简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Order Types - WikiFX Forex Trading Concepts

Abstract:Understanding the various forex order types is an important aspect of any forex trading strategy. Orders enable you to specify a precise price target to purchase or sell at to begin or terminate a deal when that rate is met. They are an important component of risk management because they may be used to minimize risk or collect profit. Please keep in mind that placing dependent orders does not reduce your losses.

Orders are important instruments for every sort of trader and should always be considered while carrying out a trading plan. Orders may be used to get into a transaction, safeguard gains, and reduce negative risk.

Understanding the distinctions between the order types offered will help you identify which orders will best fit your requirements and help you achieve your trading objectives.

Market

A market order is the most basic order type and is executed at the best available price at the time the order is received.

Limit

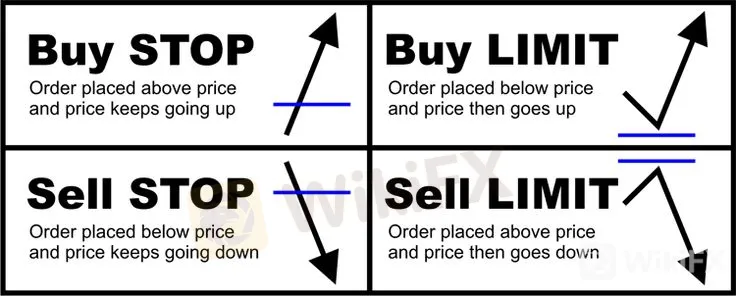

A limit order (sometimes known as a “take profit” order) is a buy or sell order that is placed at or above a certain price. A sell limit order is fulfilled at or above the specified price, while a purchase limit order is done at or below the specified price.

Limit orders allow you to be quite particular when selecting the entrance or exit point of a transaction. Limit orders do not ensure that you will join or exit a position since they are not executed if the specified price is not reached. A limit order tied to an existing open position (or a pending entry order) to close that position is also known as a “take profit” order.

Stop

When a preset rate is achieved, a stop order initiates a market order. When the offer price is reached, a buy stop order is activated, and when the bid price is met, a sell stop order is activated. Based on the available liquidity, both stop orders are executed at the best possible price. Stop orders often referred to as stop-loss orders, are frequently used to mitigate negative risk.

Stop orders aid in validating the market's direction before embarking on a transaction. It's vital to remember that when the market order is activated, stop orders are executed at the best attainable price based on existing liquidity.

Trailing Pause

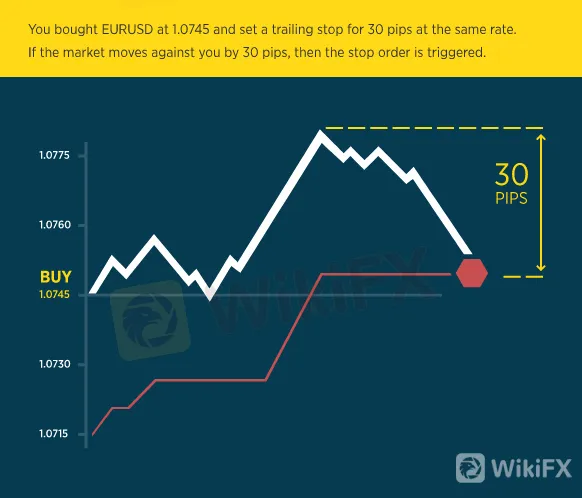

A trailing stop order is set a specified number of pips away from the current market price. When the market moves in your favor, your trailing stop will automatically track your position.

If the market moves against you by a certain number of pips, a market order is triggered, and the stop order is executed at the next available liquidity-based rate.

Contingent orders

Contingent orders combine many kinds of orders and are used to implement a trading plan. Contingent orders need one of the commands to be activated before the other.

If/Then and If/Then OCO are the two most prevalent forms of dependent orders.

If/Then

If/then orders are a pair of orders with the condition that if the first order (the “if”) is executed, the second-order (the “then”) becomes an active, unrelated single order. Unassociated orders are not linked to a transaction and operate independently of position changes. If the “if” order fails to execute, the single “then” order is rendered inactive and will not be executed when the market reaches the appropriate rate. It is crucial to understand that if one side of an if/then the order is canceled, the whole order is canceled.

OCO if/then

If the first order (the “if”) is executed, the second-order (the “then”) becomes an active unassociated one-cancels-other (OCO) order. Unassociated orders are not associated with a transaction and operate independently of any position adjustments. The execution of any of the two “then” commands, like a standard OCO order, immediately cancels the other.

If the “if” single order fails to execute, the “then” OCO order will become dormant and will not be executed when the market reaches the required rate. If any component of an if/then OCO order is canceled (including either leg of the OCO order), the whole order is canceled.

Order Expirations

Market orders are considered day orders since they are executed at the lowest possible price. However, an expiry value of End of Day (EOD) or Good Till Cancel (GTC) may be set for all other order types.

End of Day - A purchase or sell order at a certain price will remain open until the end of the trading day, which is typically at 5 p.m. / 17:00 a.m. New York.

Good Until Cancelled - an order to purchase or sell at a certain price will stay open until filled or canceled. GTC orders at FOREX.com will expire on the Saturday following the 90th calendar day from the day they were submitted.

More WikiFX educational articles may be found at the following address: https://www.wikifx.com/en/education/education.html.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Top 10 Trading Indicators Every Forex Trader Should Know

Master the top 10 Forex trading indicators to analyze real-time Forex quotes, trends, and market signals. Learn strategies to boost accuracy and avoid mistakes.

Geopolitical Events: What They Are & Their Impact?

You've heard many times that geopolitical events have a significant impact on the Forex market. But do you know what geopolitical events are and how they affect the FX market? Let us learn about it today.

Why Do You Feel Scared During Trade Execution?

Trade execution is a pivotal moment for traders. It is when analysis turns into action, and potential profits or losses become reality. However, for many traders, this moment is accompanied by fear. Why does this happen, and how can you address it?

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

In the midst of financial innovation and regulation, WikiGlobal, the organizer of WikiEXPO, stays abreast of industry trends and conducts a series of insightful and distinctive interviews on pivotal topics. We are delighted to have the privilege of inviting Simone Martin for an in-depth conversation this time.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

Why Do You Feel Scared During Trade Execution?

Currency Calculator