Score

Trader’s Way

Dominica|5-10 years|

Dominica|5-10 years| https://www.tradersway.com

Website

Rating Index

MT4/5 Identification

MT4/5

Full License

TradersWay-Demo

Influence

B

Influence index NO.1

United States 6.02

United States 6.02MT4/5 Identification

MT4/5 Identification

Full License

Germany

GermanyInfluence

Influence

B

Influence index NO.1

United States 6.02

United States 6.02Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Dominica

DominicaAccount Information

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed Trader’s Way also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Decode Global

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

AUS GLOBAL

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

Sources

Language

Mkt. Analysis

Creatives

Website

Most visited countries/areas

Canada

United Arab Emirates

United States

tradersway.com

Server Location

Hong Kong

Most visited countries/areas

India

Website Domain Name

tradersway.com

Website

WHOIS.PUBLICDOMAINREGISTRY.COM

Company

PDR LTD. D/B/A PUBLICDOMAINREGISTRY.COM

Domain Effective Date

2010-12-13

Server IP

43.249.36.81

Company Summary

| Registered in | Dominica |

| Regulated by | No effective regulation at this time |

| Year(s) of establishment | 2-5 years |

| Trading instruments | Forex, metals, energies, cryptos, stocks, indices |

| Demo account | Yes |

| Minimum Initial Deposit | $10 |

| Maximum Leverage | 1:1000 |

| Minimum spread | 0.0 pips onwards |

| Trading platform | MT4, MT5, cTrader, mobile apps |

| Deposit and withdrawal method | BITCOIN,ETHER,LITECOIN,RIPPLE,USD COIN (USDC),TETHER (USDT),TRUEUSD (TUSD),STELLAR,SKRILL,NETELLER,PERFECT MONEY,FASAPAY,BANK TRANSFER (ABRA),TC PAY,LOCAL TRANSFER (MALAYSIA),LOCAL TRANSFER (VIETNAM),LOCAL TRANSFER (NIGERIA),LOCAL TRANSFER (INDIA) |

| Customer Service | 24 hours on business days, email, phone number, address, live chat |

| Fraud Complaints Exposure | No for now |

It is important to note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

Pros and cons of Trader's Way

Pros:

Wide range of trading instruments, including forex, metals, energies, cryptos, stocks, and indices.

Multiple account types to cater to different trading preferences and strategies.

Advanced trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader.

Low minimum initial deposit requirement of $10.

Support for various payment options, including cryptocurrencies and popular e-wallets.

Cons:

Lack of effective regulation at present.

Limited educational resources compared to some other brokers.

Potential limitations or unavailability of certain payment systems due to local regulations.

Customer service response time may be relatively long.

Exposure to forex trading risks such as market volatility and leverage risks.

What type of broker is Trader's Way?

| Advantages | Disadvantages |

| Trader‘s Way offers tight spreads and fast execution due to its Market Making model. | As a counterparty to its clients' trades, Trader’s Way has a potential conflict of interest that may lead to decisions that are not in the best interest of its clients. |

Trader‘s Way is a Market Making (MM) broker, which means that it acts as a counterparty to its clients in trading operations. That is, instead of connecting directly to the market, Trader’s Way acts as an intermediary and takes the opposite position to its clients. As such, it can offer faster order execution speed, tighter spreads and greater flexibility in terms of the leverage offered. However, this also means that Trader‘s Way has a certain conflict of interest with their clients, as their profits come from the difference between the bid and ask price of assets, which could lead to them making decisions that are not necessarily in the best interests of their clients. It is important for traders to be aware of this dynamic when trading with Trader’s Way or any other MM broker.

General information and regulation of Trader's Way

Trader's Way is a forex broker that is registered in Dominica and offers trading services in various financial instruments, including forex, metals, energies, cryptos, stocks, and indices. The company provides multiple account types to cater to different trading strategies and investment levels. With a range of trading platforms, including MT4, MT5, and cTrader, as well as mobile apps, traders have access to advanced trading tools and features. Trader's Way also offers flexible deposit and withdrawal options, responsive customer support, and high leverage of up to 1:1000, providing traders with opportunities to participate in the global financial markets.

In the following article, we will analyze the characteristics of this broker in all its dimensions, providing you with easy and well-organized information. If you are interested, read on.

Market instruments

| Advantages | Disadvantages |

| Diversification | Volatility of certain instruments |

| Opportunity for profit | Market-specific risks |

| Access to different markets | Complexities in understanding markets |

| Hedging potential | Higher capital requirements |

| Potential for long-term growth | Regulatory risks |

In terms of trading instruments, Trader's Way offers a diverse range of options including forex, metals, energies, cryptocurrencies, stocks, and indices. This provides traders with the opportunity to diversify their portfolios and take advantage of various market movements. Forex trading allows for trading different currency pairs, offering flexibility and liquidity. Precious metals like gold and silver serve as potential safe-haven assets. Energies such as oil and natural gas are influenced by global supply and demand dynamics. Cryptocurrencies offer opportunities in a rapidly growing digital asset market. Stocks provide exposure to individual companies and their performance, while indices represent broader market trends.

Spreads and commissions for trading with Trader's Way

| Advantages | Disadvantages |

| Variable spreads | Commission charges |

| Lower trading costs during low-volatility | Higher trading costs during high-volatility |

| periods | periods |

| Real-time spreads reflect market conditions | Limited control over spreads |

Trader's Way offers a range of account types with different spreads, commissions, and costs, allowing traders to choose what suits them best. The advantages of variable spreads include the ability to take advantage of lower trading costs during low-volatility periods and real-time spreads that reflect market conditions. However, traders using accounts with variable spreads should be aware that trading costs may be higher during high-volatility periods.

On the other hand, ECN accounts come with commission charges. While these accounts offer the advantage of low spreads, traders need to consider the impact of commissions on their overall trading costs. Additionally, ECN accounts may provide limited control over spreads as they are influenced by market conditions and liquidity providers.

Trading accounts available in Trader's Way

| Advantages | Disadvantages |

| MT4.VAR. Account | MT4.ECN., MT5.ECN., & CT.ECN. Account |

| - Low minimum deposit | - Commission charges |

| - Flexible variable spreads | - Higher trading costs |

| - Suitable for various trading strategies | - Market volatility may increase spread |

| - No commission charges | - Limited control over spread |

| - Real-time spreads reflect market conditions |

Trader's Way offers a range of account types to cater to different trading preferences. The MT4.VAR. account is designed for traders who prefer variable spreads that reflect market conditions. With a low minimum deposit requirement and no commission charges, it provides flexibility for various trading strategies. However, traders using this account type may experience higher trading costs due to wider spreads during volatile market periods.

For experienced traders seeking direct access to the interbank market, Trader's Way offers ECN accounts through the MT4, MT5, and cTrader platforms. These accounts feature low minimum deposits and minimal variable spreads, which can reach as low as 0 pips under favorable market conditions. However, ECN accounts come with commission charges, which should be considered when evaluating trading costs.

Trading platform(s) that Trader's Way offers

| Advantages | Disadvantages |

| MetaTrader 4 ECN | Limited features compared to newer platforms |

| - Popular and widely used platform | No support for certain advanced trading strategies |

| - Provides direct access to the interbank | Limited customization options |

| market | |

| MetaTrader 5 ECN | Transition may require learning a new platform |

| - Next-generation trading terminal | Limited availability of plugins and expert advisors |

| - Improved features and functionality | Limited integration with some brokers |

| cTrader | Relatively new platform with fewer users |

| - Designed specifically for ECN/STP trading | Limited availability of brokers supporting the platform |

| - Full-featured and user-friendly interface | Fewer customization options |

| Mobile Apps | Smaller screen size may limit analysis and trading |

| - Trading on the go | Limited access to advanced trading tools and features |

| - Available for iOS, Android, and | Less efficient for complex trading strategies |

| Windows mobile devices |

The platform dimension of Trader's Way includes several options to cater to different trading preferences. The advantages and disadvantages of each platform are as follows:

MetaTrader 4 ECN is a popular and widely used platform that provides direct access to the interbank market. It is well-established and favored by traders for its reliability. However, it may lack some advanced features and customization options compared to newer platforms.

MetaTrader 5 ECN is the successor to MT4 and offers improved features and functionality. It is a next-generation trading terminal with enhanced capabilities. However, transitioning to MT5 may require learning a new platform, and it may have limited availability of plugins and expert advisors compared to MT4.

cTrader is a newer platform specifically designed for ECN/STP trading. It offers a full-featured and user-friendly interface. However, as a relatively new platform, it may have fewer users and limited availability of brokers supporting the platform. It may also have fewer customization options compared to other platforms.

Mobile Apps allow traders to trade on the go using their iOS, Android, or Windows mobile devices. It provides convenience and flexibility. However, the smaller screen size may limit analysis and trading capabilities, and access to advanced trading tools and features may be limited compared to desktop platforms.

Traders should consider their trading needs, preferences, and device compatibility when choosing a platform from the options provided by Trader's Way.

Maximum leverage of Trader's Way

| Advantages | Disadvantages |

| Higher potential for amplified profits | Increased risk of significant losses |

| Allows for greater trading volume | Requires careful risk management and disciplined trading |

| Provides flexibility in position sizing | High leverage can magnify market volatility and price movements |

| Offers potential for diversification | Inexperienced traders may be more susceptible to mistakes |

| Allows for more trading opportunities | Margin calls and forced liquidations can occur more easily |

| Can be beneficial for experienced traders | May attract speculative and high-risk trading behaviors |

The maximum leverage dimension of Trader's Way offers a maximum leverage of up to 1:1000. Leverage allows traders to control larger positions with a smaller amount of capital. It can provide several advantages but also comes with certain disadvantages that traders should consider.

The advantages of high leverage include the potential for amplified profits, greater trading volume, flexibility in position sizing, potential for diversification, and more trading opportunities. Experienced traders who understand the risks involved and employ effective risk management strategies can benefit from higher leverage.

However, it is important to be aware of the disadvantages of high leverage. Increased leverage also increases the risk of significant losses. Traders must exercise caution and implement disciplined trading practices to mitigate the risks associated with high leverage.

Deposit and Withdrawal: methods and fees

| Advantages | Disadvantages |

| Multiple payment options to accommodate client preferences | Potential fees or charges for certain payment methods |

| Quick and efficient deposit/withdrawal process | Some payment methods may not be available in certain regions |

| Secure and convenient transactions | Verification process may be required for certain actions |

| Flexibility to use different payment methods for withdrawals | Limited availability of payment systems in some locations |

| Ability to use own funds for trading | Processing of payments done by third-party systems |

The deposits and withdrawals dimension of Trader's Way offers clients a range of payment options for convenient and efficient transactions. By providing multiple payment channels, clients have the flexibility to use their preferred method for depositing and withdrawing funds. However, it is important to consider the advantages and disadvantages associated with this dimension.

The advantages of the deposits and withdrawals dimension include the availability of multiple payment options to accommodate client preferences, a quick and efficient deposit/withdrawal process, secure and convenient transactions, the flexibility to use different payment methods for withdrawals, and the ability to use their own funds for trading.

On the other hand, there are some potential disadvantages to consider. Certain payment methods may incur fees or charges, which can impact the overall cost of transactions. Additionally, some payment methods may not be available in certain regions, limiting the options for clients. The verification process may be required for certain actions, ensuring the security and compliance of the transactions. There may also be limited availability of payment systems in some locations, which can affect the convenience of depositing and withdrawing funds. Lastly, the processing of payments is done by third-party systems, and their functionality cannot be guaranteed, so it is essential to make trades based on the current balance rather than anticipating a raised balance.

Educational resources in Trader's Way

| Advantages | Disadvantages |

| Access to economic calendar for important market events | Limited availability of in-depth educational content |

| Webinars provide interactive learning opportunities | Lack of personalized education tailored to individual needs |

| Market info helps stay updated on market trends | Potential reliance on external sources for educational content |

| Enhances understanding of market dynamics and trends | Limited availability of educational resources in multiple languages |

| Helps traders make informed trading decisions | Some educational resources may require additional fees |

The educational resources dimension of Trader's Way offers clients a range of tools to enhance their knowledge and understanding of the financial markets. These resources include an economic calendar, webinars, and market information. However, it is important to consider the advantages and disadvantages associated with this dimension.

Customer service of Trader's Way

| Advantages | Disadvantages |

| Multiple communication channels for customer support | Lack of 24/7 customer support |

| Prompt response to inquiries within 24 hours on business days | Potential delays in response during high volume periods |

| Dedicated email addresses for different types of inquiries | Limited availability of support on weekends and holidays |

| Social media presence for easy accessibility and updates | Inability to provide immediate assistance for urgent issues |

| Professional and accessible contact phone number | Potential language barriers for non-English speaking clients |

The customer care dimension at Trader's Way encompasses multiple communication channels and aims to provide prompt assistance to clients. The following table outlines the advantages and disadvantages associated with this dimension.

The advantages of Trader's Way's customer care include the availability of multiple communication channels such as phone, email, and social media platforms like Facebook, Telegram, Instagram, and Twitter. This allows clients to choose their preferred method of contact. The company aims to respond to inquiries within 24 hours on business days, ensuring timely assistance. Dedicated email addresses for new accounts, customer service, and technical support streamline the inquiry process, enabling efficient communication.

Conclusion

In conclusion, Trader's Way is a registered forex broker based in Dominica that offers a wide range of trading instruments, including forex, metals, energies, cryptos, stocks, and indices. With its various account types and flexible deposit options, traders of all levels can find suitable trading conditions. The availability of popular trading platforms like MT4, MT5, and cTrader, along with mobile apps, ensures convenient access to the markets. Trader's Way strives to provide a seamless trading experience by offering competitive spreads, high leverage of up to 1:1000, and advanced trading tools. While the company operates without effective regulation at this time, it compensates by prioritizing customer support, with 24-hour service and multiple contact channels. Additionally, the company facilitates quick deposits and withdrawals through various payment methods, including cryptocurrencies. Although traders should be aware of potential risks associated with unregulated brokers, Trader's Way aims to meet the needs of its clients by offering a comprehensive trading environment.

Frequently asked questions about Trader's Way

Question: What is Trader's Way?

Answer: Trader's Way is a forex brokerage company that offers a wide range of trading instruments, including forex, metals, energies, cryptos, stocks, and indices. They provide various account types, advanced trading platforms, and payment options to cater to the diverse needs of traders.

Question: Is Trader's Way a regulated company?

Answer: At this time, Trader's Way operates without effective regulation. It is important to consider this aspect when choosing a broker and evaluate the associated risks.

Question: What are the minimum initial deposit requirements?

Answer: The minimum initial deposit at Trader's Way is $10, allowing traders with different investment levels to start trading. This low entry barrier makes it accessible to a wide range of individuals.

Question: Which trading platforms are available at Trader's Way?

Answer: Trader's Way offers popular trading platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. These platforms are well-known for their advanced features, user-friendly interfaces, and compatibility with various devices.

Question: What payment methods are accepted by Trader's Way?

Answer: Trader's Way provides a diverse range of deposit and withdrawal methods, including Bitcoin, Ethereum, Litecoin, Ripple, USD Coin (USDC), Tether (USDT), TrueUSD (TUSD), Stellar, Skrill, Neteller, Perfect Money, FasaPay, Bank Transfer (ABRA), TC Pay, and local transfers for Malaysia, Vietnam, Nigeria, and India.

Question: How long does it take for deposit and withdrawal requests to be processed?

Answer: Trader's Way aims to process withdrawal requests within 48 hours on business days. However, the processing time may vary depending on the payment method and external factors. Deposits are usually processed promptly.

Question: Does Trader's Way charge fees for deposits and withdrawals?

Answer: Trader's Way does not charge any deposit or withdrawal fees from their end. However, it's important to note that network fees may apply and are deducted by the respective payment systems or banks during the transaction process.

Keywords

- 5-10 years

- Suspicious Regulatory License

- MT4 Full License

- MT5 Full License

- High potential risk

Review 4

Content you want to comment

Please enter...

Review 4

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

Mayaz Ahmad

Bangladesh

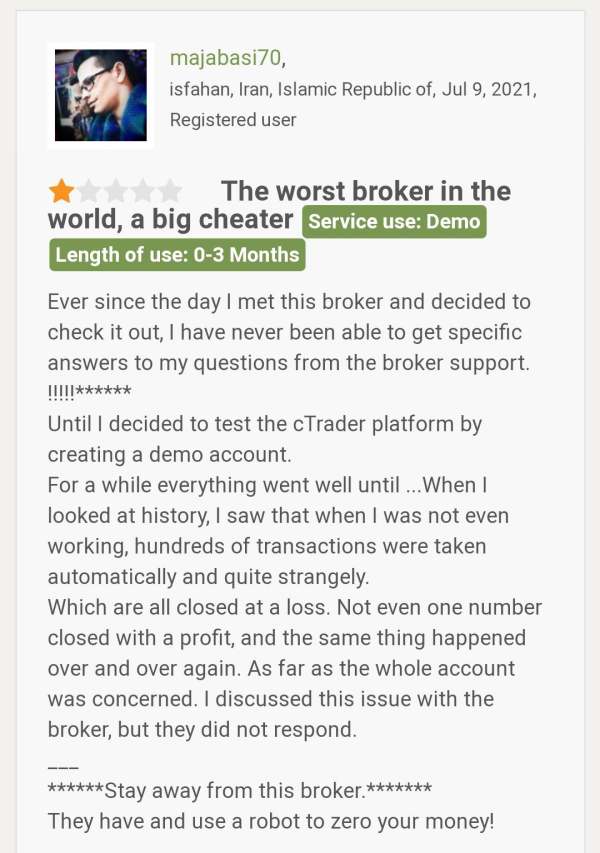

A client has complained that transactions took place automatically from his account and all of them were closed at a loss. This happened many times and when he tried to contact the broker they did not respond. The client also says they have a robot to empty your account.

Exposure

2021-07-16

Mayaz Ahmad

Bangladesh

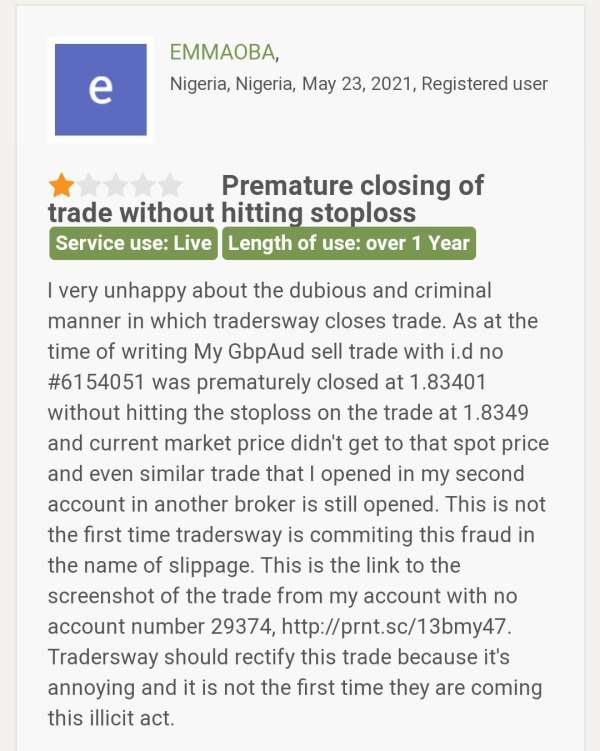

A client of Trader's Way has been conned in the name of Slippage. He called this broker a criminal.

Exposure

2021-05-28

FX1487113102

South Africa

Speaking of Trader's Way, I've got plenty to say. First off, they've got a broad range of market options to choose from, which means you can navigate your way through a wealth of financial markets. The trading process is also streamlined, making it efficient and effortless. They've got a multi-layered security system in place, which ticks the box for secure trading. And least but not last, their deposit and withdrawal process is speedy, which means you can start trading or pull out your cash in no time. All in all, it's a smashing experience. Highly recommended!

Positive

04-26

FX1222754830

Netherlands

I am 100% satisfied with them. Of course, you know customer support is very important. My customer support experience with them was 100% perfect. Unbelievably good for me.

Positive

2023-02-14