Score

Loyalty Liquidity

United Arab Emirates|2-5 years|

United Arab Emirates|2-5 years| https://www.loyaltyliquidity.com/

Website

Rating Index

MT4/5 Identification

MT4/5 Identification

Full License

Germany

GermanyContact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

United Arab Emirates

United Arab EmiratesAccount Information

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed Loyalty Liquidity also viewed..

VT Markets

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

AUS GLOBAL

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

loyaltyliquidity.com

Server Location

United States

Website Domain Name

loyaltyliquidity.com

Server IP

199.79.62.225

Company Summary

| Aspect | Information |

| Registered Country/Area | United Arab Emirates |

| Company Name | Loyalty Liquidity Limited |

| Regulation | Unregulated (Offshore) |

| Minimum Deposit | Not specified |

| Maximum Leverage | Up to 1:500 |

| Spreads | Vary by account type (e.g., as low as 0.1 pips) |

| Trading Platforms | MetaTrader 5 (MT5) for Windows, Android, iOS, and MacBook |

| Tradable Assets | Forex, Commodities, Indices, Cryptocurrencies |

| Account Types | ECN, Classic, Pro, Prime, Plus |

| Customer Support | Phone and email contact (varied quality) |

| Payment Methods | Google Pay, Visa, Apple Pay, Mastercard, Skrill, Discover, Bitcoin |

| Educational Tools | Not provided |

Overview

Loyalty Liquidity Limited is a trading intermediary based in the United Arab Emirates, offering a range of trading opportunities to its clients. It operates as an unregulated (offshore) broker, providing traders with flexibility in terms of leverage, spreads, and account types. The broker offers multiple account options, including ECN, Classic, Pro, Prime, and Plus, each catering to different trading preferences. Traders can access the MetaTrader 5 (MT5) platform on various devices, allowing for versatile trading experiences. Loyalty Liquidity offers a variety of tradable assets, including forex, commodities, indices, and cryptocurrencies, giving traders ample choices to diversify their portfolios.

While the broker accepts popular payment methods like Google Pay, Visa, Apple Pay, Mastercard, Skrill, Discover, and Bitcoin, it does not provide educational tools or resources. Customer support is available through phone and email, but the quality may vary, making it essential for traders to consider all aspects carefully before engaging with Loyalty Liquidity.

Regulation

Loyalty Liquidity is a financial intermediary operating within the investment sector that falls under the category of unregulated brokers. Unregulated brokers, also known as non-regulated or offshore brokers, operate outside the purview of traditional financial regulatory bodies, such as the Securities and Exchange Commission (SEC) in the United States or the Financial Conduct Authority (FCA) in the United Kingdom. These brokers typically offer a wide range of investment products and services but do not adhere to the stringent regulatory standards and oversight that their regulated counterparts do. Consequently, investors who choose to engage with unregulated brokers should exercise caution and conduct thorough due diligence to understand the associated risks, as they may have limited legal recourse in case of disputes or fraudulent activities. It's important for investors to be aware of the potential drawbacks and benefits of working with unregulated brokers and to carefully consider their investment choices in line with their risk tolerance and financial goals.

Pros and Cons

Loyalty Liquidity offers a range of trading opportunities, but it's essential to consider both the advantages and drawbacks before choosing this broker. Here's a summary of the pros and cons:

| Pros | Cons |

| Diverse range of trading instruments | Unregulated, lacking oversight from financial authorities |

| Multiple account types for varied preferences | Limited educational resources |

| Leverage up to 1:500 for flexible trading | Varying quality of customer support |

| Flexible spreads and commissions | Lack of regulatory protection |

| Various payment methods accepted | Potential risk due to high leverage |

| MetaTrader 5 platforms for flexibility |

In summary, Loyalty Liquidity provides traders with diverse trading opportunities and flexibility in account types and payment methods. However, the lack of regulation, limited educational resources, and varying customer support quality are factors to consider. Traders should be mindful of potential risks, especially when using high leverage.

Market Instruments

Loyalty Liquidity offers a diverse array of market instruments to cater to the trading needs and preferences of its clients. These instruments encompass a range of financial assets and markets, providing traders with ample opportunities to diversify their portfolios and potentially profit from market fluctuations.

Forex (Foreign Exchange): Forex trading is a cornerstone of Loyalty Liquidity's offerings. It involves the buying and selling of currency pairs, such as EUR/USD or GBP/JPY, in the global foreign exchange market. This market is known for its high liquidity and round-the-clock availability, making it a popular choice among traders looking to speculate on currency price movements.

Commodities: Loyalty Liquidity also allows traders to access the commodities market. Commodities include physical goods like gold, oil, and agricultural products. Trading commodities can serve as a hedge against inflation or geopolitical instability and can be an integral part of a diversified investment strategy.

Indices: The broker provides access to various stock indices from around the world. Stock indices, like the S&P 500 or the FTSE 100, represent the performance of a group of stocks from a particular market. Trading indices allows investors to gain exposure to broad market movements without buying individual stocks.

Cryptocurrencies: In addition to traditional assets, Loyalty Liquidity offers trading in cryptocurrencies. This includes popular digital currencies like Bitcoin (BTC), Ethereum (ETH), and others. Cryptocurrencies are known for their high volatility and potential for substantial gains, attracting traders interested in this emerging asset class.

| Market Instrument | Description |

| Forex | Trading currency pairs in the global forex market. |

| Commodities | Trading physical goods like gold, oil, and crops. |

| Indices | Trading the performance of stock market indexes. |

| Cryptocurrencies | Trading digital currencies like Bitcoin and Ethereum. |

Please note that the availability of specific currency pairs, commodities, indices, and cryptocurrencies may vary based on the broker's offerings and can change over time. Traders should check Loyalty Liquidity's website or contact their customer support for the most up-to-date information on available trading instruments. Additionally, it's crucial to research each instrument thoroughly and understand the associated risks before engaging in trading activities.

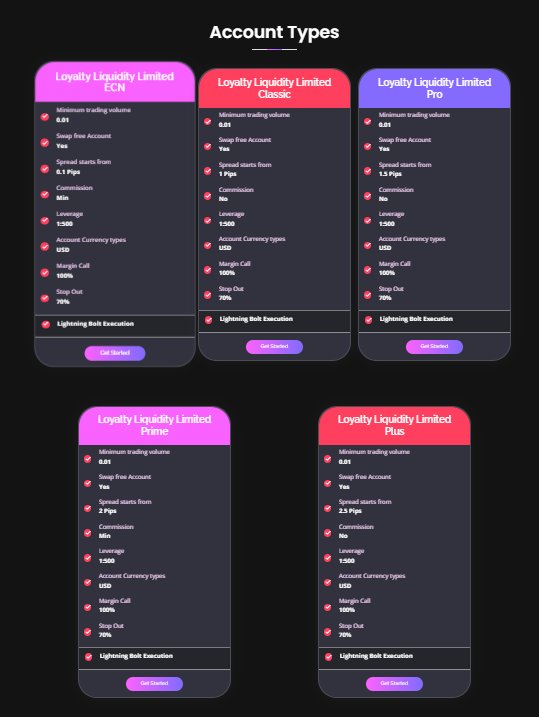

Account Types

ECN Account:

The ECN (Electronic Communication Network) account is designed for traders who prioritize tight spreads and fast execution. With a minimum trading volume of 0.01 lots and starting spreads as low as 0.1 pips, this account type is ideal for scalpers and day traders. It offers lightning bolt execution and allows for hedging and scalping strategies. Traders can benefit from the flexibility of swap-free trading and leverage up to 1:500, while a margin call level of 100% and a stop-out level of 70% help manage risk. Minimal commissions are charged for trades on this account.

Classic Account:

The Classic account is suitable for traders looking for a more straightforward and cost-effective trading experience. It offers a minimum trading volume of 0.01 lots and spreads starting at 1 pip, making it accessible for traders of all levels. This account type is swap-free and provides leverage up to 1:500. With a 100% margin call level and a 70% stop-out level, traders have a buffer to manage risk without the need for commissions.

Pro Account:

The Pro account is designed for traders who seek competitive trading conditions with slightly wider spreads. It offers a minimum trading volume of 0.01 lots and spreads starting from 1.5 pips. Similar to the Classic account, it is swap-free and provides leverage up to 1:500. With a margin call level of 100% and a stop-out level of 70%, traders can maintain control over their risk exposure. Commissions are not charged on this account, making it a cost-effective choice.

Prime Account:

The Prime account is tailored for traders who want a balance between low spreads and competitive commissions. It features a minimum trading volume of 0.01 lots and spreads starting at 2 pips. This account type is swap-free and offers leverage up to 1:500. A margin call level of 100% and a stop-out level of 70% help traders manage risk. Prime account holders pay minimal commissions for their trades, making it suitable for those who want tighter spreads while keeping costs in check.

Plus Account:

The Plus account is designed for traders who prioritize simplicity and ease of use. It offers a minimum trading volume of 0.01 lots and spreads starting at 2.5 pips. Like the other accounts, it is swap-free and provides leverage up to 1:500. The margin call level is set at 100%, and the stop-out level is at 70%. Plus account holders do not incur commissions on their trades, making it a straightforward and cost-efficient choice for traders.

Here's a table summarizing the key features of each account type:

| Account Type | Minimum Trading Volume | Swap-Free Account | Spread Starts From | Commission | Leverage | Margin Call | Stop Out | Lightning Bolt Execution |

| ECN Account | 0.01 | Yes | 0.1 Pips | Min | 1:500 | 100% | 70% | Get Started |

| Classic Account | 0.01 | Yes | 1 Pips | No | 1:500 | 100% | 70% | Get Started |

| Pro Account | 0.01 | Yes | 1.5 Pips | No | 1:500 | 100% | 70% | Get Started |

| Prime Account | 0.01 | Yes | 2 Pips | Min | 1:500 | 100% | 70% | Get Started |

| Plus Account | 0.01 | Yes | 2.5 Pips | No | 1:500 | 100% | 70% | Get Started |

These account types provide traders with a range of choices to align with their trading goals and preferences, ensuring a tailored trading experience with Loyalty Liquidity Limited.

Leverage

Loyalty Liquidity Limited offers a maximum trading leverage of up to 1:500. Leverage is a key feature in forex and CFD trading that allows traders to control larger positions in the market with a relatively small amount of capital. With a leverage of 1:500, traders can amplify their exposure to price movements, potentially increasing both profits and losses.

While high leverage can be advantageous for experienced traders who understand how to manage risk effectively, it also comes with increased risk. It's essential for traders to exercise caution when using high leverage, as it can lead to significant losses if not managed prudently.

Loyalty Liquidity Limited's provision of high leverage gives traders the flexibility to choose the level of leverage that suits their trading strategies and risk tolerance, but it's important for traders to fully comprehend the implications of leverage and use it responsibly. Traders should consider risk management techniques such as setting stop-loss orders and limiting the size of their positions to mitigate the potential downsides of high leverage.

Spreads & Commissions

Loyalty Liquidity Limited offers a flexible structure for spreads and commissions, which varies depending on the specific trading account chosen by traders. This approach allows traders to select an account type that aligns with their trading preferences and cost considerations.

Spreads: The spreads, or the difference between the bid and ask prices, vary across Loyalty Liquidity Limited's account types. The broker offers spreads as low as 0.1 pips on their ECN account, making it ideal for traders who prioritize tight spreads and fast execution. As traders move towards other account types like the Classic, Pro, Prime, and Plus accounts, the spreads may widen slightly, starting from 1 pip and increasing gradually up to 2.5 pips. This diversified spread structure caters to traders with different trading styles and risk tolerance levels.

Commissions: The broker's approach to commissions also varies depending on the chosen account type. For instance, the ECN account incurs a minimum commission, which may be a preferred option for traders who value ultra-low spreads and are willing to pay a commission per trade. On the other hand, the Classic and Pro accounts do not have commissions, making them suitable for traders who prefer a cost-effective trading experience without additional transaction fees. The Prime account, while offering competitive spreads, also incurs minimal commissions. Lastly, the Plus account does not charge commissions, focusing on simplicity and straightforward trading.

In summary, Loyalty Liquidity Limited provides traders with the flexibility to select an account type based on their specific trading preferences, whether it's low spreads with commissions, no commissions with slightly wider spreads, or a balance between the two. This approach allows traders to tailor their trading costs to their individual strategies and objectives, enhancing their overall trading experience. Traders should carefully consider their trading style and cost considerations when choosing the most suitable account type for their needs.

Payment methonds

Google Pay: A digital wallet by Google for Android users, allowing secure in-store and online payments.

Visa: A globally accepted payment card network, issued by banks, enabling transactions in various forms.

Apple Pay: Apple's mobile payment service for iOS devices, offering secure contactless payments.

Mastercard: A major payment card network similar to Visa, accepted widely for credit, debit, and prepaid cards.

Skrill: A digital wallet and online payment platform for secure online purchases and transfers.

Discover: A U.S.-based credit card company offering cashback rewards and widely used in the United States.

Bitcoin: A decentralized digital currency for online transactions, known for its pseudonymous and low-fee nature.

Trading Platforms

MT5 for Windows: A comprehensive trading platform for Windows computers, offering access to various financial markets and advanced trading tools.

MT5 for Android: A mobile trading app for Android devices, enabling on-the-go access to real-time market data, interactive charts, and trading instruments.

MT5 for MacBook: Optimized for macOS, this platform provides Mac users with the same powerful trading features as the Windows version.

MT5 for iOS: Tailored for Apple devices, including iPhones and iPads, allowing traders to execute trades and access market data on iOS devices with ease.

These MetaTrader 5 (MT5) platforms cater to a diverse range of traders, whether they prefer trading on their desktop computers, laptops, Android smartphones, or iOS devices. Each platform is designed to provide a seamless and feature-rich trading experience, enabling traders to analyze markets and execute trades with precision and efficiency.

Customer Support

Loyalty Liquidity appears to provide contact information for customer support via phone and email:

Phone Contact: You can reach out to Loyalty Liquidity's customer support team by calling the provided phone number: +971 54 295 6645. This direct phone contact allows you to speak with a representative in real-time, making it a suitable option for urgent inquiries or assistance.

Email Contact: Alternatively, you can contact their customer support via email at info@loyaltyliquidity.com. Email communication is a convenient method for non-urgent queries, account-related inquiries, or requests for information. It also provides a written record of your correspondence, which can be useful for reference.

However, the quality and responsiveness of customer support can vary from one company to another. To evaluate Loyalty Liquidity's customer support effectively, it's advisable to consider factors such as response times, the availability of support during trading hours, the professionalism and knowledge of the support team, and the overall level of assistance they provide to traders. It's also a good practice to check their website or contact them directly to confirm their current customer support hours and availability.

Educational Resources

It appears that Loyalty Liquidity does not provide educational resources as part of its services. Educational resources typically include materials such as webinars, tutorials, articles, videos, and other tools designed to help traders improve their knowledge and skills in financial markets.

While the absence of educational resources may not be a concern for experienced traders who are already well-versed in trading strategies and analysis, it may be a limitation for novice or less-experienced traders who are seeking educational materials to enhance their understanding of trading concepts.

Traders interested in educational resources may need to seek additional sources of information and education independently to complement their trading activities while using Loyalty Liquidity as their chosen broker.

Summary

Loyalty Liquidity operates as an unregulated broker, offering a diverse range of trading instruments, including forex, commodities, indices, and cryptocurrencies. They provide multiple account types with varying features, leverage up to 1:500, and flexible spreads and commissions.

Accepted payment methods include Google Pay, Visa, Apple Pay, Mastercard, Skrill, Discover, and Bitcoin. The broker offers MetaTrader 5 (MT5) platforms for various devices, ensuring flexibility for traders.

Customer support is available via phone and email, but its quality may vary. Notably, educational resources are not provided.

In summary, Loyalty Liquidity caters to traders seeking diverse trading options, but traders should be aware of the risks associated with unregulated brokers and conduct due diligence.

FAQs

Q1: Is Loyalty Liquidity a regulated broker?

A1: No, Loyalty Liquidity operates as an unregulated broker, falling outside the oversight of traditional financial regulatory bodies.

Q2: What trading instruments are available with Loyalty Liquidity?

A2: Loyalty Liquidity offers forex, commodities, indices, and cryptocurrencies for trading.

Q3: Can I customize my trading experience with different account types?

A3: Yes, Loyalty Liquidity provides multiple account types with varying features, allowing you to choose the one that aligns with your trading goals.

Q4: What payment methods are accepted by Loyalty Liquidity?

A4: Loyalty Liquidity accepts Google Pay, Visa, Apple Pay, Mastercard, Skrill, Discover, and Bitcoin as payment methods.

Q5: Does Loyalty Liquidity provide educational resources for traders?

A5: No, Loyalty Liquidity does not offer educational resources, so traders seeking learning materials should explore other sources independently.

Keywords

- 2-5 years

- Suspicious Regulatory License

- MT5 Full License

- Regional Brokers

- High potential risk

Review 5

Content you want to comment

Please enter...

Review 5

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

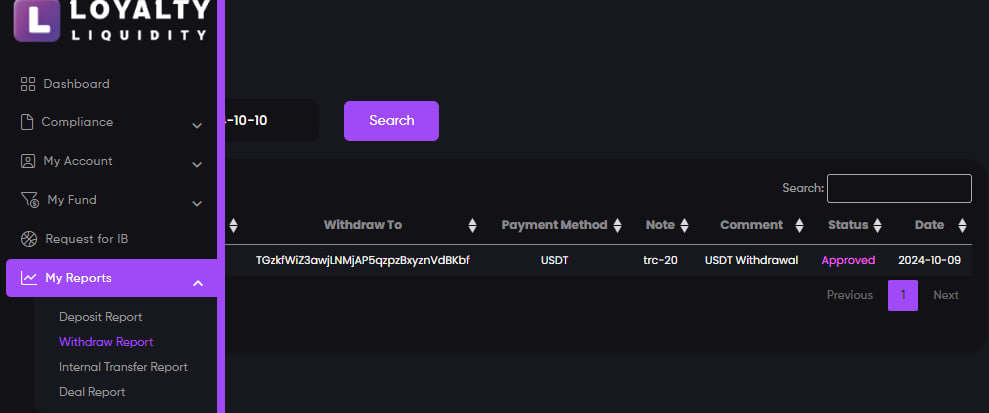

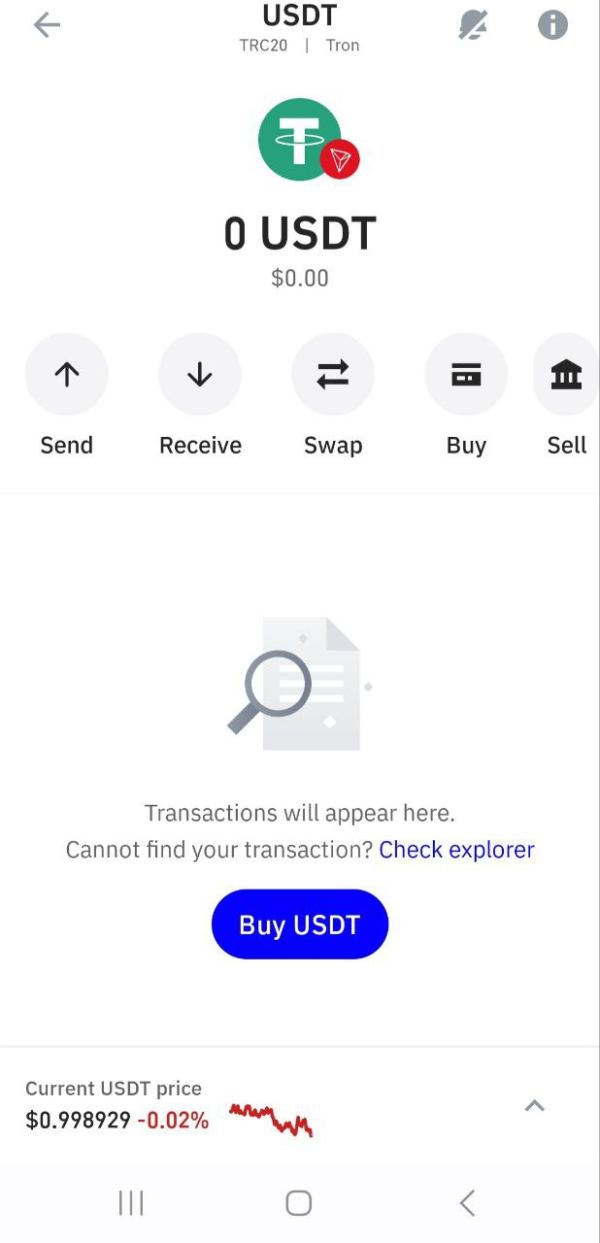

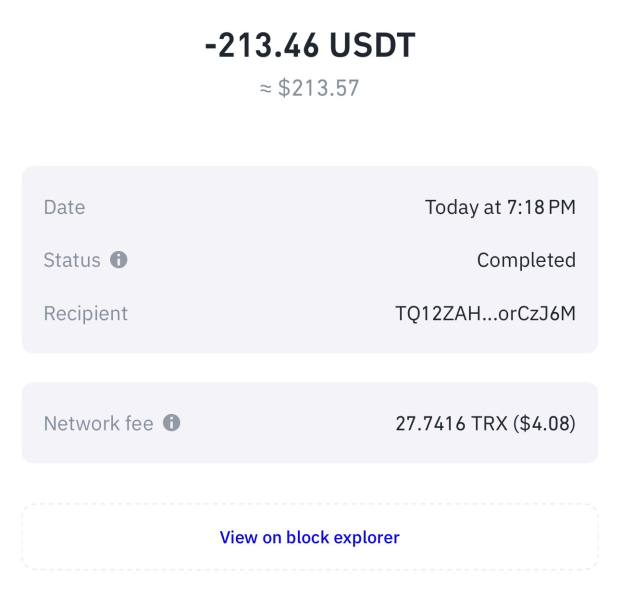

Rathodd

India

I requested a withdrawal but i did never reciaved it. i wll update to positive when i will reciave my withdrawal. also i will upload proof here . thankyou

Exposure

2024-10-10

FX2763227597

India

Hello, quick update. Finally I received my pending withdrawal just now. They said, due to some glitches the withdrawal was pending. But now I'm happy that I got my money. Thanks

Neutral

2024-09-15

Fortenor

Australia

Loyalty Liquidity provides a decent selection of account types to cater to various trader needs. Their spreads are reasonable, making it a cost-effective platform for traders.

Positive

2024-07-17

FX1496336957

New Zealand

Loyalty Liquidity is PERFECT for my scalping strategy. The tight spreads and lightning-fast execution mean I can jump in and out of trades quickly without worrying about slippage.

Positive

2024-06-18

Steve Wong

Singapore

The only reason I did not give them 5 Stars is because they do not have more Withdrawal Options. For me, VISA & Mastercard is the only option. And it cost me about $62 to withdraw money. Not too bad though.

Positive

2024-05-06