Score

GRAND FT Market

Saint Vincent and the Grenadines|2-5 years|

Saint Vincent and the Grenadines|2-5 years| https://www.grandftmarket.com/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Saint Vincent and the Grenadines

Saint Vincent and the GrenadinesAccount Information

Users who viewed GRAND FT Market also viewed..

ATFX

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GTCFX

- 10-15 years |

- Regulated in United Kingdom |

- Straight Through Processing(STP) |

- MT4 Full License

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

CPT Markets

- 10-15 years |

- Regulated in United Kingdom |

- Market Making(MM) |

- MT4 Full License

Website

grandftmarket.com

Server Location

India

Website Domain Name

grandftmarket.com

Server IP

106.51.65.187

Company Summary

| Aspect | Information |

| Registered Country | Saint Vincent and the Grenadines |

| Founded Year | 1-2 years |

| Company Name | GRAND FT Market Limited |

| Regulation | No Regulation |

| Maximum Leverage | Up to 1:1000 (Cent account), Up to 1:500 (Other accounts) |

| Spreads | 0.6 pips |

| Trading Platforms | MT4/5 White Label, Desktop Trader, Webtrader, iOS Trader, Android Trader, MyFxBook |

| Tradable Assets | Forex, Indices, Commodities, Stocks CFDs, ETF CFDs, CFDs on Bitcoin, Cryptocurrencies |

| Account Types | Standard Account, Pro Account, Raw Account, Cent Account, Insurance Account |

| Customer Support | Email: gft-uae@grandftmarket.com |

| Payment Methods | Not mentioned |

| Educational Tools | Help Center, Trading Academy, Market News, Price Tables, Market Calendar |

General Information

GRAND FT Market is an unregulated broker operating under GRAND FT Market Limited, registered in Saint Vincent and the Grenadines. The broker offers a range of trading accounts, including Standard, Pro, Raw Spread, Cent, and Insurance accounts. Each account type has specific features, such as varying spreads, commissions, and leverage options. While the broker claims to provide a diverse selection of tradable assets, including forex, indices, commodities, stocks CFDs, ETF CFDs, CFDs on Bitcoin, and cryptocurrencies.

Traders can access the markets through different trading platforms, including MT4/5 White Label, Desktop Trader, Webtrader, iOS Trader, Android Trader, and MyFxBook. To assist traders in their learning journey, GRAND FT Market provides educational resources such as a help center, trading academy, market news, price tables, and a market calendar.

Pros and Cons

| Pros | Cons |

| Variety of trading account types | Unregulated with no valid regulatory information |

| Multiple trading platforms | Negative feedback and warnings from WikiFX |

| Educational resources for traders | Lack of transparency and oversight due to the absence of regulation |

| Wide range of tradable assets | Limited information about demo and Islamic account options |

| High leverage options | Customer support options are limited to email contact |

| Accessible website in multiple languages | Limited information on deposit and withdrawal methods and fees |

Is GRAND FT Market Legit?

GRAND FT Market is described as an unregulated broker with no valid regulatory information. This means that the broker is not subject to oversight or supervision by any recognized financial regulatory authority. The company behind GRAND FT Market is called GRAND FT Market Limited. It is registered in Saint Vincent and the Grenadines, a jurisdiction known for its lax financial regulations. The company's website is https://www.grandftmarket.com/.

Market Instruments

GRAND FT Market offers a variety of market instruments for trading. These instruments can be categorized into different types, including:

1. Forex: GRAND FT Market provides trading opportunities in various currency pairs, such as GBP/USD, EUR/USD, and USD/JPY.

2. Indices: The broker allows trading on different stock market indices like US100, UK100, and DE30.

3. Commodities: GRAND FT Market offers trading in commodities like GOLD (Au) and OIL.

4. Stocks CFDs: Trading is available for individual stocks of companies such as Apple Inc, Tesla Motors Inc., and Alphabet Inc - class A.

5. ETF CFDs: The broker provides the option to trade ETF (Exchange-Traded Fund) contracts for difference.

6. CFDs on Bitcoin: GRAND FT Market allows trading CFDs based on the price movements of Bitcoin.

7. Cryptocurrencies: Apart from Bitcoin, the broker also supports trading in other cryptocurrencies like Ripple and Ethereum.

Account Types

GRAND FT Market offers a variety of trading account types for its clients.

STANDARD ACCOUNT

The Standard Account requires a minimum deposit of $500 and offers spreads ranging from 1 to 1.5 pips. There is no commission charged, and clients can enjoy leverage of up to 1:500.

PRO ACCOUNT

The Pro Account also requires a minimum deposit of $500 and features a floating spread of 1 pip. Like the Standard Account, there is no commission, and the leverage is set at 1:500.

RAW ACCOUNT

For those seeking tighter spreads, the Raw Spread Account is available. With a minimum deposit of $500, clients can experience spreads as low as 0.6 pips, but there is a commission of $3 per lot/size charged. All three of these account types support Expert Advisors (EA's) and allow hedging.

CENT ACCOUNT

Alternatively, the Cent Account - Low is designed for traders with a smaller budget, as it requires a minimum deposit of $10. Spreads on this account start at 1.5 pips, and there is no commission charged. The leverage offered is higher at 1:1000, providing greater trading flexibility.

INSURANCE ACCOUNT

Lastly, GRAND FT Market offers an Insurance Account, which requires a minimum deposit of $500. It features a floating spread of 1 pip, with a commission of $3 per lot/size. This account type also includes insurance coverage. Like the other accounts, EA's are supported, and hedging is allowed.

Leverage

Trading accounts varies depending on trading accounts, with the Cent account offering the maximum leverage up to 1:1000, leverage offered by another four accounts up to 1:500, which is considered quite high.

Spreads & Commissions

GRAND FT Market offers different leverage options depending on the type of trading account. The Cent account provides the highest leverage, with a maximum of up to 1:1000. The other four accounts offer leverage of up to 1:500, which is considered relatively high.

The spreads and commissions at GRAND FT Market are determined based on the type of trading account. The Cent, Standard, and Pro accounts provide a zero-commission trading environment. The spreads offered on these accounts range from 1.5 pips, 1 pip, to 1-1.5 pips, respectively.

For the Raw Spread account, the spreads are starting from 0.6 pips. The Insurance account also offers spreads starting from 1 pip. However, both of these accounts have an additional commission of $3 per lot per side.

Trading Platform

GRAND FT Market offers multiple trading platforms to cater to different trading styles. Here's a brief description of these platforms:

1. Android Version: The broker provides the MetaTrader 4 app for Android devices. This app allows traders to access their accounts easily from anywhere.

2. iOS Version: GRAND FT Market offers the MetaTrader 4 app for iPhone and iPad users. The mobile app provides flexibility and maintains high speed and quality.

3. Desktop Version: The desktop version of GRAND FT Market's MetaTrader is designed to be user-friendly and convenient. It includes features such as a personalized trading dashboard for efficient monitoring of positions.

4. Web Version: GRAND FT Market provides a web application that allows traders to access the trading environment without the need for a dedicated trading desk. It offers convenience and accessibility from any location.

The various trading platforms mentioned include Desktop Trader, Webtrader, iOS Trader, Android Trader, and MyFxBook.

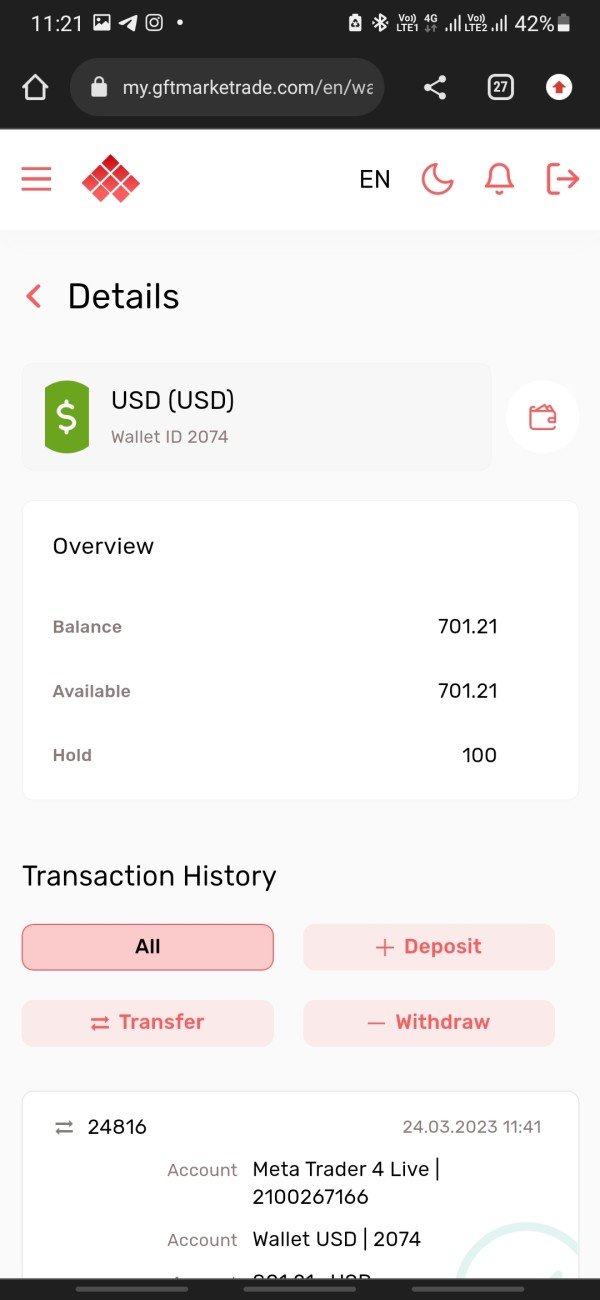

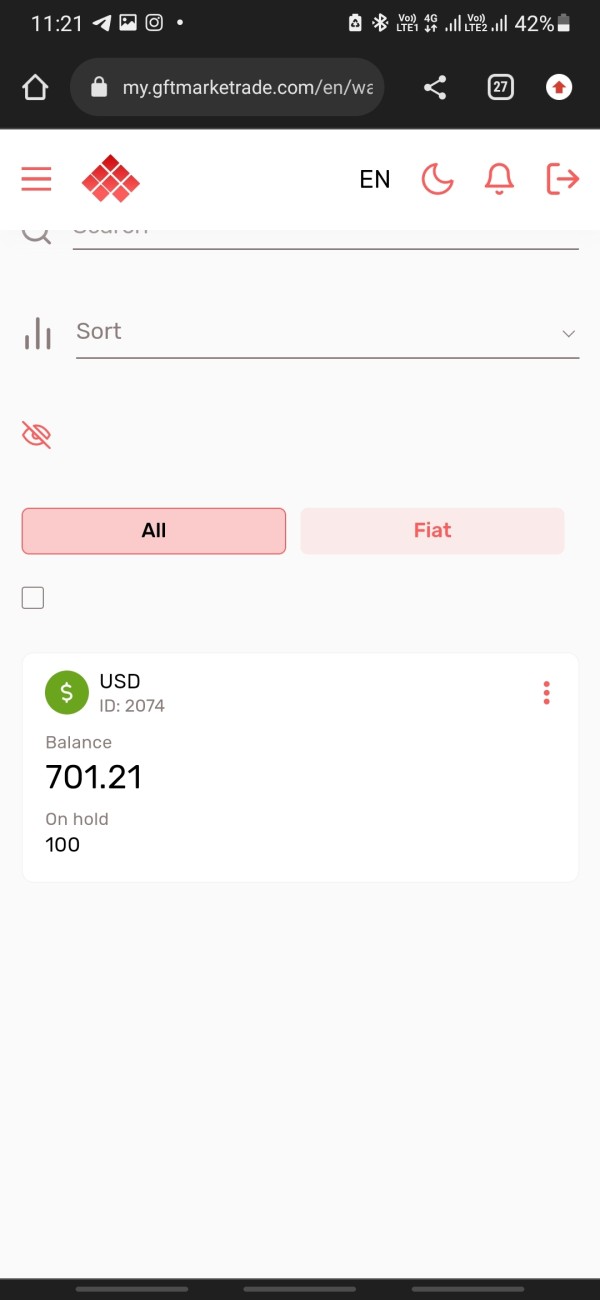

Deposit and Withdrawals

GRAND FT Market has specific deposit and withdrawal requirements for various cryptocurrencies and tokens. The minimum deposit and withdrawal amounts, as well as the required confirmations, may vary depending on the blockchain and network used.

For cryptocurrencies like Bitcoin, Bitcoin Cash, Dash, Dogecoin, Ethereum, Litecoin, Monero, Ripple, Stellar, TRON, Zcash, and Binance Coin, the minimum deposit and withdrawal amounts range from 0.0001 to 5, with minimum confirmations ranging from 3 to 20.

Stablecoins such as Binance USD, Dai, Pax Dollar, TetherUS, TrueUSD, USD Coin, TerraUSD, Tether EURt, and STASIS EURO have minimum deposit and withdrawal amounts ranging from 10 to 25, with a default number of confirmations set at 3.

Liquid tokens like 0x, Aave, Band Protocol, Basic Attention Token, Chainlink, Compound, Decentraland, Loopring, Maker, NuCypher, Polygon, Ren, SushiSwap, Synthetix, The Graph, Uniswap, yearn.finance, and others have specific minimum deposit and withdrawal amounts and default confirmations set for each token.

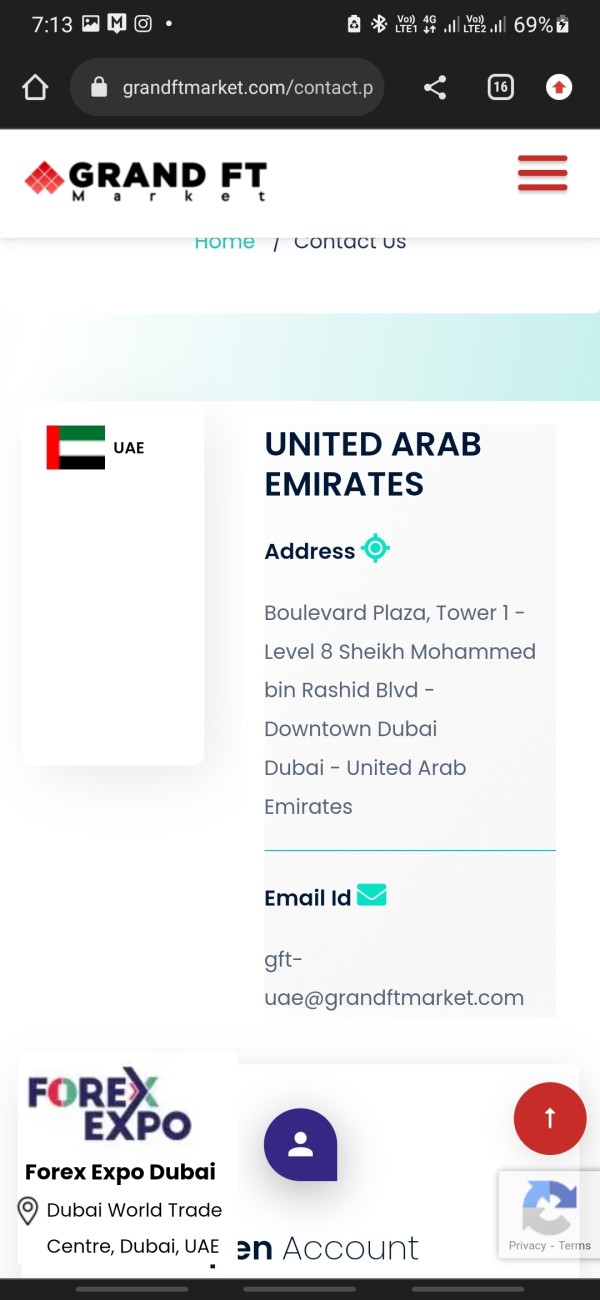

Customer Support

GRAND FT Market provides customer support through various channels.

Their official website is available in multiple languages, satisfy wider range of clients. To contact their customer support, clients can reach out via telephone or email. However, online chat support is not available.

For clients located in the United Arab Emirates, the company's address is Boulevard Plaza, Tower 1 - Level 8 Sheikh Mohammed bin Rashid Blvd - Downtown Dubai, Dubai.

The provided email address for customer inquiries is gft-uae@grandftmarket.com.

Risk Warning

Forex and leveraged trading carry a high level of risks and it is not suitable for all investors.

Conclusion

GRAND FT Market, operated by GRAND FT Market Limited in Saint Vincent and the Grenadines, offers a range of trading account types and tradable assets for its clients.

However, the company's website has received warnings and low ratings from platforms like WikiFX, indicating potential risks associated with GRAND FT Market.

FAQs

What is the minimum deposit requirement for opening an account with GRAND FT Market?

The minimum deposit requirement varies depending on the type of trading account.

What leverage options does GRAND FT Market offer?

GRAND FT Market offers different leverage options depending on the trading account type. The Cent account provides the highest leverage, while other accounts offer leverage up to 1:500.

What trading platforms are available at GRAND FT Market?

GRAND FT Market offers various trading platforms, including MT4/5 White Label, Desktop Trader, Webtrader, iOS Trader, Android Trader, and MyFxBook.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 8

Content you want to comment

Please enter...

Review 8

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

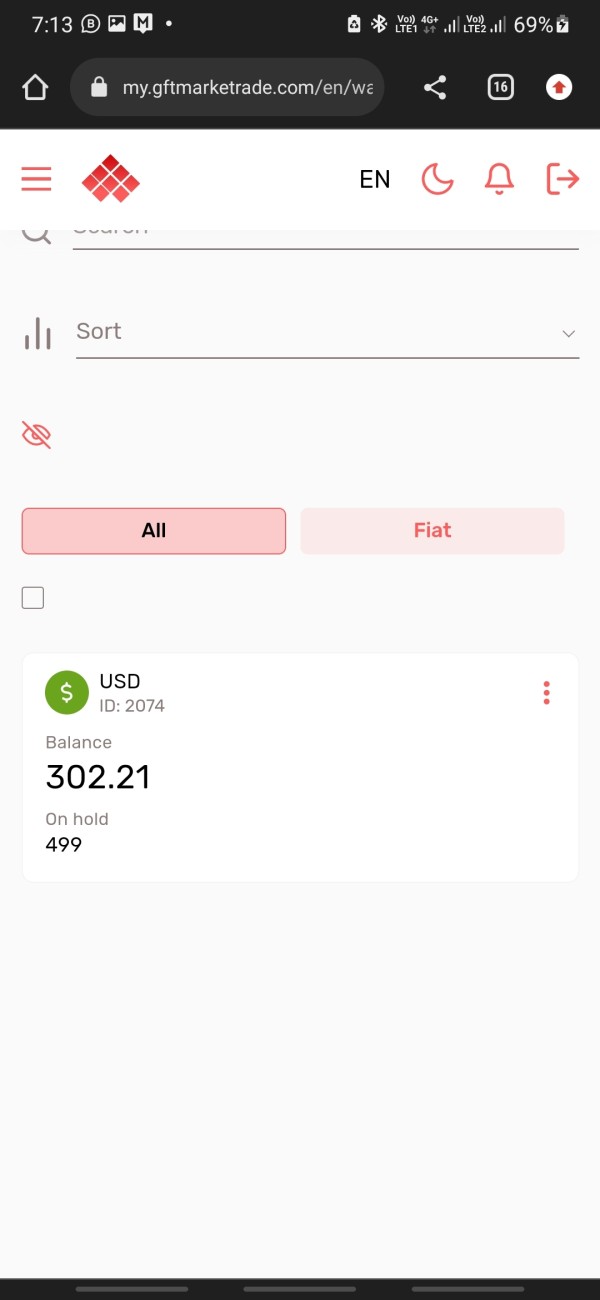

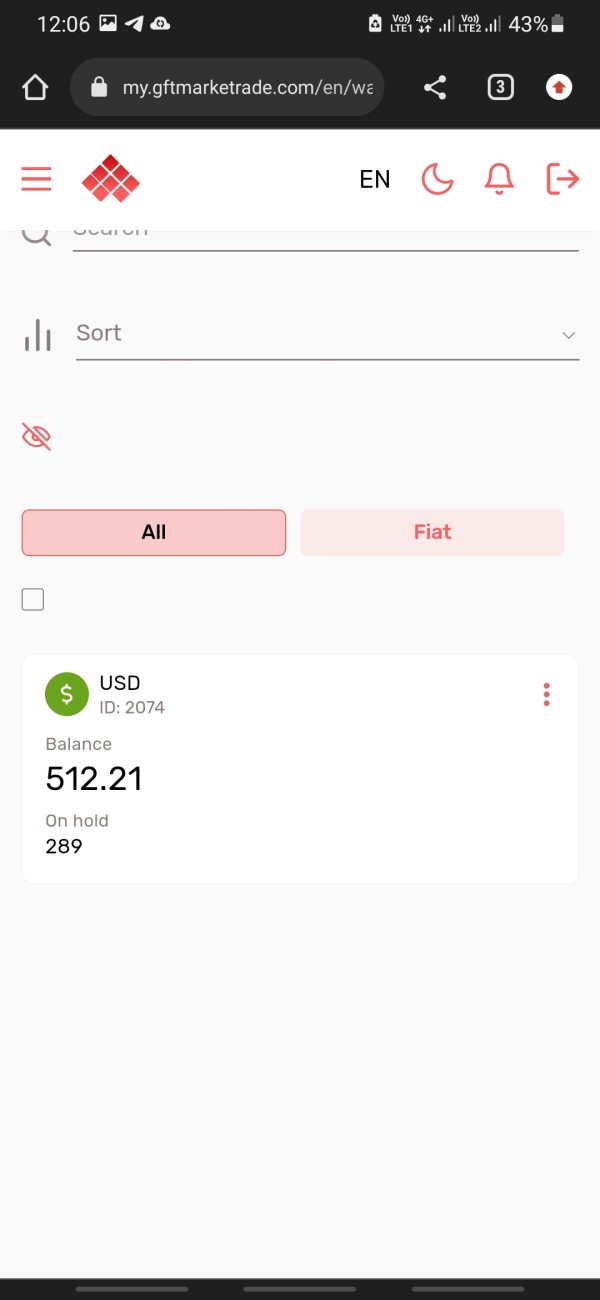

FX1466994611

India

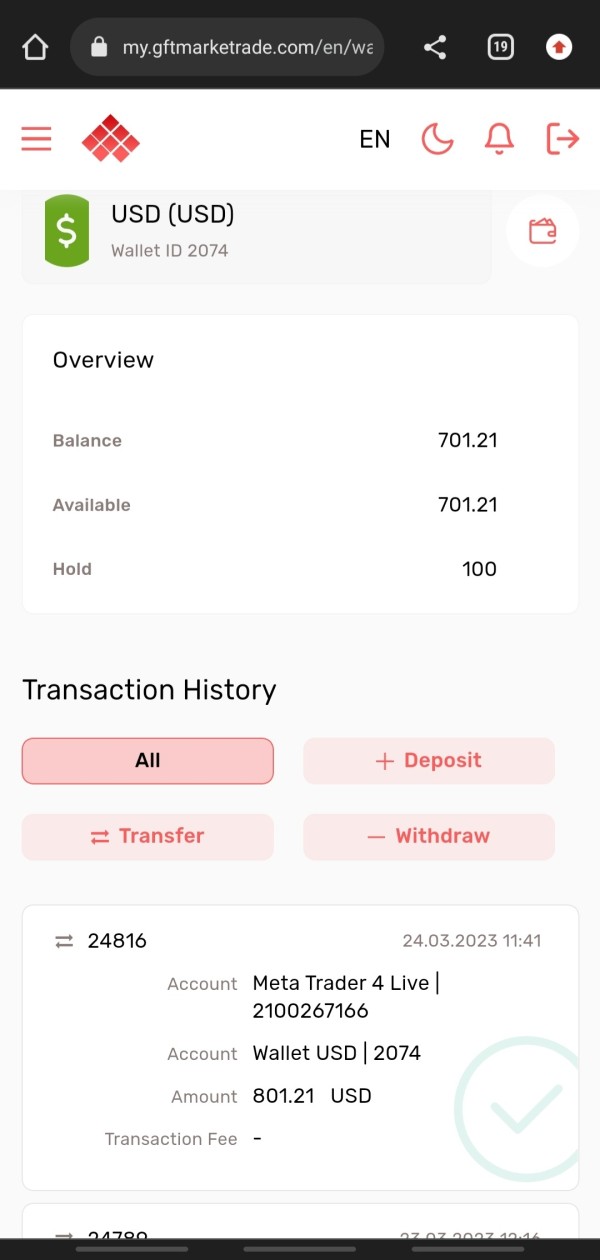

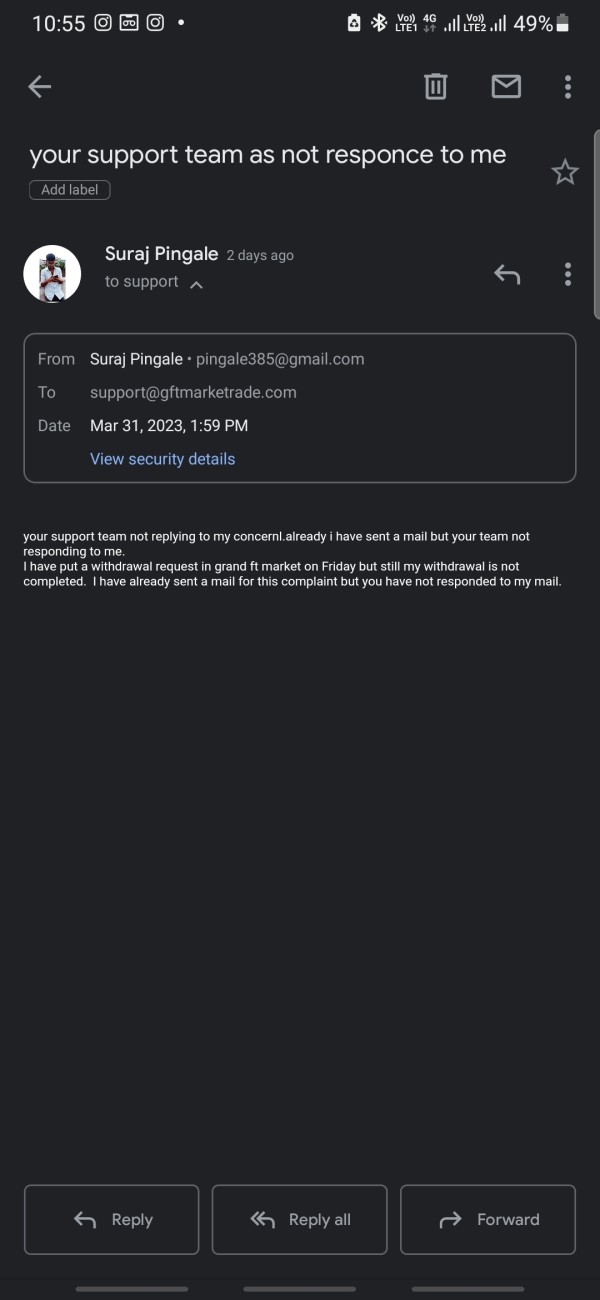

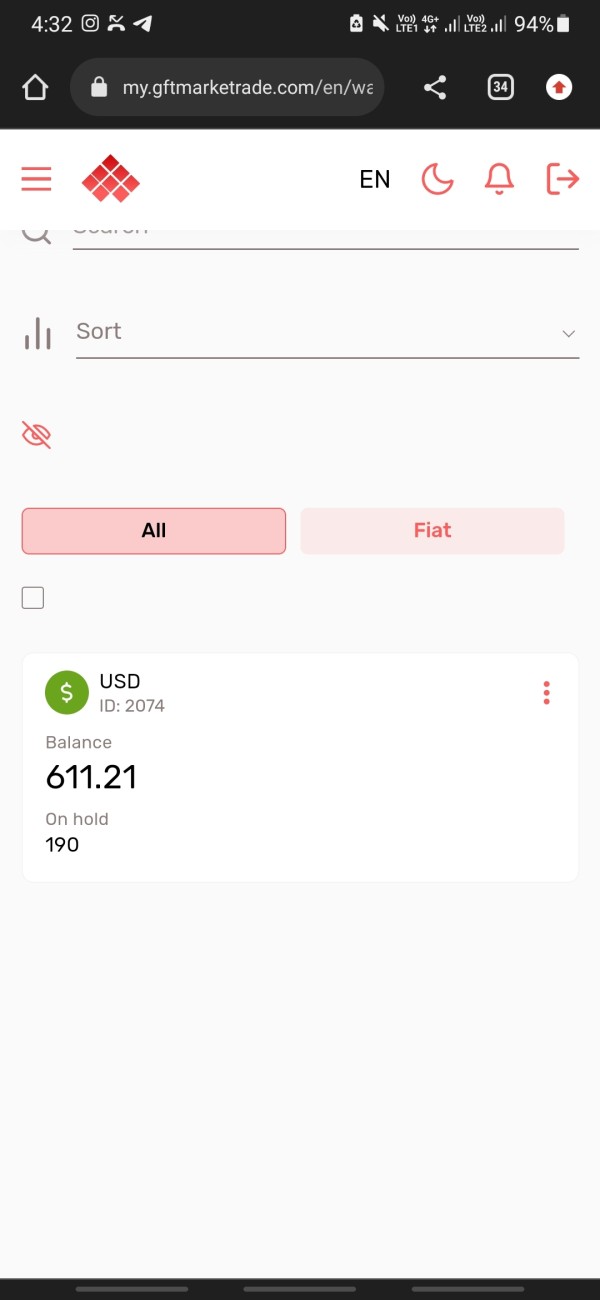

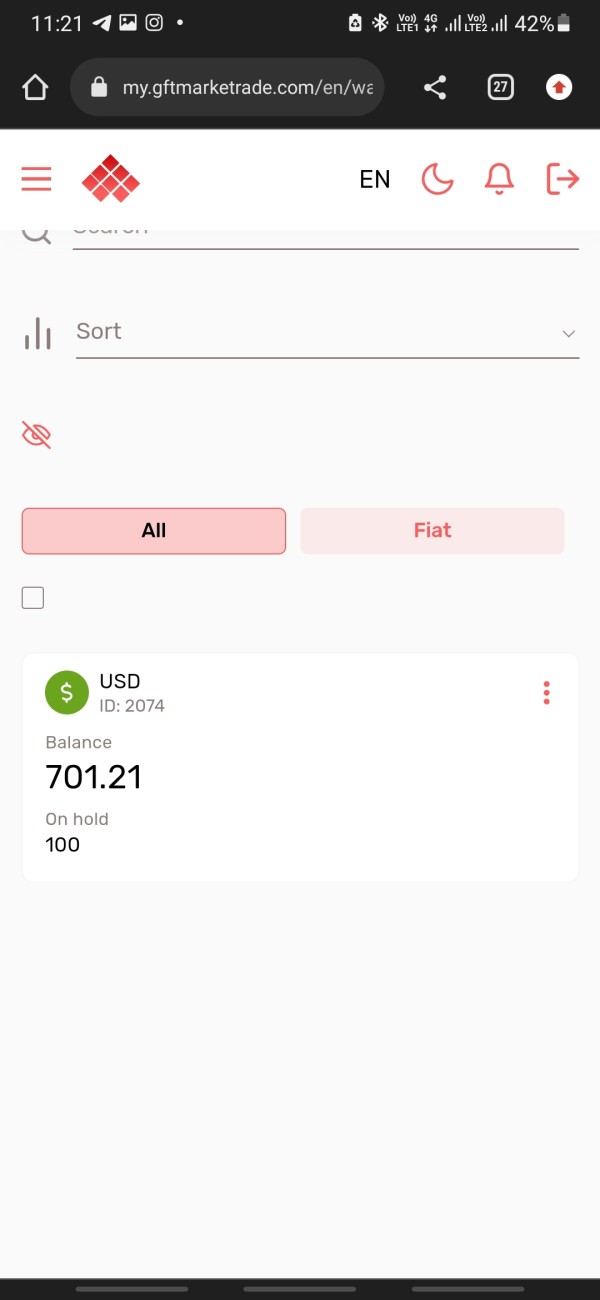

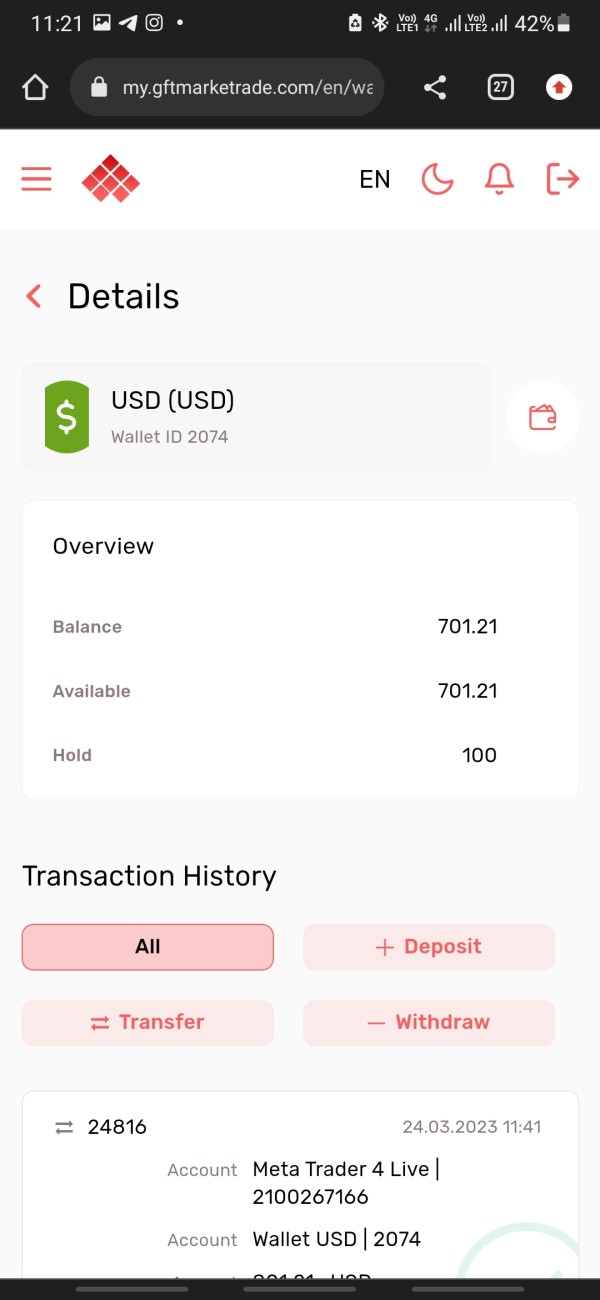

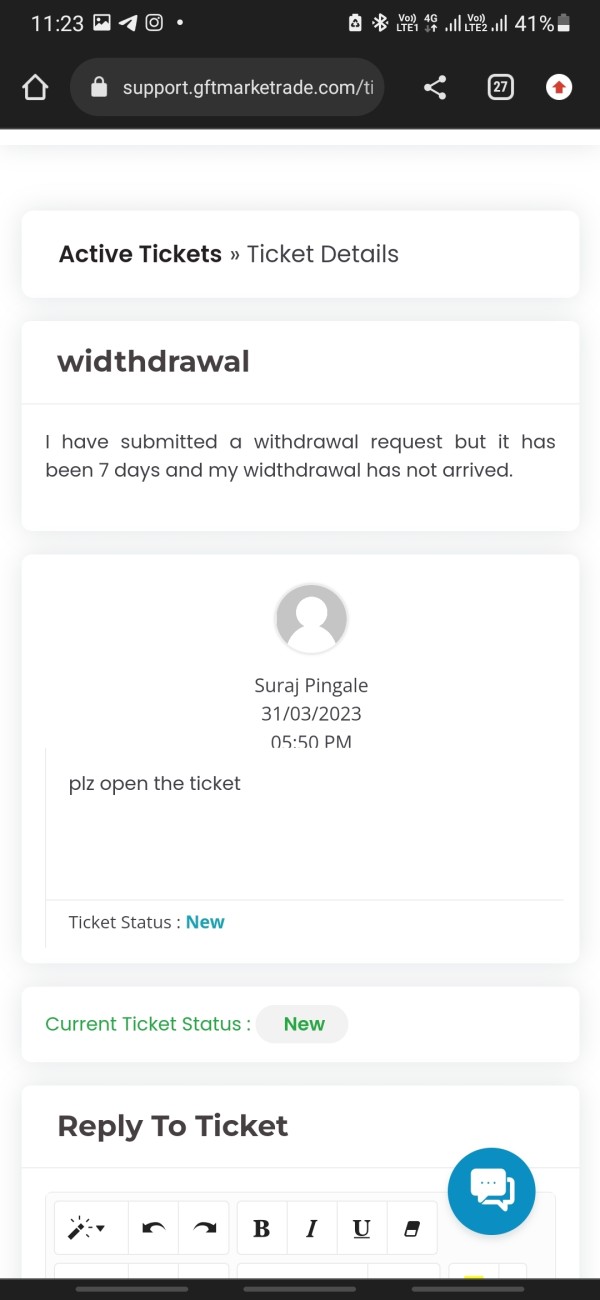

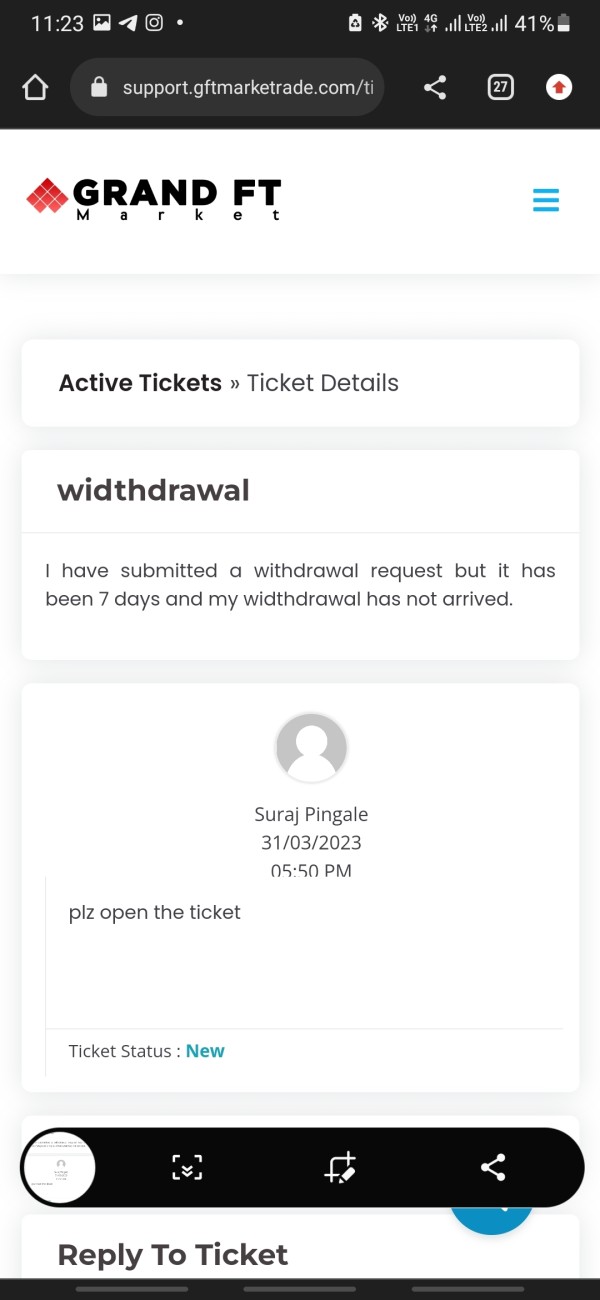

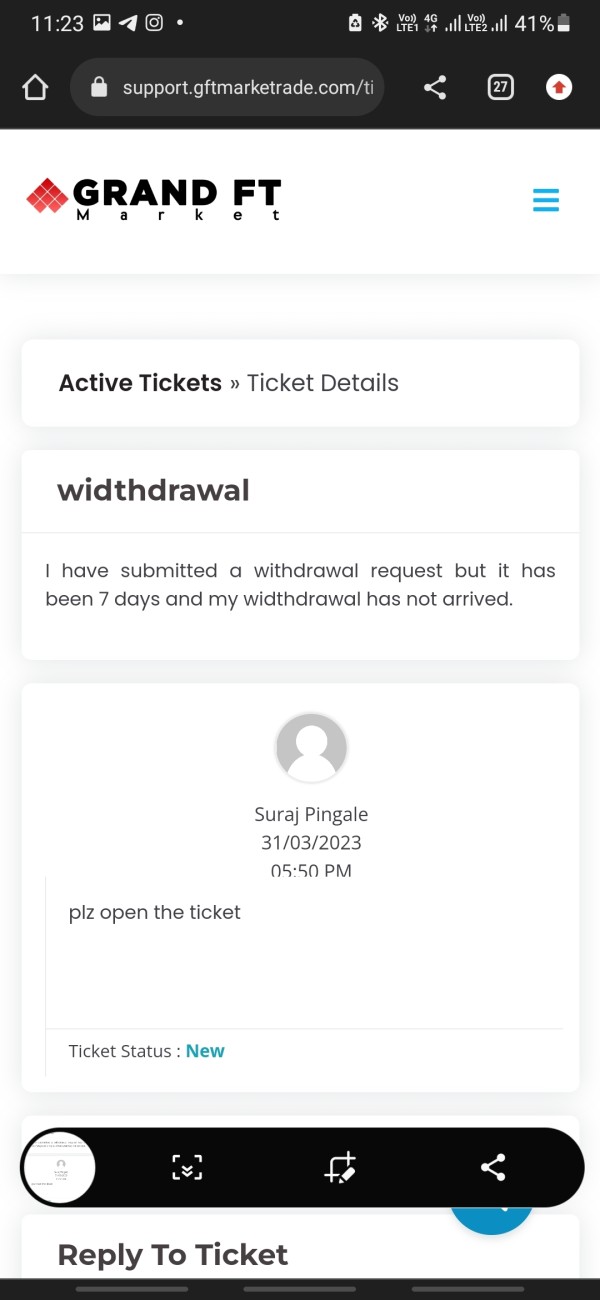

This broker is not giving me withdrawal even after 1 month. I have come across 2 websites of this. I asked for help from both of them but I did not get any help from them. Both of them are fake websites. This broker is doing scam. But it is all hollow.

Exposure

2023-04-16

FX1466994611

India

This broker is a big scammer. He doesn't give withdrawal to anyone. He doesn't reply to mails. His support team doesn't help. I have already placed 2 requests. My 3rd request is also pending.

Exposure

2023-04-06

FX1466994611

India

hold withdrawal unable to response my mails

Exposure

2023-04-05

FX1466994611

India

I have put a withdrawal request of 100 dollars to this broker. Their policy is that if the withdrawal does not come within 48 hours, it will come within 7 days. But still my withdrawal is not completed. No

Exposure

2023-04-04

FX1466994611

India

I have made a withdrawal request of 100 dollars with this broker on Friday 24 March 2023. Their policy is that if the withdrawal does not come within 48 hours, it will come within 7 days. But still my withdrawal is not completed. I have mailed their support team to inquire. Still could not solve my problem.

Exposure

2023-04-03

FX1089805244

Australia

GRAND FT Market offers a variety of account types to choose from, as well as demo accounts, but only for 15 days. By contrast, most brokers typically offer demo accounts for up to a month or even more.

Neutral

2022-12-01

蚂蚁

Netherlands

An excellent brokerage with a tight-spreads, great execution. I love how smooth the broker is. Anyway, a great broker that deserves you give it a try.

Positive

2023-02-28

战洲

Indonesia

This platform’s cent account is very suitable for those beginners who don’t want to risk too much. Besides, good news is that this broker promises that it doesn’t charge any inactivity fee. I’ve tested its demo account for over two weeks, and it did give me a good impression. Guys, I am gonna open a real one, and will share my trading experience with you later!🍻

Positive

2022-12-01