简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Nasdaq 100 Soars as FOMC Signals Strong Economy. Hang Seng Index Sees “Policy Bottom”

Abstract:Hang Seng Index looks set to extend rally after jumping 9% on Wednesday as Chinese policymakers pledged to support market. APAC stocks to open higher.

NASDAQ 100, HANG SENG INDEX, ASX 200 INDEX OUTLOOK:

Dow Jones, S&P 500 and Nasdaq 100 indexes closed +1.55%, +2.24% and +3.70% respectively

The Fed raised interest rate by a quarter-point and pointed to six more hikes in the forthcoming meetings this year

Nasdaq 100, FOMC, Hang Seng Index, Asia-Pacific at Open:

The Nasdaq 100 index soared 3.7% on Wednesday as Jerome Powell painted a clearer picture about the Fed‘s tightening trajectory at the FOMC meeting. The central bank raised the interest rate by 25bps and signaled six more hikes in the forthcoming gatherings to tame inflation, in line with market expectations. It also anticipates to begin reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities at a coming meeting, likely in May. Powell also pointed to a “strong economy” that is able to withstand the Fed’s tightening policy.

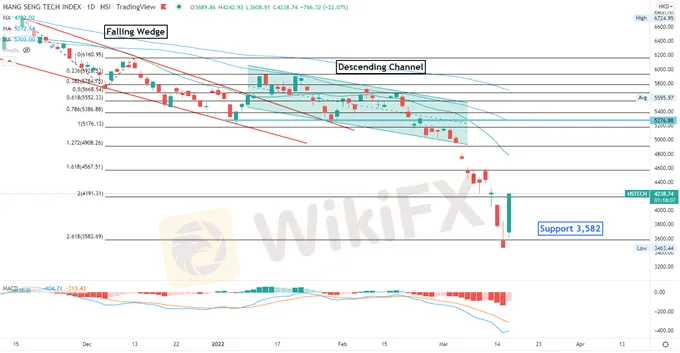

Meanwhile, Chinese policymakers made an unusual announcement to support the stock and property market on Wednesday, sparking an astonishing rally in both mainland and Hong Kong shares. The Hang Seng Index jumped the most since 2008 after China's state council pledged to support stock markets. The Hang Seng Tech Index rallied 22%and marked its largest single day gain. Chinese tech ADRs listed on US exchanges extended the rally overnight, led by Alibaba (+36.7%), JD.COM (+39.4%) and Tencent (+33.4%).

The Financial Stability and Development Committee of the State Council held a special meeting to study the current economic situation and capital market issues on Wednesday. The authorities pledged to support overseas stock listings and to keep Chinese capital markets stable. They also promised to implement measures to help handle risks for property developers. Regarding Chinese companies listed in the US, the Chinese and US regulators have maintained good communications and have made positive progress.

Positive signals sent by the state council marks a “policy bottom” for the Hong Kong stock market after a year-long selloff. The technology sector has lost 68% of its market value over the last 12 months due to Beijings anti-monopoly crackdown, US delisting threats and a slowing economy. As the state council made a “U-turn” in its attitude towards the platform companies such as Meituan and Alibaba, investors finally see lights at the end of the tunnel.

Hang Seng Tech Index - Daily

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Good News Malaysia: Ready for 5% GDP Growth in 2025!

Malaysia's economy is on track to sustain its robust growth, with GDP expected to exceed 5% in 2025, according to key government officials. The nation's economic resilience is being driven by strong foreign investments and targeted government initiatives designed to mitigate global economic risks.

Tradu Introduces Tax-Efficient Spread Betting for UK Traders

Tradu’s introduction of tax-efficient spread betting and groundbreaking tools like the Spread Tracker signals a new era of accessible, competitive, and innovative trading solutions for UK investors.

Trading Lessons Inspired by Squid Game

The popular series Squid Game captivated audiences worldwide with its gripping narrative of survival, desperation, and human nature. Beneath the drama lies a wealth of lessons that traders can apply to financial markets. By examining the motivations, behaviours, and strategies displayed in the series, traders can uncover valuable insights to enhance their own approach.

How Far Will the Bond Market Decline?

Recently, the yield on the U.S. 10-year Treasury bond reached a new high since April 2023, soaring to 4.7%.

WikiFX Broker

Latest News

High-Potential Investments: Top 10 Stocks to Watch in 2025

US Dollar Insights: Key FX Trends You Need to Know

Why Is Nvidia Making Headlines Everywhere Today?

Discover How Your Trading Personality Shapes Success

FINRA Charges UBS $1.1 Million for a Decade of False Trade Confirmations

Bitcoin in 2025: The Opportunities and Challenges Ahead

BI Apprehends Japanese Scam Leader in Manila

Big News! UK 30-Year Bond Yields Soar to 25-Year High!

SQUARED FINANCIAL: Your Friend or Foe?

Join the Event & Level Up Your Forex Journey

Currency Calculator