Score

IFIC Bank

Bangladesh|5-10 years|

Bangladesh|5-10 years| http://www.ificbank.com.bd/

Website

Rating Index

Influence

Influence

B

Influence index NO.1

Bangladesh 8.02

Bangladesh 8.02Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Bangladesh

BangladeshUsers who viewed IFIC Bank also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

MiTRADE

- 10-15 years |

- Regulated in Australia |

- Market Making(MM)

EC Markets

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FBS

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Sources

Language

Mkt. Analysis

Creatives

Website

ificbank.com.bd

Server Location

United States

Website Domain Name

ificbank.com.bd

Server IP

72.52.215.193

Company Summary

| Registered | Bangladesh |

| Regulated | No license |

| Years)of establishment | 40+ years |

| Products and services | deposit accounts, loans, cards, and online banking. |

| Minimum Initial Deposit | Not mentioned |

| Maximum Leverage | Not mentioned |

| Minimum spread | Not mentioned |

| Trading platform | own platform |

| Deposit and withdrawal method | Bank wire transfer |

| Fraud Complaints Exposure | No for now |

Pros and cons

Pros:

- Wide range of banking products and services

- Competitive interest rates and fees

- User-friendly online and mobile banking platforms

- Strong reputation and trustworthiness

- Comprehensive educational resources

Cons:

- Limited availability or eligibility requirements for some products and services

- High fees and charges for certain services

- Limited physical presence and branch network

General information and regulation

IFIC Bank is a private commercial bank in Bangladesh that was established in 1976. The bank offers a range of financial products and services to individuals and corporate customers, including deposit accounts, loans, remittance services, foreign exchange services, and more.

IFIC Bank has a strong presence in Bangladesh, with a network of over 150 branches and 278 ATM booths across the country. The bank also has a presence in Nepal and Pakistan through its subsidiaries.

In recent years, IFIC Bank has made efforts to modernize its banking services and improve its customer experience through the introduction of new technologies and digital banking solutions. The bank has also focused on expanding its SME (small and medium-sized enterprises) financing operations.

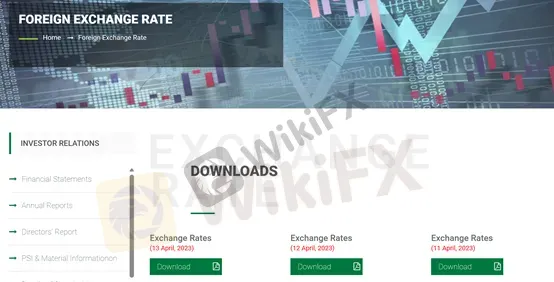

Products and Services

IFIC Bank offers a wide range of products.

For individuals, the bank provides savings accounts, fixed deposit accounts, and recurring deposit accounts that offer competitive interest rates. In addition, the bank offers credit and debit cards that come with various benefits and rewards programs.

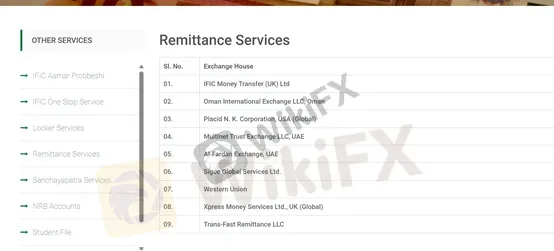

For businesses, IFIC Bank offers various loan and financing products, including term loans, working capital loans, and export-import financing services. The bank also provides trade services such as letters of credit, guarantees, and remittances.

Fees and Charges

IFIC Bank has transparent fee structures for its banking services. The bank does not charge any fees for opening or maintaining a savings account. However, the bank may charge fees for certain services, such as ATM withdrawals, debit and credit card transactions, and international money transfers. These fees are reasonable compared to those of other banks, but they can still add up for frequent users.

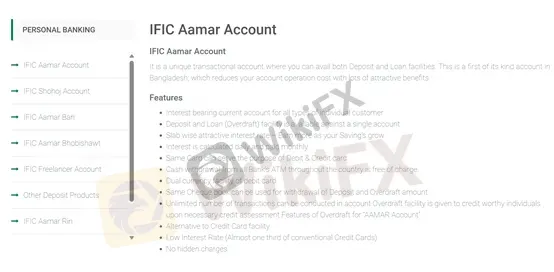

Accounts and Services

IFIC Bank offers a variety of accounts and services. For retail customers, there are savings accounts, current accounts, fixed deposit accounts, and recurring deposit accounts. Business customers can benefit from current accounts, term loan facilities, and export-import financing services. In addition, IFIC Bank offers digital banking services such as internet banking, mobile banking, SMS banking, and debit and credit card facilities.

Here is a video about their Amar account on their official YouTube channel.

Online and Mobile Banking

IFIC Bank offers its customers convenient and user-friendly online and mobile banking platforms. With these platforms, customers can easily manage their accounts, pay bills, and transfer funds from anywhere and at any time.

Deposit and Withdrawal: methods and fees

Deposits can be made through cash or check, and there are also options for online deposits. Withdrawals can be made through ATMs, checks, or online transfer. The bank also offers international remittance services.

Customer service

IFIC Bank has a customer-centric approach. Customers can contact the bank through phone, email, or in-person visits to any of its branches. The bank also provides a complaint management system for customers to report any grievances they may have.

Bank FAQs

- What types of accounts and services does IFIC Bank offer?

- IFIC Bank offers savings accounts, current accounts, fixed deposit accounts, recurring deposit accounts, term loan facilities, export-import financing services, and digital banking services such as internet banking, mobile banking, SMS banking, and debit and credit card facilities.

- Is IFIC Bank's online and mobile banking secure?

- Yes, IFIC Bank's online and mobile banking platforms are secure and reliable, ensuring that customer data and financial transactions are protected. However, technical issues or downtime may occur.

- What are the advantages of banking with IFIC Bank?

- IFIC Bank offers a wide range of products and services, competitive interest rates and fees, and user-friendly online and mobile banking platforms.

Keywords

- 5-10 years

- Suspicious Regulatory License

- High potential risk

Content you want to comment

Please enter...

Review 1

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now