简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

What is Liquidity and Volatility - WikiFX Forex Trading Concepts

Abstract:When it comes to foreign exchange trading, liquidity and volatility are two ideas that have a significant impact. Market events, such as geopolitical news and economic developments, have a significant impact on liquidity and volatility. Customers and sellers are counted as "liquidity" in the market. Volatility is a measure of how much a rate is deviating from a baseline. It's possible to raise danger, but it's also possible to take advantage of the situation.

It's typical to hear that the forex market is the most liquid financial market in the world, and it is. But what does this mean for you and your trading?

What Is the Definition of Liquidity?

The liquidity of a market is proportional to its activity. It is defined by the number of active traders and the total volume of trades. One reason the foreign currency market is so liquid is that it is open 24 hours a day, seven days a week. It is also a tremendously deep market, with almost $6 trillion in daily transactions. Although liquidity varies as financial centers across the globe open and shut during the day, there is normally a reasonably high volume of forex trading going on at all times.Finding pockets with sufficient liquidity is critical for major institutions and traders who need to fill huge orders. The liquidity of a market has a significant influence on how volatile its prices are. When these large firms enter the market, they want to be filed at the highest feasible pricing. However, given the scale of their holdings, they must find adequate counter-forces to satisfy their demands, and this is where the key to minimizing slippage resides. If a large player enters the market in a low-liquidity location, the resulting volatility will affect the average price. At the same time, lower liquidity usually results in a more volatile market with drastic price changes; conversely, if the same trader enters a trade in an area with much higher liquidity, it usually results in a less volatile market with much lower price fluctuations, ensuring a better average price for the entire position they intend to enter.

So, where do we look for these levels? Stop-loss orders are put here. Where do you believe the ancient notion of “stop-loss hunting” originated? Because significant players must join the market in regions of liquidity to amass substantial holdings. These locations will always be of interest because they include pockets of liquidity, enabling them to get the best average price while lowering the danger of slippage.

The formation of a liquidity level is caused by an initial supply/demand mismatch, which generates what is often known as a swing high or swing low. These are the levels that market participants will use as a historical reference to put their stops as additional players enter the market. When the levels are re-tested, a decision will be made. The binary result here either be a level breakthrough or a return to the mean.

As a general guideline, until the rejection reaches a 50% retracement of the preceding high/low, be on the lookout for a low-quality liquidity level; the more robust the rejection of a level, the more likely it is to hold on to a retest. I love it when a rejection leads to a structural breakout through a new cycle high or low. Other variables, such as confluence, market circumstances (risk-on/risk-off), market structure in longer timeframes, and economic data, will all play a role in deciding whether the region will hold or fold, and you should account for all of these components as part of your strategy. However, as I will demonstrate in the example below, the power of retesting a region of liquidity that has previously resolved into a successful market structure breakout is a good advantage to exploit.

Other aspects to be mindful of while trading liquidity levels include timing considerations. If the interval between the construction of the liquidity area and the first retest is too long (depending on the timeframe you trade), the level may not have the same weight as it used to when the market context changes and orders are withdrawn. At the same time, if you locate two or more liquidity levels close together — a clustering of numerous levels of interest — market players will prefer to set their stop-loss orders at the most extreme level, so keep that in mind.

What Exactly Is Volatility?

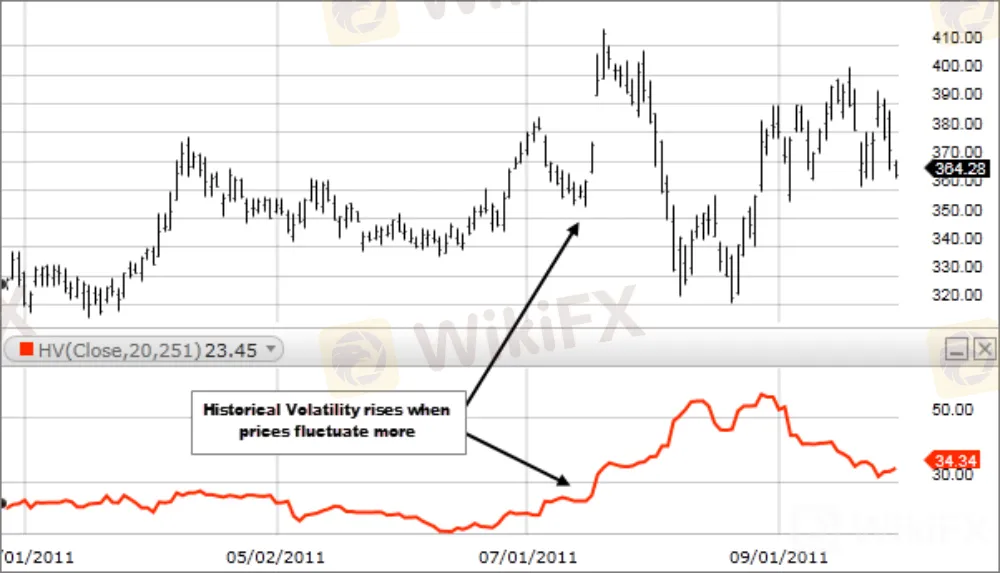

Volatility is a measure of how much a market's prices fluctuate. The liquidity of a market has a significant influence on how volatile its prices are. Lower liquidity typically leads to a more volatile market with large price fluctuations; more liquidity usually results in a less volatile market with smaller price fluctuations.

Because of their great liquidity, liquid markets such as forex tend to move in smaller increments. When several traders deal at the same time, the price generally moves up and down in tiny increments. However, in the currency market, significant and unexpected changes are likely. Many occurrences lead prices to become volatile since currencies are impacted by so many political, economic, and social events. Traders should be aware of current events and stay up with financial news to uncover possible profit and prevent potential loss.

Calculation of Volatility

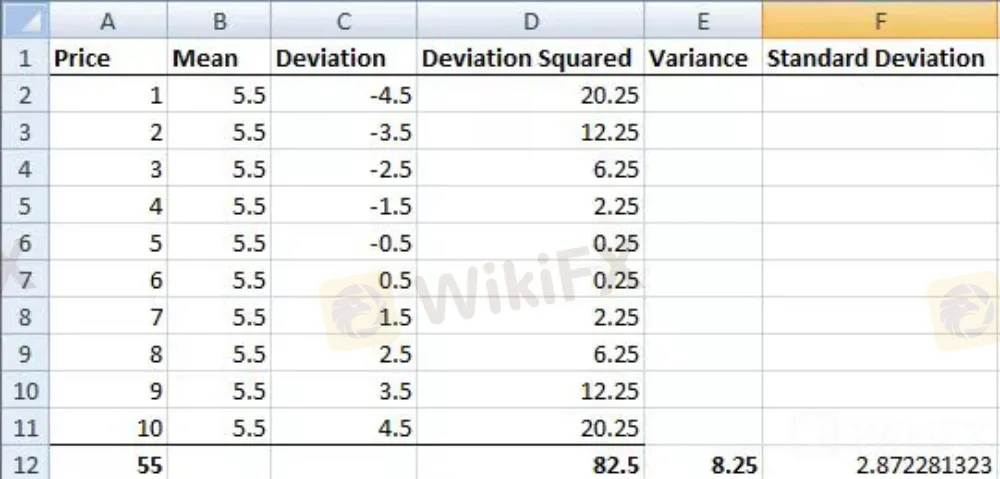

Volatility is often calculated using the variance and standard deviation. The standard deviation is the square root of the variance.

Assume monthly stock closing prices range from $1 to $10. Month one is one dollar, month two is two dollars, and so on. To calculate the variance, follow the five steps shown below.

Calculate the mean of the data set. This is done by adding all of the values together and then dividing the total by the number of values.

If we add $1, $2, $3, and so on until we reach $10, we receive $55.

This is split by ten since our data collection has ten numbers. This results in a mean, or average, price of $5.50.

Determine the difference between each data point and the mean. This is often referred to as deviation. For example, if $10 - $5.50 equals $4.50, then $9 - $5.50 equals $3.50. This pattern is repeated down to the first data value of $1. Negative numbers are permitted. Because we need each number, these computations are often performed in a spreadsheet.

The deviations must be squared. This will remove any negative values.

Total the squared deviations. This equals 82.5 in our case.

Subtract the total number of data points from the sum of the variances squared (82.5).

The difference is $8.25 in this case. The square root is used to compute the standard deviation. This amounts to $2.87. An indication of risk displays how prices vary from the average.

It tells traders how much the price may depart from the average.

Most data values fall within a standard deviation when prices are picked at random from a normal distribution. We may expect 95 percent of our data to fall within two standard deviations (2 x 2.87) and 99.7 percent of our data to fall within three standard deviations in our situation (3 x 2.87). In this case, the values of $1 to $10 are not distributed randomly on a bell curve, but rather evenly. As a result, the predicted 68–95–99.7 percent percentages do not hold. Because price return data sets often show a normal (bell curve) distribution rather than the example provided, traders often use standard deviation despite this disadvantage.

More WikiFX educational articles may be found at the following address: https://www.wikifx.com/en/education/education.html.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Top 10 Trading Indicators Every Forex Trader Should Know

Master the top 10 Forex trading indicators to analyze real-time Forex quotes, trends, and market signals. Learn strategies to boost accuracy and avoid mistakes.

Geopolitical Events: What They Are & Their Impact?

You've heard many times that geopolitical events have a significant impact on the Forex market. But do you know what geopolitical events are and how they affect the FX market? Let us learn about it today.

Why Do You Feel Scared During Trade Execution?

Trade execution is a pivotal moment for traders. It is when analysis turns into action, and potential profits or losses become reality. However, for many traders, this moment is accompanied by fear. Why does this happen, and how can you address it?

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

In the midst of financial innovation and regulation, WikiGlobal, the organizer of WikiEXPO, stays abreast of industry trends and conducts a series of insightful and distinctive interviews on pivotal topics. We are delighted to have the privilege of inviting Simone Martin for an in-depth conversation this time.

WikiFX Broker

Latest News

Volkswagen agrees deal to avoid Germany plant closures

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Currency Calculator