简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Looking For One of the Best Brokers for Copy Trading?

Abstract:The first step to succeeding in copy trading is finding one of the best brokers to join you on your journey.

Copy trading is a unique way to participate in the financial markets and can be a great system for new traders just getting started. You may think many brokers provide the same or similar copy trading experience, but conditions differ significantly between brokers.

In this article, we recap some of the basics of copy trading and then dive into the characteristics you should look for when seeking the best broker to copy trade with.

What is copy trading?

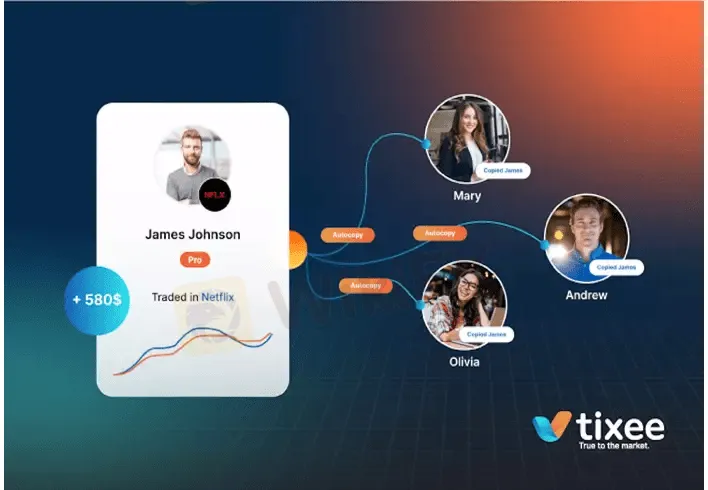

Copy trading is simply a service where one trader can copy the strategies of another, usually more experienced, trader. The strategy provider has a verifiable and proven track record of past performance, and followers have the ability to copy their preferred trading strategy. Copy trading platforms automate copying trades from the strategy provider account to the followers accounts.

The strategy provider benefits from charging a success fee, subscription fee or commission to the followers, while the followers benefit by following a potentially successful trading strategy.

Copy trading brokers

You need a copy trading broker to become a strategy provider or follower. Not all brokers offer copy trading, but many do. A copy trading broker will offer a specialised platform for traders to connect their trading accounts and set their risk parameters.

In most cases, both the strategy provider and follower will have trading accounts in a traditional trading platform (such as MetaTrader 5) while the copy trading platform connects those two accounts together.

When the strategy provider opens a position, the copy trading platform will replicate the same order in all of the accounts following the provider – which could potentially be thousands of accounts and hundreds of transactions.

What are the pros and cons of copy trading?

While copy trading has become increasingly popular in recent years, all forms of investments carry risk. Its therefore vital to understand and evaluate the pros and cons before starting your copy trading journey.

Copy trading saves time

Day trading is incredibly time-consuming, requiring many hours of research and technical analysis to identify trading opportunities. While brokers like tixee offer many great benefits, such as Trading Central analysis, live market reports and insights, the discipline of opening and closing positions can be time-consuming too. With copy trading, you can copy the trades of someone else, which can save you time for other things in life or for working on your own trading or investment strategy.

Trading instrument diversification

In today‘s modern financial markets, there’s a huge range of investment products to choose from. Suppose your trading strategy focuses on a few trading pairs that you‘re comfortable with – this could mean you’re missing out on other opportunities. Therefore, copying other traders who trade different pairs exposes you to different products. To get the full picture, it might be wise to choose a copy trading broker offering several asset classes. For example, tixee offers CFDs on forex, stocks, indices, precious metals, energy products, commodities and cryptos.

Slippage reduces profits and increases losses

For many copy traders, slippage is a huge obstacle to their success. Slippage can occur when there is insufficient liquidity to give all the followers the same order execution prices as the strategy provider, or when there is latency when the strategy providers‘ order is executed and when the followers’ orders are executed.

Because of slippage, some followers can have different prices from the strategy provider, causing performance discrepancies. As some strategy providers may have hundreds of people following their trades, this might lead to significant latency or substantial order volumes executed against thin liquidity, causing slippage.

To avoid slippage, you need a copy trading broker capable of executing large order volumes and a low latency trading infrastructure to ensure the strategy provider and followers orders are executed within milliseconds.

Fee harvesting

Some copy trading brokers let strategy providers earn profits from transaction fees, incentivising them to trade more frequently to generate more fees from their followers. By earning commissions from placing orders rather than focusing on the best trade setups, some strategy providers may be motivated to trade more frequently and potentially take on too much risk just to increase their profits.

A better revenue model is to use performance fees, which will align the interests of the strategy provider and the follower. The tixee social trading platform supports performance fees, so followers only pay for success- not pointless trades.

Ability to control risk as a follower

As a follower, your account balance is at the mercy of others and youre not always able to intervene with decisions you disagree with. Choosing a copy trading broker that offers tools to control your risk in copy trading is important.

For example, the tixee social trading platform allows you to set your risk ratio, total loss to stop following when the account balance drops to a specified level and total profit targets to give you peace of mind when following complete strangers.

Transparent leaderboards and strategy profiles

Most social trading platforms provide leaderboards to help followers find the most profitable strategies. Still, many platforms rank strategies based on all-time return rates, allowing new strategies that turned $10 into $100 (for example) to rank highly because their return is 900%.

Therefore, you need a copy trading broker offering transparent strategy profiles to clearly see essential information about each provider. The tixee social trading platform provides comprehensive strategy profile pages, which help followers make informed decisions and helps sustainable strategy providers present their advantages.

Choosing the best broker for copy trading

While there is no guaranteed success in copy trading or any investment, choosing a broker with a variety of trading platforms, risk management tools, a wide range of trading instruments, competitive fees and a diverse community of strategy providers gives you the best potential chance of success.

Luckily, tixee ticks all those boxes.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

The Royal Malaysia Police (PDRM) has received 26 reports concerning the Nicshare and CommonApps investment schemes, both linked to a major fraudulent syndicate led by a Malaysian citizen. The syndicate’s activities came to light following the arrest of its leader by Thai authorities on 16 December.

WikiFX Review: Is FxPro Reliable?

Founded in 2006, FxPro is a reputable UK-based broker, trading on various market instruments. In this article, we will help you find the answer to one question: Is FxPro reliable?

WikiFX Review: Something You Need to Know About Markets4you

Markets4you, is a global forex broker launched in 2007. It was established in the British Virgin Islands. This broker offers its global traders various market instruments.

Top 10 Trading Indicators Every Forex Trader Should Know

Master the top 10 Forex trading indicators to analyze real-time Forex quotes, trends, and market signals. Learn strategies to boost accuracy and avoid mistakes.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

WikiFX Review: Is FxPro Reliable?

Trading frauds topped the list of scams in India- Report Reveals

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Why Do You Feel Scared During Trade Execution?

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

SEC Approves Hashdex and Franklin Crypto ETFs on Nasdaq

Currency Calculator