简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

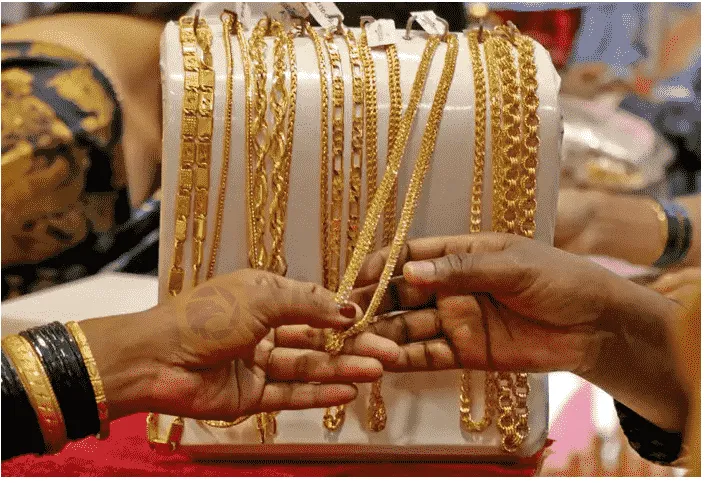

Inflation, price rise could dent India’s gold demand in July-Dec -WGC

Abstract:India’s gold demand in the first half of 2022 jumped 42% from a year ago but consumption in the second half could be lower than last year as higher inflation erodes disposable income, the World Gold Council (WGC) said on Thursday.

Lower purchases by the worlds second-biggest gold consumer could weigh on prices, which are trading near their lowest level in more than a year.

But falling demand for gold imports could help narrow Indias trade deficit and support an ailing rupee.

“Inflation is making it difficult for people, especially in rural areas, to save more and allocate to gold,” Somasundaram PR, regional chief executive officer of WGCs Indian operations, told Reuters.

India‘s annual inflation rate in June remained painfully above the 7% mark and beyond the central bank’s tolerance band for the sixth month in a row, raising the prospects for more rate hikes by the central bank next month.

In the short-term, the rise in local gold prices because of a depreciating rupee and increase in import duty on the bullion will also hurt demand, he said.

Indias demand for gold jumped 43% from a year ago to 170.7 tonnes in the quarter through June as jewellery sales improved because of weddings and the annual Hindu and Jain holy festival of Akshaya Tritiya, when buying gold is considered auspicious, the WGC said in a report published on Thursday.

In the first half of 2022, gold consumption rose 43% to 306.2 tonnes.

The WGC earlier estimated Indias gold consumption in 2022 at 800-850 tonnes, but the likely slowdown in demand in the second half prompted it to scale down that estimate to the lower end of that range at around 800 tonnes.

Higher prices prompting some Indian consumers to liquidate their holdings, which could lift scrap supplies in 2022 above 100 tonnes from 75.2 tonnes a year ago, Somasundaram said.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Top 10 Trading Indicators Every Forex Trader Should Know

Master the top 10 Forex trading indicators to analyze real-time Forex quotes, trends, and market signals. Learn strategies to boost accuracy and avoid mistakes.

Geopolitical Events: What They Are & Their Impact?

You've heard many times that geopolitical events have a significant impact on the Forex market. But do you know what geopolitical events are and how they affect the FX market? Let us learn about it today.

Why Do You Feel Scared During Trade Execution?

Trade execution is a pivotal moment for traders. It is when analysis turns into action, and potential profits or losses become reality. However, for many traders, this moment is accompanied by fear. Why does this happen, and how can you address it?

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

In the midst of financial innovation and regulation, WikiGlobal, the organizer of WikiEXPO, stays abreast of industry trends and conducts a series of insightful and distinctive interviews on pivotal topics. We are delighted to have the privilege of inviting Simone Martin for an in-depth conversation this time.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

Why Do You Feel Scared During Trade Execution?

Currency Calculator