Score

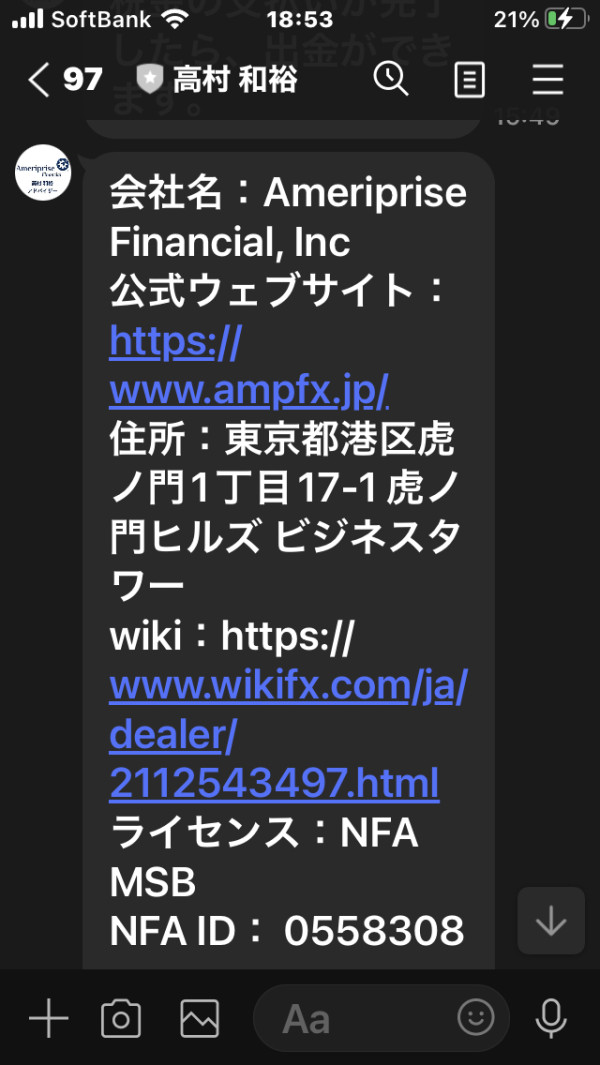

Ameriprise Financial

Japan|1-2 years|

Japan|1-2 years| https://www.ampfx.jp/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- This broker has been verified to be illegal and all of its licences have expired, and it has been listed in WikiFX's Scam Brokers list. Please be aware of the risk!

Basic information

Japan

JapanAccount Information

Users who viewed Ameriprise Financial also viewed..

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Decode Global

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FBS

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

ampfx.jp

Server Location

Lithuania

Website Domain Name

ampfx.jp

Server IP

84.32.84.32

Company Summary

| Aspect | Information |

| Registered Country/Area | Ameriprise Financial is based in Japan. |

| Founded Year | The company was established within the last year. |

| Company Name | The full name is Ameriprise Financial Inc. |

| Regulation | Regulated by the NFA (National Futures Association) with concerns about its effectiveness and operating outside permitted regions. |

| Minimum Deposit | A minimum deposit of 100 yen is required to start trading. |

| Maximum Leverage | The company has moderate financial leverage with a debt-to-equity ratio of 1.43. |

| Spreads | Fixed spreads for market instruments, e.g., 0.2 pips for USD/JPY. Commission fees for specific trades. |

| Trading Platforms | Offers a trading app for iOS and Android with various features, including offline mode. |

| Tradable Assets | Offers Forex pairs, CFDs on stocks (e.g., AAPL, AMZN, GOOGL), spot trading assets, and margin-traded assets. |

| Account Types | Provides options such as Individual Brokerage Account, IRA (traditional and Roth), Joint Brokerage Account, Trust Account, Custodial Account. |

| Demo Account | Availability not provided in the information. |

| Islamic Account | Availability not provided in the information. |

| Customer Support | Contactable at +81 03 6824 7682, located at 17-1 虎ノ門ヒルズ ビジネスタワー. |

| Payment Methods | Accepts deposits through check, cash, or wire transfer, with fees and limits depending on the method and account type. |

| Educational Tools | Specific information about educational tools is not available. |

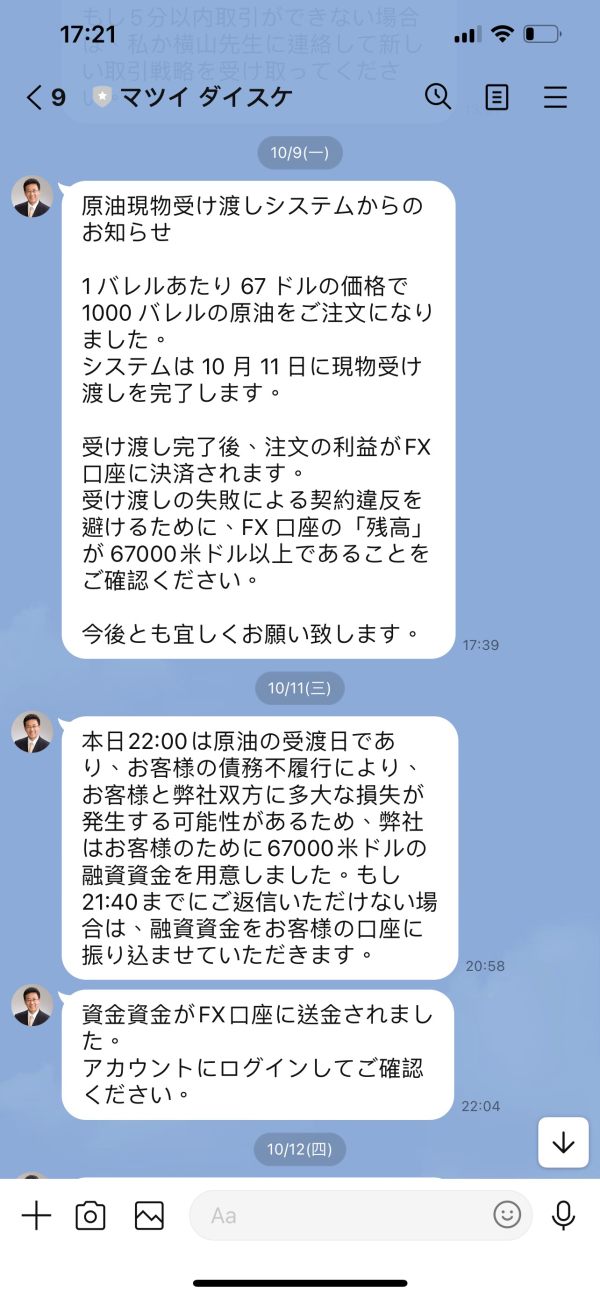

Overview of Ameriprise Financial

Ameriprise Financial Inc. is a financial services provider operating in Japan. While it is regulated by the National Futures Association (NFA) in the United States, concerns exist regarding the effectiveness of this regulation. The NFA's regulatory status is noted as “No authority,” and Ameriprise Financial is mentioned as operating outside the permitted region, raising compliance concerns. Potential clients should exercise caution and be aware of associated risks when considering this provider.

Ameriprise Financial offers various market instruments, including forex pairs, CFDs on stocks, spot trading, and margin trading. They provide fixed spreads and commission fees for trading, establishing straightforward cost structures. The company's financial leverage is moderate, with a debt-to-equity ratio of 1.43. Additionally, Ameriprise Financial offers a range of account types, including individual brokerage accounts, IRAs, joint brokerage accounts, trust accounts, and custodial accounts, catering to different investment needs.

The minimum deposit requirement is 100 yen, and while the provider offers cost-effective fee structures for account opening, maintenance, deposits, and withdrawals, fees are incurred for loss cuts and forced settlements. Ameriprise Financial also offers a trading app for iOS and Android devices, providing trading features and accessibility for traders on the go. Customer support can be reached at +81 03 6824 7682, with the company's address located at 17-1 虎ノ門ヒルズ ビジネスタワー.

Pros and Cons

Ameriprise Financial presents a mixed landscape of advantages and disadvantages. On the positive side, the company is regulated by NFA (0558308), offering a level of oversight. It also boasts a low minimum deposit requirement and a user-friendly trading app with advanced features. Additionally, the straightforward commission fee structure and free account opening and maintenance can be appealing. However, there are concerns regarding regulatory effectiveness and compliance. The firm's limited diversity in account types and the variety of fees for different instruments might be restrictive for some traders. Moreover, the selection of market instruments is somewhat limited, and commission fees could impact overall trading costs. Multiple deposit and withdrawal options are available, but certain methods may incur fees and have limits.

| Pros | Cons |

| Regulated by NFA (0558308) | Concerns about regulatory effectiveness and compliance |

| Low minimum deposit requirement | Varying fees for different instruments |

| Trading app with advanced features | Limited diversity in account types |

| Straightforward commission fees | Limited types of market instruments |

| Free account opening and maintenance | Commission fees may apply, impacting trading costs |

| Multiple deposit and withdrawal options | Fees and limits for certain withdrawal methods |

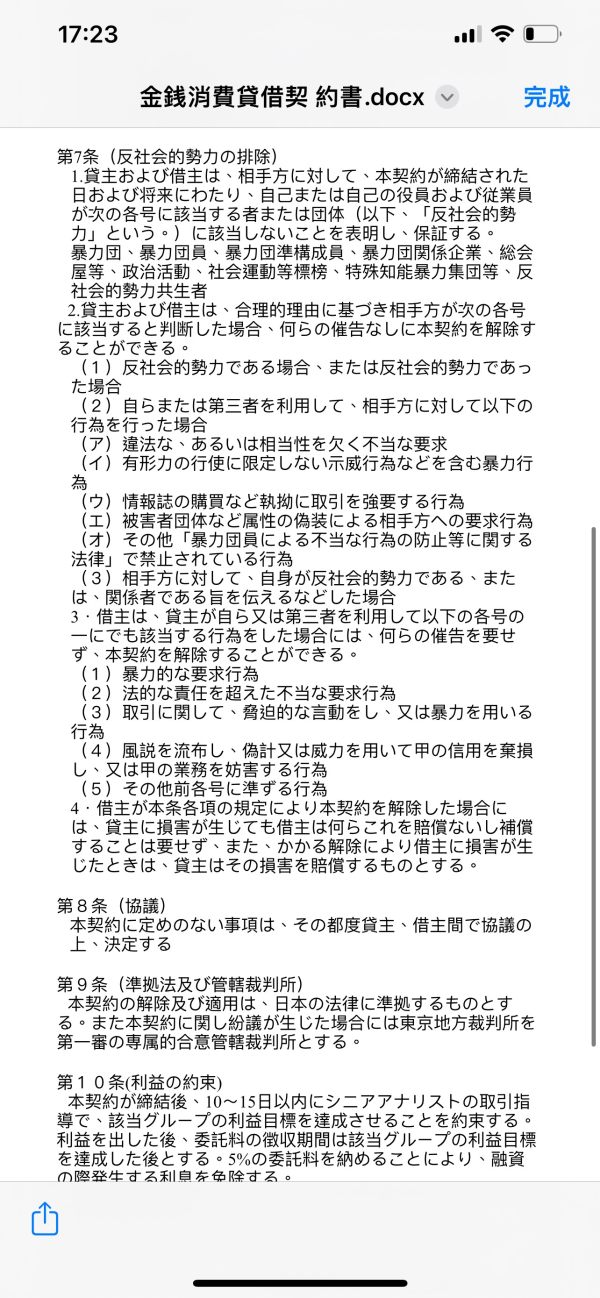

Is Ameriprise Financial Legit?

Ameriprise Financial is regulated by the National Futures Association (NFA) in the United States, with a regulation number of 0558308. However, it's important to note that according to the provided information, there are concerns about the effectiveness of this regulation. The NFA has an abnormal state of regulation, and there is a note indicating “No authority” regarding their regulatory status. Additionally, it is mentioned that Ameriprise Financial is operating outside the permitted region, which raises concerns about compliance. Therefore, potential clients should exercise caution and be aware of the associated risks when considering Ameriprise Financial as a financial service provider.

Market Instruments

FOREX PAIRS: Ameriprise Financial offers a wide range of currency pairs for forex trading. Examples include popular pairs like EUR/USD, GBP/JPY, and AUD/CAD, each with its respective spreads and fees.

CFDs ON STOCKS: Within their CFD offerings, Ameriprise Financial provides access to various stocks. Examples of these stocks may include well-known companies like Apple Inc. (AAPL), Amazon.com Inc. (AMZN), and Alphabet Inc. (GOOGL), with different fees associated with each CFD.

SPOT TRADING: Ameriprise Financial's spot trading options allow traders to engage in short-term trades. This includes 1-day flat rate plans for transactions up to 1 million yen. Examples of assets available for spot trading encompass currency pairs, commodities like gold and oil, and stock indices.

MARGIN TRADING: For those interested in leveraging their investments, Ameriprise Financial offers margin trading. Similar to spot trading, they provide a 1-day flat rate plan for transactions up to 1 million yen. Examples of margin-traded assets encompass major currency pairs, stock indices like the S&P 500, and select commodities.

Pros and Cons

| Pros | Cons |

| Wide range of forex pairs with various options | Different fees associated with CFDs on stocks |

| Access to well-known stocks through CFD offerings | Limited explanation of spot trading options and fees |

| Margin trading available for leveraging investments | Information about margin trading is relatively limited |

Account Types

Individual Brokerage Account: This type of account is designed for individuals who want to invest in stocks, bonds, mutual funds, and other securities.

IRA: An IRA is a retirement savings account that offers tax advantages. There are two main types of IRAs: traditional IRAs and Roth IRAs.

Joint Brokerage Account: This type of account is designed for two people who want to invest together.

Trust Account: A trust account is a type of account that is used to hold assets for the benefit of another person.

Custodial Account: A custodial account is a type of account that is used to hold assets for a minor child.

Leverage

Ameriprise Financial's financial leverage is moderate, with a debt-to-equity ratio of 1.43. This means that the company has $1.43 in debt for every $1 in equity.

Spreads & Commissions

Ameriprise Financial provides fixed spreads for its market instruments, such as a fixed spread of 0.2 pips for the USD/JPY currency pair, along with commission fees for specific trades, like CFDs starting at 0circle and spot trading with fees beginning at 50Yen. These fixed spreads and commission fees establish straightforward cost structures for traders.

Fees

Ameriprise Financial offers cost-effective fee structures for traders. They provide free account opening and maintenance, as well as free deposits and withdrawals. However, it's important to note that fees are incurred for loss cuts and forced settlements, and they operate on a 1-day flat-rate plan, applicable up to a total contract price of 1,000,000 yen per day.

Minimum Deposit

Ameriprise Financial requires a minimum deposit of 100 yen to start trading.

Deposit & Withdraw

Deposits can be made by check, cash, or wire transfer. Withdrawals can be made by writing a check, using an ATM, or transferring money to another account. There are some limits and fees associated with withdrawals, depending on the type of account and the withdrawal method.

Pros and Cons

| Pros | Cons |

| Multiple deposit options (check, cash, wire) | Withdrawal limits and fees can apply |

| Various withdrawal methods (check, ATM, transfer) | Fees and limits depend on the account and method |

| Some methods may incur additional charges |

Trading Platforms

Ameriprise Financial offers a range of trading platforms, including a trading app available for iOS and Android devices. The app provides users with features such as one-touch trading, customizable screen layouts, access to historical trading data, advanced drawing tools, and over 30 indicators for market analysis. It is compatible with both iOS and Android devices, providing fast trading speeds and options in screen layout customization. Additionally, users can access the app in offline mode for viewing prices and graphs. The app is available for free download from the respective app stores, ensuring accessibility for traders on the go.

| Pros | Cons |

| User-friendly trading app for iOS and Android devices | Limited information on platform stability and uptime |

| Advanced features such as one-touch trading and over 30 indicators | No popular trading platforms available |

| Accessibility with offline mode and free app download | Lack of information on customer support availability |

Customer Support

Ameriprise Financial's customer support can be reached at +81 03 6824 7682, and their company address is 17-1 虎ノ門ヒルズ ビジネスタワー.

Conclusion

In conclusion, Ameriprise Financial, though regulated by the National Futures Association, raises concerns about the effectiveness of its regulation, as it lacks clear authority and operates outside the permitted region. The company offers various market instruments, account types, and trading platforms, but potential clients should be cautious due to compliance risks. Ameriprise Financial's financial leverage is moderate, and it provides fixed spreads and commission fees, establishing straightforward cost structures. While they offer cost-effective fee structures for certain services, fees are incurred for loss cuts and forced settlements. The minimum deposit requirement is 100 yen, and there are limitations and fees associated with deposits and withdrawals. The trading app provides options for traders. However, clients should exercise due diligence and consider the associated risks before engaging with Ameriprise Financial.

FAQs

Q1: What is the full name of Ameriprise Financial?

A1: The full company name of Ameriprise Financial is Ameriprise Financial Inc.

Q2: Is Ameriprise Financial a legitimate financial service provider?

A2: Ameriprise Financial is regulated by the National Futures Association (NFA) in the United States, but there are concerns about the effectiveness of this regulation, and the company is operating outside the permitted region. Caution is advised when considering their services.

Q3: What market instruments does Ameriprise Financial offer?

A3: Ameriprise Financial offers forex pairs, CFDs on stocks, spot trading, and margin trading, providing access to various assets like currency pairs, stocks, commodities, and stock indices.

Q4: What types of accounts are available with Ameriprise Financial?

A4: Ameriprise Financial offers Individual Brokerage Accounts, IRAs (traditional and Roth), Joint Brokerage Accounts, Trust Accounts, and Custodial Accounts.

Q5: What is the minimum deposit requirement for trading with Ameriprise Financial?

A5: Ameriprise Financial requires a minimum deposit of 100 yen to start trading.

Q6: What trading platforms are offered by Ameriprise Financial?

A6: Ameriprise Financial offers a trading app for iOS and Android devices, providing trading features, customization options, historical data access, and over 30 market analysis indicators.

Q7: How can I contact Ameriprise Financial's customer support?

A7: You can reach Ameriprise Financial's customer support at +81 03 6824 7682, and their company address is 17-1 虎ノ門ヒルズ ビジネスタワー.

Keywords

- Scam Brokers

- 1-2 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 7

Content you want to comment

Please enter...

Review 7

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

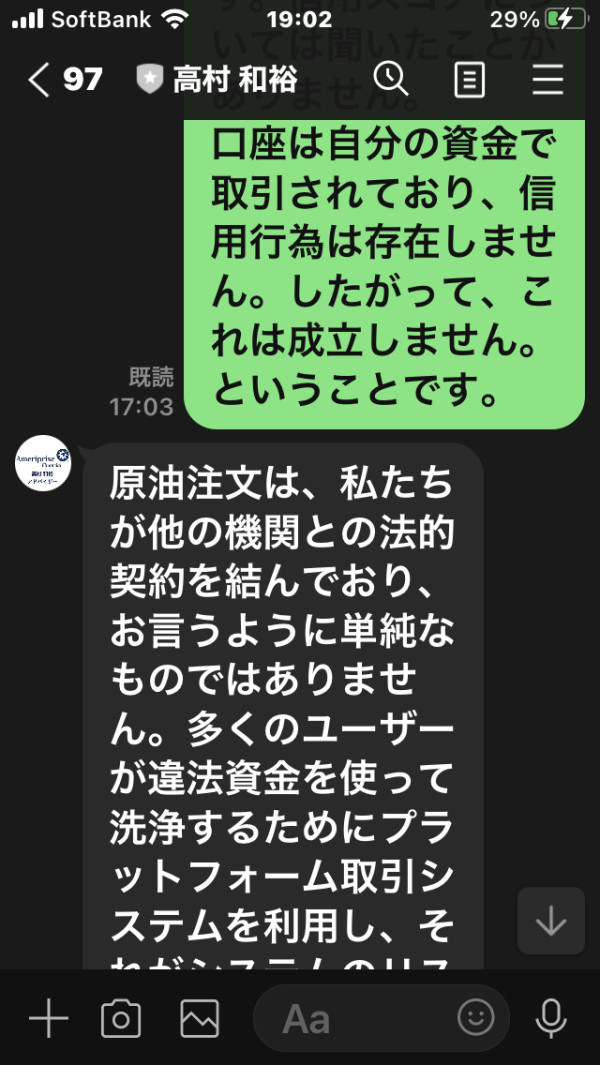

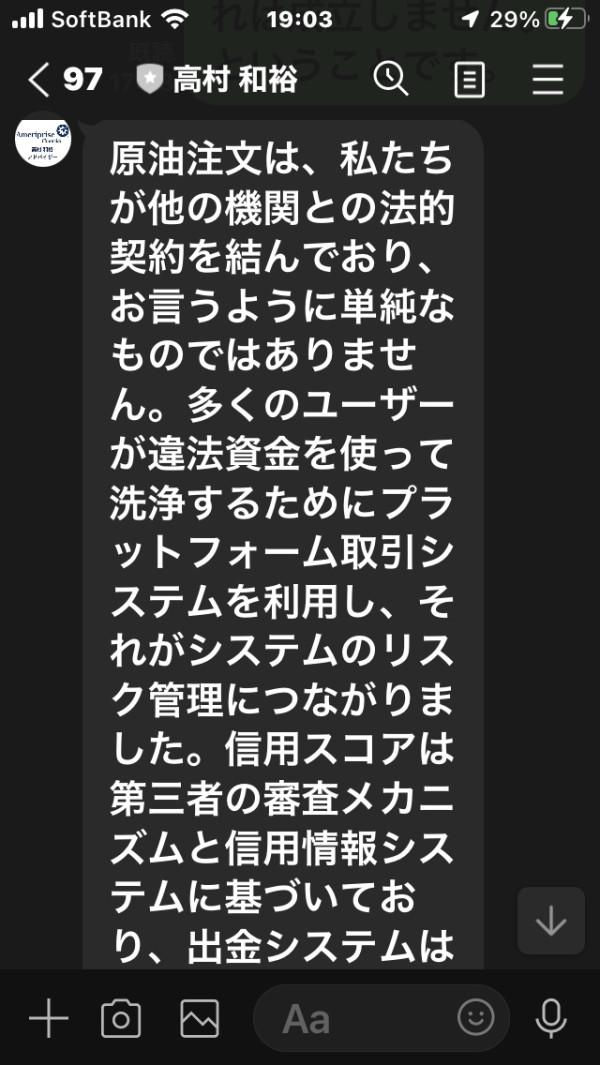

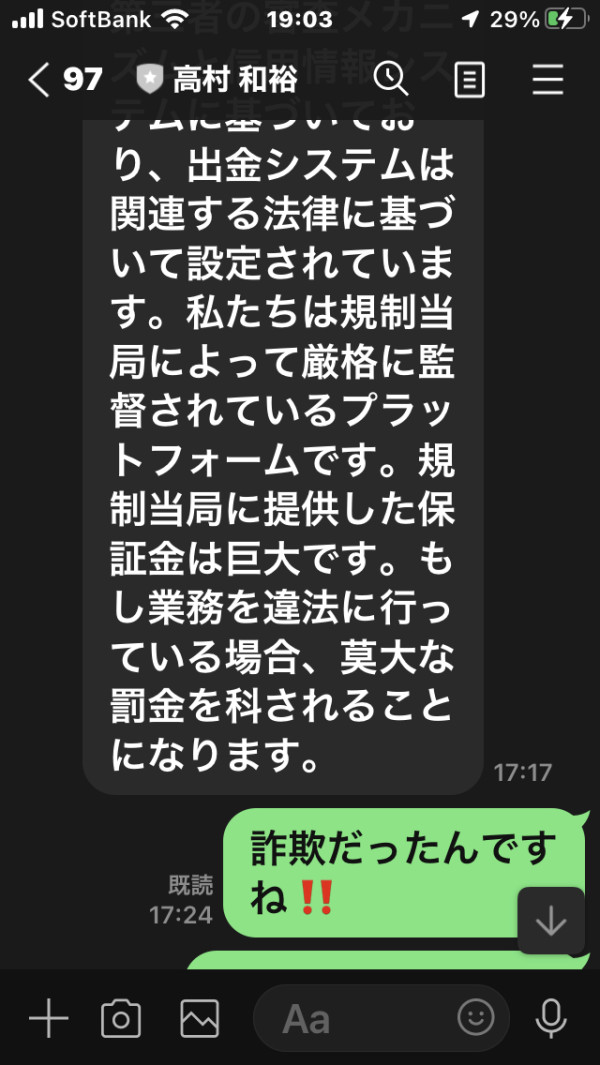

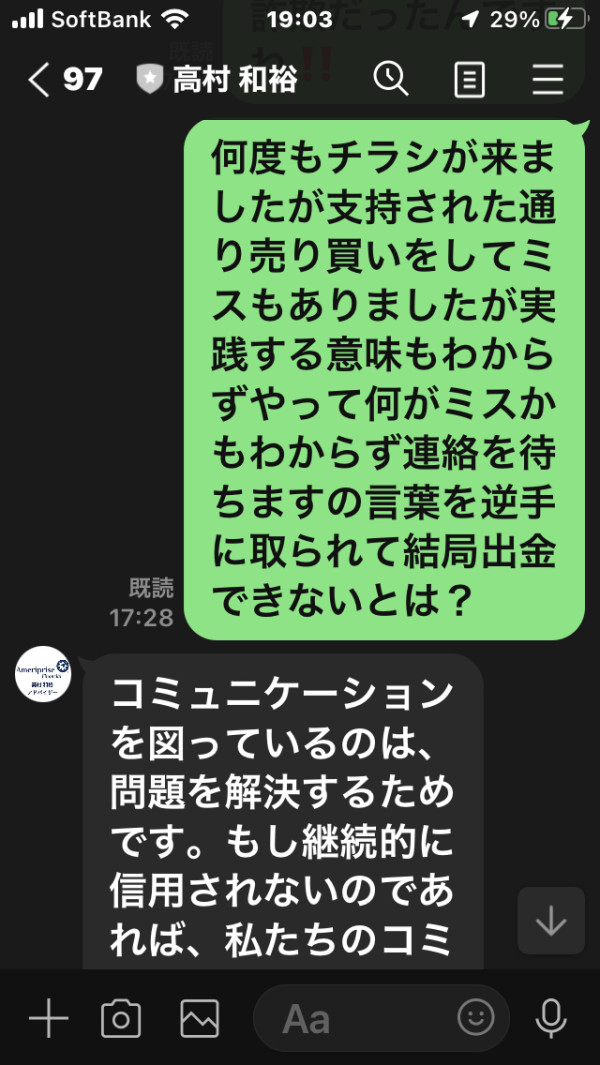

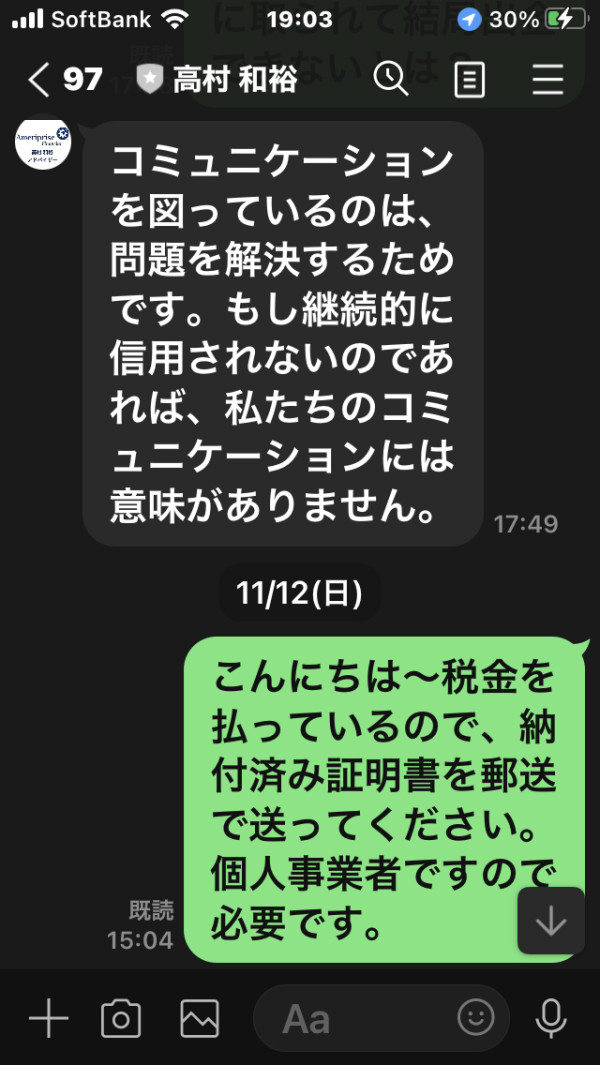

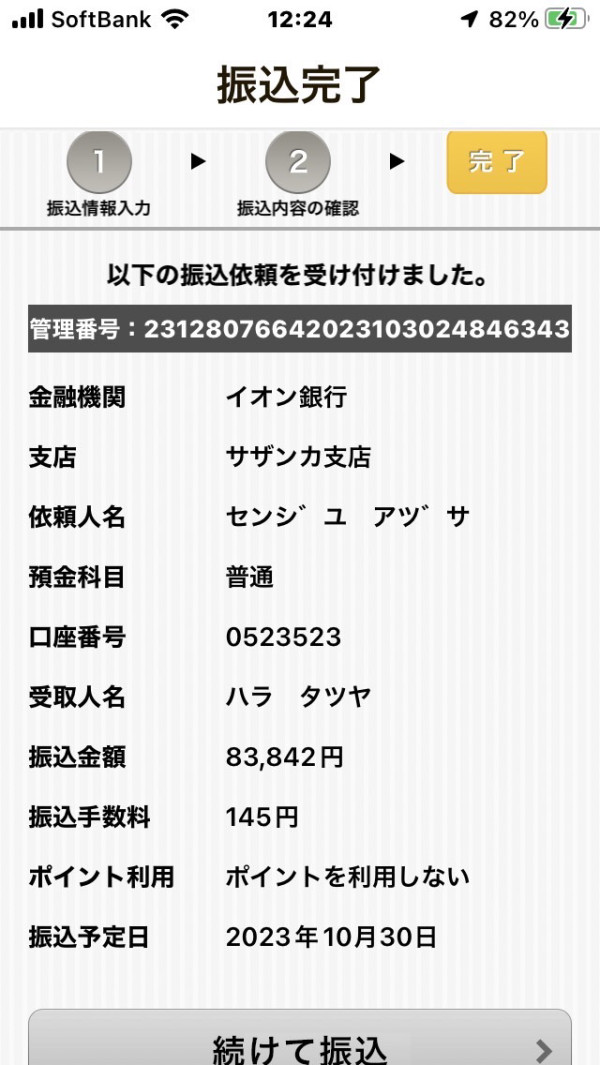

あずさゆみ

Japan

I mentioned that I could not withdraw money on November 16th.

Exposure

2023-11-17

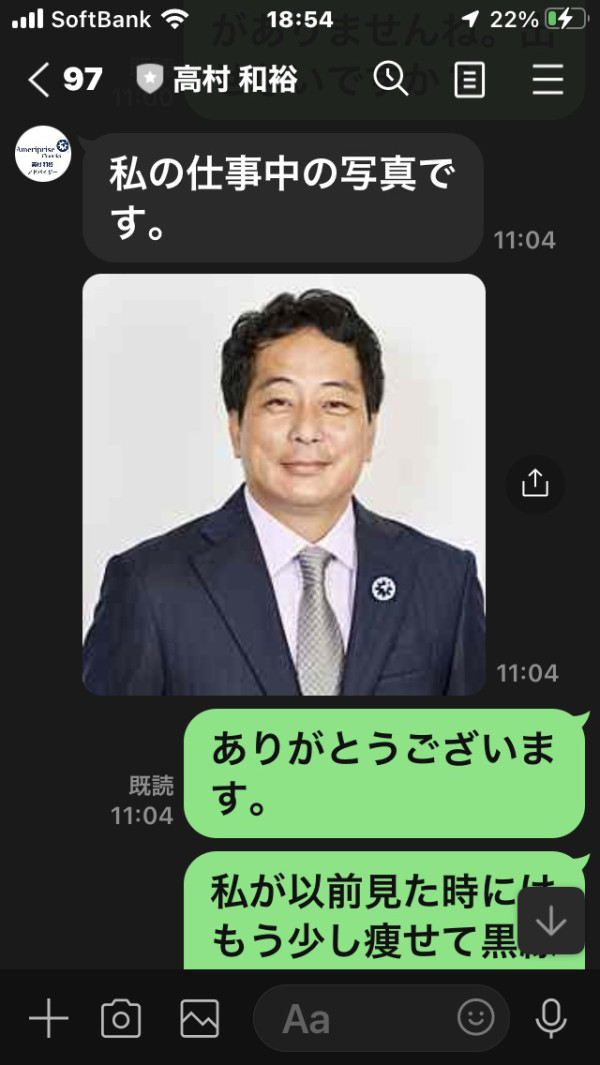

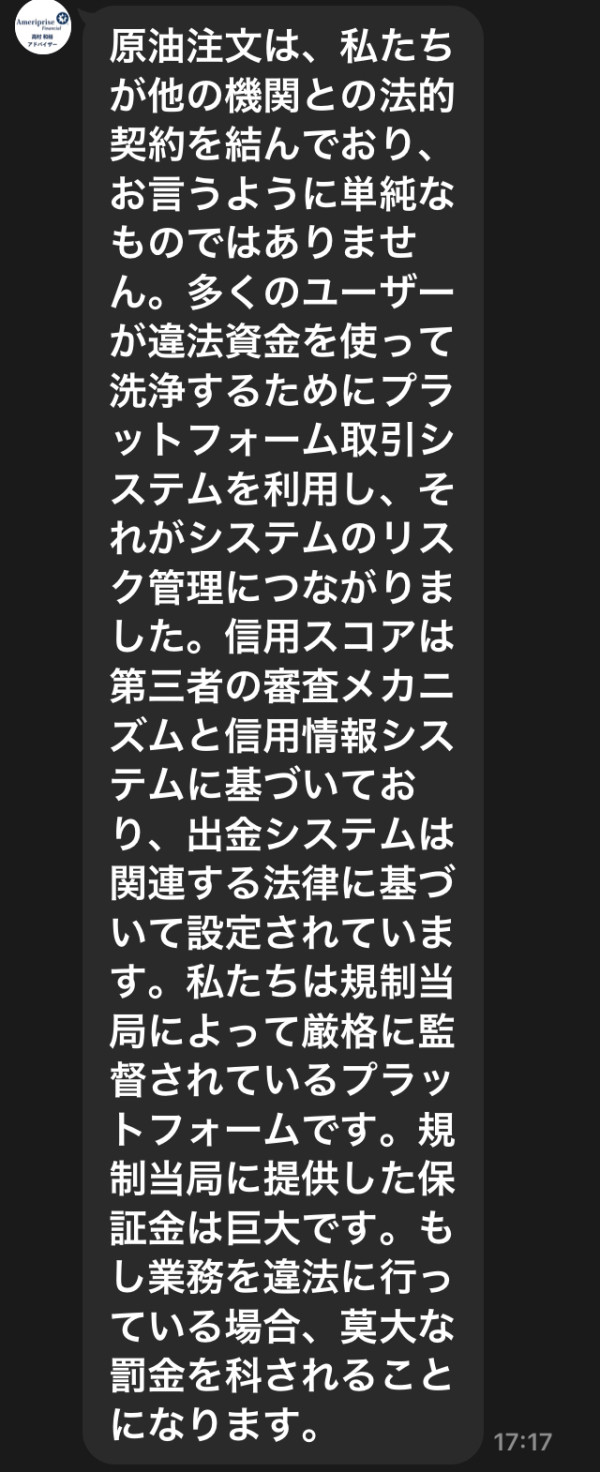

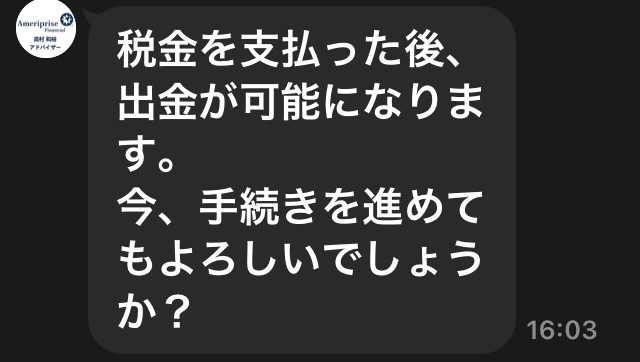

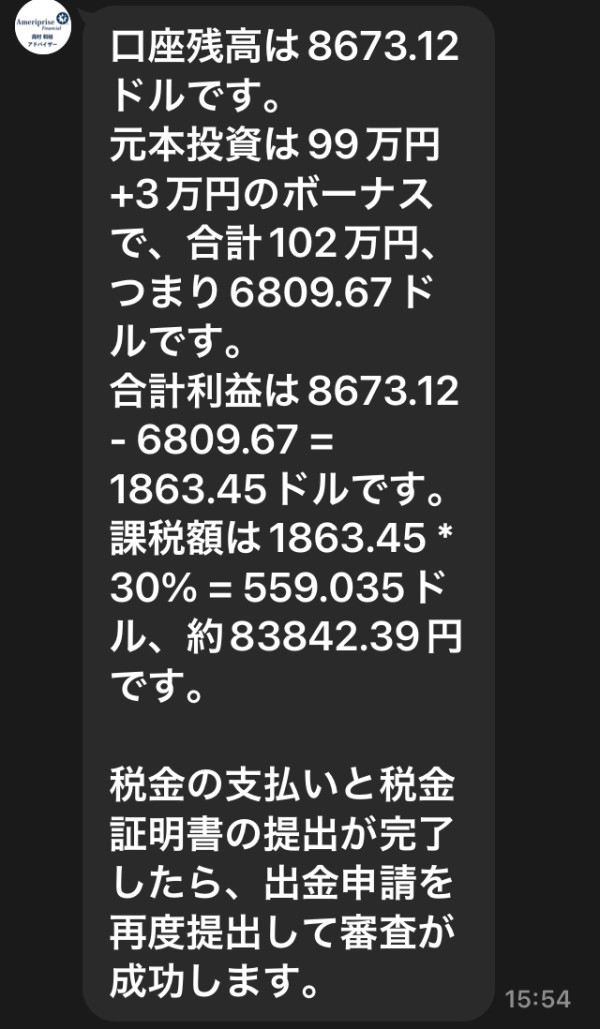

あずさゆみ

Japan

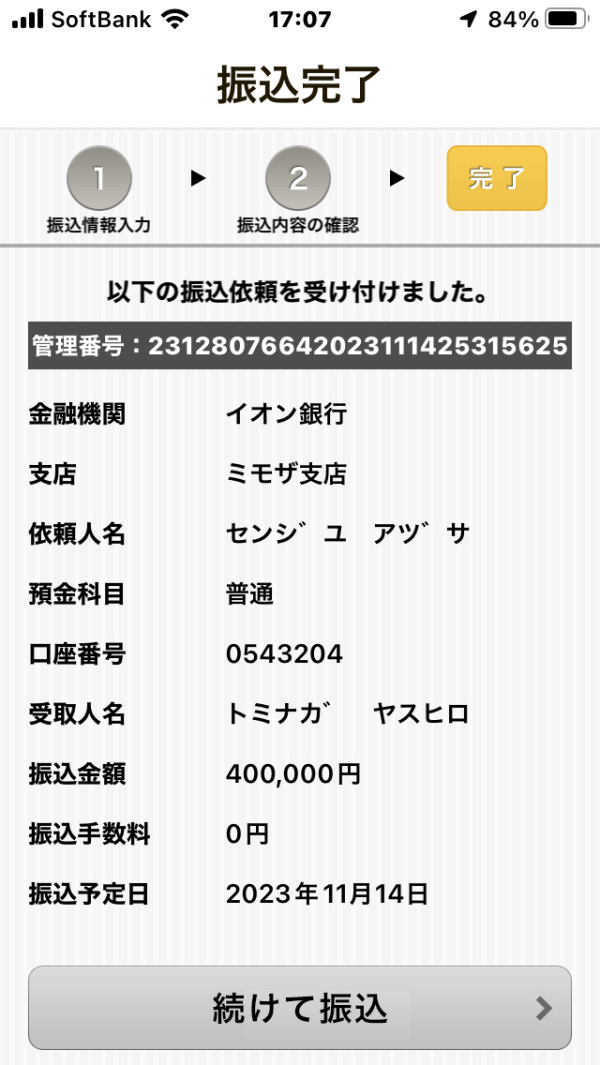

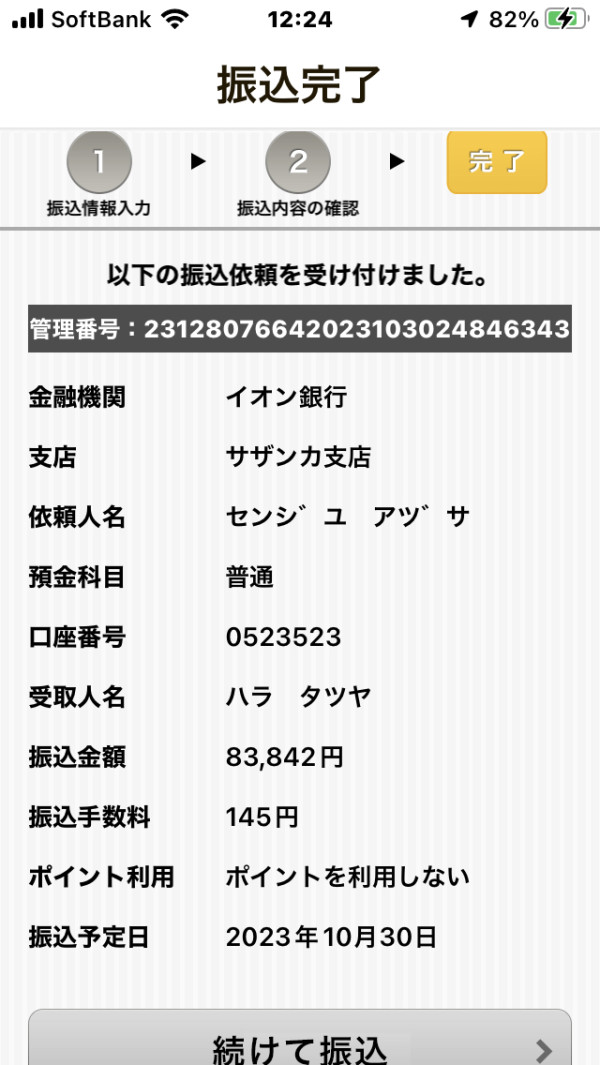

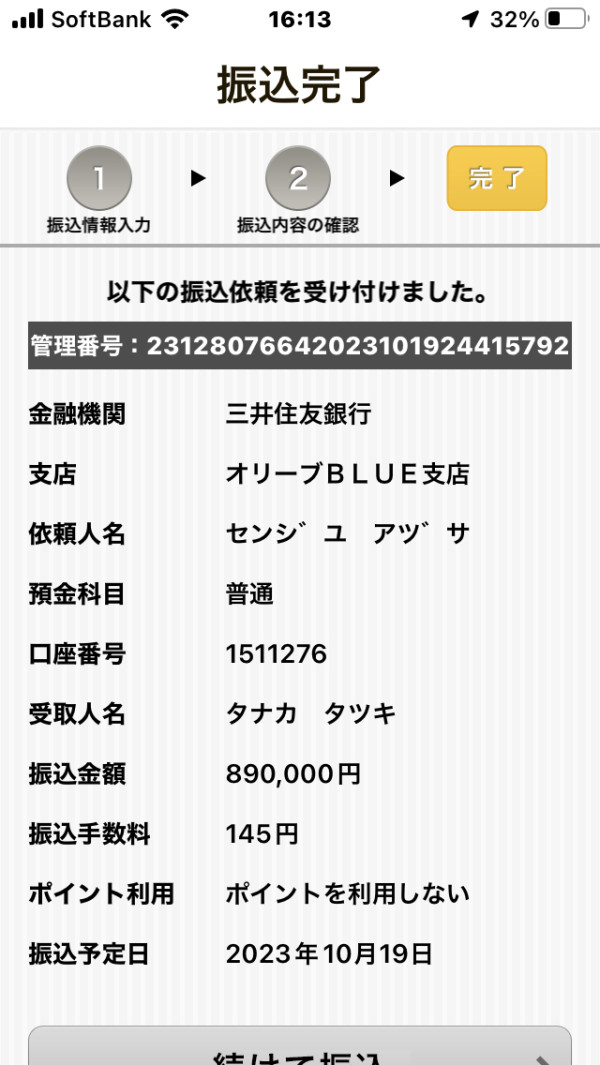

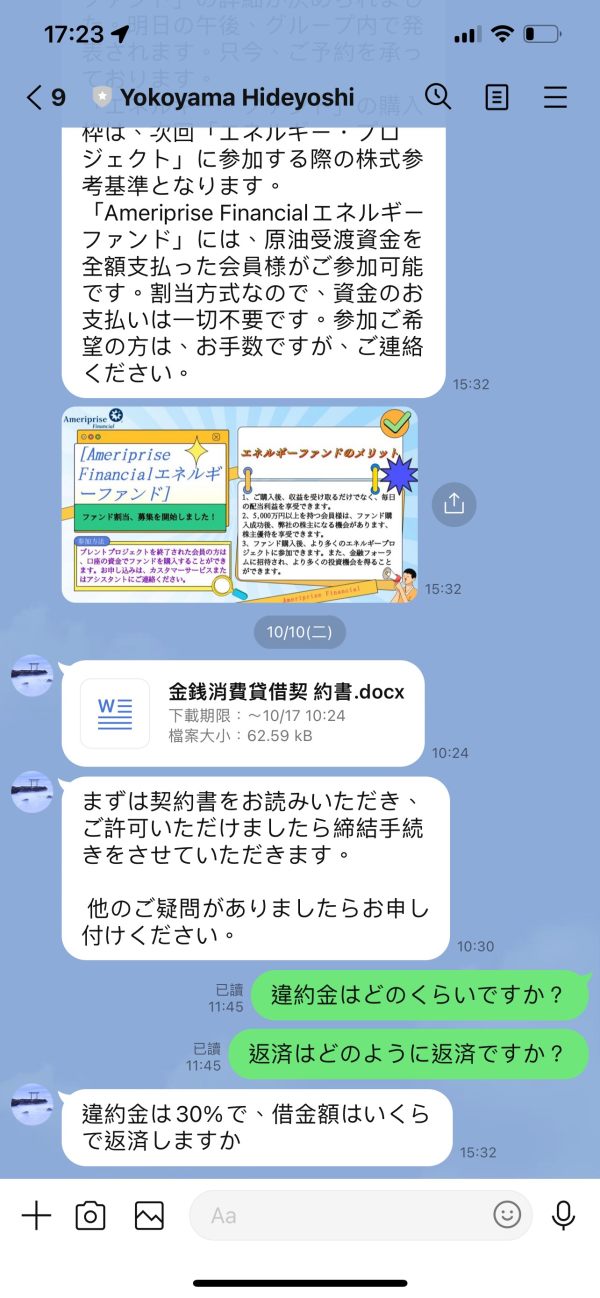

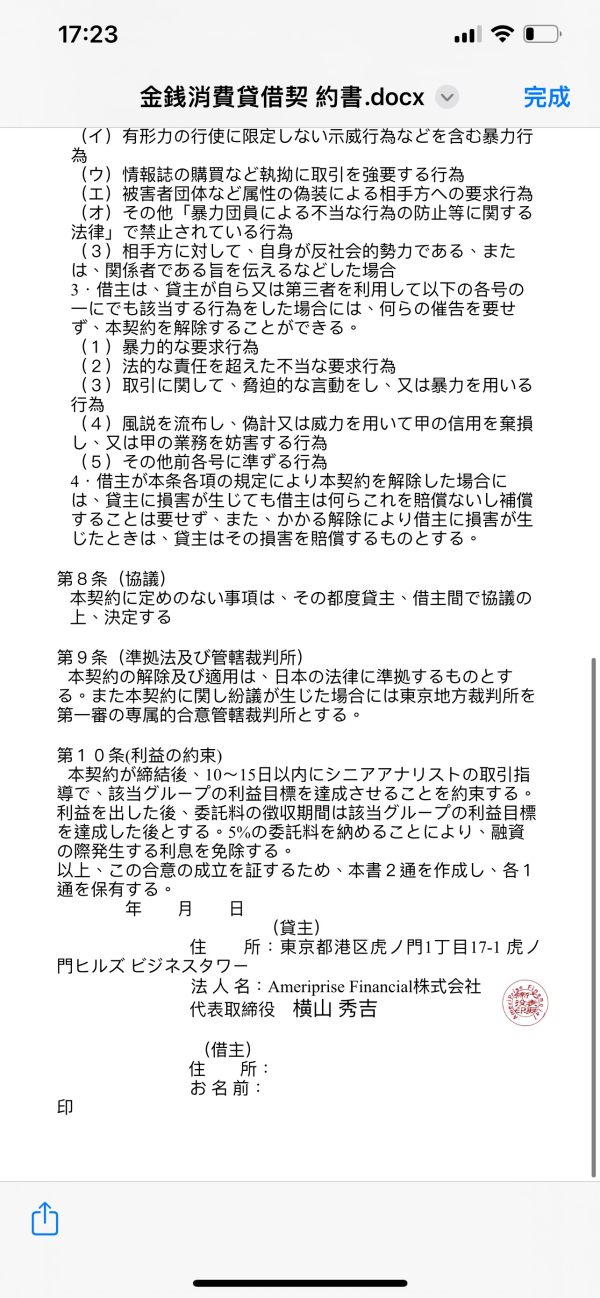

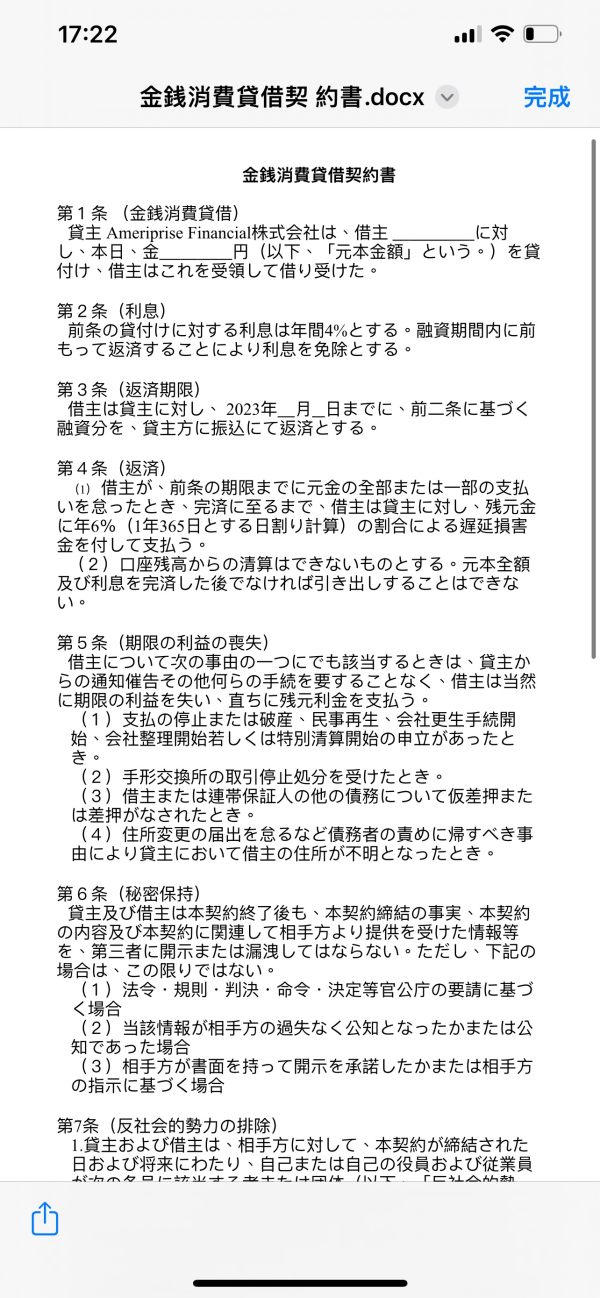

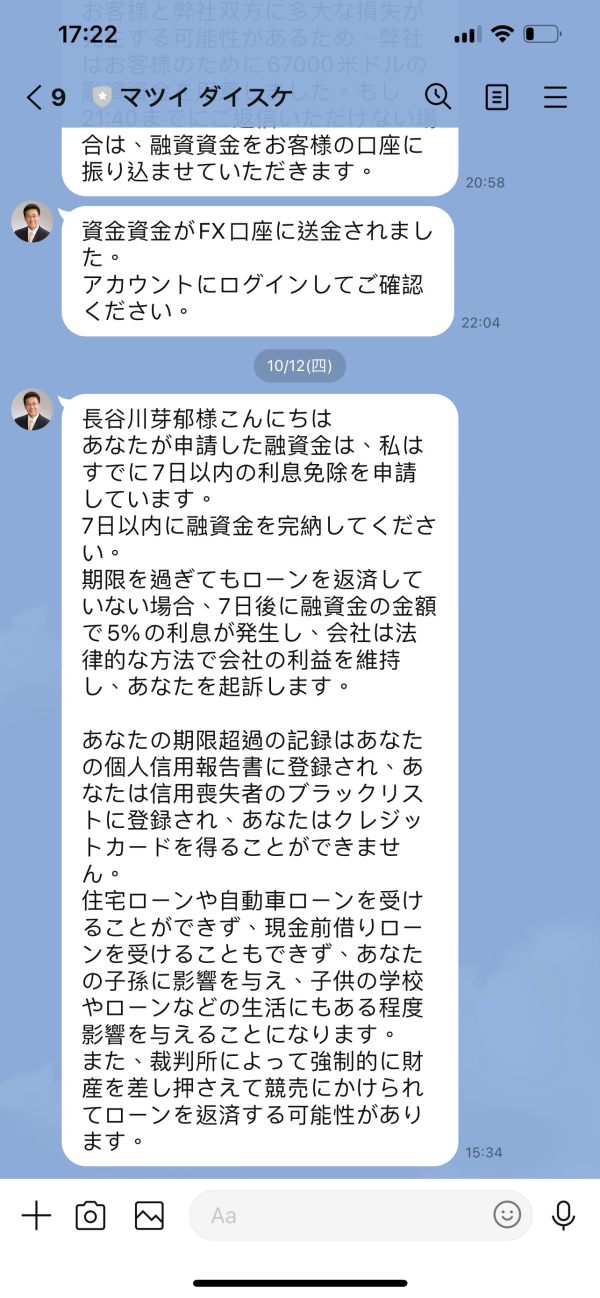

Ameriprise Finacial Introducing Platform Trader by Hideyoshi Yokoyama, Ameriprise Finacial I can't withdraw the funds I traded forex under the guidance of Kazuhiro Takamura, and recently I can't even view them because of a comment that the storage period has expired. I downloaded "AMPINC" from the app store, deposited 100,000 yen, got a bonus of 30,000 yen, and started trading FX. I was a beginner and made the mistake of buying a 0.1 lot as 1, but the settlement was successful and I made a profit of $80. I was told that my current funds would not be enough to buy one lot, but I was told to be careful next time, things went smoothly after that, but I misunderstood the payment procedure instructed on October 11th and ended up losing money. I was told that it was completed successfully. When I asked him how much profit he was making after that, he said, "The reason I can't participate in the oil project is because I haven't paid the penalty fee. I can either pay the balance of 1,040,000 yen and receive a profit of $1,638, or I can pay the 30% penalty and profit. I resisted, saying that I had no recollection of closing the transaction, but in the end, on October 4th, I was unable to pre-settle the crude oil transaction and had to wait for the delivery date. When I was told that there would be a penalty fee, I emailed and said, ``I'll wait,'' but in the end, I ended up paying a delivery fee of 1,040,000 yen, and I was responsible for all of the payments and profits in my account. I was told that it was in my account. The amount to be paid was 1,024.46 dollars ($1,638 subtracted from 2,662.46 dollars), approximately 150,000 yen. In other words, we paid 1,040,000 yen ➖ 150,000 yen = 890,000 yen. After that, transactions continued and the number of lots increased, but on October 23 I requested that I withdraw 1.2 million yen as I would be using it for my day job, and it was approved, so I completed the procedure and waited. However, I was told that my FX trading account would be reviewed, so please wait. This time, based on the country's foreign exchange tax policy. After receiving the profit, you need to pay taxes, and then the examination will be successful. At that time, there was $8,673.12 in the account. "Account balance: 8,673.12. Principal investment: 990,000 yen ➕ 30,000 yen = 1,020,000 yen = $ 1,863.45 Taxation The amount is 1863.45 x 30% = $559.03, approximately 8384.39 yen. Once you have completed paying the tax and submitting the tax certificate, you can resubmit the withdrawal request. "I have no choice but to transfer the tax as well and after the tax audit is completed, the full amount of the account will be refunded. It says that you can withdraw funds and there are no restrictions, but it says that you can withdraw funds or continue trading after tax is completed, around this time I started thinking, ``Is this strange?'' We have repeatedly urged you to withdraw money, but this time we have asked you to make a withdrawal. Our platform integrates a comprehensive evaluation system, a third-party audit mechanism, and a credit information system. The withdrawal system is based on relevant laws. You need to raise your credit score to 85 points or higher, which is the minimum standard for the platform's withdrawal screening. This will allow you to avoid being blocked by the withdrawal system and withdraw money. My score is around 80.'' ``There are two ways to improve your credit score without paying taxes: 1: Increase the amount of time you spend trading to improve your account's credit score. 2: Improve your credit score more quickly.'' If you want to increase your credit score, you can increase your credit score by increasing your active deposits. For every $1,340 you deposit, the system will automatically increase your credit score by 1 point. Raise your credit score to 85 points or higher. If you increase the amount, you will be able to bypass the withdrawal review and make withdrawals normally." In November, I made many requests, but they were insistent that I continue as is or pay the fee, and refused to submit a tax certificate because my credit score was insufficient and that it could not be sent to my account. The evidence has been disappearing from LINE since yesterday, but I have saved it all. Could you please tell me if I'm wrong? When I filed a complaint for destruction of evidence, the company wrote, ``If you hurt our company, we will hold you responsible.'' On November 15th, during an exchange on LINE, evidence such as Takamura's photo and the transfer form suddenly disappeared. I'm already tired, but please evaluate and make your decision. We are saving all email correspondence, detailed images, etc., so we look forward to hearing from you.

Exposure

2023-11-16

toiawaseq

Japan

I made a total of 7 transfers and transferred 37.1 million yen. So I asked them to use my money with peace of mind and instructed me to withdraw $321,307, but I was unable to withdraw the money. Even though they have no right to close the account, they ask me to pay the damages, commission, etc. First, and I cannot withdraw the money from the account.

Exposure

2023-11-01

長谷川 芽郁

Japan

When I wanted to withdraw money, the other party told me there would be a 48-hour review. But now I am still unable to withdraw money. When I asked a question in the group, I was immediately kicked out.

Exposure

2023-10-21

長谷川 芽郁

Japan

When purchasing crude oil for the first time, the funds of the parties involved were reviewed before making a recommendation. However, for the second purchase, the funds were not reviewed and a quantity of 1,000 was purchased directly, resulting in insufficient funds during the transaction. Because I have some concerns about the content of the contract. I had doubts, so I didn’t sign the pact, but the company directly signed and transferred $67,000 to Ameriprise’s company account. I want to ask customer service to help solve the problem.

Exposure

2023-10-15

Matthew Johnson

United Kingdom

Hey, been exploring Ameriprise Financial Inc., and I'm impressed by their diverse market offerings and a super user-friendly trading app. They've got some real potential. Though there are a few regulatory concerns and limited account types, their low minimum deposit is a real win for new traders. Keep an eye on the compliance risks, but overall, it's quite promising!

Neutral

2023-11-08

Oliver Smith

United States

Oh, Ameriprise Financial has been quite handy for me. They've got this cool variety of financial tools and an app that works like a charm on my phone. The costs are pretty straightforward too. But hey, just a heads up, some folks are a bit worried about how well they're regulated. Still, for someone like me looking for easy and cost-effective financial services, it's been a good pick!

Positive

2023-11-07