简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Crucial Things to Do Immediately After Getting Scammed

Abstract:Abhorrent internet frauds and crimes have been mushrooming as the internet finance industry develops. The tactics used by syndicate groups are constantly evolving in various forms and scales making it difficult to predict and prevent, let alone for the police to prosecute them.

Nowadays, most telecom fraud crimes, as well as forex broker scams, are being conducted overseas. These fraudsters usually commit crimes in a gang operation and have a specific division for each stage of conduct. This makes it easy for them to launder the money that they scammed to make it difficult to trace over time.

If you have unfortunately fallen prey to a scam by your forex broker, the most important thing is to not panic. There are some important “SOS” steps that you need to carry out within the golden 30 minutes after you have been scammed. If done right, there is a chance that you could recover your losses.

The fraud victim should immediately carry out self-help measures as below:

Call the bank immediately. Deliberately call the bank that you have done the transfer. Any bank will have an automatic voice prompt in place for password and identity checks. At this stage, you must deliberately give them the wrong information, so the bank in concern will lock that bank account. The fraudster now cannot have access to his bank account through internet banking, ATM, or over-the-counter. Your transferred funds could be rejected and be redeposited back into your personal account. Simultaneously, this gives the police more time to step in for an investigation while the bank is also alerted about this specific account and user.

It should be noted that this method can only keep the fraudsters account locked within the day and he could regain access after that. Therefore, you can keep doing this step until his account gets locked and frozen.

At the same time, you should also gather as much evidence as you can and quickly submit them to the police. Bring the police report to the bank to bring this issue to their attention. Most banks will have a specialized team that works to prevent money laundering and financial crimes, and they will likely cooperate with the police as well.

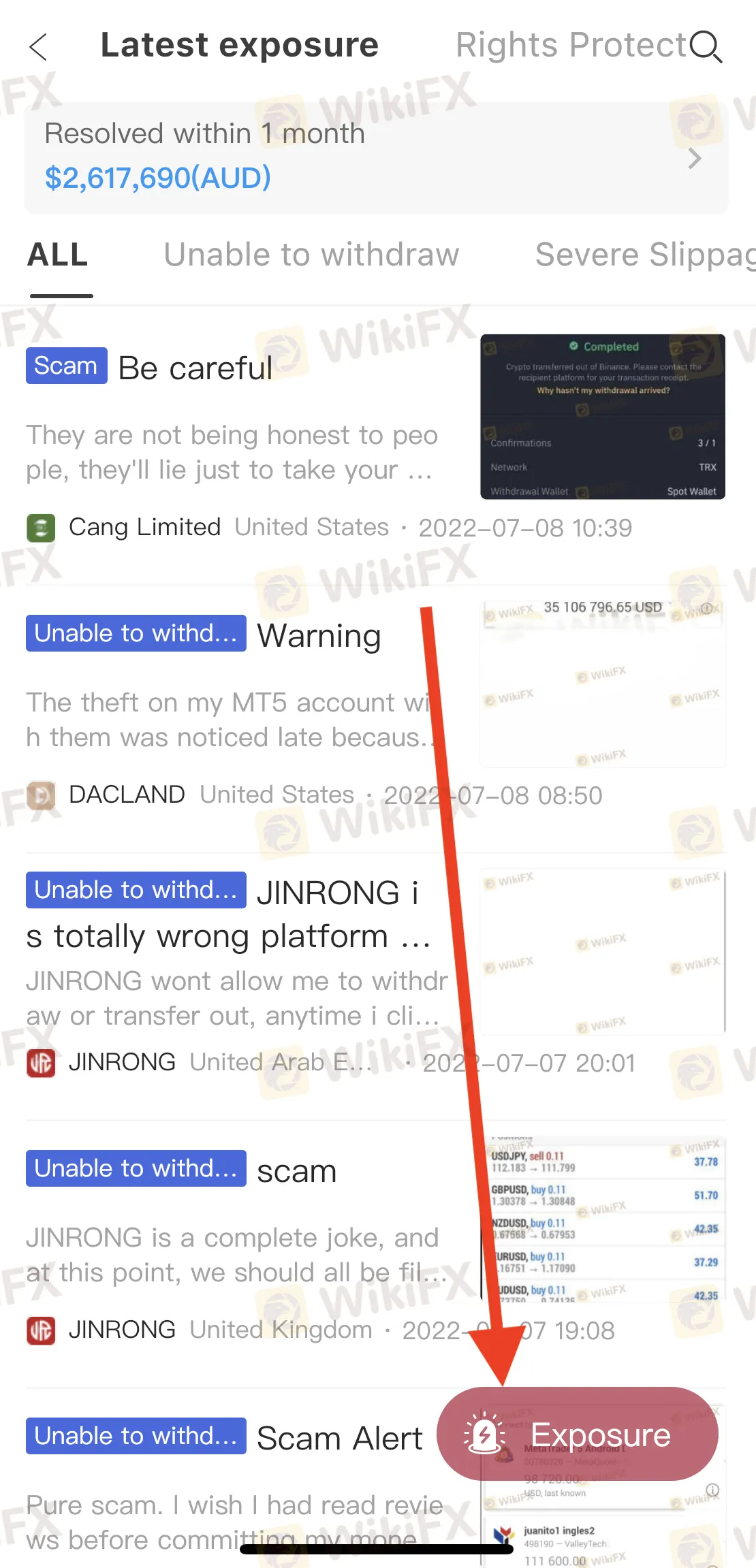

Another thing that you can do is lodge an Exposure case on the WikiFX mobile app along with the gathered evidence. WikiFX is a global forex broker regulatory query app that specializes in any broker-related information and issues. We also act as a mediator for unresolved dispute cases between traders and their brokers – without any fees or charges.

Follow the simple steps below:

Alternatively, get in touch with WikiFXs customer support team for assistance and guidance via any of the channels below:

Within the golden half an hour after one finds out that he has been cheated, the first thing is to report to the police and contact the bank with the official police report. This step if done in a timely manner can increase the chances of stopping the transaction from going through.

Criminal groups often open multi-level of accounts and transfer money through banks in rapid layers. Determine this golden half hour, is to consider the fraudster found the money to the account also need about half an hour or so to find someone to transfer money, so it is a race against the fraudster in time. The quicker the scammed person finds out he or she has been scammed the more effective it is to save themselves.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Smart Prop Trader to Close Doors in December 2024

Smart Prop Trader, a proprietary trading firm known for offering funded trading accounts, has announced plans to cease onboarding new traders as it prepares to wind down operations by the end of the year.

XM Group: A Leading Multi-Asset Broker Honored for Exceptional Customer Experience and Service

XM Group, operating under the entity name XM Global Limited, has emerged as a prominent force in the global forex and derivatives trading industry, boasting over 15 million clients worldwide. Since its inception in 2009, XM has evolved into a reputable multi-asset broker, offering an extensive range of more than 1400 trading instruments across 10 asset classes. With a strong emphasis on corporate values, innovative technology, and exceptional customer service, XM has established itself as a true industry leader.

NAGA Adds UAE, Saudi Stocks to Platform with Zero Commissions

NAGA introduces UAE and Saudi Arabian stocks to its trading platform, offering zero commissions and expert tools like Autocopy to tap into booming Middle Eastern markets.

Moomoo Financial & M1 Finance Face FINRA Sanctions for Influencer Misconduct

FINRA has fined Moomoo Financial and M1 Finance for failing to ensure compliance with regulatory standards in their social media influencer programmes, highlighting the growing need for robust oversight in digital marketing within the financial services industry.

WikiFX Broker

Latest News

Unleash Your Trading Skills: Join the WikiFX KOL India Trading Competition!

NAGA Adds UAE, Saudi Stocks to Platform with Zero Commissions

Tether to Discontinue EURt Stablecoin Amid Regulatory Shifts in Europe

Adani’s Bribery Scandal! SEC Charges, Major Fallout & Adani’s Stand

Broker Review: Is FOREX.com a solid Broker?

Philippine Banks Launch PHPX Stablecoin to Transform Payments

ED uncovered 106 Crore "Nagaland Crypto Scam"

Smart Prop Trader to Close Doors in December 2024

Meme Coins: Fleeting Fortune or Financial Folly?

Philippine Scam Ring Targets Aussie Men with Fake Crypto Offers

Currency Calculator