简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

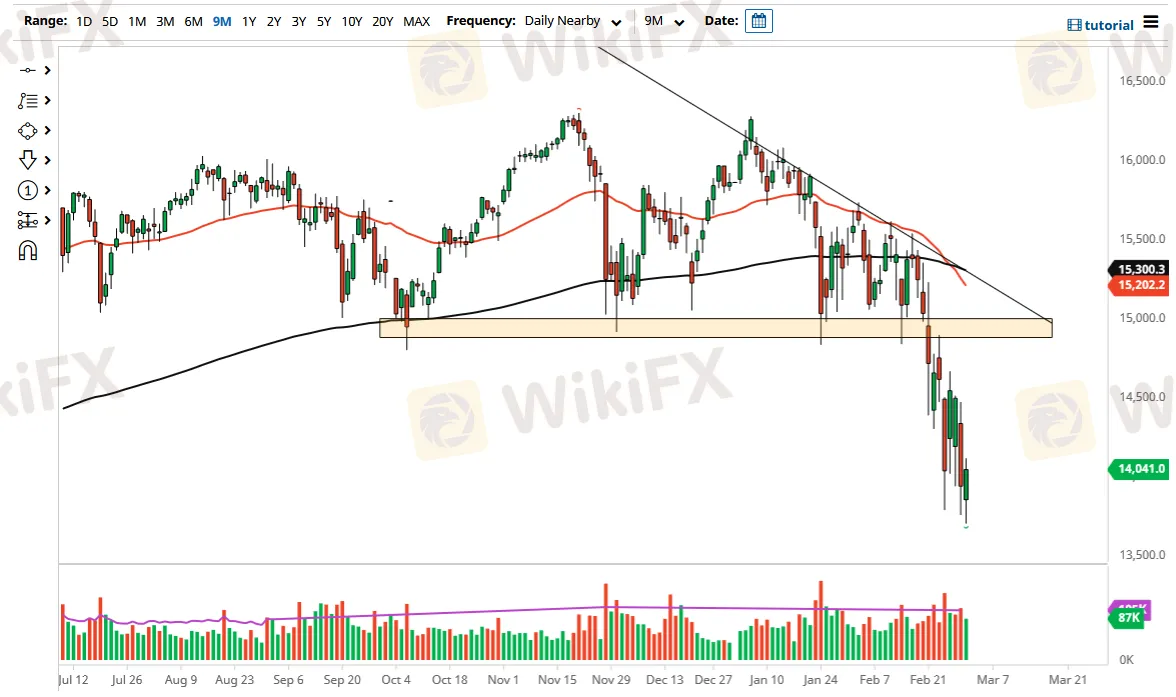

DAX Forecast: Showing Signs of Trying to Stabilize

Abstract:The German DAX Index gapped lower in the futures market on Wednesday and then plunged to make a fresh, new low. However, we have turned around to show signs of life and recapture the €14,000 level. Above there, we also have resistance at the €14,500 level, where we had seen a lot of selling pressure. This is a market that continues to see a lot of downward pressure overall though, and even though we have recovered a bit, it is very likely that we will continue to see selling pressure come back.The German DAX Index gapped lower in the futures market on Wednesday and then plunged to make a fresh, new low. However, we have turned around to show signs of life and recapture the €14,000 level. Above there, we also have resistance at the €14,500 level, where we had seen a lot of selling pressure. This is a market that continues to see a lot of downward pressure overall though, and even though we have recovered a bit, it is very likely that we will continue to see selling pressure come back.

The German DAX Index gapped lower in the futures market on Wednesday and then plunged to make a fresh, new low. However, we have turned around to show signs of life and recapture the €14,000 level. Above there, we also have resistance at the €14,500 level, where we had seen a lot of selling pressure. This is a market that continues to see a lot of downward pressure overall though, and even though we have recovered a bit, it is very likely that we will continue to see selling pressure come back.

At this point, I believe that a relief rally makes a lot of sense as we have seen a lot of volatility in the past week or so. On a break to the upside, it is likely that we go looking towards the €14,500 where a lot of sellers would come in and start shorting. The market has been noisy overall, and I think that will continue to be the case as Germany is suffering at the hands of inflation a lack of growth going forward. The situation in Ukraine is certainly not helping the markets, but we are not collapsing so we are at least trying to bounce.

It is worth noting that we recently had the “death cross” form over the last week or so, so it does suggest that longer-term traders are looking for a bigger move to the downside. In general, it is not until we break above the €15,000 level that I would consider this market as being ready to turn around for a significant move. It is obvious that the DAX will continue to be noisy but at this point, and it is likely that the easier trade is going to be fading rallies that show signs of exhaustion. After all, we have seen a major breach of support not only in the DAX, but multiple indices around the world. The DAX is not necessarily shielded from the rest of the world, so it is likely that we will continue to see a lot of choppy but negative behavior. Simply waiting for some type of exhaustion after a short-term bounce will probably end up being the best trade possible. The DAX is the first place that money goes looking for when you are investing in the European Union, so look at this as a harbinger of how other things go on the continent.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

AI-Driven Fraud: Social Media Fraud Reportedly Soars 28%

HKEX to Open Riyadh Office in 2025, Strengthening Ties Between China and the Middle East

Hong Kong Exchange Pioneers Asia's First EU-Compliant Crypto Index

STARTRADER PRIME: Your Trusted Partner in Institutional Liquidity Solutions

J.P. Morgan Leads with Five Awards in Global $7.5 Trillion FX Market

DON’Ts DURING US Election 2024

Trump vs. Harris: Whose policies are Better for US stock investors?

MyTrade Founder Guilty of Crypto Manipulation

Can Blockchain Technology Protect Your Money from Risk?

Hong Kong Court Rules in Favor of Investors in JPEX Case

Currency Calculator