors to stay alert to fraud entities, investors also need to take due precaution to avoid falling prey to scam brokers like Raiffeisen Centrobank.

Raiffeisen Centrobank- Review

Raiffeisen Centrobank (https://www.centrobanc.com) was an offshore broker registered in the Marshall Islands (Company name: Sucaba Enterprise Ltd). But the registration has been annulled. The company has been around serving around since 2018. Besides claiming to be a traditional bank, the broker extends its services to the retail trading industry and lists multiple assets across various financial markets. While the broker doesn't offer any third-party trading platform, clients have the company's in-house proprietary trading platform at their disposal.

Is Raiffeisen Centrobank Regulated?

No, Raiffeisen Centrobank is neither registered nor regulated anywhere. The company hasn't listed any information on its official website about its regulatory status either.

Clients feedback

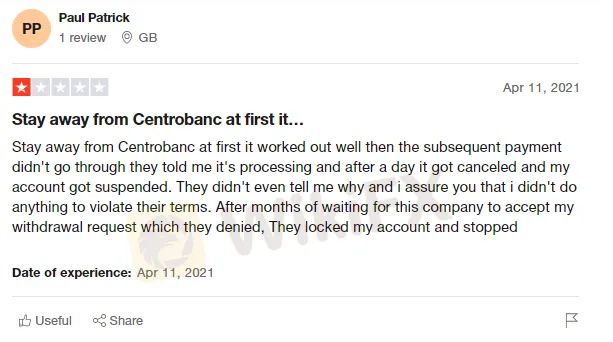

Raiffeisen Centrobank holds a poor reputation among investors. Like other scam entities, the broker receives critics amid withdrawal issues. Clients have also accused the company of delayed order executions and poor customer support.

What Makes Raiffeisen Centrobanka Scam Broker?

First, the broker's contact page does not include its address. That's a red flag of fraud or a low-quality broker. It might also discontinue providing traditional means of contact such as email, and phone.

In addition, the operator of the site, Sucaba Enterprise Ltd, has also been blacklisted by the Italian Securities and Exchange Commission (CONSOB) and the Austrian Financial Market Authority ( Austria FMA) for providing financial services without authorization.

How Scam Brokers Like Raiffeisen Centrobank Fool Around People?

Forex trading scams can adopt the same sales tactics as a legitimate broker or financial services organization. They sometimes pretend to be registered with a government body that has no authority over forex businesses, such as SVGFSA and IRI, etc.

When clients set up an account with such brokers, they start following them immediately and ask for a deposit. No matter how many times you refuse, they keep persuading you to fund your account and make false promises of unrealistic returns over a short period. However, you may see their true face once you make deposits. Besides never answering your phone calls or replying to your emails, they sometimes block access to your trading account.

What to do If I have deposited funds with Raiffeisen Centrobank?

The absence of regulations accompanying poor customer feedback makes the broker a high-risk investment firm. You should immediately place a withdrawal request with the company since you can't trust it with your hard-earned money.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Trader Exposes Unethical Practices by STP Trading

A recent allegation against STP Trading has cast doubt on the firm's business practices, highlighting the potential risks faced by retail traders in an increasingly crowded and competitive market.

What Makes Cross-Border Payments Easier Than Ever?

Cross-border payments are now faster, cheaper, and simpler! Explore fintech, blockchain, and smart solutions to overcome costs, delays, and global payment hurdles.

WikiEXPO Dubai 2024 is set to open!

4 Days Left

FCA Identifies Clone Firm Exploiting Admiral Markets' Credibility

The UK Financial Conduct Authority (FCA) has issued a public warning regarding a fraudulent entity impersonating Admiral Markets, a legitimate and authorised trading firm. The clone firm, operating under the name Admiral EU Brokers and the domain Admiraleubrokerz.com, has been falsely presenting itself as an FCA-authorised business.

WikiFX Broker

Latest News

Webull Partners with Coinbase to Offer Crypto Futures

eToro Expands Nationwide Access with New York Launch

Why Is UK Inflation Rising Again Despite Recent Lows?

Hackers Charged for $11M Crypto Theft Using SIM-Swaps

Role of Central Banks in the FX Market

FCA Alerts Against Sydney FX

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Interactive Brokers Launches Tax-Friendly PEA Accounts in France

Google Warns of New Deepfake Scams and Crypto Fraud

Currency Calculator