简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Clientele Feedback: What are Investors' Opinions of Forex4you?

Abstract:While investment markets have always been on the hit list of scammers, the foreign exchange market is more susceptible because of the sheer number of its transactions.

With an average of $6.6 trillion daily turnover, the forex market is the most tempting place for money stealers to make off their loot. Since multiple complaints have been filed against Forex4you, we suspect this broker to be a suspicious entity and warn investors from signing up with it.

Forex4you - A Quick Overview

Founded in 2007, Forex4you (https://www.forex4you.com/) is an online brokerage firm based in the British Virgin Islands. The company provides retail trading services across various financial markets, including forex, commodities, stocks, and indices. Flexible account types and multiple trading platforms appear to be the company's strong points in enticing traders. The company also supports social trading services, enabling clients to copy the trades of expert professionals and generate a passive income. An educational library is also available for clients to learn the basics of forex and CFD trading.

Is Forex4you Regulated?

Forex4you, a brand name of E-Global Trade & Finance Group, Inc., is authorized and regulated by the British Virgin Islands Financial Services Commission (BVI FSC) under the Securities and Investment Business Act, 2010, license number SIBA/L/12/1027. And the brokerage is neither registered nor regulated anywhere else.

Clientele Feedback

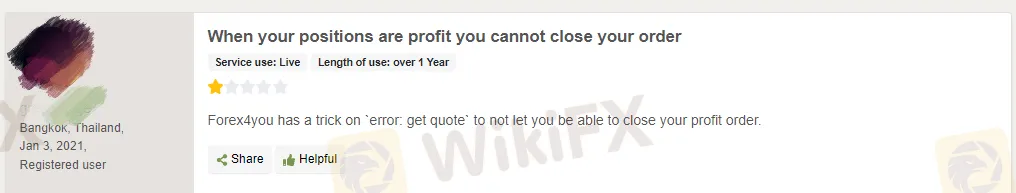

Forex4you holds a poor reputation among clients. The organization is accused of stealing from its customers by artificially inflating prices, closing accounts without warning, and ignoring customers' requests to withdraw their funds. Here are some screenshots.

What Makes Forex4you A Suspicious Broker?

First, it is an offshore entity that only regulated by BVI FSC. Although the regulator has been around for almost 20 years, it is still less stringent than the FCA, ASIC, or CySEC due to its relatively easy registration and low minimum paid-in capital requirements.

Second, the broker is a poorly rated companies. More than 80% of the reviews have reported its malpractices on social and digital marketing platforms.

Why Forex4you Dissatisfied Customers?

A dissatisfied client told us the whole experience when trading with Forex4you.

When he signed up with a broker, a member of the sales team contacted him, claiming to be his account manager. The manager asked the client to deposit money into the account, making fake promises to help him generate lucrative returns.

After the client made an initial deposit, the case got transferred to retention agents who try to con him out of even more funds.

Once the company believed the customer has invested up to the maximum extent, it became less incentivized for the company to keep in touch with him. Therefore, it stopped answering his calls and emails. The most disappointing aspect was that the withdrawals were never

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

WikiFX Review: Is Ultima Markets Legit?

Ultima Markets has played a significant role in the forex trading industry for decades. WikiFX created a comprehensive review to help you better understand this broker. We will analyze its reliability based on specific information, regulations, etc. Let’s get into it.

WikiFX Review: Is FXTRADING.com still reliable?

FXTRADING.com is an online brokerage firm that offers trading services for various financial instruments such as forex, cryptocurrencies, shares, commodities, spot metals, energies, and indices. WikiFX has comprehensively reviewed this broker by analyzing its regulations, specific information, etc. so that you have a deep understanding of this broker.

Financial Educator “Spark Liang” Involved in an Investment Scam?!

A 54-year-old foreign woman lost her life savings of RM175,000 to an online investment scam that promised high returns within a short timeframe. The scam was orchestrated through a Facebook page named "Spark Liang."

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

Starting from January 1, 2025, Russia will implement a comprehensive ban on cryptocurrency mining in 10 regions for a period of six years. The ban will remain in effect until March 15, 2031.

WikiFX Broker

Latest News

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

YAMARKETS' Jingle Bells Christmas Offer!

Why is there so much exposure against PrimeX Capital?

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

Two Californians Indicted for $22 Million Crypto and NFT Fraud

WikiFX Review: Is Ultima Markets Legit?

Colorado Duo Accused of $8M Investment Fraud Scheme

MTrading’s 2025 "Welcome Bonus" is Here

FCA's Warning to Brokers: Don't Ignore!

Currency Calculator